| Broker | |

|---|---|

| Official website | |

| Social network | |

| Date of foundation | 1970 |

| Head Office | 123112, Moscow, 1-st Krasnogvardeysky Proezd, 15, Mercury City Tower, floor. 18 |

| Company owner | OOO IK Freedom Finance |

| Types of support | |

| Phone Support | 8 (800) 100-40-82free within Russia +7 (495) 783-91-73Moscow +7 (812) 313-43-44St. Petersburg +7 (843) 249-00-51Kazan +7 (861) 203-45-58Krasnodar +7 (391) 204 65 06Krasnoyarsk +7 (846) 229-50-93Samara +7 (831) 261-30-92Nizhny Novgorod +7 (343) 351-08-68Yekaterinburg +7 (863) 308-24-54Rostov-on-Don |

| Languages | Russian |

| Terminals | QUIK, Tradernet authoring platform |

| Min. first deposit | From 1 RUBDepends on the selected tariff and availability of subscription fees |

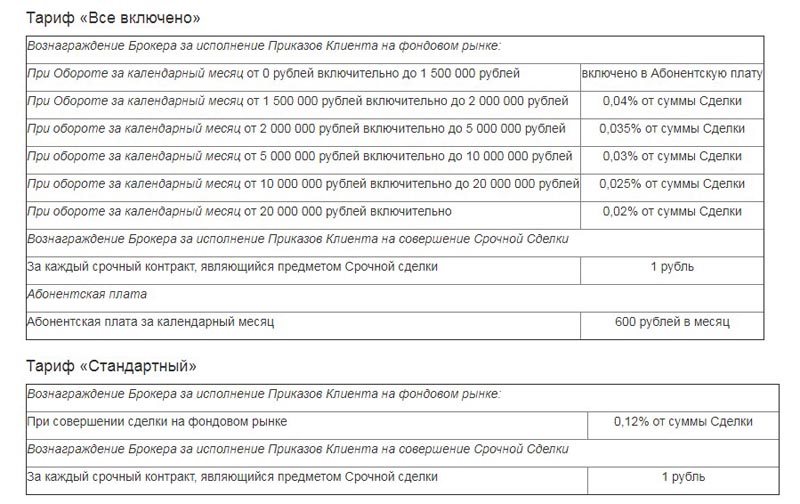

| Brokerage commission | Depending on the tariff and turnover: "All Inclusive", "All Easy" - at a monthly fee of 600 rubles / month. at a turnover of up to 1.5 million rubles / month and from 0.02% to 0.04% at a higher turnover. "Standard" - 0.12% is fixed. "Advisory" - 0.5%. "Universal" - 0.35%. "Agent" - 0.3%. "Partner" - 0.2%. Urgent contracts - plus 1 rub. to the rate. There are additional commissions for swap. |

| Depositary commission | Until 3000 RUBDepends on the type of operation |

| Commission on over-the-counter market transactions | From 0.0002 to 0.5 %Depending on the type of transaction |

| Entry threshold | From 970 RUB |

| Authorized capital | 4509792000 RUB |

| Equity | 1965342377 RUB |

| Trading volume | 1970 г. / 2.2 trillion RUB |

| Number of active clients | 73000+ |

| Free demo account | No |

| Adjustable | Yes |

| Regulators | CENTRAL BANK OF RUSSIA |

| Licenses | Licensed № 045-13567-001000 (Active) № 045-13561-100000 (Active) № 045-13564-010000 (Active) № 045-13570-000100 (Active) |

| Types of accounts | Demo, All-Inclusive, Standard, Consulting, Universal, All-In-One, Agent, Partner |

| Methods of replenishment | Wire transfer, Bank card (Visa/MC/MIR) |

| Withdrawal methods | Wire transfer, Bank card (Visa/MC/MIR) |

| Number of assets | 7+ |

| Types of assets | Stocks Bonds Futures ETF Currency pairs |

| Account Currencies | RUB |

| Reliability Rating | ruBB+ |

| Mobile apps | |

| Weekend trading | Yes |

| Tournaments/competitions | In the broker's communities in social networks |

| Trader training | Individual consultations, seminars, webinars, courses, "Financier" magazine, "U.S. stock market" book, handbook |

| Trust management | Yes |

| Fee for using the terminal | When using an additional account - 350 rubles/month for web-platform, 2500 rubles/month for mobile application, 6000 rubles/month for F-Trader |

