Learning to Trade Cryptocurrencies

Contents

- 1 Learning to trade on the cryptocurrency exchange

- 2 Top 3 crypto exchanges to get to know the market

- 3 Correct selection of cryptocurrencies for work

- 4 Trading strategies: what they are and what they are

- 5 Technical and fundamental analysis

- 6 What trading courses are available and is it necessary for a beginner trader?

- 7 Learning to trade cryptocurrency from scratch

- 8 A brief overview of crypto-exchanges

- 9 How to store cryptocurrency

- 10 Trading Psychology

- 11 Risk Management

Learning to trade on the cryptocurrency exchange

Cryptocurrency trading – one of the rapidly developing areas of trading. It attracts investors with the ability to make impressive profits rather quickly. But in order to trade effectively you need to devote enough time to education. And you have to start with the basics.

A cryptotrader should know what cryptocurrencies are and how to choose the right coin to trade.

We need to study trading strategies, understand their advantages and disadvantages, and master a few of them.

It is critical to understand how to work the market, to be able to use fundamental and technical analysis.

Perhaps, self-training in all the subtleties of crypto-trading will seem too difficult, then you need to learn the criteria for selecting training courses.

The trader has to understand everything Crypto exchanges and choose one or more sites for permanent trading. Of course, he must also understand where and how to store coins, so as not to lose his earnings.

Finally, he must know the basics of trading psychology and the key rules of risk management.

About all this we will tell in order. And let’s start with the question of selecting coins to work with.

Top 3 crypto exchanges to get to know the market

| Exchange | Bonuses | Registration |

|---|---|---|

|

1

|

Until 4000 USD

Registration Bonus

|

Go to |

|

2

|

Until 10000 USD

Welcome Bonus

|

Go to |

|

3

|

2 USDT

Welcome Bonus

|

Go to |

|

4

|

1000 USDT

Bonus for futures trading

|

Go to |

|

5

|

0%

Fee for withdrawal to bank card

|

Go to |

Correct selection of cryptocurrencies for work

Before you start trading, you need to do analytical research to choose a cryptocurrency or several coins to be traded.

However, if a trader is a beginner and takes the first steps on the digital market, it is better to choose the most popular assets to start trading, because there is enough information about them on the Internet. A well-known cryptocurrency will be a good trainer, because it most often shows the effectiveness of trading strategies, these coins are discussed on forums and social networks, their behavior is more predictable.

When the period of initial training in trading popular coins is completed with positive results, you can try trading another cryptocurrency.

First of all, you need to assess the following parameters:

- how long the coin has existed;

- features of its technology and infrastructure: where and what it is used for, whether there are applications, what is the speed of transactions, what is the regularity of updates;

- how competent the development team is, in particular, whether there are famous figures in the cryptocurrency industry;

- media background: the presence of the cryptocurrency on specialized sites, forums, the dynamics of popularity, expert feedback, feedback from ordinary users, the frequency and nature of news, and so on.

Then there is a more detailed analysis of the most interesting coins. In evaluating cryptocurrencies, the following factors must be taken into account:

- What is the peculiarity of cryptocurrency, what it was created for, what is its usefulness – this will help to determine its prospects, its applicability for trading;

- Whether a coin is traded on exchanges: obviously, you should invest in assets that are invested in several, preferably many, cryptocurrency exchanges;

- The number of coins: if there is already a lot of digital currency on the market, its price is small and will not be large in the long run;

- Issuance: If a coin is programmed to issue in large quantities over the long term, its value will rise, if at all, slowly and only slightly; conversely, if its issue is limited, its price will rise, especially if most of the currency has already been issued;

- Mining: the more complex and energy-consuming the process of working here, the higher the price of the coin;

- The higher the price of the asset, the higher the risks of correction – earnings can be large, as well as losses;

- The lower the price of a cryptocurrency, the easier it is for trading and, theoretically, the higher its growth potential and lower risks;

