| Forex broker | |

|---|---|

| Official website | |

| Date of foundation | 2025 |

| Company owner | Tradeel LTD |

| Types of support | |

| Phone Support | +44 7458 164441Support works from Monday to Friday, 9:00–18:00 GMT+2 |

| Languages | English |

| Terminals | Tradeel WebTrader (TradingView-based), Mobile App |

| Min. first deposit | From 100 USD |

| Brokerage commission | Included in spreads (no separate commission) |

| Lot size | From 0.01 Standard lots |

| Maximum open positions | No specific limits |

| Leverage | Until 1:1000Varies by asset: 400x on forex/crypto, 100x on gold |

| Spreads | Floating: 1-2 pips on EUR/USD, up to $150 on BTC |

| Free demo account | Yes |

| Adjustable | Yes |

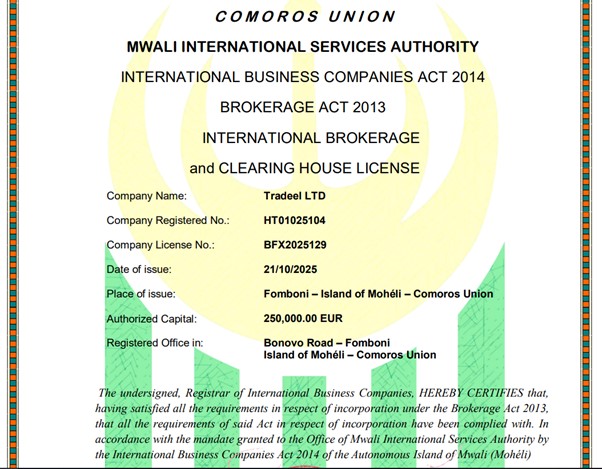

| Regulators | MISA |

| Licenses | Licensed With Mwali International Services Authority (MISA) as an International Brokerage and Clearing Company under number BFX2025129 (Active) |

| Types of accounts | Single unified account type |

| Margin call / Stop out | Standard margin protection with negative balance protection enabled |

| Transaction volume | Standard lots available, minimum 0.01 |

| Peculiarities of trade | Zero-margin hedging (0% margin on equal opposite positions), Copy trading, Negative balance protection |

| Order execution | Market Execution (at market price) |

| Methods of replenishment | Bank Transfer (SEPA), Bank card (Visa/MC), Cryptocurrencies, PayPal |

| Withdrawal methods | Bank Transfer (SEPA), Bank card (Visa/MC), Cryptocurrencies, PayPal |

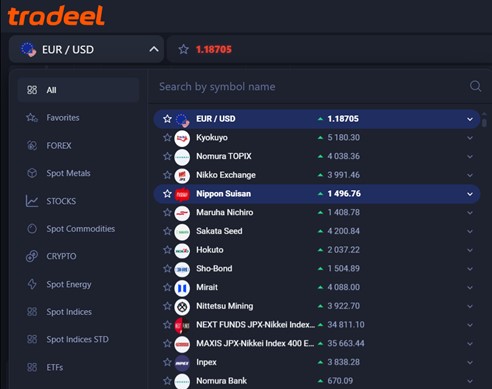

| Number of assets | 4000+ |

| Types of assets | ForexMajor, minor, and exotic currency pairs IndicesGlobal stock market indices StocksCFDs on major company stocks CommoditiesEnergy, metals, agricultural products CryptocurrenciesBitcoin, Ethereum, and major altcoins ETFs fundsExchange-traded funds across multiple sectors |

| Account Currencies | USD |

| Weekend trading | Available for cryptocurrency assets (24/7), limited for traditional markets |

| Trader training | Exclusive closed trading course for active traders, Regular webinars with financial analysts, Market analysis and educational content |