| Withdrawal fees | 0.5% from the withdrawal amount in rubles (within the range of 2,000-20,000 rubles)/in case of single sale of securities, additional 1.5% from the order amount is charged |

| Trading robots | No |

| Asset management | Trust management |

| Managerial assistance | Paid consultations of experienced managers, which increase the efficiency of investments |

| Trading ideas | For all account types |

| Single Account | Invest from one account on the markets of all exchanges to which the broker has provided access |

| EIS | Type A - up to 52,000 rubles/year with no limit on the minimum amount of contribution, 13% deduction, type B - no limit on the minimum amount of contribution and tax deduction |

| Autosequestration | No |

| Analytics | Exchange news, analytical summaries, calendar |

| Margin trading | Yes |

| Available exchanges | NASDAQ, NYSE, LSE, Moscow Exchange, Spbexchange, et al. |

| Whose shares can be purchased | Gazprom, Sberbank, Magnet JSC, MTS, LUKOIL, Rosneft, Norilsk Nickel, NOVATEK, et al. |

| Affiliate Program | No |

| Advantages | Russian broker with 13 years of experience and ruBB+ reliability rating (stable outlook), member of NAUFOR Trading highly liquid shares of well-known companies Transparent conditions - clear tariffs, all legal and financial documentation is publicly available, there are references to licenses of the Central Bank of the Russian Federation Inexpensive service and free refill of the brokerage account from any card You can change the type of account at any time Multilingual functional platform and the ability to open a demo account Withholding of personal income tax from clients' accounts is automatic Different formats of trading education and free analytics |

| Disadvantages | There are complaints about the "hangs" of the terminal and problems when closing transactions The broker unilaterally sets limits on assets and instruments for each client |

| Company requisites | Legal name: OOO IK Freedom Finance Legal address: 123112, Moscow, 1st Krasnogvardeysky Proezd, 15, Bldg. 18.02 TIN: 7705934210 CAT: 770301001 OGRN: 1107746963785 |

| Date of update | July 20, 2023 |

| Overall assessment | 5/10 |

Freedom Finance is this a scam? Review and Customers Reviews

Contents

Freedom Finance was founded by Timur Turlov in 2008. It is a financial holding company, whose first and main office today is located in Moscow. The broker operates in 7 countries: Russia, Uzbekistan, Ukraine, Kazakhstan, Kyrgyzstan, Cyprus and Germany, and is showing stable growth, scaling up.

The stock is already listed on NASDAQ, with several large Russian and American brokerage companies joining in 2020. How honest is this representative of the market with clients and does it live up to their expectations? Stock Broker Freedom Finance – is it a scam or is it really reliable? Let’s find out.

Terms of trading with Freedom Finance

Freedom Finance specializes in stocks, bonds, ETFs, futures and currencies (dollars). And it opens access to two Russian stock exchanges: the Moscow and St. Petersburg ones. And also several foreign (American, Asian, Kazakh, Ukrainian, Turkish, European) exchanges: NYSE, NASDAQ, LSE, etc. The latter is opened under a sub-brokerage contract through a Russian with an American brokerage company.

You can open an account with a subscription fee – “All Inclusive” for regular traders or “All Simple” for qualified investors. In it at a turnover up to 1.5 million rubles a month it is not necessary to pay the commission for execution of transactions. On larger amounts it ranges from 0.2%-0.4%. There are several types of accounts without monthly maintenance – the broker recommends to start with them if you are just studying the trading conditions:

- “Standard” with a rate of 0.12% of the transaction amount.

- “Advisory” – 0.5%.

- “Universal” – 0.35%.

- “Agent” is a special rate for qualified investors with a rate of 0.3%.

- “Partner” is a special rate for qualified investors with a rate of 0.2%.