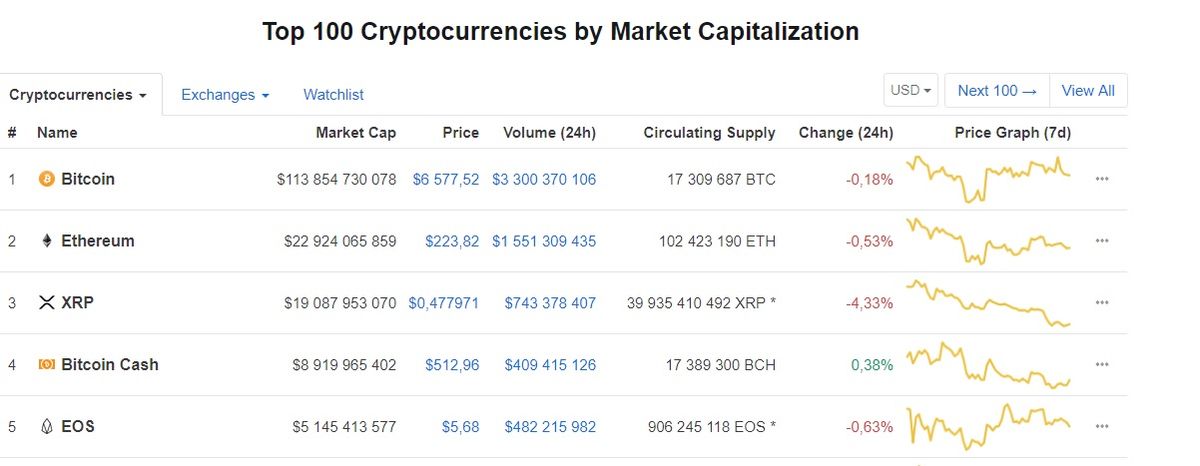

- Capitalization (Market Cap): you can check this parameter on the website coinmarketcap.com. Coins from the top 100 list are considered more suitable for trading; the interface of the Coinmarketcap website with the main market parameters of cryptocurrencies looks like this:

- The volume (Volume) of trades within 24 hours – the larger it is, the better for work in the short term;

- Volatility is the key quality of cryptocurrencies, which allows traders to make money on this market; the higher this indicator, the more opportunities to make a profit over a short distance; price fluctuations are evaluated in a short period of time, but the dynamics over 3 months, six months and a year are also analyzed; it is also necessary to consider how it corresponds to the general market trend;

- The ratio of risk and profit, which is determined: at the minimum price – the risk of falling in value to this level; at the maximum price – the potential profit for the period of time (half a year or a year); the trader himself determines the data, while being guided by the parameters with which you should start trading. The optimal solution is a situation when the potential profit exceeds the risks by 5 times.

After determining the main parameters of the cryptocurrency, it is worth evaluating additional factors that affect the dynamics of its price. For example, its anonymity can be seen as an additional advantage.

Once you gain experience in cryptocurrency trading, you need to look more closely at new coins so you don’t miss out on a promising asset. New currencies can outperform conventionally old ones in terms of utility: if they are designed to take into account the shortcomings of popular assets and if the community appreciates their progressive qualities, they can rise dramatically in value.

Trading strategies: what they are and what they are

In cryptocurrency trading, the trader uses various data, which should make the work more effective. To do this, it is necessary to structure the analysis of material, choose the most informative tools, work out a system of responding to signals, and adjust one’s actions according to the results. That is, to develop a trading strategy.

Popular Strategies

A trading strategy streamlines trading and makes it easy to analyze. Off-system actions will never lead a trader to stable positive results.

Crypto-trading has existed long enough for market participants to define template strategies that are convenient for a beginner to start trading with. Subsequently, when he has mastered one or more of the most frequently used strategies well, he will be able to develop an individual technique.

All crypto-trading strategies can be divided into two main types: those that take into account temporal parameters and those that analyze the market situation.

Among the strategies according to the time parameters it should be noted the following:

- Intraday tradingThe following is an analogue of the normal working day, when the trader opens and closes positions during the day or 24 hours. When leaving trading, he closes all positions until the next session. One of the most common and rather pragmatic strategies. The price of a cryptocurrency can change dramatically overnight and closing all positions prevents losses. But on the other hand, the trader will not get the profit that would have been waiting for him if he correctly predicted the sharp price movement.

- Position Trading: With this strategy, the trader works only at a certain point in time, for example, when the trend reverses. It is impossible to predict with sufficient reliability the events in the crypto market, if the trader predicts a reversal, he starts trading at any time when it happens. This strategy has certain advantages: the market player works with one factor, which is easy to identify, he uses few instruments, reacts monotonously and makes fewer mistakes. But he misses an opportunity to make money outside of the event he is focused on at the moment.

