P2P Cryptocurrency Trading: Features and Platforms

Trade cryptocurrency Many people still see it as something very complicated, requiring both trading and at least small technical skills. There are such trading methods, too, and they are still leading in the market. But the audience of technically competent traders is limited, and platform creators are interested in attracting anyone who wants to trade in cryptocurrencies. This is how simple trading methods, such as P2P, emerged.

Contents

What is P2P trading?

P2P trading is a trading method in which two users interact directly with each other, in peer-to-peer mode: one sells cryptocurrency, the other buys. The interaction takes place on a platform, which can be a full-fledged exchange or a trading platform with limited functionality. Simplified, the order of trading looks like this: the seller places an ad to sell cryptocurrency, the buyer places an ad to buy – at a certain value or within a certain price range.

In general, the process of P2P-trading is similar not to the exchange method, but to the popular nowadays online trading, like buying/selling goods on eBayIn a P2P marketplace, buyers offer their goods for sale, and the buyer chooses a specific seller and favorable terms. On a P2P platform, cryptocurrencies act as commodities. Types of P2P trading include not only electronic exchange methods, but also the practice of direct exchange, as platforms allow the buyer to find a user who will offer the right cryptocurrency at the right value, and conduct the transaction offline, using a payment method that suits both of them. At the same time, a P2P platform can guarantee the integrity of the transaction.

Overview of P2P platforms

Let’s look at the most well-known peer-to-peer cryptocurrency trading platforms and their main parameters.

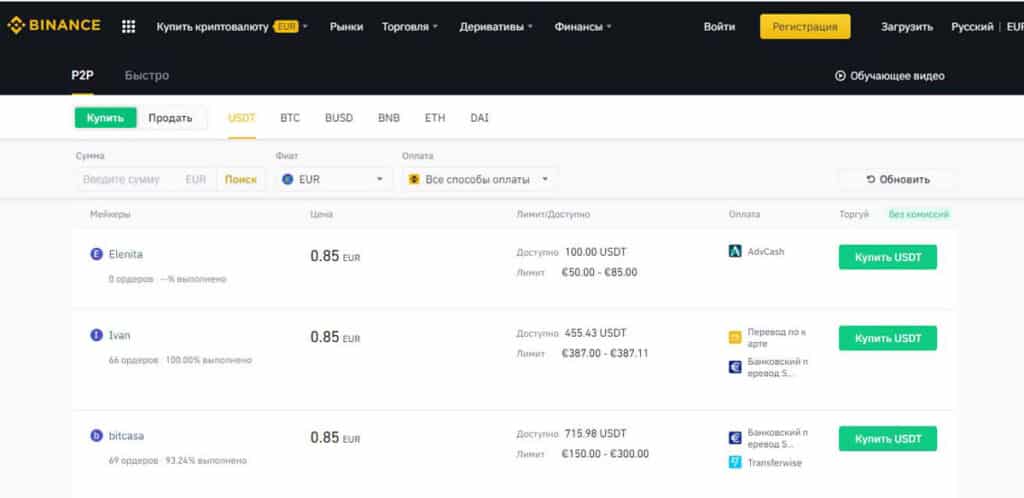

Binance P2P

Binance P2P (https://binance.com) is a popular P2P service. It provides exchange of USDT, BTC, BUSD, BNB, EOS, ETH to any or almost any fiat currency. It should be noted that you need to pass KYC/AML verification in order to get access to the exchanger. That is, in order to exchange cryptocurrencies for fiat currency, you need to provide the exchange with your name, last name, date and year of birth, home address and ID.

Binance P2P participant can trade in P2P mode for amounts equivalent to 0.01-5 bitcoins by transferring funds from spot wallet to exchanger account. To trade, you need to select the fiat currency for which you plan to sell the cryptocurrency, the payment method and the amount of coins to be sold. Then the appropriate ad is selected and the selling process begins, during which you can communicate with the counterparty via chat. To buy a cryptocurrency, you need to go through a similar algorithm.

