ByBit Copy Trading

Contents

Copy trading is an investment strategy that allows traders to automatically replicate the trades of more experienced and successful traders. This method allows users to follow the strategies and decisions of professionals, minimizing the need for deep market knowledge and analysis. Copy trading makes financial markets more accessible to beginners and provides an effective way to manage investments. The Bybit exchange offers this feature to traders of various skill levels.

Key Participants: Followers and Master Traders

In copy trading, two key types of users participate:

- Followers – are investors who choose experienced traders (Masters) to copy their trades. Followers typically select professionals whose trading strategies align with their investment goals and risk profiles.

- Master Traders – are traders who provide their trading strategies and trades for others to copy. Masters share their successful methods and analysis, allowing followers to benefit from their expertise.

Bybit also offers an advanced copy trading feature called Copy Trading Pro, which provides enhanced options for copying trades, including trading on spot markets and USDT/USDC perpetual contracts. Copy Trading Pro offers improved flexibility and precision in managing investments, providing advanced copy modes, enhanced risk management tools, and additional customization options.

Overview of Copy Trading on Bybit

On the Bybit platform, copy trading allows users to automate the trading process by following professional traders. It’s essential to understand what tools are available to implement copy trading strategies and how they affect trading efficiency. One of the key tools in this process is USDT perpetual contracts.

USDT Perpetual Contracts

USDT perpetual contracts are financial instruments that allow traders to trade cryptocurrencies using Tether (USDT) as the base currency. These contracts have several features:

- No expiration. Unlike traditional futures contracts, perpetual contracts do not have a set expiration date, allowing traders to hold positions for an indefinite period, which is especially useful for long-term strategies.

- Funding. To maintain positions in perpetual contracts, traders pay or receive funding depending on the difference between the contract price and the spot price of the asset. This mechanism ensures the contract price stays close to the spot price.

- Leverage. USDT perpetual contracts offer the use of leverage, which increases profit potential but also raises risks.

The advantages of USDT perpetual contracts include the lack of expiration dates, trading flexibility, and the ability to use leverage to increase profits.

Trading Bot: Features and Benefits

A trading bot is an automated tool that executes trades based on user-defined algorithms and strategies. On the Bybit platform, trading bots offer several features and benefits:

- Automated trading. Bots can execute trades based on specified criteria without the need for constant market monitoring, allowing users to focus on other activities without missing market opportunities.

- Strategy optimization. Bots can utilize complex algorithms and trading strategies that optimize decision-making processes. This may include algorithmic trading, risk management, and the application of technical indicators.

- Emotion reduction. Automation helps eliminate emotional decisions that may negatively impact trading results. Bots operate strictly by algorithm, reducing the likelihood of errors due to emotional stress.

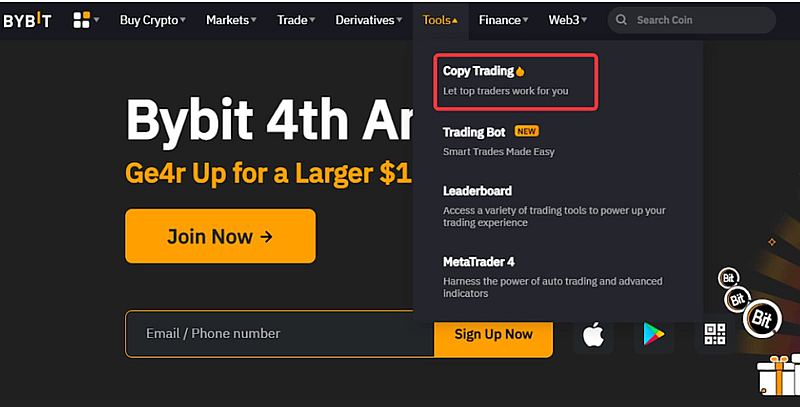

Trade Copying Process: Step-by-Step Guide

Copying trades on Bybit is a simple and convenient process, including a few key steps:

- Choose a master trader. Start by selecting an experienced trader or Master whose strategies align with your investment goals. Bybit provides detailed profiles and rankings of Masters to simplify this selection.

- Set copy parameters. Determine how much you want to invest and which copy settings to use, such as the percentage of total capital, position size, and other settings.

- Connect to copy trading. After selecting and setting up, you connect your funds to the chosen Master, and the system automatically begins copying their trades to your account.

- Monitor and adjust. Regularly track your copy results and, if necessary, adjust the parameters or select a new Master.

Copying Modes

Bybit’s copy trading platform offers two primary copying modes, each with its own features that can be chosen depending on your trading preferences and goals.