- Swing TradingTrading here is carried out within a certain long cycle from 10 hours to several days. The trader places a position at the beginning of the trade, waits for the cycle to end, places another position and fixes the profit. Thus, it works with the cycles of decline or growth of the coin price, the period of increased volatility or flat. The advantage of this strategy is that cycles are subject to regularities and trading results are more predictable. On the other hand, the crypto trader does not make money on short sharp price fluctuations, which are very typical for virtual coins.

- Scalping: A crypto trader tries to make money on every price movement. This is high-frequency trading, based on a superficial analysis of the market. Minimum fluctuations of the cryptocurrency rate are always observed, so scalping is possible at any time. The strategy requires constant trader’s attention, ability to quickly predict the situation and react to its changes, which comes only with experience.

Among the trading strategies that are based on the analysis of market conditions, it should be noted:

- Trading on a pullback: The investor traces the moment of a small correction after a maximum or minimum price within a trend. For example, the value of a coin is steadily growing, an uptrend prevails, but continuous growth of any asset is impossible, at some period of time there is a correction – a slight decrease in price. It is at this point, the trader buys the cryptocurrency, and the coin returns to the uptrend. Given the prices of many cryptocurrencies, even a small correction can bring an investor significant profit, but this strategy requires a very good understanding of the market.

- Trading on a reboundIn implementing this strategy, the player waits for a mark on the falling trend, after which, as follows from the analysis of the situation, the price will begin to rise – this is called a rebound. After that, he can sell cryptocurrencies at a higher price. This methodology also assumes a very good knowledge of the market.

- Impulse trading: To work with this strategy, the trader must see an impulse – a certain movement of the price rate in the up or down direction without correction. In this case, he buys the asset at the beginning of an upward impulse or sells it at the beginning of a downward one.

- Trading for a breakthrough: This strategy implies an accurate prediction of the moment of a breakthrough – such a price level, “breaking through” which the trend changes. That is, if we are talking about downtrends, then the trader determines when the price has broken through the lower mark and buys the asset at the lowest price, and the price rises.

There are many more methods of working in the crypto market, but the options listed here are, in fact, ready trading templates, using which a trader can create an individual strategy. In this case, he may not develop something new, but use already proven methods.

It is believed that for effective trading, a trader needs to master no more than five strategies, but for some cryptocurrencies, 1-2 are enough. Some investors manage with one system, which they use to perfection.

When choosing a strategy, the trader proceeds from the cryptocurrency he is planning to trade, the state of the digital assets market, his financial capabilities and the goals he sets for himself.

Technical and fundamental analysis

For crypto trading to be effective, it is necessary to carefully study the market. There are two types of analysis that allow predicting to some extent the price of cryptocurrency and the dynamics of its development – technical and fundamental analysis. Let’s consider them in more detail.

Fundamental analysis

This type of analysis focuses on the factors that are believed to determine the value dynamics of a cryptocurrency. In particular, the trader studies the features of the coin – practical application, popularity, media background, involvement in the real economy and more.

Fundamental analysis is more time consuming and complex because it requires knowledge and understanding of many factors of the crypto market and real economy, the relationships between them. If used correctly, it allows you to estimate the value of an asset compared to its speculative price. A trader can identify overvalued and undervalued cryptocurrencies and use this information in trading.

One of the provisions of fundamental analysis states that the price of a cryptocurrency is set speculatively during trading for a limited time, that is, it is more or less than some real value of it. However, in the long run, it inevitably reaches objective values. Determination of this indicator is the purpose of the trader, who carries out the fundamental analysis. Its followers believe that it is the only one that allows predicting the dynamics of cryptocurrency value accurately enough.

This method has a number of disadvantages. In particular, the fundamental analysis implies the study of a large number of factors. The reality of the crypto market is such that the exact relationship between the price and certain facts is a matter of debate. The very large choice of factors makes it difficult to find the really important ones and can leave relevant factors out of the analysis. This will lead, let’s say, to a trader analyzing a lot of unnecessary information and missing the most important ones.

Interpretation of materials also presents significant difficulties to players, there are no stable rules for their evaluation, so traders interpret the same factors differently.

Technical analysis

Technical analysis involves predicting the value of a cryptocurrency based on information from price charts and the stock market. Followers of technical analysis believe that the price dynamics already include all the factors affecting it and there is no need to study each of them separately, there is no need to look for reasons why the price has changed or may change in the future. Instead, we should focus on the dynamics of the price and trading volume of the cryptocurrency.