Garantex

Cryptocurrency exchange offers its own version of P2P platform Garantex (go online). To be able to sell/buy cryptocurrency at Garantex, you need to register, as it is customary at most cryptocurrency exchanges. Press the corresponding button in the upper right corner of the site and fill in the registration form: enter your email address (you will need to confirm it by following the link in the email), make up a password, agree to the rules, confirm that you are not a U.S. citizen or resident.

ByBit

Platform ByBit (go online) provides clients with favorable, and most importantly, comfortable conditions for P2P trading. The exchange is similar to its competitors in many ways, but there are a few distinctive features. Clients are offered more than 50 fiat currencies at the best market prices. For novice traders, the platform will be especially useful because there is a manual with detailed instructions for beginners, as well as a demo account where customers can try their hand at trading cryptocurrencies (Cryptocurrency Trading Strategies). A separate section with the latest news and informative articles is also provided for users.

Cryptolocator

Cryptolocator (go online) has been developing since 2017 and is one of the most popular P2P trading services. Offers the functionality of a peer-to-peer exchanger of Bitcoin, Ethereum and USDT cryptocurrencies in the shortest possible time using popular payment methods. The exchanger supports buying, selling, exchanging, storing cryptocurrencies in dollar equivalent. To start trading, you need to register an account and top up your balance – you need to have a positive balance for transactions. After topping up the balance, the user begins to conduct operations on the main page of the resource.

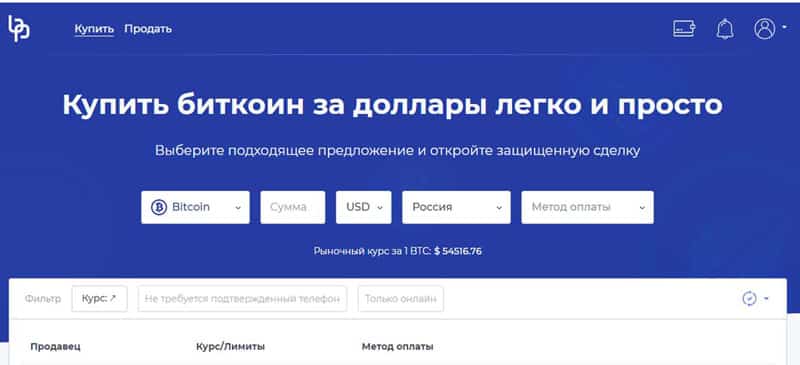

There are “Buy” and “Sell” buttons, which take the user to the corresponding services. They are slightly different, but intuitively understandable and the algorithm of their use is about the same. To buy or sell in the form (Fig. 1) you enter the appropriate data – the amount of sale or purchase, and the currency is determined automatically by the region to which the account is tied, or you can select the desired currency. You can also select the country from the list – or not to select, to see all offers for the price. From the list you choose the method of payment, or, if you leave this field blank, the service itself will offer some method.

Image. 1

The exchanger has an informative gradation of users according to the speed of response to requests – a green circle near the user name means that the response time is about half an hour, a gray circle near the user name means that the response time is more than 30 minutes, a blue circle shows that the user is new to the service and the response time is unknown. Once the transaction is initiated, the transaction amount is deposited until the transaction conditions are confirmed (escrow). The transaction will require data such as bank account information if the transaction is made with payment through a bank. Payment confirmations are sent by text message, email or on the website. You can leave a message for the counterparty when processing the transaction.

