| Broker | |

|---|---|

| Official website | |

| Social network | |

| Date of foundation | 1970 |

| Head Office | 85 Willow Road, Menlo Park, CA 94025, United States |

| Company owner | Robinhood Markets, Inc. |

| Types of support | Help CenterFeedback form on the siteFacebookTwitterInstagram |

| Languages | English |

| Terminals | Author's platform |

| Min. first deposit | From 1 USDThere is no minimum deposit amount |

| Brokerage commission | No |

| Entry threshold | There is no minimum deposit limit. Requires 2000 USD for access to margin trading |

| Authorized capital | 539 millions USDFrom venture capitalists |

| Equity | 4 billion USD |

| Trading turnover per month | 24 billion USD |

| Number of active clients | 13000000+ |

| Free demo account | No |

| Adjustable | Yes |

| Regulators | FINRA SEC№ 008-69188 |

| Types of accounts | Instant, Gold, Cash Management |

| Methods of replenishment | Bank card (Visa/MC), Wire transfer |

| Withdrawal methods | Bank card (Visa/MC), Wire transfer, Cash Management |

| Types of assets | Stocks ETFInvestments without commissions in individual companies or packages of investments Binary options CryptocurrencyBuy/sell Bitcoin, Ethereum, Dogecoin and other cryptocurrencies without commissions |

| Account Currencies | USD |

| Mobile apps | |

| Weekend trading | No |

| Tournaments/competitions | No |

| Trader training | There is an information center on the website and an informational blog |

| Trust management | No |

| Fee for using the terminal | No |

| Withdrawal fees | Robinhood does not charge a withdrawal fee, but a fee may be charged by the receiving bank |

| Trading robots | No |

| Asset management | No |

| Managerial assistance | No |

| Trading ideas | When subscribing to Gold, the user receives information from Morningstar |

| Single Account | Yes |

| EIS | No |

| Autosequestration | No |

| Analytics | Investment ideas, market review from Morningstar, issuer news |

| Margin trading | Deals with leverage are available. Commission on margin transactions - 2.5% |

| Available exchanges | NYSE, NASDAQ, et al. |

| Whose shares can be purchased | Apple, Amazon, Facebook, Tesla Motors, Microsoft Corporation, Ford, 5,000+ shares of U.S. companies |

| Affiliate Program | RegistrationAvailable on demand for content makers, webmasters |

| Advantages | Trading without commissions and fast registration Instant buy or sell transactions Access to 5,000 U.S. stocks, ETF support Access to options, cryptocurrencies, convenient application The possibility of investing from 1 dollar Trading in real time |

| Disadvantages | The broker works only with traders from the U.S. Quotes differ from the market |

| Company requisites | Legal name: Robinhood Markets, Inc. Legal address: 85 Willow Road Menlo Park, California, USA |

| Date of update | April 21, 2023 |

| Overall assessment | 4.7/10 |

Robinhood is this a scam? Review and Customers Reviews

Contents

Robinhood – a U.S.-based company offering stock market transactions via a mobile app. It was founded in 2013. The authors are Vladimir Tenev and Baiju Bhatt. The Robinhood app quickly became popular due to zero commissions and simplified access to the stock market. The company focuses on small investors – it doesn’t require a large initial deposit. In addition, you can buy single stocks through the app. These two factors set Robinhood apart from “classic” brokers. At the time the app appeared, American investment companies required an average of several thousand dollars of the first deposit from their clients and only allowed them to buy securities in lots.

In 2012-2013, before Robinhood launched, the average brokerage fee in the U.S. was $10 per order. For the small private investor who wanted to send a portion of his savings into securities on a monthly basis, that was too much expense. The offer from Tenev and Bhatt appealed to the American public – it’s economical, fast, and convenient. With Robinhood, you can invest in stocks, ETFs, options, and cryptocurrencies. Registration in the application is available only to residents of the United States. The developers say they are not going to expand to foreign markets yet. In this review we will find out if it’s a scam. Stock Broker Robinhood.

Terms of trading with Robinhood

The main condition for work is residence in the United States. The company does not accept clients from the CIS countries and does not work with EU residents. After opening an account, the application gives a new client one share from its list. It includes the most popular securities in the price range from $3 to $225. To receive the gift, you must link a bank account to your account. This can be done through the app or the website robinhood.com. You can sell the stock two days after you receive it. Only one Robinhood account per person is allowed. If the customer loses the password, he has to write to support to regain access.