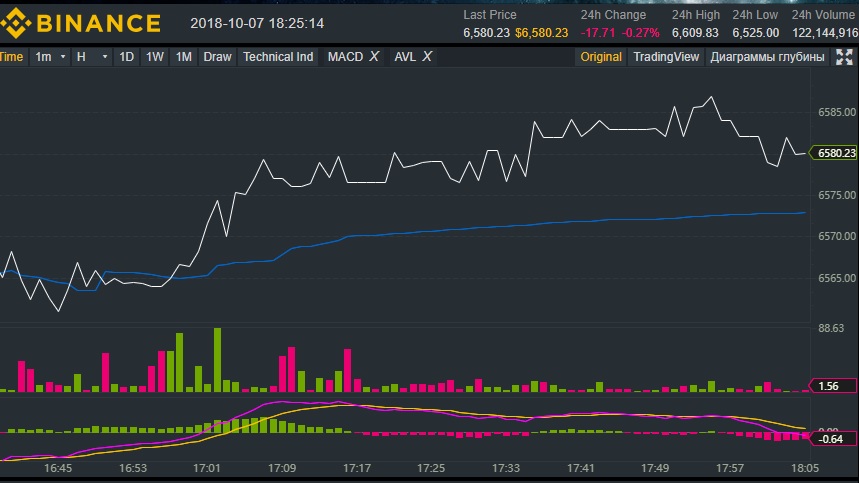

Indicators on the Kraken cryptocurrency exchange chart

According to the basic premise of thechanalysis, the aggregate of supply and demand changes over a certain period of time forms trends – downward or upward, short-term, medium-term and long-term. If supply and demand for cryptocurrencies are balanced, there is a sideways price movement with small fluctuations, which is called a “flat”.

It is also believed that market conditions are repeated and, accordingly, the dynamics of prices are repeated. This makes it possible to apply working schemes that have already been used many times in trading. In the analysis such indicators as value changes, trading volume and dynamics, supply and demand ratio are tracked with the help of support and resistance lines and a number of other data, figures – stable and repeating patterns, indicators, such as “moving averages”, which show the average price of a cryptocurrency for a certain time, Japanese candlesticks, charts of trading volume, etc.

The disadvantages of such analysis are related to the fact that it is impossible to predict the movement of the value of cryptocurrencies. The market can move in full accordance with the trader’s expectations, and then change abruptly for absolutely unknown reasons.

What trading courses are available and is it necessary for a beginner trader?

Cryptocurrency trading requires knowledge and understanding of the processes that occur in the cryptocurrency market, analysis methods and trading strategies.

When a novice trader starts searching for the necessary information, he or she faces great difficulties. On the one hand, there is a lot of information on crypto-trading. On the other hand, a closer look reveals that there is little really useful information.

In the search for knowledge, many traders come to the need to take courses from professional market players or companies that provide training.

Courses can be online or offline, paid or free, individual or group, in-depth or accelerated, some courses even issue diplomas and guarantee a refund if the student, using the strategy taught in the course, went into a loss.

Courses can be effective, or they can be just a way to lure a novice trader out of money – if the courses are paid. Free courses are not likely to be very useful, because traders are not inclined to share really useful information for free. And the paid ones are not very forthright either.

In any case, whatever the courses are, the main criterion for their selection is the successful trading experience of the trainer or the training company and the activity of the community that has formed around the trainer or the company. Practical experience is important because trading is practice, practice and practice again, although the study will still begin with the theory, which everyone has their own, because there is no single generally accepted theory of cryptocurrencies.

Among the courses that are well represented on the Internet are:

Paid courses

- Cryptocurrency trading schools (go online);

- Namana School of Cryptocurrency Traders (go online);

- Paid courses by Vladimir Bazhenov (go online);

- Paid individual online trading training by Stanislav Stanishevsky (go online).

Free courses

- Free online course Crypto Samurai (go online);

- and a number of others.

When choosing courses, you need to be clear about your learning goals and your level of competence. If you don’t know anything about the cryptocurrency market, then you should choose courses that give you an understanding of this industry from scratch. It is better to choose the same courses for those who have already tried to work in the crypto market and that experience was unsuccessful, and for those who have worked with other assets a little before.

More focused courses are needed for traders who have an understanding of the market, have tried trading, and are confident that they want to continue, as well as for traders who have productive experience trading other assets.