If the transaction is questionable, the service allows you to open a dispute over the transaction, with the Cryptolocator team acting as the arbitrator. For bitcoins and ethers the dispute opens in an hour after the confirmed completion of the transaction. Questions on disputed transactions are solved in most cases within 24-48 hours. You should pay attention to the fact that each listing has a minimum and maximum amount set by the seller. Cryptolocator limits only the minimum amount in bitcoins and ethers, equivalent to any fiat, – in this case it will be necessary to keep in mind about

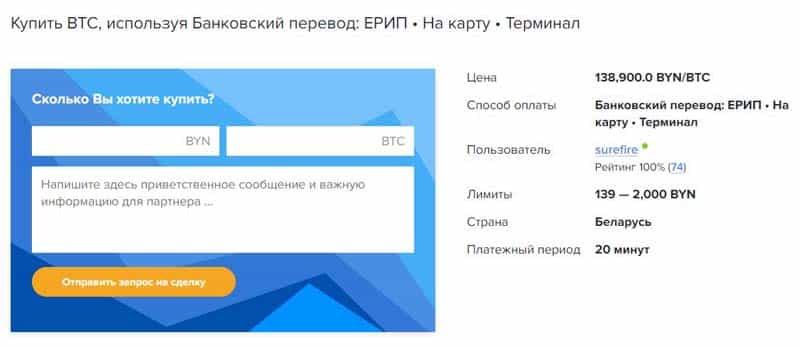

PaxFul

PaxFul (go online) – P2P-marketplace for buying and selling bitcoins, operates in the U.S., Canada, some countries in Asia and Africa, the post-Soviet territory, has a Russian-language interface among others (by the way, you can rate for the correctness of the translation functionality into Russian). At the same time supports the possibility of transactions through the payment systems Kiwi, Yumani (former Yandex Money), WebMoney, Paypal, Western Union, Moneygram and standard bank transfers. The main advantage of the platform is a large number of payment methods, about 350.

The user can add a payment method, which is not pre-installed on the platform. The original development of PaxFul – a widget “bitcoin kiosk”, which can be embedded into a blog or an online store and receive 2% from each transaction in bitcoin equivalent. To make transactions, you need to create an account by filling out a registration form. The service sends the following e-mails at once: an offer to pass the obligatory verification, an offer to confirm the account with a code, a notification of account creation. The name is generated by the service. After confirming the code, the service sends another letter with an invitation to the seminar, and the service also requires confirmation of the phone number.

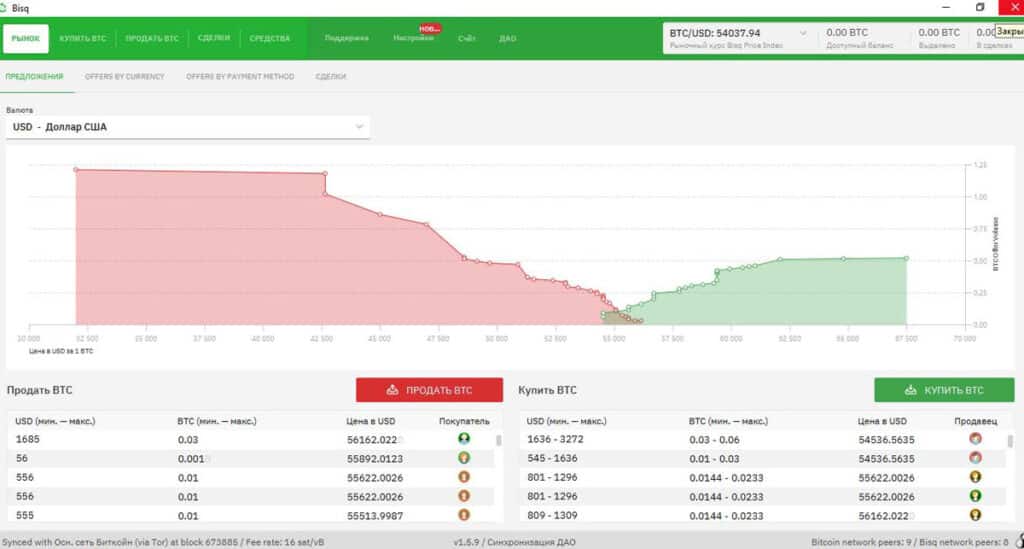

After confirming the account via a cell phone number, the user is automatically moved to the trading interface. It should be noted that there are restrictions imposed on users – limits on the amount of a transaction depending on the status. It is possible to increase the limit by verifying one’s identity. Here there is some ambiguity, because it is offered to confirm the identity immediately after registration. But it is possible to work with money before verification with a limit of the equivalent of $1,000. The main buttons in the service are two: “Buy” and “Sell”. To buy, click “Buy” and get a list of offers from sellers (Fig. 2) and instructions. Methods of payment for the transaction are available depending on the region, which is determined by the geolocation of the service.