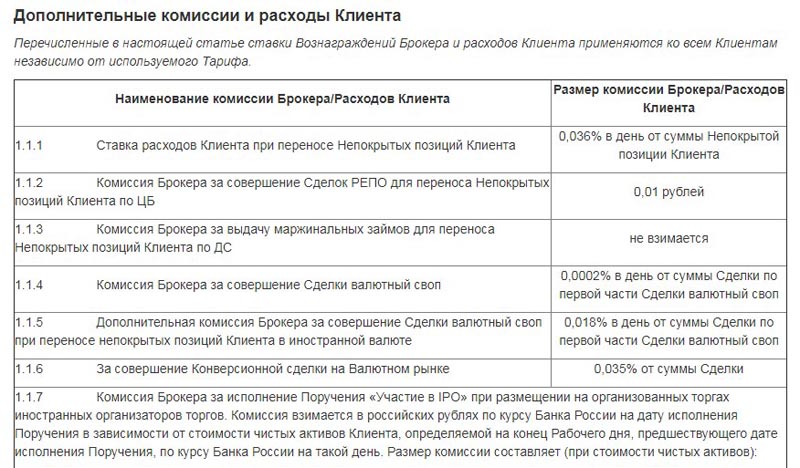

All tariffs have an additional commission of 1 ruble for executing fixed-term contracts. Additional fees are payable:

- The transfer of uncovered positions – 0.036% of the amount.

- Currency Swap – 0.0002% per day in Russian currency and +0.018% over and above that for transactions in foreign currencies.

- Placement on foreign auctions – 3%-5% for the placement itself and 0.12%-0.5% for the execution.

- Execution of the order simultaneously with the top up of the client’s account from the card – 0.12%.

- Opening of special brokerage accounts (clearing, segregated property account) – 10,000-30,000 rubles.

- Sending paper versions of documents to the client – 300-1500 rubles.

- Execution of OTC trades – from 0.0002% to 0.5% depending on the type of asset.

There is also a separate fee for custody services:

- The debit and transfer from the account is paid at the rate of 500 rubles per transaction.

- Processing an order to participate in a corporate action – 500-3000 rubles per order.

- Fixing/removing restrictions on the disposal of trading securities – 300 rubles.

- Securities encumbrance fixing – 2000 rubles + 0.2% of the obligation amount.

- Write-ups and reports on the account – 100 rubles per document.

- Execution of orders for operations with shares – 1000 rubles for each.

All Freedom Finance accounts are opened in Russian rubles. Besides, it is possible to open an IIM – an individual investment account. This will allow to return tax deductions (13% according to Russian requirements), which Freedom Finance automatically deducts from clients’ earnings to the tax authorities.

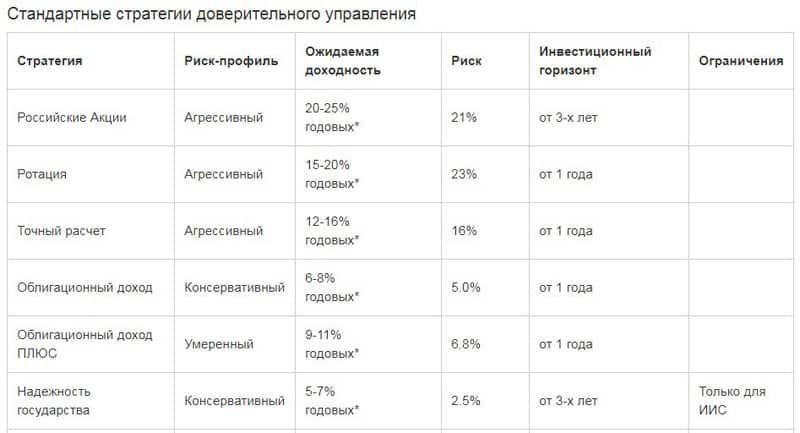

Clients are offered paid professional advice from experts, as well as free general support line consultations. Plus several training formats: open seminars, webinars, courses, access to the “Financier” electronic magazine about personal investments, stocks and brands. In the offices of the company you can buy the book “The U.S. stock market for novice investors,” edited by Freedom Finance. You can entrust your money to Freedom Finance experts on a trust management program. There are several options, varying in risk profile (moderate, aggressive, conservative) and expected returns (from 6 to 25% per annum depending on the portfolio). Some are available only to IIM holders.

On the site ffin.ru There is a section with analytical materials divided into several headings: “Comments”, “Recommendations”, “Market Today” and “Reviews”. It is possible to read stock exchange news, directories on stock exchanges, stocks and ETFs and study the macroeconomic calendar for the current date. The Special Projects section of the website contains tests for novice investors and information about participation in events organized jointly with Freedom Finance partners. For example, the Tesla-Tour – a test-drive of an electric car. Or the podcast “It’s to Money” from Banki.ru.

