Cryptocurrency Exchanges with Margin Trading

Margin trading is a form of trading when a trader can trade with more funds than he has in his balance at the expense of credit funds – the leverage, which can be of different size. Margin Trading cryptocurrency trading is possible and it is quite a popular type of trading. Let’s take a look at what Cryptocurrency Exchanges offer to trade with leverage.

Contents

Pros and cons

Margin trading is a risky type of trading, especially if traded cryptocurrency. It is not recommended for beginners in crypto trading. Although, even experienced traders regularly incur losses in margin trades. So, if a trader decides to try trading with leverage, it is necessary to start with small amounts.

On the other hand, if you win, a margin trade brings much more profit than a regular trade. This is even more true for the crypto market, which is highly volatile. But the losses will also be large if you do the wrong thing.

The advantages of margin trading also include a low entry threshold for traders who want to try to operate with large funds, but do not have them available. Margin trading will help to diversify the investment portfolio when a trader is looking for more profitable cryptocurrencies at the moment.

The disadvantages are that margin trading is very stressful, one wrong decision and all positions can be lost and the trader will owe more.

Top marginal crypto exchanges

Huobi

Huobi (go to the exchange site) (Fig. 1) is an international crypto-exchange, headquartered in Singapore, is one of the ten largest in the world, mainly focused on the Asian region and Europe.

The crypto exchange is a multifunctional trading platform where you can trade more than 100 cryptocurrencies, Huobi has its own token HT.

Margin trading on the exchange is available for several cryptocurrencies. The maximum leverage for bitcoin is x5. There is a special section for margin trading.

For margin trading it is necessary to verify the account, it can take up to two days. Registration is done via e-mail or by phone. The registration form is filled in, in which nationality, contact data and so on are specified.

Image. 1

Verification on the crypto-platform allows you to increase protection and withdraw funds in large amounts. Verification requires ID card data and a scan or photo of it.

Huobi has a compensation fund, money from which can be paid in case of hacking, theft or irretrievable loss of cryptocurrency.

Almost all of the crypto exchange users’ funds are in cold wallets with multi-signatures. Login security is ensured by SMS authorization, linking email to the account and activation of Google Authenticator.

To start margin trading, you need to send money to your balance for normal trading, then click on the “Margin” section and select a pair for trading, for example, BTC/USDT.

In the window that appears, you must enter the desired amount of credit, confirm it and wait for credit approval. Then you can start the bidding process by pressing the “Margin” button.

After the trade operation, you need to quickly pay the debt to the exchange, to do this in the section “Margin” you need to find the appropriate service, scroll down and click “Pay debt”.

Binance

Binance Crypto Exchange (go to the exchange site) (Fig. 2), one of the leaders in cryptocurrency trading volume, a frequent winner of surveys of crypto-enthusiasts on usability, size of commissions, reliability, and so on.

It has two versions – Basic for novice traders and Advanced, with advanced functionality for experienced traders.

There are more than 450 trading pairs on the exchange, the largest trading volumes are in cryptocurrencies BTC, ETH, TRON, NEO. Some coins can only be withdrawn in whole amounts. The exchange’s internal token BNB is popular, with which you can reduce commissions.

Image. 2

To register, you need to fill out a form, enter your email address and password, accept the terms and conditions, and enter captcha. Then confirm the email with the Verify email link in the letter from the exchange. Exchange recommends and insists on two-factor verification, for which you need to connect the authorization from Google, download the application Google Authenticator. But the ability to add your phone number is not available in all regions.

The initial user status is Lv 1, which allows you to withdraw up to two bitcoins per day. If you want to upgrade to Lv 2 and withdraw up to 100 bitcoins per day, you need to pass verification, which is possible only when 2FA-authentication is connected. For verification scans of documents are already uploaded and checked by the exchange.

Binance only launched margin trading this year. The exchange warns that margin trading is possible after two-factor authentication and identity verification. If a user’s data is not on the blacklists, he can start creating an account for margin trading.

For margin trading, you need to open an account in the account control panel by clicking the “Margin” button, then “Open margin account”.

When the margin account is activated, you can start transferring funds from your wallet: select “Margin” in the “Wallet” tab, click “Transfer”, select a coin, confirm the transfer. Funds on the balance determine the size of the leverage at a fixed rate of x3.

