Cryptocurrency Trading Strategies

Clarity on what factors influence price dynamics cryptocurrenciesThere is still no such thing. Cryptocurrencies are highly volatile, they are very poorly connected to the real economy, so it is impossible to predict their behavior with more or less high accuracy.

Contents

- 1 The essence of trading strategies for cryptocurrency

- 2 Varieties of strategies for trading cryptocurrency

- 3 Top 3 crypto exchanges to practice your strategy

- 4 How to trade on the stock exchange using a strategy?

- 5 Example of cryptocurrency trading strategy on the Binance exchange

- 6 How to choose the right exchange for your strategy?

- 7 Risk Management

- 8 Conclusions

The essence of trading strategies for cryptocurrency

In fact, the only meaningful way to use cryptocurrency right now is trading (Cryptocurrency Signals). When cryptocurrencies rise in price strongly and for quite a long time, the market experiences an influx of people willing to trade. And they use the only strategy – to bet on price growth. When the price starts to fall and goes into a flat, those who want to make money on the fluctuations of cryptocurrencies become much less, they leave the market and after a while cryptocurrency trading acquires a civilized framework, in particular, traders try to use different strategies.

When using strategies, crypto-trading is more profitable during relatively calm market developments, when the trader can notice some patterns in the behavior of cryptocurrencies. If the trader correctly identifies these patterns, the strategy can be effective for some time.

In order to determine the regularities correctly, a trader must have an understanding of the market, experience in trading, know the methods of technical analysis, get information from trustworthy sources and so on. But the main thing is that the market should be relatively stable.

Strategies for cryptocurrencies can be generic, because in general the cryptocurrency market is characterized by uniformity and patterns. Still, there are differences in the behavior of cryptocurrencies, so a trader should know well the coins he or she trades. As part of the strategy, the trader determines the entry and exit points, the period between entry and exit points, the period for the next entry, and develops typical reactions to price changes during trading.

Varieties of strategies for trading cryptocurrency

There are two basic strategies cryptocurrency trading. The first, the most popular, is to buy and hold, such traders (hodlers) are rather investors for a long period of time. Hodlers have bought cryptocurrencies at a low price and are waiting for some price at which they can sell the cryptocurrency.

This applies mainly to holders of bitcoinBut since bitcoin absolutely dominates the market, hodlers can potentially have a big impact on the cryptocurrency market as a whole. For example, if it becomes apparent that cryptocurrencies have not revolutionized finance and bitcoin will no longer grow, disappointed hodlers will start selling bitcoins en masse.

The second strategy is pumping. It is used by owners of a large number of cryptocurrencies. They organize information blasts, which cause a stir in the market and mass buying of cryptocurrencies in the hope of further growth, at a certain point, the information reason stops working and the price falls, leaving most buyers without profits. But the average trader can also make money on the bump, if he successfully enters the market. The problem in this case will be to get out of trading in time.

Both basic strategies are little used now, as interest in the cryptocurrency market is declining. But it also leads to the fact that cryptocurrency trading has become more streamlined and more meaningful strategies can be applied in trading.

Crypto trading strategies are based on a time period or typical market situations. Time-based strategies include, in particular, intraday trading. According to this strategy, the trader trades during the trading day and closes all open positions by the end of the day. Given the unpredictable volatility of cryptocurrencies, this strategy is very common.

Swing trading is trading within a specific time cycle, a fairly long one. It can be a period of price rise, price decline or flat movement. The trader tries to determine the beginning of the movement, trades in the course of this movement and finishes trades with the end of the cycle.

Scalping is a high-frequency strategy in which the trader makes trades on every rate fluctuation. These can be dozens of trades within one hour, but most of them are loss-making, so the trader expects to “recoup” losses and make a profit on a certain number of very profitable trades.

Situational crypto trading strategies include, for example, trading on a pullback. With this strategy, the trader waits for the moment when the price decreases slightly in a rising trend (pullback) and at that moment, the trader buys coins and the trend returns to growth. Conversely, on a downtrend, there is a correction to the upside and here the trader sells the coins and the trend returns to the downside.

Bounce trading is used on a downtrend, when the trader determines a certain minimum price, after which there can be a rise. If the trader guesses this exact moment, he has an opportunity to buy the cryptocurrency at the minimum price (How to Make Money on Cryptocurrency?).

Impulse trading strategy implies that the trader correctly identifies the beginning of the impulse, that is, the moment of formation of a clear trend, either downtrend or uptrend. Accordingly, if the trader sees the formation of an uptrend, he buys, but can also buy during the trend, up to the extremes, as momentum allows to make a profit in this way. In the opposite case, the trader sells the cryptocurrency at the moment of formation of the downtrend or in its course.