| Contract Difference Commission | Included in spreads |

| Swaps | Yes, applicable on overnight positions |

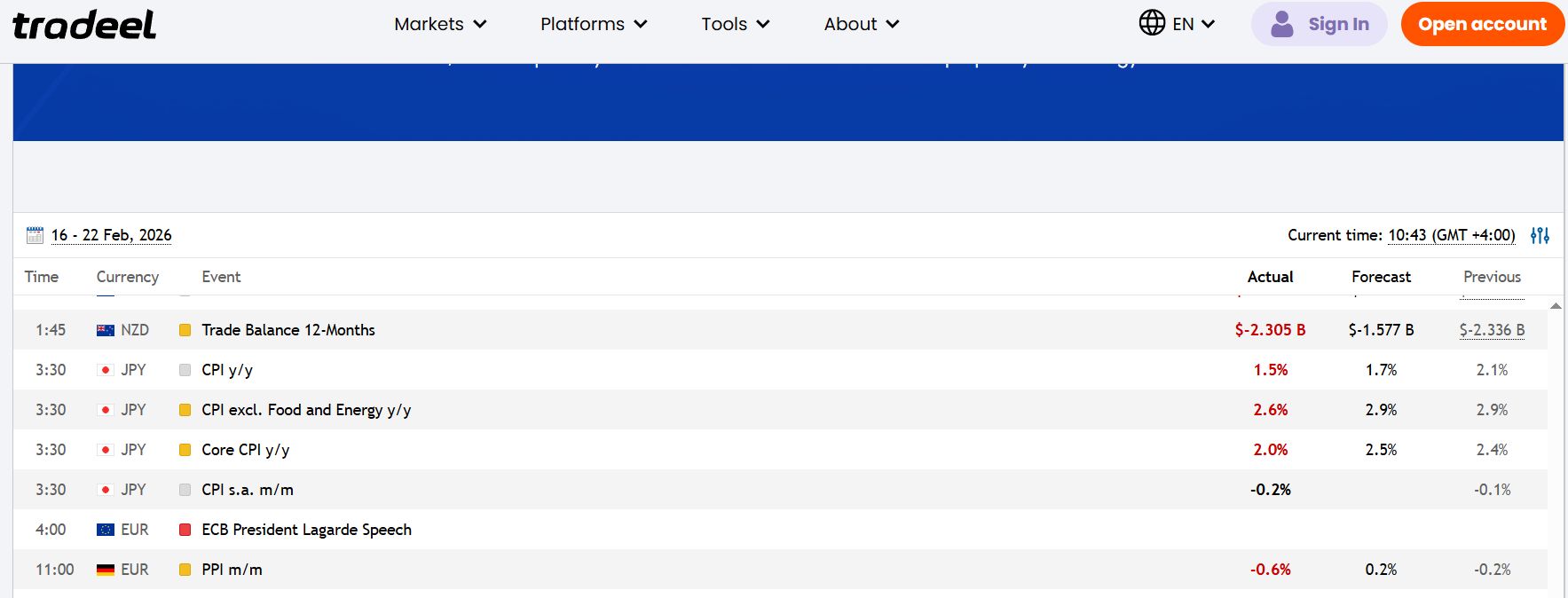

| Analytics | Market analysis tools, Economic calendar, TradingView charting integration, Webinar analysis from professional traders |

| Margin trading | Yes, with leverage up to 1:1000 |

| Affiliate Program | RegistrationAvailable, up to 5% profit rate for level 1 referrals |

| Advantages | Browser-based instant WebTrader access without downloads 4000+ multi-asset selection in one unified interface Multiple payment options High leverage up to 1:1000 Copy trading feature available Modern TradingView-based trading platform True zero-margin hedging capability Negative balance protection Fast verification and onboarding process All-in-one trading hub for multiple asset classes |

| Disadvantages | No MT4/MT5/cTrader platforms available Single account type only (no account tiers) Short operating history (launched 2025) No PAMM trading available |

| Company requisites | Legal name: Tradeel LTD |

| Platform type | Proprietary browser-based WebTrader with TradingView integration and custom trading application |

| Date of update | February 21, 2026 |

| Overall assessment | 8.3/10 |

Is Tradeel a Scam? Complete Review and Real Customer Feedback

Contents

- 1 Introduction to Tradeel

- 2 Trading Conditions at Tradeel

- 3 Tradeel Trading Platforms

- 4 Account Types and Features

- 5 Demo Account

- 6 Educational Resources

- 7 Deposit and Withdrawal

- 8 Regulation of Tradeel LTD

- 9 Regulation of Tradeel LTD: What Are Traders Saying?