The exchange also shows the level of risk, taking into account the amount on the balance sheet and the total debt, shows how much additional funds need to be deposited or reduced. The Exchange warns that at a margin level of 1.1, the trader’s assets will be sold and he will need to repay more debt.

The exchange repeatedly draws attention to the high risks of margin trading, before you open an account, it is proposed to study the principles of margin trading, as well as learn and agree to the terms of trading.

BitMEX

Bitcoin Mercantile Exchange (go to the exchange site) is another leader in the crypto trading industry, initially more suitable for experienced crypto traders, with easy registration, anonymity and security.

To register at the exchange BitMEX you need only an email, after registration, the first time you enter the exchange, it is recommended to go to “Account and Security” and connect to a two-factor authentication through Google Authenticator or Authy applications.

The peculiarity of the exchange is that you can trade in different cryptocurrencies, but deposits and withdrawals are only in bitcoins. Another peculiarity is that they have an insurance fund of more than 30 thousand bitcoins, the advantage of which is that if a trader goes in the red, no payments are required, the lender will receive a profit even if the trader’s losses don’t cover his expenses.

The account on the exchange is deposited through the “Deposit” on which coins are credited, which is enough for one confirmation in the network. Deposit at any time, withdrawal only once at 13.00 UTC, but without exchange commission.

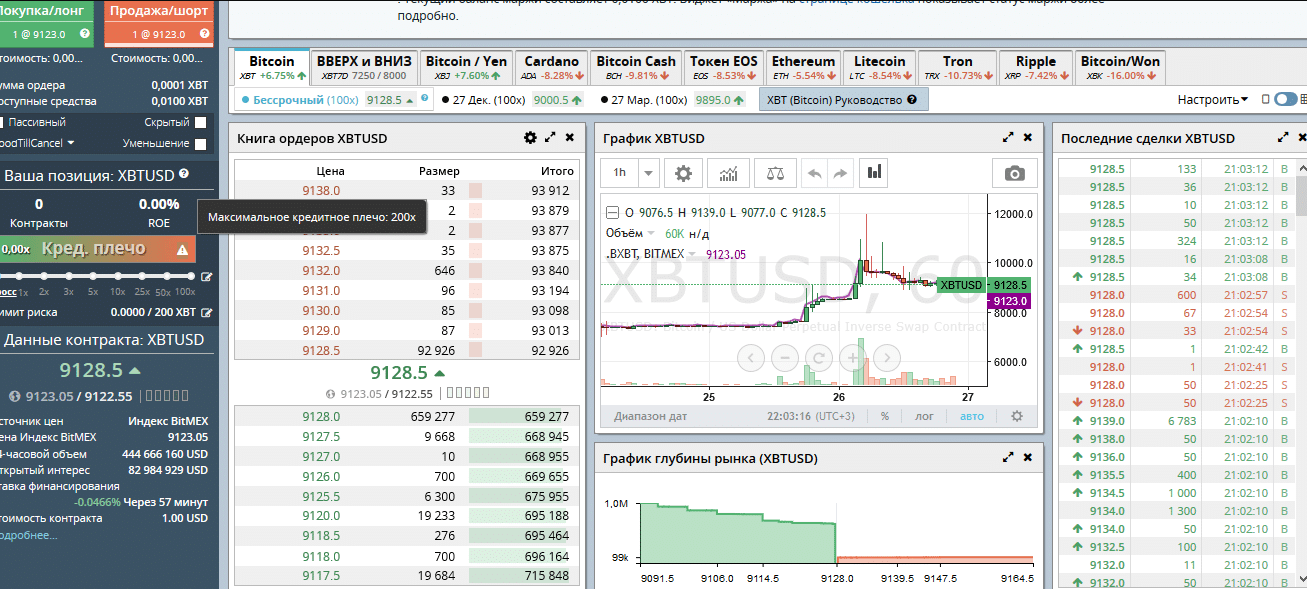

Margin trading is considered a strength of BitMEX. Traders are offered two types of margin trading – Cross margin and isolated trading.

Cross is set by default, according to its terms between the positions of a trader is distributed his entire balance and the size of the leverage is determined by the size of the commission.

Isolated trading allows you to set the size of the leverage, which allows you to allocate part of your balance to trading.