Trading on a breakout also assumes that the trader can accurately determine the moment the price changes. For example, on a downtrend, he traces at what moment the price breaks through a certain price value, after which the trend reverses. At the moment of the breakout, the trader can buy the asset at the lowest price within the new trend.

The strategy of position trading is that the trader trades only when the asset is in a certain position. For example, the trader trades only when the trend reverses, the trader does not consider other situations.

Top 3 crypto exchanges to practice your strategy

| Exchange | Bonuses | Registration |

|---|---|---|

|

1

|

Until 4000 USD

Registration Bonus

|

Go to |

|

2

|

Until 10000 USD

Welcome Bonus

|

Go to |

|

3

|

2 USDT

Welcome Bonus

|

Go to |

|

4

|

1000 USDT

Bonus for futures trading

|

Go to |

|

5

|

0%

Fee for withdrawal to bank card

|

Go to |

How to trade on the stock exchange using a strategy?

During a period of minor price fluctuations in the crypto market, the effectiveness of trading depends on the trading strategy. The main task in this case is to choose an effective trading strategy. The market situation, deposit size, timeframe, trader’s personal traits and other factors are important in choosing a strategy. Let us consider some of them in details.

The size of the deposit is one of the main, if not the main factor in choosing a strategy. Significant financial resources of a trader allow to conduct a sufficient number of deals with good volumes and in any time period, without fear of account nullification. Also, a large deposit allows you to conduct long-term strategies, with trades of months and years.

A small deposit allows you to rely only on trading on short time periods and requires constant monitoring of price dynamics. The trader has no reserves to compensate unsuccessful deals and to change the strategy. And it is obvious that trading with a small deposit is more stressful and requires the trader to know the market and at the same time to react quickly. In cryptocurrencies with a small deposit, you should not implement any strategies with bitcoin and other very expensive coins. It is also better to avoid periods of particularly strong volatility.

Equally important for the implementation of any strategy is the trader’s knowledge (all about learning to trade cryptocurrencies here). Experience in trading allows to achieve profit even with relatively small deposit. The problem is that crypto-trading started to develop relatively recently, there are not many specialized and quality courses, books, video tutorials and other things, almost every trader learns immediately in real conditions. This is not the best option.

To mitigate the effects of such training, traders choose simple strategies on small timeframes during a clear trend. But it will not save you from losses at first, you should be prepared for that. Only after gaining certain knowledge can you choose more complex strategies.

Having a sufficient deposit and certain trading skills, the trader can choose a strategy and trade on it, taking into account the factors described below. The trader must take into account:

- How much free time he has for trading, if it is not his main activity;

- What is the time when you can open a deal, taking into account the deposit;

- What part of the deposit can be lost without prejudice to further work;

- What tools are supposed to trade with.

It is also necessary to take into account psychological peculiarities – emotional stability, stress tolerance, inclination to risk or analytical activity and so on. These factors can be called fundamental when choosing a strategy and they will also determine the individual characteristics of cryptocurrency trading.

Trades should not start “out of nowhere” and end “with nothing”, so that each new trading period starts from zero: the trader should somehow record the course of trading, results and features of trading, market situation, influence of news and so on. The trader can write down this information or fill in the table at the end of the trading period, illustrating it with screenshots. Any information about each trade should be saved and analyzed.

During trading, one should not deviate from the selected strategy, unless the market situation is completely unpredictable – in this case, the trader should have a fallback option. After making the first profit, many crypto traders consider it right to withdraw it into more significant assets, into fiat. Also, given the volatility of the crypto market, it is necessary to have a reserve and replenish it regularly.

Diversification of assets in the crypto market is very desirable, you need to create a portfolio of different coins. They do not differ so much in behavior as in value and technical features. The most expensive coins are more often used as investments, smaller coins are more convenient to trade and there are not so big losses in case of sharp price changes.

Example of cryptocurrency trading strategy on the Binance exchange

One of the uncomplicated and frequently used strategies when working on the stock exchange Binance is trading cryptocurrencies on a rate correction on a rising trend. Such dynamics is typical for cryptocurrencies – the price can grow for quite a long time, but necessarily corrects, i.e. decreases at a certain level for some time.