- 10 Complaints About Tradeel Broker

- 11 Is Tradeel Legitimate?

- 12 Conclusion

Introduction to Tradeel

Tradeel is a newly established retail CFD trading platform that launched in 2025, operated by Tradeel LTD. Despite being relatively new to the market, the broker positions itself as a comprehensive trading solution, offering access to over 4000+ trading instruments across six major asset classes: forex, indices, stocks, commodities, cryptocurrencies, and ETFs.

What distinguishes Tradeel from many other brokers is its focus on browser-based accessibility and multi-asset trading convenience. The platform operates entirely through their proprietary WebTrader, which runs directly in a web browser and loads up almost instantly. The platform doesn’t require any downloads or installations. This approach appeals particularly to traders who value immediate access and cross-device compatibility.

The broker targets a very diverse audience, from beginners seeking exposure to all the asset classes with high leverage, to experienced users looking for a broad selection of instruments, and crypto futures traders who appreciate multiple asset access in a single platform.

In this review, we examine Tradeel’s offerings, trading conditions, platform capabilities, and overall reliability to help you determine whether this new broker deserves any consideration.

Trading Conditions at Tradeel

Tradeel positions itself as a multi-asset broker capable of serving traders with varied interests. The platform’s asset selection spans traditional forex markets, global stock indices, individual company stocks, commodities, and the increasingly popular crypto sector.

Leverage and Margin

One of Tradeel’s standout features is its leverage offering, which reaches up to 1:1000 on certain instruments. However, leverage here varies by asset class:

- Forex major pairs: Up to 400x leverage

- Cryptocurrencies: Up to 400x leverage

- Gold spot: Up to 100x leverage

- Other instruments: Leverage varies based on asset class and market conditions

The broker implements negative balance protection, ensuring that traders cannot lose more than their deposited funds even during extreme market volatility. This feature provides an important safety net, particularly for those utilizing high leverage.

Spreads and Trading Costs

Tradeel operates on a spread-based commission structure. The spreads vary by instrument:

- EUR/USD: 1-2 pips (floating)

- Nvidia: less than 0.50$

- Bitcoin (BTC): up to $150

- Ethereum (ETH): up to $10 during volatility

- Other instruments: Spreads vary based on liquidity and market conditions

It’s worth noting that the Bitcoin spread is slightly higher than the industry average, but ETH and many altcoins have spreads that are much lower. Stock CFD spreads are typically below 0.5% of the underlying share price under normal market conditions. The EUR/USD spread of 1-2 pips also falls right into an acceptable range for a broker of this type.

Special Trading Features

Zero-Margin Hedging

Tradeel offers a unique feature that experienced traders will appreciate: true zero-margin hedging. When you open two positions of the same size in opposite directions on the same instrument, the margin requirement drops to $0. This means you maintain 100% free margin despite having both positions open.

This feature proves particularly valuable during high-impact news events. For example, during Non-Farm Payrolls releases or central bank announcements, traders can hedge existing positions without locking additional capital as collateral. Once volatility subsides, the hedge can be closed while the original position remains intact.

Multi-Asset Risk Management

With 4000+ instruments available, traders can implement sophisticated risk management strategies by hedging across different asset classes. The ability to trade forex, stocks, commodities, and crypto from a single account eliminates the need for multiple broker relationships and simplifies portfolio management.

Tradeel Trading Platforms

Unlike many brokers that rely on third-party platforms like MetaTrader 4 or 5, Tradeel has developed its own trading infrastructure, including WebTrader platform and advanced mobile trading app.

