| Service | |

|---|---|

| Official website | |

| Social network | |

| Head Office | 1 West Regent Street, Glasgow, Scotland, G2 1RW |

| Company owner | PayBis LTD |

| Types of support | |

| Phone Support | |

| Languages | Spanish, Italian, French, Portuguese, German |

| Number of cryptocurrencies | 35+ |

| Maximum withdrawal limit | Until 200000 EURDepending on the method and level of verification |

| Minimum deposit limit | From 50 USD |

| Methods of replenishment | Neteller, Sepa, Skrill, Cryptocurrencies, Bank card (Visa/MC) |

| Withdrawal methods | Neteller, Sepa, Skrill, Cryptocurrencies, Bank card (Visa/MC) |

| A way to store cryptocurrencies | Cold: no Hot: no |

| Laws regulating activities | UK Financial Services Authority The Latvian branch of the organization is regulated by local law |

| Affiliate Program | RegistrationFrom 10 to 20% the amount of referral commission |

| Account currencies | EUR, USD, GBP |

| Types of cryptocurrencies | Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Ripple, Stellar, NEO, Tron, etc. |

| Exchangeability for fiat currencies | There's |

| Verification | In 90% cases verification takes less than 5 minutes, there are several levels of verification |

| Additional services | Blog, Market News |

| Age restrictions | From 18 years old |

| Advantages | Possibility to buy bitcoin by bank card No knowledge of blockchain technology required Large selection of cryptocurrencies Referral program Cancellation of the transaction if the funds have not been sent within 48 hours |

| Disadvantages | High commissions Many complaints about transfer delays, loss of funds No license No mobile app |

| Company requisites | Legal name: Paybis LTD Legal address: 1 West Regent Street, Glasgow, Scotland, G2 1RW |

| Overall assessment | 8.9/10 |

| Date of update | December 16, 2024 |

Is Paybis a Scam? Complete Review and Real Customer Feedback

Contents

PayBis is an exchanger, registered in the UK in 2014. The service covers almost all the countries of the world, the exchange can be made in 180+ countries and 48 states of America. How profitable and safe is it to use the platform?

Is Paybis a scam or is it a convenient and effective platform in terms of earning money? Let’s take a look.

Why Paybis?

Paybis, as stated on the website paybis.com. The most important thing is that you don’t have to be a blockchain expert at all: the system will do everything for you. The most important thing is that you do not need to be a blockchain expert and understand technical analysis, as in the case of the exchange: the system will do everything for you. True, there will be no choice either, you just pick the right moment when the price is optimal. The advantages of the exchange:

- easy-to-use interface;

- several payment options, including card and bank transfer;

- availability of a license;

- quick verification

- high level of security;

- several stages of verification;

- 24-hour technical support;

- no hidden fees.

Registration is available not only via a form but also through social networks (Facebook, Google+).

The site is very informative: there is general information about what cryptocurrency is and how to earn from it, a detailed FAQ section (“Frequently Asked Questions”), a support portal with the function of creating tickets (new questions/tasks for the support team) and a blog. The service interface is simple and easy to use, the sections show only the basic functions, each of which can be opened separately. This simplifies the appearance of the page and does not distract a newcomer from learning the information.

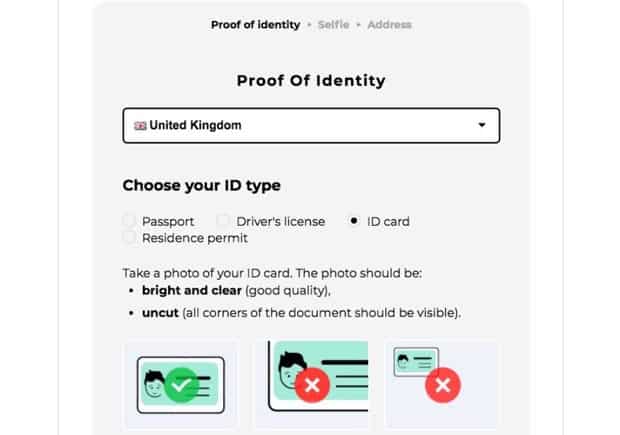

As for security, the exchange enforces strict KYC (know your customer) rules. This means that you have to go through several stages of identity verification before you can make any transactions on the platform. To do so, you will need:

- register;

- go to the “Verification” section in the cabinet and start the process of identification;

- send a scanned photo of the requested documents;

- undergo a 3D face scan via webcam;

- Wait for confirmation of identity.