Customer support is provided:

- by phone – there is a nationwide line of communication and phone numbers of regional offices;

- by e-mail – [email protected] and [email protected] for individuals, [email protected] for corporations;

- via online chat or the feedback form on the website;

- On Telegram;

- on social networks, through Freedom Finance community administrators;

- at the broker’s headquarters and regional offices.

There is a “hot” line of communication with the general director of the company, Timur Turlov. To talk to him, you need to make an application through a special form, and the head of the project will personally answer.

Freedom Finance platform

Freedom Finance has developed its own stock market trading platforms. There are two of them:

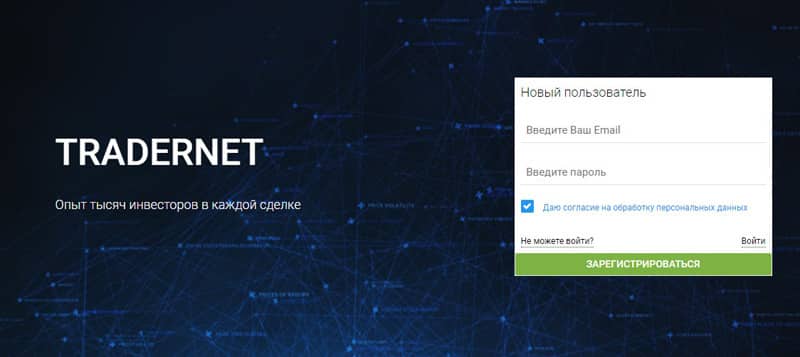

- Tradernet is a web-based platform.

- QUIK is a program for installing on a personal device.

Both provide access to the markets of several countries and standard features: asset management, technical analysis (indicators, timeframes, trend patterns, different types of charts, etc.), statistics, import of transactions, fast entry and withdrawal of orders – there are 6 types. To start using the web-platform, you need to register a trading account. To do that, click on the link “Web-platform” in the upper right corner of the website. ffin.ru. And by selecting the item “Open an account” in the main menu of the resource, fill out the form.

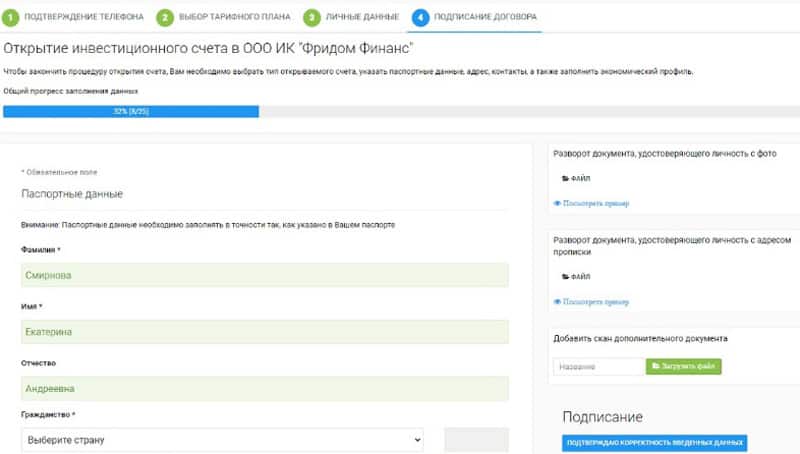

The system will register you as a new user. You will need to go through several steps. First, enter and confirm your phone number: this is done with the help of a 6-digit code, which the broker sends you via SMS. The next step is to choose a tariff. You can start with a package with no subscription fee, as there is no need to spend money on a training account. Then you need to select the status – individual/legal entity – and enter data about yourself: full name, date of birth, and region of service.

And in the end – to provide passport data and upload a scan/photo of the document, as well as fill out a short questionnaire on the knowledge of trading in the stock market. The data will be sent for review, and in the meantime you will be able to understand the personal account and the features of the platform. In order to use QUIK after registration of a trading account you need to download the program distributive and install it on your device. Then, go to the “Orders” – “Account settings” menu item and select “Connect QUIK”.

Broker quotes ffin.ru

Quotes used in the analytical section of the site ffin.ru, taken from TradingView. In addition, Freedom Finance Holding is represented by the bank of the same name. And it is one of the sources of financial data. Nothing is known about other providers.