Image. 2

If any method is not available – it is displayed in the list of proposals, and you will need to make adjustments to the data. It is possible to set the condition “In any country” and choose from a list of suitable offers, among which there is a wide range of interesting conditions. By clicking on the selected seller, the buyer goes to the purchase service and can read the data of the seller, as well as the reviews about him. PaxFul strongly recommends studying the seller’s information before concluding a deal.

Next, you need to enter the amount of payment and purchase, additionally check all the information and start the transaction. After all conditions of the seller of bitcoins are met, it is necessary to click on the button “Paid” – after that the seller will send bitcoins to the buyer’s internal wallet, accordingly, the buyer receives a receipt of the transaction. Immediately after the transaction is opened, the amount of bitcoins in the seller’s account remains unchanged. The transaction time is timed, you need to confirm the payment within the stipulated period of time. Selling bitcoins starts with the “Sell” button, the corresponding page specifies the methods of sale, in the list of offers you can select reliable (cryptocurrency trading). With an additional filter you can specify the desired parameters of the seller.

The platform provides the ability to cancel the transaction, the ability to open a dispute through a moderator, the ability to send a complaint about the actions of the counterparty. The platform does not charge commission from the buyer, and the seller is charged depending on the payment method, from 0.1% to 5% of the transaction amount. The service has a “Find the Best Offer” feature, which can speed up transactions. A useful feature for newbies is the tutorial program, which is highly recommended. Also, one should not ignore the instructions that are offered when making the first transactions on the platform.

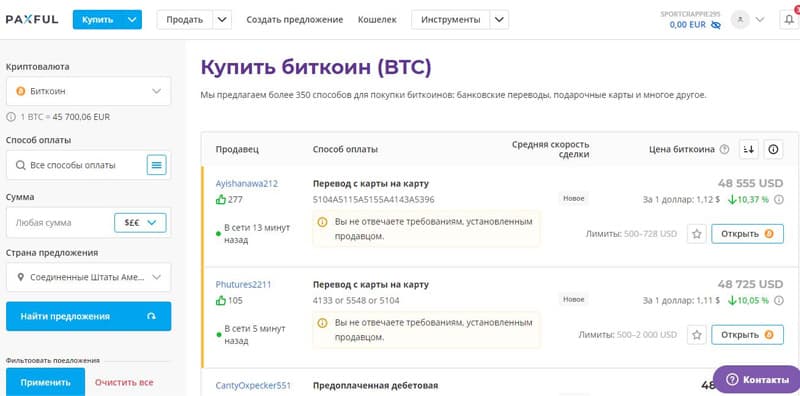

LocalCryptos

LocalCryptos (https://localcryptos.com) is a non-custodial cryptocurrency platform. Custodial services provide third-party secure storage for cryptocurrencies, such as banks refer to custodial services. Non-castodial ones provide the user with the ability to control their funds and be responsible for them and their transactions with them. LocalCryptos P2P is the former LocalEthereum platform. It now provides peer-to-peer trading of ETH and BTC cryptocurrencies, as well as Litecoin and Dash.

To make transactions, it is not necessary to verify the account, it is enough to confirm the e-mail. Important: when registering, you need to write down your password, because the specifics of the platform do not allow to restore the lost password by software means – non-custodial service implies that the user himself takes care of his password. It is also important to specify during registration that the user is not a resident of Australia (the service is Australian). At the same time LocalCryptos requires two-factor authentication – you can do it via a link to an email or Google Authenticator or another OTP application. In addition, the administration offers to keep a backup copy of your wallet in case LocalCryptos stops its work – then the funds on the wallet will remain available.