One of the features of the exchange is that it does not store users’ cryptocurrency on its platform. Each client must have his own wallet to which he will transfer his funds after he finishes trading. Crypto assets will always be more secure in a user’s own wallet than on an exchange. Other security features:

- anti-fraud systems (fraud protection);

- internal hardware protection algorithms;

- SSL encryption to protect your traffic.

The first exchange on the platform without commission service for credit and debit cards. For the amount of exchange up to $250 a fixed commission of $10 is always taken. When exchanging a larger amount or other methods of exchange, all commissions are written at once. Cancellation of the transaction is possible in one case: if the funds have not been sent within 48 hours. Paybis, like most cryptocurrency exchangers/exchanges, offers a referral program: cashback from the trading volumes of each client who came to your recommendation.

How to Buy Cryptocurrency on paybis.com

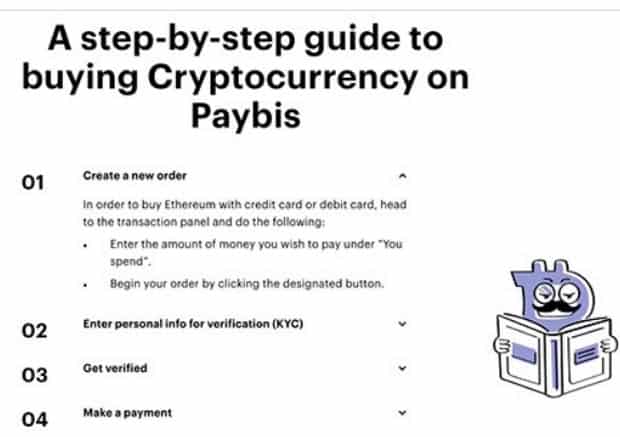

For cryptocurrency purchases via Paybis, you should register on paybis.com, or log in to your account, if you have one. Specify the name, last name, and email, make up a login and password, fulfill the conditions of the captcha (just put a tick in front of the phrase “I’m not a robot”), and accept the terms of use, AML-policy and exchange rates.

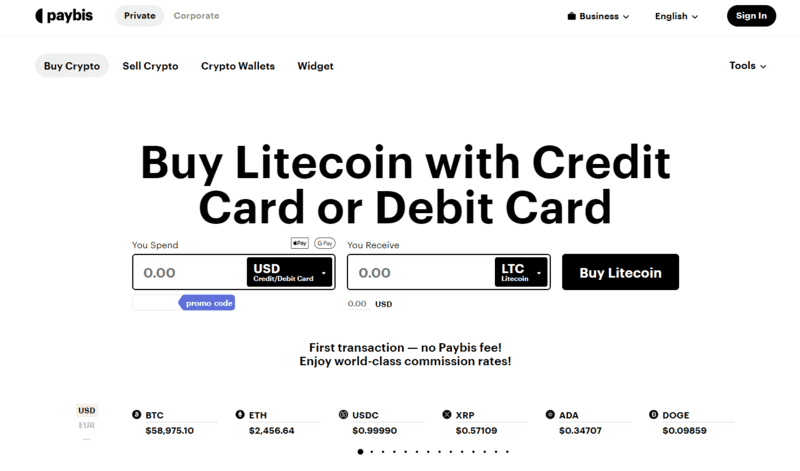

Now you can move on to the exchange. On the left, you choose what you sell, on the right – what you buy. Let’s say we need to exchange 1000 dollars for bitcoins and we will use a bank card. We set the initial data, and see the commission, it is immediately reflected in the calculator.

When you click “Buy,” the service will redirect you to a separate page that prompts you to complete a KYC check. It involves providing Paybis with an ID, selfies, and residential address.

Since cryptocurrency is highly volatile, to minimize your losses, Paybis fixes the price reflected in the order for 30 minutes. And then it starts to update every minute. However, given that trades sometimes take longer, this is little consolation.

