HTX Exchange Interface

Contents

HTX is one of the leading cryptocurrency exchanges, founded in 2013. The exchange offers a wide range of services, including spot and margin trading, futures, options, and various investment products. HTX has established itself as a reliable platform with high liquidity and a diverse set of trading tools.

Trading Interface Overview

The trading interface plays a crucial role in successful trading on a cryptocurrency exchange. It serves as the primary tool for traders to interact with the market, enabling them to analyze price movements, place orders, and manage positions. A user-friendly and functional interface can enhance trading efficiency, reduce decision-making time, and minimize errors. Understanding the features and capabilities of the HTX trading interface is vital for traders who want to maximize the potential of this platform.

HTX Web Interface

The HTX web interface is a comprehensive trading space designed to accommodate users of various skill levels. The interface is divided into several functional areas, allowing traders to manage their trading activities effectively.

Key Elements:

- Chart (HTX and TradingView): At the center of the interface is the price chart. HTX offers a choice between its chart and the popular TradingView chart, which provides an extended set of technical analysis tools, including various indicators and drawing tools. A “Depth” chart is also available, displaying market depth.

- Order Book: The order book, showing current buy and sell orders, is located to the right of the chart. This allows traders to assess the current demand and supply in the market. Next to the order book is the “Trades” tab, displaying the most recent transactions on the exchange.

- Order Placement Module: Below the chart is the order placement module, where traders can select the type of order, set the price and volume, and apply additional parameters such as Take Profit (TP) and Stop Loss (SL). This module also allows switching between spot and margin trading.

- Account Management: The account management module, where traders can view their balance and manage their funds, is located to the right of the order placement form.

- Tables for Open Orders, Order History, and Assets: At the bottom of the interface, there are tables, that display current open orders, trade history, and information about the user’s assets.

Futures Trading Interface Features

The futures trading interface has some differences from the spot trading interface. The main distinction is the placement of the trading module, which is moved to the right. Below the chart are information tables for “Position,” “Open Orders,” “Order History,” and others, allowing traders to manage their futures positions more efficiently.

HTX Mobile App

The HTX mobile app is available for iOS (iPhone, iPad) and Android devices. It can be downloaded directly from the exchange’s website or through official app stores like the App Store and Google Play.

The HTX mobile app offers a wide range of features similar to the web version of the platform. Users can trade on spot and futures markets, utilize margin trading, work with investment products and options. The app also allows users to complete KYC procedures, deposit and withdraw funds, change account settings, and invest in Earn products.

Comparison to the Web Version

The HTX mobile app largely replicates the functionality of the web version, providing access to all key features of the exchange. The main difference is the interface, which is adapted for mobile devices and optimized for smaller screens. Despite this, the app retains all essential tools for full-fledged trading, including charts, order books, and the order placement module. This makes the HTX mobile app a convenient tool for trading anytime and anywhere with internet access.

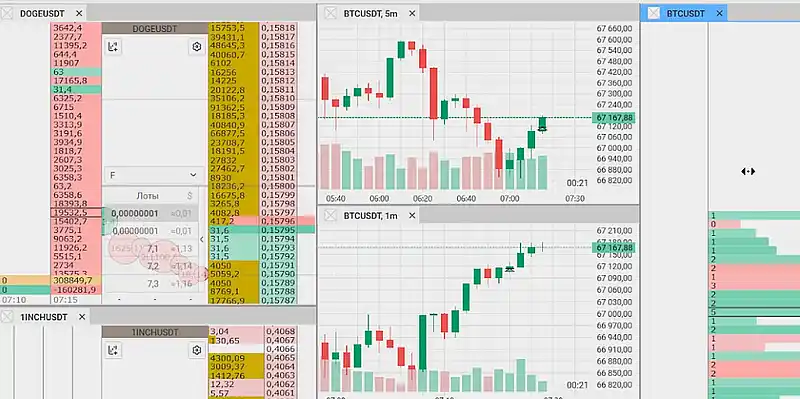

Trading via CScalp

CScalp is a professional trading terminal designed for active trading on cryptocurrency exchanges, including HTX. It offers advanced market analysis capabilities and fast order execution, making it an ideal choice for scalpers and intraday traders. The main goal of CScalp is to increase trading efficiency, especially when working with high-frequency strategies that require instant decisions.

Advantages of Using CScalp for HTX Trading

CScalp has several advantages that make it an attractive tool for traders:

- Direct connection to HTX via API for quick access to market data and order execution.

- Utilization of advanced analytical tools not available in the standard HTX web interface, offering more market analysis opportunities.