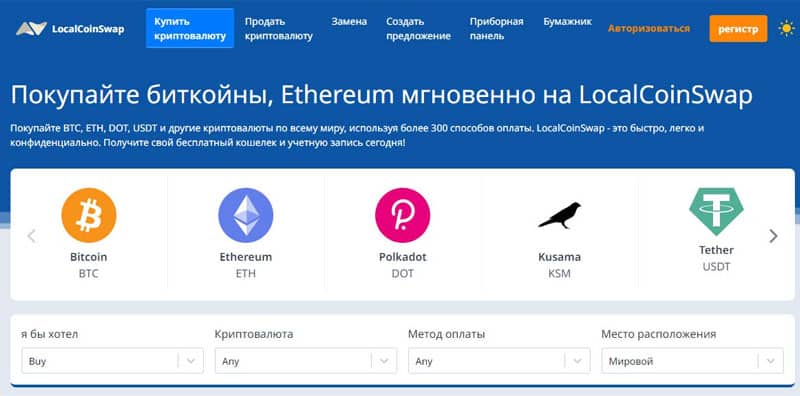

Among the available payment methods is Western Union, AdvCash, Payeer, PayPal, bank transfers, Alipay, Cardless Casg, Efecty, IMPS, Interac e-Transfer and many others. Transaction fees are 0.25% from the creator of the ad, 0.75% from those who respond to it. Transactions are conducted from the main page of the service (Fig. 3), where there are “Buy” and “Sell” functions, choice of cryptocurrency, payment method and region. In the list of “Sellers/Buyers” you can cut off newcomers and leave counterparties with a reputation. This does not mean that you should ignore new market entrants, the main thing is to check the terms of the deal. As for the safety of funds, like many similar platforms, on LocalCryptos funds are deposited during the transaction.

Image. 3

Nevertheless, this is far from being a useless feature – P2P does attract fraudsters, who can take advantage of the chargeback feature – the buyer cancels his payment after depositing. The reputation of a long-term user makes it highly likely to avoid such situations. By the way, to avoid getting caught in an unpleasant situation, it is also not recommended to use PayPalI have to check any payment system, with its irrevocable transactions. By the way, any payment system should be checked, because their general algorithm is the same, but in the nuances there may be surprises in the form of some huge commissions, timing of transactions, additional requirements for users, etc.

To start a transaction, you need to send a message to a potential counterparty, get consent, and start the process. The buy/sell page shows the counterparty’s data and you can view its detailed profile. If the counterparty seems to be bona fide, you can transfer money to the seller and expect it to arrive to his account and cryptocurrency in your wallet. A similar algorithm works when selling. Details for payment the seller specifies in the dialogue – these data are available only to counterparties and the administration in the case of opening a sport. The deposit time on the platform account is 120 minutes, during this time the buyer must send the money, otherwise the transaction will be cancelled and the seller can take his money.