When studying on the course, you need to focus on mastering the sequence of actions when entering the market, on typical mistakes and ways to avoid or correct them. It is important to learn how to identify risks and master basic analytical tools.

What should not be hoped for when choosing courses? That there is bound to be a quick success after the course. Courses that guarantee huge profits as a result of learning are not ones to be trusted. No trader experiences losses when starting real trading. Good courses give a lot, but 90% of learning is constant independent practice.

Is it possible to learn crypto-trading initially on your own? It is possible and it remains the most popular way.

Relatively mass interest in crypto-trading has recently emerged and most, if not all, existing successful traders have trained on their own, so this way is guaranteed to lead to good results.

But, understandably, self-study is a more difficult and risky method than learning in quality courses. The main problem is the difficulty of selecting valid, valuable information.

Among the materials available to novice traders: educational articles and newsletters from cryptocurrency industry websites, special literature, a huge number of YouTube videos (they should be treated with special caution), specialized forums, chats of cryptotraders.

Learning to trade cryptocurrency from scratch

Before you start trading cryptocurrencies, you need to get basic knowledge about this market, about the cryptocurrency you plan to trade, about the factors that affect price dynamics.

Market basics

Here you should start by learning the most basic concepts. Among them: blockchain or distributed data registry technology, smart contract, cryptocurrency, fork, altcoin, mining.

Some novice traders do not consider it necessary to understand the peculiarities of the cryptocurrency industry, and this negatively affects the trading results, because without understanding the basics it is much harder to predict the movement of asset prices.

At the same time, investors do not need to delve deeply into the technical features of cryptocurrencies and blockchain, because this knowledge is not useful for trading.

It is important to understand in detail how crypto exchanges work – how to deposit money to the account, buy currencies, on what terms to withdraw income, with what commissions. It is necessary to choose a resource or even several platforms, on which it is supposed to trade assets.

It is also necessary to understand the work of cryptocurrency wallets, to choose from them the most suitable for you.

Dynamics of transactions on the Binance exchange

Trading Basics

Once you understand the basics of the crypto market, you need to move on to the next stage – theoretical preparation for trading. You should start by studying terminology and slang: learn who the bulls, bears, hamsters, cobra, order, pumpe and dump, high (peak), bottom, long, short, swing, and so on are.

Fluent terminology will allow you to read forums of traders and chats of crypto exchanges, where players communicate, which is necessary for a deeper understanding of digital trading.

Chaotic trading in the crypto market will quickly lead to defeat, so every beginner trader should learn the basics of fundamental and technical analysis and strategies. Before investing in crypto exchanges and starting trading, you need to know how to analyze the price and trading volume of a coin, use charts, make deals, analyze results and adjust your actions.

Preparing

Before you start real trading with a particular cryptocurrency, you need to learn as much as possible about it, assess its place in the market, whether a large community has been created around it, how actively it is traded and on which exchanges, what is the transaction rate, what is its media background. It is also worth assessing the history of its price dynamics.

There are more than 1500 coins on the crypto market, each of them has its supporters, but only currencies from TOP-150 are considered to be effective for trading. Beginners are recommended to start with the most famous of them, because there is a lot of information about them on the net, analytics, experts’ and leading traders’ opinions are completely available. The difficulty in this case will be the choice of reliable information.

Newbie mistakes

Mistakes are almost unavoidable at the beginning of such work, and experienced traders have them on a regular basis. Nevertheless, before trading, one should be aware of typical mistakes that are caused by not understanding the specifics of cryptocurrency trading.

1. Lack of concentration: beginners underestimate the speed and scale of price changes in currencies. You cannot lose concentration in your chosen strategy, you must always be ready to identify the situation on the market and react to it correctly;

2. The desire to “win back”: losses when trading cryptocurrencies are inevitable, but beginners often lose their temper and try to compensate for losses, which leads to even greater losses;

Using one strategy: One trading system can be effective, but only if an experienced trader is using it. Beginners work with one strategy because they are afraid to try others. This also leads to losses;

4. Underestimating the seriousness of trading: cryptocurrencies are a high-risk asset, trying to trade as entertainment only leads to losses.

A brief overview of crypto-exchanges

A cryptocurrency exchange is where investors trade digital coins. There are 200 to 500 crypto-exchanges in the world, but the main flow of currencies is distributed among the largest of them. This is where the vast majority of crypto traders try to get rich. Let’s tell about the most popular exchanges today.