The exchange offers different leverage sizes for different cryptocurrencies:

- Bitcoin – x 100

- Bitcoin Cash, Cardano, Ripple, EOS, Tron – x20

- Ethereum – x50

- Litecoin – x 33.33

Image. 3

The margin trading conditions offered by BitMEX are very risky (Figure 3), especially given the volatility and price of bitcoin. In the history of the exchange, there have been numerous cases of liquidation of positions worth millions of dollars. That’s why even experienced players are offered to try trading in test mode first –https://testnet.bitmex.com

Poloniex

Poloniex Crypto Exchange (go to the exchange site) giant of the crypto-movement and the largest trading platform, it now accounts for 20% of global bitcoin turnover and in general, the exchange is characterized by a huge trading turnover, the equivalent of $ 1 billion a day.

High turnover means that almost any order will be executed, and it also allows you to keep transaction fees small and the trader has the opportunity to reduce them.

The exchange offers many cryptocurrency pairs, but does not operate with fiat, provides a large toolkit for trading, for analysis and statistics, strategizing, forecasting. Most of Poloniex users’ funds are stored in cold wallets.

Registration in Poloniex is done through e-mail, but simple registration does not allow to do almost anything, only gives access to the platform, it is impossible to trade, withdraw funds too. And moreover, if there is a long pause between account registration and verification, the exchange can block the account.

Therefore, it is desirable to be verified immediately for trading, the KYC process, which takes several hours, scans of documents, selfies with IDs and other data are checked manually by exchange specialists and can take, officially, up to 24 hours, but according to reviews much longer.

As with all modern exchanges with a high reputation, it is recommended to protect the registration with a two-factor authentication, for Poloniex it is important because the exchange has been repeatedly hacked.

Image. 4

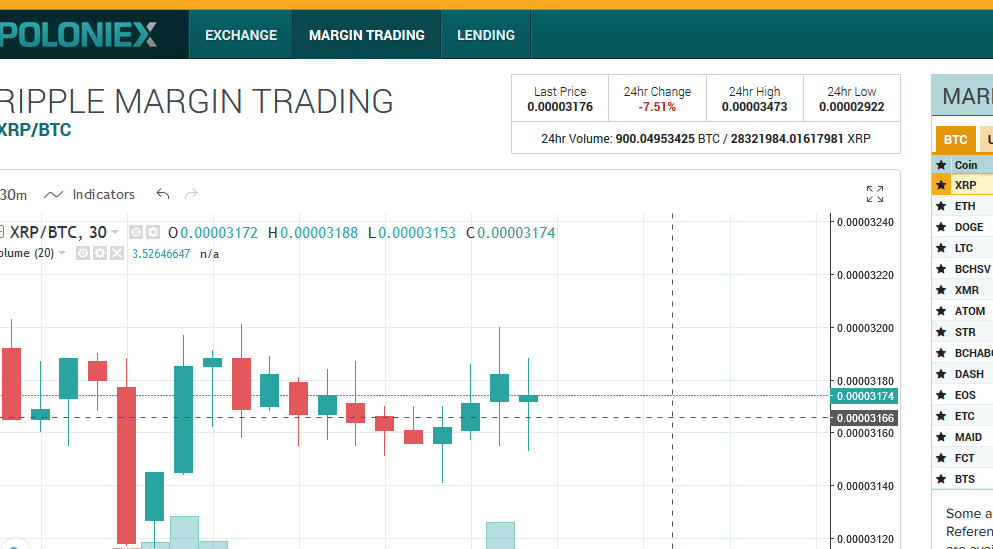

Margin trading (Fig. 4) is one of the main areas of trading on the Poloniex crypto exchange, the corresponding section is located directly in the “header” of the interface.

To start margin trading, funds are transferred from a Poloniex Exchange account to a Poloniex Margin account. Lenders offer funds for margin trading through the Poloniex Lending feature.

Poloniex offers up to x2.5 leverage for BTC paired with: Ethereum, Stellar, Monero, Ripple, Litecoin, Dash, Dogecoin, Maidsafecoin, Factom, Clams, ATOM, STR, EOS, ETC, Bitcoin Cash ABC.

The initial margin is 40%, which means it is necessary for a trader who is trading seriously to have significant funds in the balance. In the account for margin trading such items are specified as Total Borrowed Value – the full amount of credit, Total Margin Value – the balance of the margin account, Unrealized P/l – estimated loss/profit, Unrealized Lending Fees – interest on borrowed funds, Net Value amount of funds minus commissions and profit or loss, Current Margin – current margin, if this figure is below Maintenance, maintenance margin, which is 20 %, the position is liquidated.