Paybis Cryptocurrency Price

Another advantage of Paybis is that the service allows you to buy cryptocurrency not only with credit and debit cards but also with a bank transfer. Not all destinations are available for purchase this way, but the very fact of such payment indicates a high level of security. Few exchanges accept bank transfers, and only those that use KYC verification and provide a high level of security do so.

Verification on the PayBis platform

Paybis Ltd. operates within the AML anti-money laundering policy. Therefore, it verifies the identity of each of its clients and monitors all transactions. If suspicions arise, they are withdrawn and the account can be frozen or permanently blocked.

PayBis Ltd. Verification

For verification, you need to go to the appropriate menu item in your cabinet after registration. To confirm the address and identity you need to send a photo of the requested documents. What you need to confirm your identity and address:

- passport or other ID;

- driver’s license;

- international passport;

- utility bill;

- bank statement for the last 3 months.

Additional requests may include:

- a photo of the credit card and selfies with it;

- photo with a printed declaration (for operations with large amounts).

Verification can take from 5 to 15 minutes. There are several levels of verification (based on the currency you plan to buy/sell):

- Level 1 – personal data only. For cryptocurrencies.

- Level 2 – personal data (full name, date of birth, address), ID card (information and scans of pages). For cryptocurrencies.

- Level 3 – personal data (full name, date of birth, address), ID card (information and scans of pages), photo account statement no older than 3 months at the time of the transaction. For fiat currencies.

They also determine the minimum and maximum amounts of transactions. In some cases, the company may request selfies with the credit card and even a photo with a printed/written declaration. This is most often required for high turnover.

Terms of Buying Cryptocurrency

The exchanger can be used by residents of 180+ countries who are of legal age and have confirmed their identity. You will also need a wallet from a third-party resource, where you want to get the money.

Then you just follow the instructions given above. The status of the application is displayed on the information panel above the calculator in the online mode. It is forbidden to have multiple accounts registered to one person/one device. If this kind of account violation is detected, the company requests additional confirmation of the account owner’s identity and may block the account based on the results of the verification.

Buy and Sell Limits

As already mentioned, limits are determined by the level of verification. And they are often set for the user individually. So, after completing the registration we got an annual limit of 10,000 USD for buying BTCs, a weekly limit of 1 USD for withdrawing assets via Neteller. However, not all assets proved to be KYC level 1 (“Know Your Client”).

It is very convenient, when clicking on any of the payment services, you’re able to see the required information for verification and obtaining a limit. If you consider the range of values, the minimum deposit amount is 50-200 dollars, depending on the asset. At most, you will be able to exchange up to 20 thousand dollars per transaction. On the withdrawal of a day will be allowed to send no more than $ 300,000 (of course, such limits are not available for all methods).

PayBis Commission

Paybis fee is set at each stage of work with the service:

- Depositing funds from your payment account, wallet, or card.

- The deal.

- Withdrawal of funds to the selected payment system or cryptocurrency wallet.

On the site, there is a table of common values with the section “Rates” in the footer of paybis.com. When you make a transfer, you see specific numbers in the calculator.

For example, at the first conversion of the corresponding amount of BTC in $1000, you will give the company only $24.9 of them, which is 2.49%. The highest rate when exchanging fiat currency for cryptocurrency by Skrill: is 8.49%.

Bonuses at Pybis

The first exchange with a credit or debit card on Paybis is without commission.

Referral Program

Paybis has a standard referral program. To receive your reward, you register in the system and receive a unique (referral) link, which you place on your website, blog, and/or social network page.

When a new client registers through a link on the site, you automatically receive a cashback from each of their transactions. Depending on the number of referrals (clients who have come) and the volume of transactions, you earn 20%. Payments are carried out at the end of the month at an accumulation minimum of $50. For registration in the program, you request the invitation, and data for input in the account of the partner of service will be sent on your e-mail.