Poloniex

The advantages of Poloniex, in addition to a large selection of cryptocurrencies and comfortable commissions, include quick registration, high liquidity, and platform security.

- Founding Date: 2014;

- Jurisdiction: United States;

- Verification: mandatory for trading and withdrawal;

- Withdrawal and deposit of fiat: bank transfer is available;

- Fees: Fees depend on the status of the client;

- Trading pairs: more than 30;

- Languages: English, Japanese;

- Safety level: the highest;

- Features: limited options for withdrawal of funds, the complexity of trading, the exchange is designed for professionals;

- Detailed review and reviews: https://revieweek.com/review/poloniex/;

- Website: https://poloniex.com/.

Bitfinex

- Date of establishment: 2012;

- Jurisdiction: British Virgin Islands;

- Verification: mandatory;

- Withdrawal and deposit of fiat: bank transfers are available;

- Commissions: for deposit 0.01%, for withdrawal – depends on the cryptocurrency, trading up to 0.2%;

- Trading pairs: more than 30;

- Languages: English, Chinese, Russian;

- Safety level: the highest;

- Features: provides great opportunities for trading, while the verification system is labor-intensive, the commission on the withdrawal through the banks is high;

- Detailed review and reviews: https://revieweek.com/review/bitfinex/;

- Website: https://www.bitfinex.com/.

Kraken

- Date of establishment: 2011;

- Jurisdiction: United States;

- Verification: not required;

- Withdrawal and deposit of fiat: bank transfers are available;

- Commissions: no deposit, no withdrawal – the amount of the fee depends on the cryptocurrency, the trading commission – up to 0.26%;

- Trading pairs: more than 50;

- Languages: English;

- Safety level: the highest;

- Features: The site is designed for professionals, it is difficult to trade on the exchange, while at the same time it is possible to conduct large transactions anonymously;

- Detailed review and reviews: https://revieweek.com/review/kraken/;

- Website: https://www.kraken.com/.

Bittrex

- Founding Date: 2014;

- Jurisdiction: United States;

- Verification: no mandatory verification;

- Withdrawal and deposit of fiat: bank card transfers are available;

- Commission: no deposit, no withdrawal – is, the amount depends on the cryptocurrency, the trading commission – 0.25%;

- Trading pairs: more than 200, there is fiat;

- Languages: English;

- Safety level: the highest;

- Detailed review and reviews: https://revieweek.com/review/bittrex/;

- Website: https://bittrex.com/.

Binance

- Verification: no mandatory verification;

- Withdrawal and deposit of fiat: QIWI, JD, Webmoney, Skrill/Moneybookers, Neteller, Visa/MasterCard;

- Commission for withdrawal: there is, the trading commission 0.1%;

- Trading pairs: about 400 cryptocurrencies, no fiat;

- Languages: English, Chinese, Russian;

- Safety level: high;

- Detailed review and reviews: https://revieweek.com/review/binance/;

- Website: https://www.binance.com.

EXMO

- Founding Date: 2014;

- Jurisdiction: United Kingdom;

- Verification: no mandatory verification;

- Commission: no deposit fee, for the withdrawal – from 0% to 6%, trading – 0.2%;

- Languages: English, Chinese, French, German, Russian, Ukrainian, Polish;

- Safety level: high;

- Features: there is a mirror for users of countries where the exchange may be blocked;

- Detailed review and reviews: https://revieweek.com/review/exmo/;

- Website: https://exmo.me.

CEX.IO

- Founding Date: 2013;

- Jurisdiction: United Kingdom;

- Verification: no mandatory verification;

- Withdrawal and deposit of fiat: bank transfers are available;

- Commission: no deposit fee, for withdrawal – up to 1%, trading – up to 0.25%;

- Currency: more than 20 trading pairs, including fiat;

- Safety level: high;

- Detailed review and reviews: https://revieweek.com/review/cex-io/;

- Website: https://cex.io/.

HitBTC

- Founding Date: 2014;

- Fiat deposit and withdrawal: SWIFT USD, SEPA EUR transfers;

- Commission: for deposit – 0.0006 BTC, for withdrawal – 0.001 BTC, trading – 0.1%;

- Languages: English, Chinese;

- Safety level: high;

- Features: demo account;

- Detailed review and reviews: https://revieweek.com/review/hitbtc/;

- Website: https://hitbtc.com/.