Smart Copying Mode

The smart copying mode is designed for users who want to automate the process of copying trades and minimize intervention in the trading process. It automatically selects the trades of the Master Trader based on predefined parameters and current market conditions.

- Automation. Smart copying allows automatic copying of trades without the need for constant market monitoring.

- Optimization. This mode analyzes the results of the Master’s trading strategies and adjusts the copying process based on their performance.

- Strategy selection. In smart copying, users can choose from suggested strategies or create their own based on historical data and current market trends.

Advanced Copying Mode

The advanced copying mode offers more control and flexibility for experienced traders. In this mode, users can manually adjust copying parameters such as trade volumes, order types, and other key aspects.

- Flexible Settings. Users can configure copying settings, including trade frequency, investment volume, and order types, allowing for a more precise alignment with personal trading strategies.

- Analysis and Adjustment. This mode allows regular analysis and adjustments to strategies, as well as detailed risk management.

- Interactivity. Users can make changes during trading and adapt their strategy according to changing market conditions.

Comparison of Modes

Both copying modes have their pros and cons:

- Smart Copying is ideal for those who want to minimize effort in managing trading strategies and automate the process.

- Advanced Copying Mode is better suited for experienced traders who desire more control over their investments and are ready to actively manage their trades.

The choice between these modes depends on your level of experience, your desire to manage your investments, and the time you are willing to spend on trading.

Copying Strategies

In copy trading, various strategies can be used to achieve desired results:

- Moderate. This strategy aims for stable but moderate returns. It involves more cautious risk management and less aggressive use of leverage.

- Aggressive. The aggressive strategy is focused on achieving higher returns but is associated with greater risk. In this case, larger trade volumes and leverage are used, which can lead to more significant fluctuations in profits and losses.

Each strategy has its features, and the choice depends on your goals, risk tolerance, and trading experience.

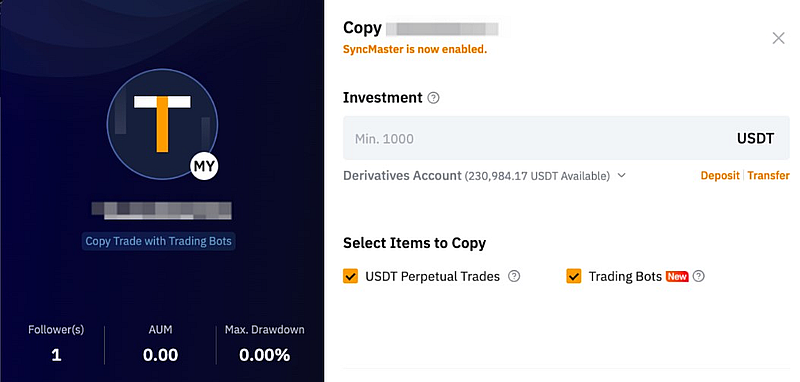

SyncMaster Feature

SyncMaster is a powerful tool designed to ensure synchronized trading actions between the master trader and subscribers in Bybit’s copy trading system. SyncMaster provides automatic and precise trade copying, allowing subscribers to follow the strategies of experienced traders without manual intervention. This feature greatly simplifies the copying process, making it more reliable and efficient.

Forced Synchronization

One of the key features of SyncMaster is forced synchronization. This option allows the master trader to initiate synchronization manually, ensuring that changes in trading strategies are instantly applied to all subscribers. Forced synchronization is especially useful in highly volatile markets, where quick responses to changing conditions are required. This helps avoid delays and discrepancies between the master’s and subscribers’ trades.

Benefits for Subscribers

SyncMaster offers several significant benefits for subscribers:

- Accurate Trade Copying. Subscribers can automatically follow the master’s trades, ensuring their operations are aligned with professional actions.

- Risk Reduction. With instant application of all changes, subscribers can reduce the risks associated with trade copying delays and achieve more stable results.

- Simplified Investment Management. Subscribers can focus on other aspects of their investment portfolio without spending time manually tracking and copying trades. SyncMaster handles all synchronization, ensuring ease and convenience in managing investments.

SyncMaster significantly enhances the copy trading experience on Bybit, providing a high degree of automation and reliability in the trade copying process.

Copying Settings

When setting up copy trading parameters on Bybit, subscribers can manage their investments individually and choose which elements of the master trader’s strategy they want to copy. The first and most crucial step is selecting the amount you plan to invest. It’s important to consider both risk tolerance and the chosen master trader’s strategy.