Complaints Against PayBis LTD

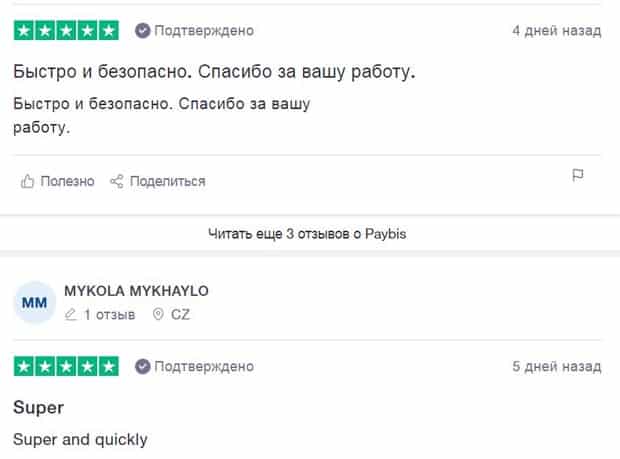

The Trustpilot website has over 12,000 reviews about Paybis with an average rating of 4.5 stars. This is the highest rating among competitors. All of the complaints on the site are handled by the company.

Many clients of the exchanger, in addition to the above, complain about high interest rates and inconsistency of the real price indicated in the calculator. The latter is prescribed in the “Terms of Dynamic Cryptocurrency counting,” but the spread, according to forum participants, is too large. There is also feedback that often the transfer has to be made in two transactions.

But there are also positive comments about the work of the exchange. Clients who leave them like the speed of processing requests and the high level of security. Users also note the receipt of messages at each step of the exchange procedure, which allows them to control the process.

If there are any reviews about the Paybis service, we’ll post the information on social media. Sign up to make sure you don’t miss anything!

Please keep yourself informed about news and complaints. We copy the most valuable information to social networks, so please sign up!

Paybis Regulation

The virtual currency market is decentralized, which, on the one hand, gives freedom from bank restrictions, but on the other hand, creates the risk of losing funds. Not only because of the high volatility but also because of the lack of clear regulation. Let’s see what guarantees are provided by Paybis Limited.

Regulator

Paybis is licensed by the FCA, the Financial Conduct Authority, which operates independently of the government. The FCA is one of the licenses regulating crypto companies. Paybis has received temporary registration of crypto-assets, making it a controlled company, and ensuring compliance with all FCA standards. Permanent registration is expected once the company’s functions and security assessments provided by the exchange, AML (anti-money laundering) policies and procedures are completed. The Latvian branch of the organization is regulated by local law and registered under the number 14629828 in the registry of that jurisdiction. When resolving disputes, you can rely on the terms of the user agreement posted on the official resource of the service.

Paybis.com User Agreement

The user agreement includes the interpretation of all the important moments in the legal relationship between the owners of the exchanger and the clients of the company. Let’s look at a few points. For example, clause 3 states that only the client is responsible for errors in filling out the transaction order – the consequences are irreversible.

Errors in transaction processing due to equipment malfunctions, network failures and force majeure circumstances are beyond the control of the company (item 4). However, any completed transaction is itself irreversible.

However, there is a guarantee period for the execution of client orders – it is 48 working hours (weekends and holidays are not taken into account). If it is violated, the funds sent will be returned to the applicant within 24 hours (clause 5).

All claims and disputes not resolved by pre-trial settlement shall be resolved in Great Britain (clause 6)

You warrant that you have provided complete and accurate information about yourself. Any errors or omissions will be treated as an attempt to defraud you. The service operator has the right to close your account at any time without notifying you and without asking for your permission, if at that moment there is no withdrawal procedure running (point 10). The terms of the agreement are also changed unilaterally.

Is Paybis a Scam?

Service Paybis has an FCA license, which is extremely difficult to obtain, as well as the availability of the service in 48 states of America, which is extremely tough for such financial instruments. The functionality is small, but it is convenient. Everything is clear and accessible and does not require professional knowledge in cryptocurrency.

By the way, the choice of assets is not bad either: it includes about 30 types of digital currency and 10 basic fiat. The security policy complies with the EU requirements. Paybis is regulated only for the Latvian branch. At the same time, all the disputes of the visitors of the site are solved on the territory of Great Britain. In addition, the terms of the user agreement allow you to close your account at any time and even change the requirements, rates, and wording.

Conclusion

At first glance, Paybis looks like a very convenient platform: tutorials and general materials for beginners, concise and at the same time clear form of the calculator, where you see both the commission and the rate, and all the ways of deposit and withdrawal. In summary, webelievePaybis is not a scam.

Reviews

- New0

- Resolved0

- Not resolved0

Paybis reviews