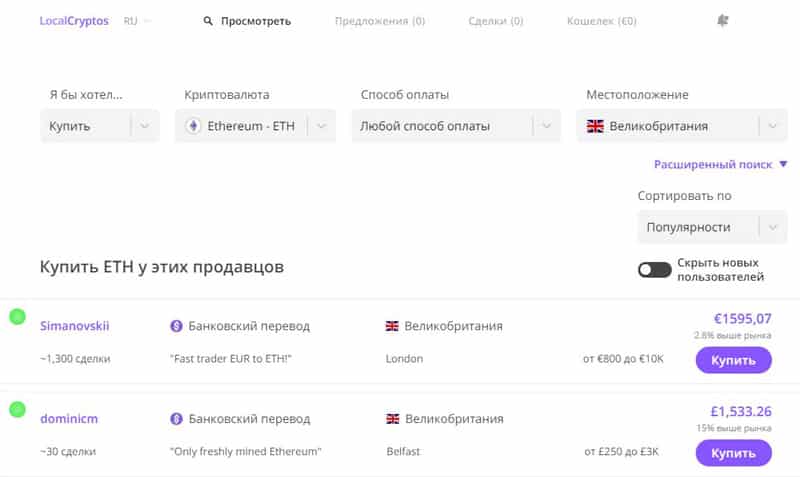

Bitpapa

Bitpapa (go online) – marketplace for P2P-exchange, supports cryptocurrencies Bitcoin, Ethereum, Stablecoin USDT and fiat currencies dollars, euros and rubles. Registration requires only email, verification is not required for trading (Fig. 4), but you can increase the degree of protection of the service by connecting a two-factor identification. You can access the exchange and make transactions through the Marketplace’s Telegram account.

Image. 4

Clicking on “Sell” or “Buy” brings up a list of sellers or buyers with transaction terms. Clicking on the buy or sell function takes the user to a page where he can read the terms of a particular transaction and user data. To create an ad, in Bitpapa account, click “Create ad” function, enter the parameters – buy or sell, what currency, indicate region, in which currency the payment is required, how the price will be calculated, trading schedule. On Bitpapa there are no limits and commissions for transfers within the system, but there is a commission for the withdrawal of 0.5%. It is up to the counterparties to verify the bona fides of the counterparties, who themselves determine the appropriate way to verify each other.

Discussion of any details between counterparties is possible in the chat service of the transaction, but the chat opens only after the execution of the transaction begins. Transactions can be made on the exchange using financial services such as Sberbank, Tinkoff Bank, Alfa-Bank, VTB and other Russian banks. Yandex.Money, WebMoney, Western Union, QIWI, Skrill, SolidTrustPay, PerfectMoney, Paysera, Paysafecard, Paypal, Payoneer, Payeer, Paymer, Paxum, Neteller, NixMoney, Moneygram, Idram, Liqpay, Epese, GlobalMoney, Epayments, CASH, E-kzt, Alipay, Capitalist, AdvCash.

HodlHodl

HodlHodl (https://hodlhodl.com/) – P2P platform with access to two more services – Predictions (P2P bitcoin prediction market), Lend at Hodl Hodl (non-custodial P2P bitcoin lending platform). To register, you need to enter an email address, enter any nickname, specify the user’s time zone, confirm that the user is a non-resident and not a U.S. citizen, and solve the captcha. The platform does not require verification, but it can be passed, it somewhat expands the user’s possibilities – to increase the limits and reduce commissions.

To pass the verification, you need to enter your real name and surname, date of birth, residence address, phone number, citizenship, identification documents (scan, which clearly shows the basic data, date of birth, expiration date), document confirming the place of residence (no more than three months old), photo of your face together with identification document and signature: “Photo was taken to confirm identity on hodlhodl.com exchange”. But to fully trade on the HodlHodl platform a registered account and a bitcoin wallet are enough. Trading operations start with a click on the functions “Sell BTC” or “Buy BTC”, offers in the list are displayed by region by default, but this parameter can be changed in the filter.

The sale/purchase announcement includes information about the bitcoin exchange rate (set by the seller, not the market), the counterparty’s rating, and whether the counterparty has verification. After selecting a particular counterparty, one can find out more detailed information about it. As long as the counterparties are at the clearance stage and the money has not been sent to an escrow (not deposited on the platform), the transaction can be withdrawn. At the stage where the seller has deposited the cryptocurrency, only the seller can cancel the transaction. When the buyer sends the payment to the seller, the transaction cannot be reversed. If there are claims, the dispute is resolved by the moderator, the funds remain deposited until the outcome of the dispute.