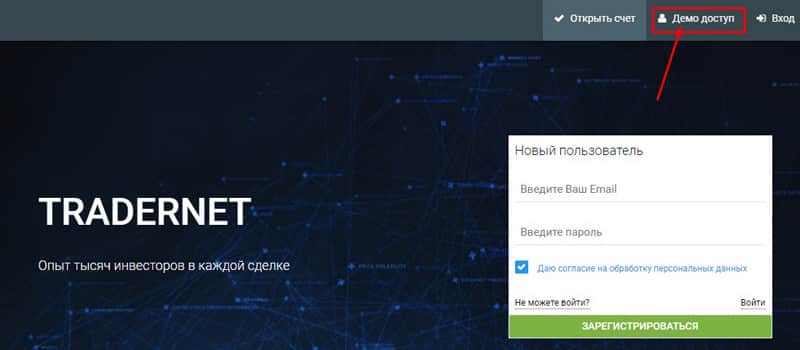

Demo account

You can get free test access to the broker’s web platform by opening a demo account. At first, however, you will have to go through all the steps of registration, only choosing “Demo access”, not “Open an account”.You will have 1 million virtual rubles on your balance for training. The functionality of the trial is the same as that of the trading platform. There is no time limit for demo access.

Mobile application

The broker’s Tradernet terminal is represented by a mobile application for Android-versions of devices no older than 6.0 and iOS-versions. It can be downloaded from Google Play Market and App Store, respectively. The functionality is the same as on the desktop:

- Account and account management.

- Securities trading.

- View analytics, statistics, training materials.

Users rate mobile at 3.8-4 points out of 5 depending on the platform. The main reasons for dissatisfaction are problems with verification and technical failures and delays in program operation.

Bonuses at Freedom Finance

As such, the broker offers few bonuses. In addition to special conditions for depositing to the trading account (funds can be deposited from the cards of any Russian banks without commission), Freedom Finance can boast of regular contests and a good loyalty program. The site had an affiliate program. But now it does not seem to work.

Contests and raffles

Held in the broker’s communities in social networks. Most often – on Instagram. One of the most recent was a raffle for a unit of the “Primary Placement Fund” on New Year’s Eve. Participants had to share a promotional post on their pages and write about their most significant financial achievement of the year in the comments under the contest description. The broker chose three winners.

Loyalty Program

For trading activity, finding bugs on the site/platform, interesting innovations, and inviting friends to Freedom Finance, clients of the broker earn loyalty points. These points are then converted into rubles and can be traded.

Referral program

There is a separate section on the affiliate program on the ffin.ru, no. The details are prescribed in the personal account of the user of the web-platform. The conditions are slightly different than those of other referral programs. You also get a unique link, which you place on public resources (your website, page/society of a social network, blog, messenger, forum, etc.), so that other users will go to the broker’s website and register on it. But the reward is not in the form of currency, but in the form of bonus points on the loyalty program. For each friend who registers with Freedom Finance, there are 1,000 bonus points. However, according to official data, the broker’s full-fledged affiliate program is in development and traders will soon be able to earn extra income.

Deposit and withdrawal

You can deposit the account opened with Freedom Finance without a commission fee from the card of any Russian bank or at the branch, to the broker’s details. There is no minimum limit. But you will not be allowed to do anything until the documents sent during registration and verification are confirmed. Withdrawal of funds is made on request – to the same cards or bank account from which you made the deposit. The fee for withdrawal from the account is 0.5% from the amount withdrawn in rubles (within the range of 2,000-20,000 rubles). Besides at single sale of securities the broker will take in addition from you 1.5% from the order sum.

Complaints against Freedom Finance

The feedback about Freedom Finance is varied. There are traders who note the speed of working with the broker: registration, order execution, withdrawal – everything requires a minimum of time. Clients also like the company’s analytics. Although some users of the service lack information in narrow areas.

In contrast, other users report that the platform “hangs up”, orders may not be executed, and the broker then shifts the blame to the exchange. In addition many do not like the annoyance of the consultants, offering to connect some or other options. On the whole, the broker’s ratings on the serious feedbacks are not bad, at 3-4 points out of 5. For the securities sector this is a decent score.

If there are any complaints about Freedom Finance, we’ll be sure to post on social media. Sign up to stay up-to-date with the news.