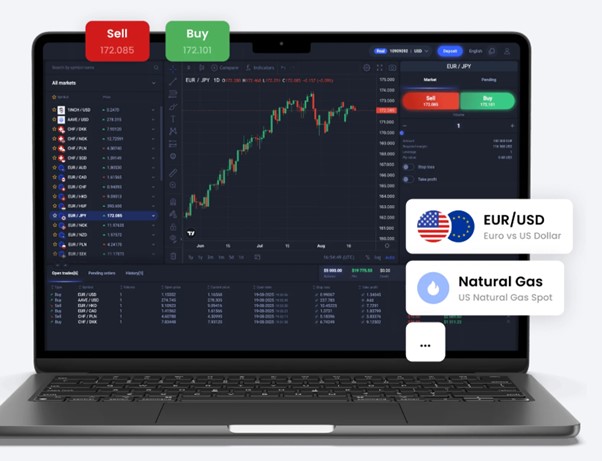

WebTrader Platform

The Tradeel WebTrader is built on TradingView technology, leveraging one of the most popular charting and analysis platforms in the trading community. This integration provides several advantages:

Instant Access: The platform runs entirely in your browser, requiring no downloads or installations. You can access your account from any device with an internet connection and a modern web browser.

TradingView Charts: Traders benefit from TradingView’s comprehensive charting capabilities, including:

- Advanced technical indicators

- Drawing tools and pattern recognition

- Multi-timeframe analysis

- Custom indicator creation with Pine Script

- Clean, intuitive interface

Cross-Device Compatibility: Whether you’re on Windows, Mac, Linux, or even a tablet, the WebTrader maintains consistent functionality and appearance.

Market Analysis

Tradeel provides traders with various analytical tools to support informed trading decisions:

- Technical analysis capabilities through TradingView integration

- Fundamental analysis resources

- Market forecasts and insights

- Economic calendar tracking major market-moving events

Order Execution

The platform uses market execution, meaning orders are filled at the best available price at the time of execution. This approach is standard for CFD brokers and generally provides faster execution than pending order systems.

Tradeel Mobile Trading App

For individuals engaged in mobile trading, Tradeel presents convenient smartphone applications catering to all their trading needs. The mobile platform ensures traders can manage their positions and respond to market opportunities regardless of their location.

Professional Analysis Suite: Mobile users gain access to professional-grade analytical tools, including over 100 technical indicators and built-in drawing tools. This comprehensive suite enables precise charting and in-depth market analysis directly from smartphones.

Smart Risk Management: The mobile platform includes advanced risk management capabilities, allowing traders to set stop-loss and take-profit levels with precision. These advanced options provide transparent risk control and help protect your capital even when trading on mobile devices.

Personalized Watchlists: Traders can create and manage custom watchlists of their favorite assets for instant access and faster decision-making. This feature streamlines the trading process by keeping your most-watched instruments readily available.

Hedging Mode Enabled: The mobile app supports hedging mode, enabling traders to open positions in both directions on the same asset. This capability allows you to offset short-term market moves and optimize margin usage, providing the same zero-margin hedging functionality available on the desktop platform.

Real-Time Alerts & Notifications: Traders can stay informed with instant alerts and custom notifications that track market moves and help manage their trading seamlessly. Real-time notifications are a valuable tool because they allow users to never miss an important price movement they’ve been watching for days, and capitalize on more trading opportunities.

The Tradeel mobile trading platform ensures that professional trading capabilities are available wherever you are, providing the flexibility modern traders demand without compromising on features or functionality.

Account Types and Features

Unlike many brokers that offer multiple account tiers (such as micro, standard, and VIP accounts), Tradeel simplifies the structure with a single unified account type. This approach has both advantages and disadvantages.

Single Account Structure of Tradeel

Advantages:

- No confusion about which account type to choose

- All traders receive the same trading conditions

- Simplified account opening process

- No need to upgrade or switch accounts as capital grows

Disadvantages:

- No ability to choose between different spread/commission structures

- Cannot select accounts optimized for specific trading styles (scalping, swing trading, etc.)

- Limited flexibility for traders with different capital levels

The account requires a minimum deposit of $100, making it accessible to beginners while remaining reasonable for experienced traders.