Bisq

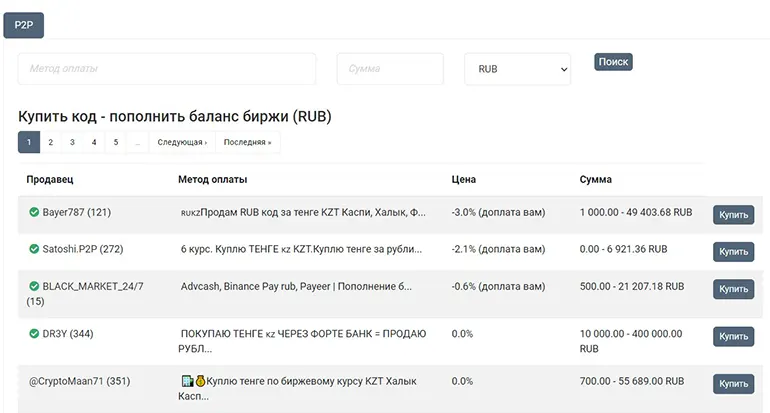

Bisq (Bitsquare) (https://bisq.network/) is a registration-free P2P application for buying and selling cryptocurrency for the national currency. However, in order to work you need to download the application. Upon launching, you are prompted to read the terms of use – in English, and to agree – in Russian. When launched, the app connects to the Tor network and synchronizes with the main bitcoin network. Transactions are conducted directly in the bitcoin blockchain, with no third parties involved (Figure 5), meaning there is no trading on the site itself. This project is not quite correct to call it a crypto-exchange, as trading is done in a fully centralized mode.

Image. 5

Access to trading on the service is open and instant, it is possible to exchange cryptocurrencies in minutes. The service supports bitcoins, ethers, U.S. dollars, euros, yuan and many other currencies. In total, the platform offers more than 120 cryptocurrencies and about 120 fiat currencies. Bisq presents two trading options, in one, the trader places an order in the trading book and waits for a counterparty to accept it. Or the trader accepts an order placed by another trader.

Service interacts with banks, payment systems AliPay, OKPay, Perfect Money, Zele, US postal money orders, SEPA and others. Issues of using a particular payment system are resolved before the transaction, as well as issues of the amount of cryptocurrency, the currency of exchange, and so on. Traders who add new orders pay 0.1% commission, counterparties who accept orders pay 0.3%. The minimum commission is 0.00005 BTC. Due to its fully decentralized nature, the Bisq platform is more suitable for more experienced traders who are well versed in the crypto market. For them, a fully decentralized exchange is preferable, and newcomers to the market, in case of incorrect actions that led to losses, there will be no one to appeal to.

LocalCoinSwap

LocalCoinSwap (https://localcoinswap.com) (Fig. 6) is a standard peer-to-peer trading platform that supports more than 20 cryptocurrencies. Registration via email, and then you can immediately start trading. But it is necessary to record the password, because the platform does not restore it. The creator of the ad pays 1% of the amount of completed transaction. Payment can be made by cash, bank transfer, bank debit/ by credit card, Paypal, Amazon or iTunes gift cards. Buying and selling is no different than on most similar platforms.

Image. 6

Advantages and disadvantages of P2P

The main advantage of P2P trading is that there is no central superstructure, as on the usual cryptocurrency exchange. If the central service is hacked, all traders’ funds are at risk, and this has happened to crypto-exchanges more than once. Crypto exchanges are openly pressured by the government, hence all these initiatives to tighten registration and verification. To be fair, some P2P platforms also rushed to formalize KYC standards. But most of them remain virtually anonymous, that is, virtually independent of government agencies, at least for now. Some services work even without registration.

Most P2P platforms work on exchanges faster than crypto exchanges and with fewer commissions, and at the same time, users have more opportunities to check the integrity of counterparties – most platforms have ratings and reviews of users. The disadvantages of P2P platforms include less liquidity and fewer trading pairs than on regular crypto exchanges. For professional traders, P2P platforms are not suitable because they do not have technical analysis tools. While the speed of exchange is higher, but the speed of withdrawal through payment systems can be lower than from crypto-exchanges. P2P-platforms are generally more suitable for experienced participants of the crypto market, who are well-versed in the prices of cryptocurrencies, do not make mistakes in exchange transactions and are able to take care of their own security. In general, P2P marketplaces are used by market participants as advanced exchangers.

Reviews