- “One-click” trading – buying and selling cryptocurrency with one click, speeding up operations.

- Optimized interface for scalping and short-term trading, which is particularly convenient for traders using active strategies.

- Free licensing makes the terminal accessible to all HTX users without additional costs.

These features collectively make trading more convenient and effective, which is especially important for traders working in volatile markets.

Key CScalp Features for Market Analysis and Trading

The CScalp terminal provides users with a full set of tools for in-depth market analysis. An essential element is the detailed order book, allowing traders to analyze market depth, helping them better understand market behavior. The trade tape with volume filtering and cluster analysis provides insights into the market structure. Additional charts with volume indicators help in conducting technical analysis, while the “one-click” trading feature allows for instant order execution. The ability to work with multiple trading instruments simultaneously makes CScalp indispensable for those conducting active trading across several markets.

Features and Tools of the Trading Interface

HTX offers a variety of order types to implement different trading strategies, including:

- Limit Order, allowing traders to specify an exact execution price.

- Market Order, executed at the current market price.

- Stop-Limit Order, is a combination of stop and limit orders that provides additional risk management options.

- Trailing Stop Order, which automatically adjusts the stop price as the market moves in a favorable direction, helping to lock in profits during market changes.

- Iceberg Order, which breaks down a large order into smaller lots, only displays a portion of the total volume.

These diverse order types allow traders to adapt flexibly to changing market conditions.

Chart and Indicator Settings

The HTX and CScalp interfaces offer extensive options for customizing charts and using technical indicators. Users can choose between candlestick, line, and bar charts, adjusting time intervals from one minute to one month. A wide range of indicators, such as moving averages, RSI, MACD, and Bollinger Bands, is also available.

Drawing tools like trend lines and Fibonacci levels help traders visualize important price levels. All chart settings can be saved for future use, allowing traders to quickly return to their preferred workspace.

Risk Management

HTX provides risk management tools like Take Profit (TP) to lock in profits and Stop Loss (SL) to limit losses. There’s also the option to set a trigger price, activating an order once a specific price is reached.

In CScalp, traders can take advantage of additional risk management features like trailing stops and the ability to close all positions with one click. These tools are especially important for active traders dealing with the high volatility of the cryptocurrency market, enabling effective risk control and partial automation of trading decisions.

HTX offers easy navigation between different markets. At the top of the interface, there is a main menu, where users can quickly switch between spot and futures markets. When transitioning to the futures market, traders can choose between USDT-M (USDT-margined) and COIN-M (crypto-margined) contracts. The interface adapts to the selected market, displaying the relevant tools and information.

HTX provides efficient ways to search for and select trading pairs. Above the chart, there’s a ticker showing the name of the current trading pair. Clicking on the ticker opens a table of available trading instruments, grouped by theme and quote currency for easier navigation. A search bar is available for quickly finding the desired coin or pair.

Additional Interface Features

HTX offers several additional features.

Access to Investment Products

The HTX trading interface is integrated with the platform’s investment products. The main menu includes an “HTX Earn” section, offering various investment opportunities. Users can directly access staking, dual-currency investments, and other products.

Integration with Other HTX Services

The HTX trading interface is closely integrated with other platform services. Users can quickly access the P2P marketplace for buying and selling cryptocurrencies, as well as the HTX Earn service for passive income. Tips for Efficient Use of the HTX Trading Interface:

- Customize the interface to fit your needs by arranging essential elements in a convenient order.

- Use hotkeys for quick order placement and navigation.

- Master different order types to implement advanced trading strategies.

Regularly check the “Assets” section to monitor your balance and open positions.

Conclusion

The HTX trading interface is a comprehensive and functional solution for cryptocurrency market trading. It combines an intuitive design with a wide range of tools for analysis and trading. Both the web version and mobile app provide access to all key exchange features, while integration with CScalp expands opportunities for professional traders.

Recommendations for Traders of All Levels

For beginners:

- Start by exploring the basic HTX web interface, and gradually mastering its features.

- Pay special attention to the “HTX Earn” section to discover passive income opportunities.

For experienced traders:

- Explore the capabilities of CScalp for deeper market analysis and faster trading.

- Use advanced order types and risk management tools to implement complex strategies.

For professionals:

- Maximize the capabilities of the HTX API to create custom trading solutions.

- Consider margin trading and using high leverage to increase potential profits.

Regardless of experience level, all traders are encouraged to regularly monitor interface updates and new features, as HTX constantly improves the user trading experience.

Reviews