Please keep yourself informed about news and complaints. We copy the most valuable information to social networks, so please sign up!

Freedom Finance broker regulator

The legal name of the broker is OOO IK Freedom Finance. It operates on the basis of licenses issued by the Central Bank of Russia on May 19, 2011:

- No. 045-13567-001000 for securities management activity,

- No. 045-13561-100000 for brokerage activities,

- No. 045-13564-010000 for dealer activity,

- No. 045-13570-000100 for depository activities.

The documents are perpetual and are valid until they are revoked by the regulator. Screenshots of the licenses are posted at ffin.ru. Freedom Finance investment company is present in the registers of dealers, depositories, investment advisors and brokers of the Central Bank – we have attached the links to verification below. So Freedom Finance operates in Russia officially.

- View Freedom Finance licenses on the broker’s website

- Look for Freedom Finance on the broker registry at cbr.ru (line 208)

- Look for Freedom Finance on the dealer registry at cbr.ru (line 245)

- Search Freedom Finance on the register of investment advisors on cbr.ru (line 46)

- Search Freedom Finance at the register of depositories on cbr.ru (line 219)

User Agreement ffin.ru

Its role is performed by the service agreement, terms and conditions of which are accepted by Freedom Finance client when registering a trading account. The place of its conclusion is Moscow. The broker has the right to refuse to conclude the contract at his own discretion, without giving any reasons and to any person. And refuse to execute trade orders on transactions – if the client does not fulfill his obligations or there are not enough assets on his balance (clause 3.11).

In turn, the client agrees to provide the broker in a timely manner the documents required under the agreement (for example, details for debiting or identity card for verification), to pay commissions (fees) and reimburse the costs incurred by the broker as a result of cooperation with him (paragraph 4.1).

Freedom Finance unilaterally sets limits on assets and instruments for each client. And does not accept for execution the orders that will lead to a violation of these restrictions. And if detected – immediately close (clause 5.12).

During the entire term of the contract, the broker has the right to dispose of the money on the client account in his own interests. As long as he does not need it (clause 6.1). In this case, the profit received from such actions will belong to Freedom Finance (clause 6.2).

Is Freedom Finance a scam?

Freedom Finance – is an officially operating broker with licenses from the Central Bank of the Russian Federation for all types of activities. It has extensive experience and a good rating by ACRA, which demonstrates its solidity. All trading conditions, legal and financial documentation is publicly available on the website – the service provider behaves honestly and openly in relation to the client. The client agreement is quite loyal: with the exception of the broker’s right to impose trade restrictions on clients unilaterally (which is one of the standard conditions), we have not found stringent conditions. There are no bonded clauses either.

The reviews of the holding are varied. But among them there are no accusations of fraud related to the delay of withdrawal or refusal of payment. Basically, the complaints are related to the terminal, its “freezing”, which leads to the loss of money, and the refusal of the support team to take responsibility for such situations. So Freedom Finance is not a scam, but a serious and reliable representative of the market, albeit with some flaws.

Conclusion

Freedom Finance is distinguished by a good, 13-year experience, work experience with different securities markets and transparent trading conditions: the broker does not hide financial or legal documentation from the clients. The broker is a member of SRO and has been licensed by the Central Bank of Russia. The broker’s service is comparatively inexpensive and the account can be funded for any amount and without commission from a Russian bank card. Freedom Finance offers several types of accounts with different restrictions and fees. It is possible to choose the account with a subscription fee or with the payment of a percentage of the concluded transaction.

The trading platform is developed by the company’s specialists and contains all the familiar functionality for traders: several chart types, indicators, trend patterns, display settings, sorting assets, etc. Fulfillment of tax obligations is undertaken by the broker: 13% fee is automatically deducted from the client account. In addition to trading, you can put your funds on an individual investment account, and there is a program with no tax deduction. There are also several formats of paid and free training, analytics from Freedom Finance experts and partner services. Legal entities have access to underwriting service – issuance and distribution of the company’s securities. Among the disadvantages of the broker – the need to go through all the steps of registration, including verification by passport, confirmation of mobile and giving address data to open a demo (test) account, as well as complaints about delays in the trading terminal at the time of execution of an order.