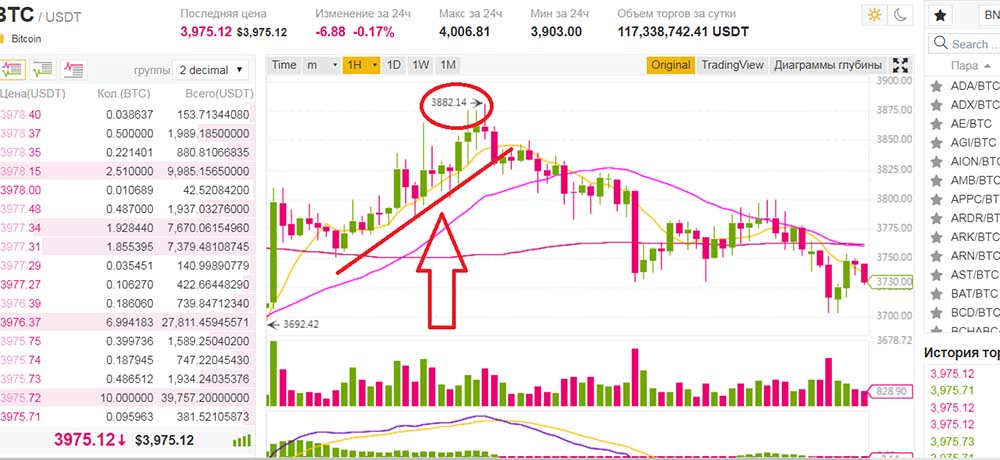

Suppose a trader has enough money to trade bitcoin. At a certain interval bitcoin grows quite dynamically (Fig. 1) from $3,773 to $3,882.14.

Image. 1

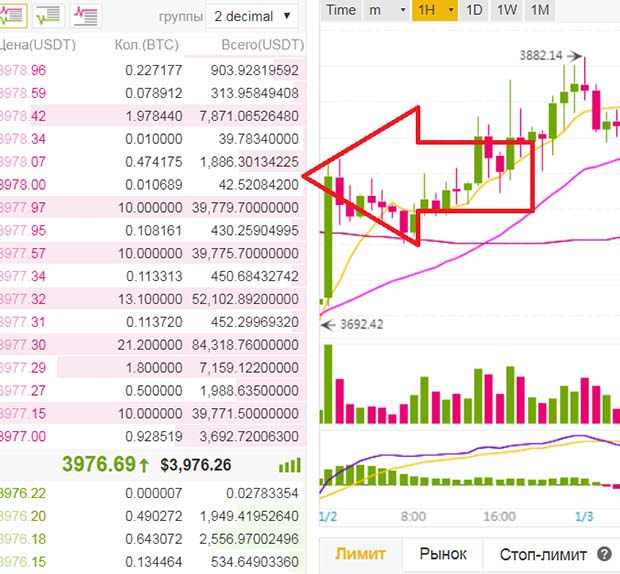

At the moment of growth there was a correction, which can be clearly seen in the candlesticks, and you could make money by buying bitcoin at the moment of a short-term decline in price, making a profit when the trend returned to growth. How exactly the price changes and how it will change must be clarified in the quotation stack (Fig. 2).

Image. 2

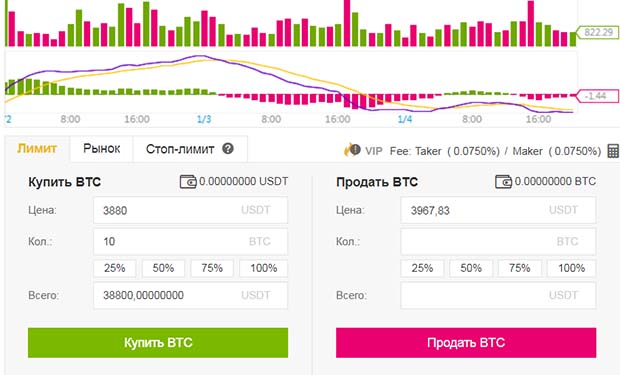

But, of course, manually trading cryptocurrencies on a pullback is a difficult task, so stop-limits are set (Fig. 3). For example, you need to put a limit of $3880, if the price reaches this value, the trade will be opened automatically. If the price does not reach this value, the trade will be cancelled – automatically or the trader himself cancels it.

Image. 3

Cryptocurrencies are a volatile asset, so it is not advisable to wait for the maximum price increase in order to sell. This is all the more true since cryptocurrencies are very likely to stop growing in price at any time and collapse – something that has been happening in the market for the last year almost constantly. Traders in this strategy buy when the price rises by 10-20%, sell, and put stop-losses again for a short period.

In addition, this strategy allows you to trade with a small deposit, but with the certainty that there will be a profit or at least be able to avoid losses. It is possible to implement such a strategy on any cryptocurrency, but on such large coins as bitcoin, it is still better not to train, there are many lighter coins.

The main difficulty will be to notice when the price of a cryptocurrency starts to rise. To do this, you need to follow the news, market events, read specialized forums, pay attention to the dynamics of prices and the number of orders in the quotation stack. It is also difficult to predict the end of price growth and the beginning of its fall. At the moment the dominating trend on the cryptocurrency market is descending, the news background is sluggish, so you can be sure that the growth of price will stop soon, but when exactly – is unknown. That’s why it is necessary to use stop-losses.