You can also select specific elements to copy, such as trading pairs, order types, leverage usage, and other settings. This offers subscribers greater flexibility and control over trade copying, allowing them to adapt the strategy to their preferences and risk profile.

Additional Settings for USDT Perpetual Contracts

Copy trading for USDT perpetual contracts on Bybit has unique features related to margin and leverage use. In the settings section, subscribers can set the maximum leverage they are willing to use and choose the type of margin (isolated or cross-margin).

These are important parameters as they directly affect the risk level of each trade. Additionally, you can set parameters such as loss limits (stop-loss) and take-profit, which help automatically close positions when certain price levels are reached, reducing risks and locking in profits.

Settings for Trading Bot

If you are using a trading bot within Bybit’s copy trading framework, the settings can be even more specific. Bots can be configured to automatically buy and sell assets based on predefined conditions. Available options include selecting trading pairs, trade frequency, trade volume, and the indicators that the bot will use for decision-making.

Subscribers can also set additional rules, such as the frequency of opening trades, the maximum number of active positions, and the conditions for ending a trading cycle. This allows for flexible adaptation of the bot’s strategy to your goals and preferences. Proper configuration of copying parameters plays a key role in risk management and ensuring income stability, making copy trading on Bybit as efficient and convenient as possible for users.

Features for Subscribers and Investors

Copy Trading on Bybit offers a wide range of opportunities for subscribers and investors looking to leverage the strategies of experienced traders to improve their investment outcomes. One of the key factors for success in copy trading is the proper selection of a Master Trader, effective investment management, and continuous monitoring of strategies.

Selecting a Master Trader is the first and one of the most important steps for subscribers. Bybit provides an extensive catalog of Masters, each showcasing their historical performance, profit level, and risks. Subscribers can analyze trade statistics, past results, and the trader’s strategy before subscribing.

For users aiming for a more advanced level of copy trading, there is the Master Pro option—traders who not only operate on the spot market but also use USDT/USDC perpetual contracts. Master Pros have more complex and dynamic strategies, offering subscribers greater profit potential, but they also require a higher level of risk management.

After choosing a Master Trader, subscribers can adjust their investment parameters for copied trades. Bybit allows you to set the amount for each copied trade, helping tailor the Master’s strategies to individual preferences and the subscriber’s risk profile.

Investment management in Copy Trading also includes the ability to distribute capital among multiple Masters, creating a diversification effect. This reduces risk by not depending on a single strategy or market and allows you to adapt your portfolio to current market conditions.

Monitoring and Adjusting Strategies

Copy Trading on Bybit isn’t limited to passive copying of trades. Subscribers can monitor the Master’s performance at any time and adjust the copying parameters. This includes increasing or reducing the amount of copied funds, changing the risk management strategy, or selecting a different Master.

Bybit provides subscribers with detailed analytics for each copied trade, allowing them to respond quickly to market changes or reduce risk when a Master’s strategy is underperforming. Regular monitoring helps subscribers stay ahead and maintain control over their investments.

Investment Cycles and Withdrawal

In Bybit Pro Copy Trading, there are flexible investment cycles, allowing subscribers to start copying trades at any time. However, subscribers may face delays in copying new trades due to active trades by the Master.

Withdrawal of funds is also flexible in Bybit Pro Copy Trading, allowing subscribers to withdraw part of their profits or stop copying at any time. However, it’s important to consider the current market conditions and active positions before initiating a withdrawal to avoid unexpected losses or costs when closing trades.

Thus, Copy Trading on Bybit, especially its Pro version, offers subscribers and investors high flexibility in managing their investments and allows them to make informed decisions to achieve better results in cryptocurrency trading.

Technical Aspects

In Bybit Copy Trading, technical settings play a crucial role in helping subscribers and investors more precisely manage their positions and risks. Options like margin modes, leverage settings, slippage management, and the Unified Trading Account (UTA) feature play a key role in successful trade copying.

Margin Modes

Bybit offers two margin modes—cross margin and isolated margin – each with its advantages.

- Cross-margin uses the entire account balance to cover margin requirements for a trade, minimizing the risk of forced liquidation. This is particularly useful for traders with more aggressive strategies, as reducing the risk of liquidation helps maintain positions in unfavorable market conditions.

- Isolated margin limits the risk within the selected position, allowing users to control the exact amount of funds involved in the trade. This is an ideal choice for those who prefer precise risk control and want to avoid unexpected losses.

Leverage Settings

Leverage is a powerful tool that can significantly increase profits, but it also raises risk. In Bybit Copy Trading, subscribers can adjust leverage depending on their preferences and the level of risk they are willing to take.