BitMEX

- Date founded: 2014;

- Jurisdiction: Hong Kong;

- Verification: none;

- Deposit and withdrawal: only cryptocurrency;

- Commission: no deposit and withdrawal, trading – up to 0.25%;

- Safety level: high;

- Features: great opportunities for cryptocurrency trading, withdrawal and deposit of capital on the platform only in digital assets;

- Detailed review and reviews: https://revieweek.com/review/bitmex/;

- Website: https://www.bitmex.com/.

Bitstamp

Bitstamp crypto exchange supports few cryptocurrencies, as well as dollar and euro, is quite popular. Verification is required here, it can be attributed to both the advantages and disadvantages of the platform. The simple interface is an advantage of the project, it is convenient for beginners and experienced traders.

- Founding Date: 2014;

- Jurisdiction: Hong Kong;

- Verification: not required;

- Deposit and withdrawal: only cryptocurrency;

- Commission: no deposit and withdrawal, trading – up to 0.25%;

- Languages: English, Chinese, Russian, Korean, Japanese;

- Safety level: high;

- Website: https://www.bitstamp.net/.

LiveCoin

- Founding Date: 2013;

- Jurisdiction: United Kingdom;

- Verification: no mandatory verification;

- Deposit and withdrawal: Yandex Money, Kiwi, Webmoney;

- Commission: no deposit, to withdraw – up to 6%, trading – up to 0.18%;

- Trading pairs: more than 300, including fiat;

- Interface languages: Chinese, Turkish, French, Russian;

- Safety level: high;

- Features: a referral program with high commissions and a sweepstakes on the rate of bitcoin;

- Detailed review and reviews: https://revieweek.com/review/livecoin/;

- Website: https://www.livecoin.net/.

How to store cryptocurrency

There are few ways to store cryptocurrency, the trader chooses the relevant method based on the goals he plans to achieve in the crypto market. If constant trading is intended, a significant portion of funds will have to be stored on an exchange account. Most of these platforms allow you to convert cryptocurrencies into fiat and withdraw money via bank cards or transfers.

But hardly any traders keep all of their cryptocurrencies on the exchange. Almost all of them were subjected to successful attacks of hackers and there were technical failures. That is, the risk of losing money on a cryptocurrency exchange is always there. It is impractical to start trading with buying digital money for fiat every time, because these coins are volatile. That’s why traders put some funds on the exchange, and withdraw the profit in cryptocurrencies to their wallets.

Wallets come in hot and cold versions. Hot wallets can be used with an internet connection on a computer or smartphone. In essence, it is a well-secured online service, the advantage of which is the ability to quickly transfer funds to or from an exchange. For identification, a private key is used, which is stored in the cloud. The advantages of this solution turn out to be its disadvantages: if there is no Internet, the service is unavailable, the wallet can be opened, the smartphone can be lost, and so on.

A cold wallet is a program installed on a computer or external storage device. A desktop wallet can be “thick” or “thin. A thick one will require a lot of space on your computer because it contains the entire blockchain of a particular cryptocurrency and this blockchain will be constantly updated. “Thin,” on the other hand, does not take up much space, but is considered less reliable. Cold wallets can function without connection to the network, but, understandably, it is impossible to withdraw money from them without the Internet. In such a wallet, the money is in complete safety. Problems in this case can create the user himself: forget the password, identification information.

A hardware wallet is an analogue of a flash card, you can use it on any computer, carry it around with you like an ordinary wallet. Obviously, it can simply be lost, and that is its main problem. It can also be very difficult to regain access to it in case of loss of identification data.

Currently, the most popular cryptocurrency wallets include:

- Jaxx, desktop, mobile and as a Google Chrome wallet extension;

- Holy Transaction, an online wallet;

- Exodus, desktop wallet;

- Cionomi, mobile wallet;

- Coinbase, an online wallet;

- KeepKey, a hardware wallet;

- Ledger Nano, a hardware wallet;

- Trezor, the hardware wallet.

Trading Psychology

Psychology is often of key importance in cryptocurrency trading. First of all, we are talking about the need for stability during periods of dramatic changes in the value of digital coins. Simply put, a trader needs to have strong nerves when the price of an asset rises or, on the contrary, falls. Here, it is important to know a few important rules that will allow you to maintain psychological stability in any development of the situation on the market.