The trading conditions are simple – the commission of $0 for any transaction on the American stock market. OTC trades from a limited list of issuers are also available. Investors can work with ETFs, options, cryptocurrency also without a fee. But Robinhood reminds you that the client’s bank may charge a fee for the transfer. Also a fee may be charged for requesting a paper account statement. Securities transactions go through Robinhood Financial. It is a legal entity that is a member of SIPC. For the average user, this means financial insurance for up to $500,000. But the cryptocurrency transactions are not insured – users take more risks here. Robinhood only works with American securities. That’s more than 5,000 tickers from NYSE exchanges, NASDAQ. Securities of foreign issuers are processed in ADR format – depositary receipts. There are no corporate or government bonds in the application. Mutual funds are also not among the available assets.

Robingood Platform

The entire trading functionality of the platform is supported in the mobile application. It is available for iOS and Android smartphones. The company has a website, but it only allows registration in the system. After installing the app, registration, the client gets to the Robinhood platform. The functionality here is minimal. Basically, the user can only look at the charts, buy or sell stocks. That is, customers do not get technical analysis capabilities. The implication is that the user will make the decision to buy the stock elsewhere. Robinhood will simply provide a service for investments.

The company has an extended version, Gold. It is available by subscription for five dollars a month. Gold users see a stack of orders, can make accelerated deposits, and view analytics from Morningstar vendors. Most traditional brokers provide this for free. Gold gives access to margin trading. It’s paid – you’ll have to pay 2.5% on each leveraged position. This is a low rate by American standards. The market average is 8%. Cryptocurrency trades are separate from wallets. Technically, Robinhood customers do not buy cryptocurrency per se (Cryptocurrency Trading Training).

They only get an entry in the app that they have, say, 2.5 BTC. Unlike cryptocurrency exchanges or exchanges, Robingood will not allow the user to send cryptocurrency to a third-party wallet. You’ll have to sell the coins for fiat first, and then withdraw the money to your account. That is, crypto is seen only as a means of speculation, in isolation from its capabilities. The platform also includes Cash Management. This is a variant of banking services: customers can sign up for a Mastercard debit card linked to their Robingood account. You can withdraw cash or receive transfers directly to an investment account. Except for money used for leverage or placed in a warrant.

Broker quotes

Robinhood does not disclose market makers, intermediaries or providers. The company states that quotations are received from American exchanges – NYSE, NASDAQ. But in fact they are different. The reason is the business model of the application. Because the company does not charge a commission for transactions, it earns from reselling client orders to intermediaries. The difference between the resale price and the real execution price on the exchange is split between the reseller and the company. But it is included in the price in the application in advance. Roughly speaking: a customer buys one share for $100 in the app. Robinhood forwards the order to the clearing intermediary, who buys the stock on the exchange for $98. The difference of $2 is the profit of Robinhood and the intermediary.

Demo account robinhood.com

Robinhood has no demo accounts. Clients are offered to trade with real money right away. To prepare, investors are recommended to read the information materials posted in the Learn section of the website robinhood.com.

Mobile application

The mobile app is the only way to interact with the trading platform. In the App Store, the iOS version received a rating of 4.1 stars out of a possible five. A total of 3.6 million ratings from users. The Play Market has 400,000 ratings and an average score of 3.7 out of five. The application’s interface is simplified to the maximum. The client is presented with a list of the most popular stocks. It can be searched by ticker. The Stocks list shows the name of the company, the price of the paper, and a simplified chart. The stock page has:

- The security’s ticker.

- Company name.

- Current bidding price.

- Change the price for the selected segment.

- Schedule. It can be set: day, week, month, three months, year or five years.

The Buy or Sell button is placed under the chart. The trading volume for the day is indicated. In Portfolio, users see the assets in their portfolio. It is possible to create lists of tracked tickers to add stocks or cryptocurrencies to them. By clicking on a security in their portfolio, the client will see the details of an open position. These are the purchase price, the number of shares, the current value of the package, and the percentage of the entire portfolio. There are Return statistics for the day or from the moment of purchase.

Replenishment and withdrawal of earnings at robingud.com

After registering on the website robinhood.comThe client must link a bank account to the account. In the app this is done as follows:

- You have to open the Transfers menu.

- Go to the Linked Accounts section.

- Click Add New Account.

A list of U.S. banks will appear, where you have to choose yours. In the window that appears, you will need to log into online banking and select a specific account to link. Then you can send money from your bank account directly to Robinhood. If client connected Cash Management, he can transfer money to his card from other cards or bank applications. Then the money will be credited to the Robinhood profile as if it was transferred from the bank by direct payment. From the app, the money can be sent to the bank, to the linked account.

Complaints about Robinhood

Despite its acceptance by the public, Robingood is often criticized. A popular opinion is that the platform attracts inexperienced traders and profits from their money losses. There are more specific complaints about the company’s narrow functionality: users do not see the stack and cannot place limit orders. Because of this, their trades are less flexible than when using standard trading terminals.