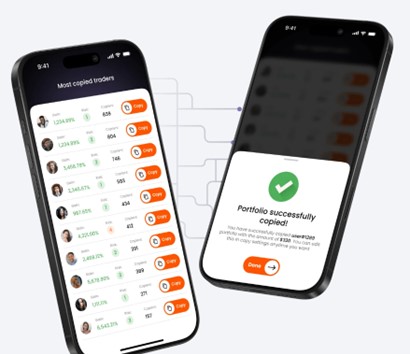

Copy Trading Platform

Tradeel includes a copy trading feature, allowing less experienced traders to replicate the strategies of successful traders automatically. This service provides:

- Access to strategies from experienced traders

- Ability to diversify across multiple strategy providers

- Transparent performance statistics

- Control over risk parameters and position sizing

Copy trading can serve as both a passive income opportunity and an educational tool, as followers can observe and learn from the decision-making of more experienced market participants.

Demo Account

Tradeel offers a free demo account, allowing prospective traders to test the platform and practice strategies without risking real capital. The demo account provides:

- Access to the same platform interface as live accounts

- Virtual funds for practice trading

- Full access to charting and analysis tools

- Opportunity to test the copy trading feature

- No time restrictions or expiration dates mentioned

Demo accounts here, in our estimate, can serve as valuable tools for:

- New traders learning the basics of CFD trading

- Experienced traders testing new strategies

- Prospective clients evaluating the platform before funding an account

- Anyone wanting to familiarize themselves with Tradeel’s interface and features

Educational Resources

One of Tradeel’s notable strengths is its commitment to trader education. The broker goes beyond basic tutorials, offering comprehensive learning resources that cater to both beginners and experienced traders.

Exclusive Trading Course

Active Tradeel account holders receive access to a closed trading course sent individually. This educational program covers:

- Platform Basics: Understanding the WebTrader interface, order types, and execution methods

- Trading Fundamentals: Risk management principles, position sizing, and trading psychology

- Market Analysis: Technical analysis methods, fundamental analysis approaches, and sentiment analysis

- Trading Strategies: Specific strategies applicable to different market conditions, suitable for both beginners and advanced traders

Tradeel broker has a personalized approach to trader education, rather than a generic one-size-fits-all content, which we can appreciate. This certainly raises its score in this category a bit, in our eyes.

Regular Webinars

Traders with active accounts also gain access to exclusive webinars hosted by financial analysts and professional traders. These sessions provide:

- Market overviews and analysis of current conditions

- Specific trading tips based on the current market environment

- Analysis of major economic events and their potential impact

- Interactive sessions where traders can ask questions

The real-time nature of these webinars adds significant value, as the content remains relevant to current market conditions rather than becoming outdated.

Educational Value Proposition

The combination of structured courses and live analyst webinars creates a comprehensive learning environment. This educational ecosystem can help traders:

- Develop consistent trading strategies

- Understand risk management principles

- Stay informed about market conditions

- Learn from experienced professionals

- Avoid common trading mistakes

For beginners, this level of educational support can significantly accelerate the learning curve. For experienced traders, the analyst webinars provide fresh perspectives and ongoing professional development.

Deposit and Withdrawal

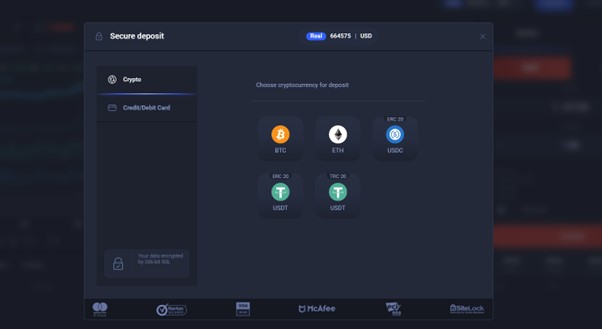

Tradeel supports a variety of funding methods, reflecting both traditional and modern payment preferences.

Deposit Methods

- Bank Transfers

- Bank Cards: Visa and Mastercard

- Cryptocurrencies: BTC, ETH, USDT, USDC

- E-Wallets: PayPal

The inclusion of multiple cryptocurrency options distinguishes Tradeel from many traditional brokers, appealing to traders who operate primarily in digital assets.