Don’t be greedy

Most often, greed manifests itself when the price of a cryptocurrency rises quickly and steadily and the trader does not sell the coins, but rather adds them up, because he is waiting for a certain highest price. In reality, however, he often waits for the price to fall and then for the asset’s price to collapse. There is no way to accurately predict the movement of currency prices on the crypto market, so “a bird in the hand is better than a crane in the sky” is a justified tactic. Another manifestation of greed is buying up coins that for some reason seem promising, but are not. To avoid this, one must initially evaluate each crypto-asset skeptically, without succumbing to hype, advertising, and promises of quick profits.

Patience

Traders don’t need to rush either with buying or selling coins – they don’t need to dump them at the slightest sign of growth, they don’t need to organize mass buying of currencies when the price moves down a bit. Crypto market fluctuations can be fast and significant, but they are not instantaneous – there is always time to rationally assess the situation. In addition, trends here now last for months.

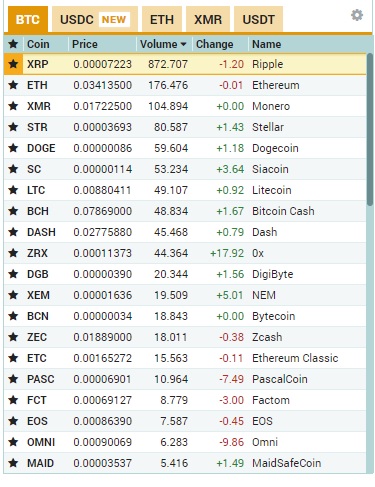

Poloniex bid glass

Request glass

The order book is the main source of information that can quickly cool down a trader’s emotional outburst. For example, if the column for selling a cryptocurrency shows a surplus of a coin and a deficit for buying, it will not be possible to sell it at a good price, perhaps it has lost prospects or was originally a scam and there is no need to worry about further actions. It is necessary to carefully study the asset before buying.

Volume and capitalization

The cryptocurrency’s capitalization and trading volume are a direct indication of its promise. If the figures are high, it indicates that the coin is in demand and has a high price. Understanding this pattern will help to avoid wasting time and energy on emotions.

As a conclusion, we can say here that the key to the psychological stability of crypto-trader – a thorough analysis of the market situation.

Risk Management

Risk management should be at the core of digital coin trading, but the paradox is that few pay attention to it. Cryptoinvestors have identified certain patterns that make cryptocurrency trading less risky.

Signals that indicate a rise or fall in the price of cryptocurrencies are believed to be reliable at most 70%, not higher. Thus, it is impossible to put the entire deposit into a deal or their series. It is always necessary to leave a reserve of money as a guarantee of an opportunity to win back in case of a negative outcome of trades.

As experience of traders shows, it is not recommended to put more than 10% on one coin of the trading deposit and more than 50% on all coins of the investment portfolio. This will somewhat reduce the amount of profit, but will minimize losses in case of price decrease.

The average risk per trade should not exceed 1-4%, with great confidence. It is possible to enter into the transaction and with risk 5%, but only at full understanding that trades will end with success. In any case it is necessary to be ready to unexpected losses.

It is believed that in the case of firm confidence in the downtrend, you can not sell more than 20% deposit.

It is recommended to divide cryptocurrencies into two parts – a trading deposit and an investment portfolio. The ratio of coins is set depending on the trader’s goals. The investment portfolio enrolls assets that are considered the most promising.

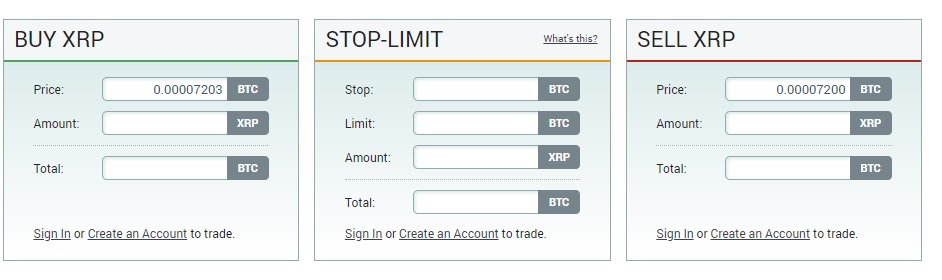

Buy, sell and stop-loss function on the Poloniex exchange

When trading, you should always put a Stop-loss.