How to choose the right exchange for your strategy?

The main trading platform for cryptocurrencies is a cryptocurrency exchange. There are many exchanges, but among them there are exchanges which can be called the main ones. They have about the same functionality, you can implement any strategy on any exchange, but there are differences, based on which you need to choose the most suitable for a particular trader.

When choosing a crypto-exchange, you need to clarify the following information:

- Does the exchange work in the country the trader needs? More precisely, whether the exchange works with a trader from a certain country, because crypto exchanges may not provide services to residents of some countries, or provide limited functionality. There can be problems with verification and withdrawal. Just in case, it is useful to specify in which jurisdiction the crypto exchange is located, it is unlikely to be needed in case of a trial, but it is preferable if the exchange is based in a country with a developed legal culture, because in such countries it is more difficult to be licensed for financial services.

- The duration of the exchange is important, but not so significant. A number of exchanges operate almost since the advent of bitcoin, but there are exchanges with a good reputation, which opened much later. A typical example here is the cryptocurrency exchange Binance, which has been operating since 2017.

- Next, you need to carefully read the information about the crypto exchange, posted on the crypto exchange itself: features of verification, security, what coins are traded and what pairs, features of input/output of money, trading functionality, features of charging commissions (for what and how much) and the presence/absence of own tokens (preference for exchanges with their tokens, it allows to save money) and so on.

- Reviews about a crypto exchange are very important. In this case, pay attention to informative reviews, but not to the label “good”, “bad” and the like. More attention should be paid to verification issues, depositing and withdrawal peculiarities, whether all fees are included in exchange descriptions, how often the exchange was hacked and how the exchange reacted to such attacks, how loyal the support service is. If the exchange generally suits the trader, the reviews will give an idea of which side to wait for danger.

- Additionally, there may be interesting information such as liquidity, place in the rating, trading volume, – they can be viewed on the Coinmarketcap site.

Risk Management

Risk management in cryptocurrency trading is particularly important given the volatility and unpredictability of this market. The essence of risk management is not to get rid of risk in general, but to determine the rational limits of risk.

The main methods of risk management for crypto trading are asset diversification and limitation of possible losses. Diversification means distribution of investments into different coins, creating a portfolio with one or two major coins and a number of additional coins. Some traders consider that it is possible to reach optimal risk level only when trading with 10-15 coins. Given the uniformity of cryptocurrency price dynamics, that makes sense. A trader’s portfolio should be checked periodically, maybe some coins should be excluded from it, some new coins should be included.

Limiting losses implies that the trader knows what proportion of the funds invested in trading he can irrevocably lose – and in no case more than this amount. The most common recommendation is to put no more than 10% of income per month or from a particular trading period into “unavoidable losses”. In this context, special attention is required for margin trading, in which losses can accrue much faster than when trading within a single exchange.

Another way to manage risk is to calculate the dependence between profit and risk. For cryptocurrencies, the correlation between profit and risk is relevant – the higher the risk, the higher the profit can be. The trader must determine what risk will no longer be just high, but excessive, and make a deal based on that.

Risk management also includes the proper allocation of funds during trading – not all funds or even the predominant part of funds should be placed on a single trade. In addition, it is advisable to calculate the risk of loss for each trade, not for a certain trading period, as far as possible. It is considered to be optimal to calculate profits and losses as a percentage of the total capital: in this way, it is easier to see when losses are coming and it is easier to evaluate the effectiveness of the strategy.

It is important to keep in mind that the risk management should take into account not only the actual trading – opening and closing positions – but also the commissions on cryptocurrency exchanges, which may be charged for trading, and for the transfer, and for the use of leverage – all this information must be clarified before trading, otherwise small losses can suddenly become very sensitive.

In cryptocurrency trading, minimum leverage is recommended, due to the particular volatility of cryptocurrencies. Most often, traders choose levels of 1:5, 1:3, anything more than that can lead to a one-time loss of traded funds.

Risk management can include sources of information about the crypto market. News, announcements of events, announcements – all this can greatly influence the crypto market and a trader must take this influence into account and have a selection of news sources, the information from which is more or less reliable.

Conclusions

Cryptocurrency trading strategies are essential. They are especially important when the price of cryptocurrencies is not rising too fast and strong and not falling too fast and strong. For strategies to be effective, it is important to remember that cryptocurrencies are volatile and unpredictable even in calm periods of the market, so strategies need constant adjustment, control and risk management.

In particular, it is necessary to diversify investments by investing in different cryptocurrencies, assess the risks of each transaction, correctly allocate invested funds, and so on. Cryptocurrencies are mainly traded on cryptocurrency exchanges, but you can also trade them on other trading platforms.