Master Traders may also use different levels of leverage for various strategies. Users should ensure that the chosen leverage aligns with their overall goals and risk profile.

Slippage Management

Slippage is the difference between the expected price of a trade and the actual price at which it was executed. In volatile cryptocurrency markets, this can significantly affect trading results.

Bybit offers slippage management features that allow traders and subscribers to minimize the negative effects of this phenomenon. Precise settings allow limiting possible slippage by setting a maximum price deviation, ensuring that trades are automatically closed if the price moves beyond the acceptable range.

Unified Trading Account in Pro Copy Trading

In Bybit Pro Copy Trading, a Unified Trading Account (UTA) is available, simplifying capital management and allowing the use of funds across different markets simultaneously. UTA consolidates the user’s balance into one account, enabling them to use it for both spot trading and perpetual contract trading.

This increases trading flexibility and helps subscribers manage their assets more efficiently, supporting trade copying across all available markets. UTA also allows traders to use their assets more effectively without transferring funds between different account types.

The technical aspects of Bybit Copy Trading play a key role in risk management and enhancing trading efficiency. Proper margin and leverage settings, slippage control, and the use of UTA help subscribers maximize their use of the platform to achieve financial goals.

Tips for Effective Use of Copy Trading

Effective use of copy trading requires a thoughtful approach and an understanding of key aspects of how the system works. Here are some tips to help you make the most of the copy trading opportunities on Bybit.

Choosing the Right Copying Mode

The first step to successful copy trading is choosing the right copying mode. Bybit offers two main modes: smart copying and advanced copying.

- Smart Copying is ideal for beginners and those who prefer automatic management. This mode allows you to copy the trades of master traders with minimal user involvement in the setup process.

- Advanced Copying provides more control and flexibility. Here, you can adjust copying parameters in more detail, tailoring them to your trading goals and style. This allows for more precise strategy customization and investment management.

Balancing Profitability and Risk

A crucial aspect of successful trading is finding the right balance between potential profitability and risk. Copy trading helps minimize risks by using proven strategies from master traders, but it’s essential to remember that all investments carry some risk.

- Determine the level of risk you’re willing to take and choose a master trader with a suitable profile. Pay attention to their trading history and strategies.

- Use risk management settings, such as stop-loss and take-profit, to protect your capital from unexpected losses.

Regular Performance Analysis

Regularly monitoring and analyzing results is key to successful copy trading. Track your investment performance and analyze the results of master traders’ trades.

- Evaluate results regularly and adjust your copying settings as necessary.

- Use available analysis tools to understand which strategies are working best and identify areas for improvement.

Choosing Strategies in Bybit Copy Trading Pro

Copy Trading Pro on Bybit offers unique opportunities for deeper strategy customization, including choosing between moderate and aggressive strategies.

- Moderate. It is suitable for those who prefer stability and lower risks, aiming for long-term capital growth while providing more balanced risk management.

- Aggressive. Involves higher risks but potentially higher returns. This approach is suitable for experienced traders willing to face significant fluctuations and fast-paced trading.

Conclusion

Copy trading on Bybit is a powerful tool for traders and investors who want to take advantage of the experience of more seasoned market participants. The system provides convenient opportunities for automatically following successful strategies and managing investments. Benefits of copy trading on Bybit include:

- Ease of Use. Allows beginners and busy traders to easily follow successful strategies without needing deep analysis or constant market monitoring.

- Flexible Settings. The ability to choose between different copying modes and strategy settings allows you to tailor them to your individual needs and goals.

- Risk Management Tools. Built-in risk management features help protect your capital and minimize potential losses.

Comparison of Regular Copy Trading and Copy Trading Pro

Regular Copy Trading is suitable for those seeking a simple solution to follow master traders. It offers basic features and settings that meet the needs of most users.

Copy Trading Pro provides additional opportunities for advanced users, such as more detailed strategy settings, working with different contract types, and enhanced risk management and customization features. This makes it ideal for those who want more flexibility in managing their investments and using more complex trading strategies.

Recommendations for Beginner Traders and Investors

For beginners who are just starting with copy trading on Bybit, it’s important to follow several key recommendations:

- Start with basic copying modes and gradually transition to more advanced features as you gain experience.

- Regularly analyze your investment results and adjust your strategies based on their effectiveness.

- Choose master traders with a proven track record and strategies that align with your risk profile.

- Use available risk management tools to protect your investments from significant losses.

By following these recommendations, you can effectively use Bybit’s copy trading features and achieve your investment goals.

Reviews