Withdrawal Methods

Withdrawal options mirror the deposit methods:

- Bank cards (Visa/MC)

- Bank transfers

- Cryptocurrencies (BTC, ETH, USDT, USDC)

- PayPal

Withdrawal Processing Time

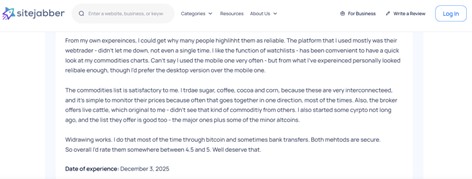

One of Tradeel’s strong points is withdrawal speed. According to our tests and available Tradeel user reviews, withdrawals are processed within 1-2 days at a maximum, if the user is verified. This timeline compares favorably to many brokers where withdrawal requests can take 5-7 business days or longer.

Fast withdrawal processing addresses one of the most common concerns among retail traders. The ability to access your funds quickly provides peace of mind and flexibility in capital management.

Minimum Deposit

The minimum deposit requirement is $100, positioning Tradeel as accessible to beginners while maintaining professional standards. This entry point allows new traders to start with manageable capital while learning the markets.

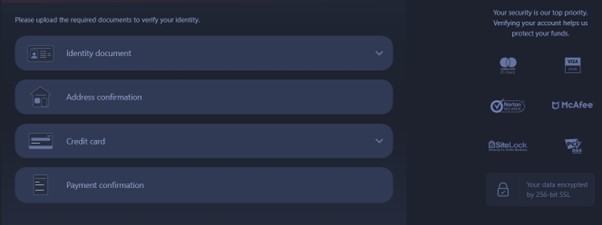

Verification Requirements

Tradeel broker has typical, industry-standard verification requirements. To trade on a real account and withdraw your profits, you would need:

- Government-issued photo ID (passport or driver’s license)

- Proof of residence (utility bill or bank statement)

- Potential payment method verification

The verification process appears straightforward, with most traders reporting same-day approval and the ability to trade during Asian session hours after evening verification.

Regulation of Tradeel LTD

Tradeel LTD launched operations in 2025 and holds a brokerage license from MISA (Mwali International Services Authority) as an International Brokerage and Clearing Company under license number BFX2025129.

The Mwali International Services Authority oversees international financial services in the Union of Comoros. As a regulatory body, MISA provides adequate licensing and supervision for international brokerage firms operating in global markets. That being said, this is not a Tier-1 regulation, so far. Organizations like the FCA (from the UK), CySEC (Cyprus), and ASIC (Australia), are considered to be more robust.

Security Measures

That being said, from their own side, Tradeel broker implements:

- Negative Balance Protection: Ensures traders cannot lose more than their deposited funds

- Secure Payment Processing: Support for established payment methods suggests standard security protocols

- Account Verification: KYC (Know Your Customer) procedures to prevent fraud and money laundering

Regulation of Tradeel LTD: What Are Traders Saying?

As a newly launched broker in 2025, Tradeel has a limited history of customer reviews. However, analyzing available feedback provides insights into user experiences.

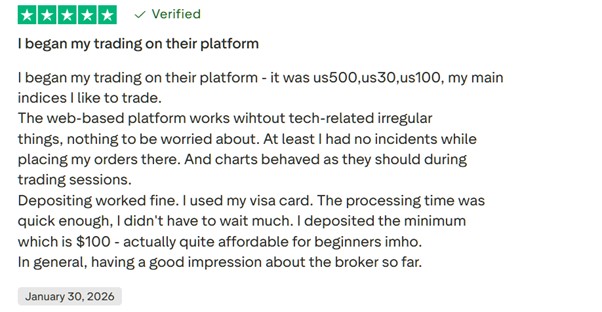

Out of the reviews we’ve researched on Trustpilot, SiteJabber, and Reviews.io, we’ve noticed several general feedback themes, such as decent withdrawal experience, lack of lags or glitches on the platform, and helpful interactions with support staff. At the same time, most people are satisfied with onboarding speed.

Interestingly, some traders report switching to Tradeel from MT4/MT5 brokers, citing these convenience factors.