Reviews

-

Feedback approved for publication Rate your review 000Great broker

Everything is good at the broker (commissions, spreads, access to all exchanges, support), but sometimes the app glitches. In support I was told to update the android version – it helped. My broker is very good, I use mainly the in-application investing and the advices of the manager. I buy funds for… Read more

-

Feedback approved for publication Rate your review 000opened an account in Freedom

I opened an account in Freedom on the advice of a trader friend, he has been trading for a long time, he has several accounts with different brokers in different countries, as he explained, for a person with a russian passport, a brokerage account in kazakhstan is one of the best solutions today, because… Read more

Positive- works great

Minuses- No

-

Feedback approved for publication Rate your review 000Excellent analytics

In addition to the fact that Freedom provides direct access to the USA, I would like to point out the excellent work of the company’s analytical department. They analyze the US economy, make forecasts and recommendations, of course, each investor decides for himself what to invest in, but it is definitely… Read more

-

Feedback approved for publication Rate your review 000No complaints

I have been investing with Freedom for three years. In general I like everything. But I don’t trade intraday, I don’t make risky trades, I buy long term because I do not have the opportunity to spend a lot of time on the stock market, to understand all the intricacies and nuances. As a result, my portfolio… Read more

-

Feedback approved for publication Rate your review 000Quite a working option

It is quite a working option for trading foreign stocks. I am not familiar with other companies in Kazakhstan, I went to Freedom because I knew the Russian division of the broker. In general, the level of customer service plus or minus is the same. The only thing that I did not like was that they did… Read more

-

Feedback approved for publication Rate your review 000Broker number one

Freedom Finance Global is the number one broker. They were the first to understandably and quickly open accounts for Russians abroad. I was pleasantly surprised that it could be done remotely and continue to trade in foreign securities. At the same time I decided to improve my knowledge about the stock… Read more

Positive- useful and productive

Minuses- No

-

Feedback approved for publication Rate your review 000Freedom remained afloat

Of course I didn’t choose the best time to invest – the end of 2021, when markets started to fall actively, so my portfolio has been colored red for a long time, but what can I do. At least I can keep trading foreign stocks thanks to Freedom Finance. When most brokers were hit by sanctions Freedom Finance… Read more

Positive- Stability, clarity.

Minuses- Have not found

-

Feedback approved for publication Rate your review 000I recommend

A huge plus of the company is that there is access to the world financial markets, first of all to the largest American stock market. Kazakhstan’s Freedom Finance Global provides good analytics that you can rely on, especially now, when the markets are in an unstable state. I also like the fact that… Read more

-

Rate your review 000They don't give away money

I put them money through the card, when I came to my senses I realized that I had made a mistake (verbal agreements manager did not comply, the conditions have changed in The FF has blocked the funds and requires a photo of the bank card.

I am struggling with them For several days now, I have been… Read more

Positive- None

Minuses- Dishonest company

- Incompetent support

- Inconvenient application

-

Rate your review 000It's strange to see Freedom here

It is strange to see Freedom here – from the first mention of the Central Bank license it is clear that this is a normal broker. There is also a lot of outdated For example, already in January there were about 140 thousand clients, and then Moscow Exchange did not publish any information, but it is known… Read more

-

Rate your review 000I hope that FF restrictions will not affect

I had to quickly change one broker for another because of the sanctions, and I decided to choose Freedom Finance. Of course, the queue for transferring my assets grew huge, which is understandable. I had to wait until my problem was solved, but now everything is ok, I am a client of Freedom Finance and… Read more

-

Rate your review 000I have had an account with Freedom for three years now

Freedom Finance is a licensed company, which is regulated not only by our Central Bank, but also by the US Securities Commission. It is strange to see on this site information about a company which is not in the last place in the TOP of the leading Russian brokers. However, there are many ICs here. I… Read more

-

Rate your review 000Great broker

All the necessary information about the company’s activities is published on the website, including the license of the Central Bank of Russia. I trust the broker. Freedom also has its own products – funds. I bought an IPO fund to take part in the IPO. I cannot participate directly, because I am an unqualified… Read more

-

Rate your review 00I work with them for the second...

I work with them for the second month, I am surprised that a company with all possible licenses have negative reviews, commitments fulfill their obligations. previously tried themselves on ingrino.com and tinkoff.ru, the first did not like what little tools, and others because they do not like themselves… Read more

- New0

- Resolved0

- Not resolved0

Freedom Finance reviews