Nevertheless, most users like Robinhood. This is evidenced by the 13 million open accounts, the number of downloads of the application, and evaluations from customers. The main advantages of the application, according to investors:

- No commissions.

- Quick account registration.

- Instant buy or sell transactions.

- Access to 5,000 U.S. stocks.

- ETF support. This is useful for index investors.

- Access to options, cryptocurrencies.

It should be noted that the subscription to the Gold account extends the functionality. It compensates for some of the disadvantages of the application, such as the lack of a bid cup. In addition, the developers listen to the audience, update the interface, and regularly add more features.

If there are any complaints about Robinhood, we will be sure to post on social media. Sign up so you don’t miss anything!

Please keep yourself informed about news and complaints. We copy the most valuable information to social networks, so please sign up!

Broker regulator

The company is regulated by FINRA. This is the U.S. Financial Services Industry Regulatory Service. Robinhood is also regulated by the SEC, the U.S. Securities and Exchange Commission. Stock transactions are conducted through the legal entity ROBINHOOD FINANCIAL, LLC, incorporated in the state of Delaware. Its CRD registry number is 165998 and its SEC registry number is 8-69188.The robinhood.com website says that customer securities in the platform accounts are protected by SIPC for up to $500,000. This information is confirmed by the SIPC registry.

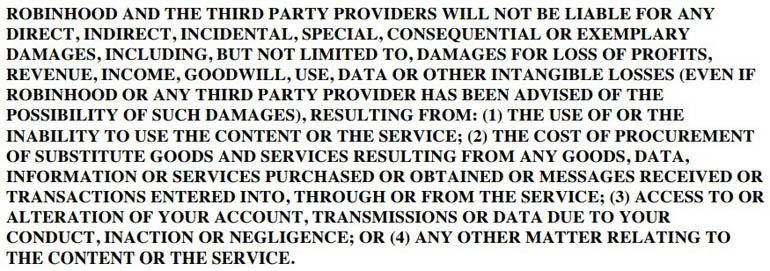

Robinhood.com User Agreement

All customers of the company must read and accept the user agreement. This is a document regulating the platform’s operation, relationships with users, rights and obligations. The agreement is written on behalf of Robinhood Financial LLC. An important point is stated in the disclaimer: Customers accept the service as it is, along with all possible technical errors. Users understand and accept the risk of losing their capital.

Robingood, as well as the intermediaries involved in the company’s activities, is not responsible for the clients’ monetary losses, as well as for any lost profits. The firm states that it does not give investment advice, and users make any investments based on their own analysis. The agreement also states that price changes in the app can be delayed by up to twenty minutes.

According to the agreement, all users release Robinhood, its subsidiaries, intermediaries, employees of the firm from liability. In essence, the customer who accepts this document undertakes not to sue Robinhood or any person associated with the platform.

Robinhood is a Scam?

Regarding the legal clarity of the platform Robinhood there is no doubt – the information about the company is verified in the open US government sources, in the press, in the published documentation. Therefore, we believe that Robinhood is not a scam. The developers were able to combine free exchange transactions with the simplicity of the interface, which won 13 million customers. Nevertheless, the company’s reputation was damaged by the participation in several scandals. The broker received an especially sharp negative reaction after the suicide of Alexander Kerns. This client did not cope with the situation, seeing a minus of 730 thousand dollars on his balance.

Despite Robinhood’s attempts to clarify the situation, the company has been accused of excessive gamification of investments. Risky deals with potentially high profits attracted gambling novices, and the app made them accessible. Other claims Robinhood owners received because of their influence on the Gamestop “short squeeze” situation. At that time, the platform blocked trades in GME securities for ordinary users, but allowed institutional investors to trade. And although the company’s marketing stance is built around protecting the interests of the small investor, in reality Robinhood acts in the opposite direction. Therefore, when working with the application, it is worth watching the level of risk.

Conclusion

Robinhood – the easiest way to start investing if you are a newcomer. Experienced traders are not suited for this platform. There are no tools for technical analysis, the available stocks are limited to the U.S. market, there are no bonds, mutual funds, or the usual futures. The platform only works through a mobile app, which also constrains analysts. Finally, this company does not accept clients from Russia or the CIS.

But close products have already appeared on the market. For example, in Europe, it is the German Trade Republic or the Dutch BUX. The business model of Robingood has proved its worth. It is likely that in the near future, we will see similar applications for Russian investors as well.

Reviews

- New0

- Resolved0

- Not resolved0

Robinhood reviews