Complaints About Tradeel Broker

So far, we haven’t found any public complaints about this broker, but there were a few potential issues worth highlighting, such as a lack of typical MT4/MT5 platforms which are liked by some, as well as the relative ‘newcomer status’ of the platform itself.

Is Tradeel Legitimate?

Determining the legitimacy of a newly launched broker requires careful consideration of available evidence and a realistic assessment of risk factors.

Evidence Supporting Legitimacy:

- Highly Functional Platform: The broker operates a working trading platform with apparent real market connectivity and execution.

- Withdrawal Processing: Many reports confirm that withdrawals are processed within the stated 1-2 day timeframe, which is a critical indicator of broker reliability.

- Educational Investment: The provision of comprehensive trading courses and regular analyst webinars suggests a genuine commitment to trader success rather than a pure commission-focused model.

- Multiple Funding Options: The integration of various payment methods, including cryptocurrencies and PayPal, indicates an established payment processing infrastructure.

- Customer Support: Available support through multiple channels (chat, email, phone) with responsive service suggests an operational infrastructure.

Risk Factors to Consider:

- Limited Regulatory Oversight: The absence of clear regulation from established authorities represents the primary concern. Regulatory oversight provides traders with protection mechanisms and recourse options.

- Short Operating History: Launched in 2025, Tradeel lacks the track record of established brokers, making long-term reliability difficult to assess.

- Higher Spreads on Some Assets: Some spreads we checked exceed industry standards, potentially impacting profitability, especially for crypto-focused traders.

Recommendations for Prospective Traders

If you’re considering trading with Tradeel, implement these risk management practices:

- Start Small: Begin with the $100 minimum deposit to test services before committing larger capital.

- Test Withdrawals Early: Make a small withdrawal within the first week to verify the process works as advertised. One trader noted: “No ‘minimum 30 days before first withdrawal’ policies hidden in terms. Tested $50 withdrawal day 3, worked fine.”

- Regular Profit Withdrawal: Rather than accumulating large account balances, withdraw profits regularly to minimize exposure.

- Diversification: Don’t concentrate all your trading capital with a single broker, especially one with limited regulatory oversight.

- Documentation: Keep records of all deposits, trades, and withdrawal requests as evidence if disputes arise.

- Due Diligence: Continue monitoring reviews and feedback from other traders as the broker’s history develops.

Conclusion

Tradeel presents an interesting proposition in the retail CFD trading landscape. As a newly launched broker in 2025, it combines modern technology with comprehensive multi-asset access, appealing particularly to traders seeking convenience and variety.

Standout Strengths:

- Platform Accessibility: The browser-based WebTrader built on TradingView technology provides immediate access without downloads, appealing to traders who value convenience and cross-device compatibility.

- Asset Variety: With 4000+ instruments across six major asset classes, Tradeel offers genuine one-stop-shop capability for traders interested in multiple markets.

- Educational Commitment: The combination of individualized trading courses and regular analyst webinars demonstrates investment in trader development, which can significantly benefit both beginners and experienced traders seeking continuing education.

- Withdrawal Speed: The 1-2 day withdrawal processing time compares favorably to industry standards and addresses one of traders’ primary concerns.

- Unique Features: Zero-margin hedging and negative balance protection provide valuable risk management tools, particularly for traders utilizing high leverage.

- Payment Flexibility: Support for multiple cryptocurrencies alongside traditional payment methods reflects modern trader preferences.

Tradeel appears best suited for:

- Beginner traders seeking comprehensive education alongside trading capabilities;

- Experienced multi-asset traders are comfortable with newer brokers;

- Crypto-focused traders who appreciate combined traditional and digital asset access;

- Traders prioritizing platform convenience and immediate accessibility.

Our Overall Rating: 8.96/10

- Trading instruments and assets: 96%

- Withdrawal speed: 93%

- Platform technology: 89%

- Educational resources: 86%

- Transparency and regulation: 84%

This review is based on information available as of February 20, 2026. Trading conditions, features, and company policies may change. Always conduct your own research and consider your risk tolerance before opening a trading account.

Reviews

- New0

- Resolved0

- Not resolved0

Tradeel reviews