To open a position, the trader specifies the amount, volume and maximum rate for the use of credit, per trading day. The rate is assigned by the trader and agreed by the creditor.

Kraken Exchange

Kraken (go to the exchange site) is the oldest cryptocurrency exchange, founded in the U.S. at the dawn of the cryptocurrency era. Cryptocurrencies available for trading on the crypto exchange are Bitcoin, Ethereum, Bitcoin Cash, XRP, Tether, Stellar, Litecoin, Monero, Cardano, Ethereum Classic, Dash, Tezos, Augur, Qtum, EOS, Zcash, Melon, Dogecoin, Gnosis, and the Canadian dollar CAD, GBP, USD, JPY, EUR. By the way, it takes the lead in terms of euro turnover in the crypto world.

The exchange offers several levels of verification. At level zero, the user can explore the platform, but cannot trade. At the first level, only cryptocurrencies can be traded. From the second level, a trader can trade in fiat currency and the limits are increased.

Registration takes place via e-mail, to which a letter arrives with a personal code, the activation key. It must be copied, go back to the account page and enter the Activation Key in a special window. After the activation of the account, the user will have access to a personal account with settings.

To be able to trade you need to verify your account by providing step-by-step:

1. Contacts, citizenship, place of residence, personal data and get the opportunity to unlimitedly deposit and withdraw daily up to $2500, monthly up to $20000.

2. Provide information about the place of registration, propiska, getting the opportunity to trade in cryptocurrencies equivalent to $5000, up to $50000 per month and fiat currency equivalent up to $2000 per day, up to $10000 per month.

3. Proof of identity and residency. From now on, plus another increase in crypto and fiat limits, margin trading becomes possible.

4. Verification for the major players and corporations, as a result of which an individual contract with the exchange is concluded. At this stage we are talking about amounts of hundreds of thousands and millions of dollars.

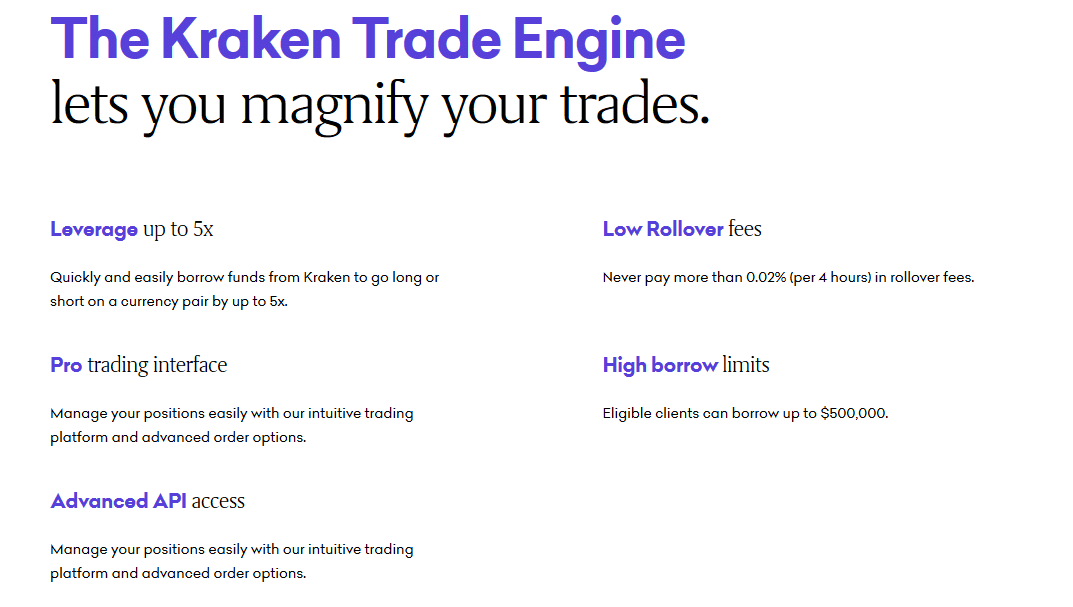

Margin trading opened on the crypto exchange at the end of last year (Figure 5). So, at the third level of verification, a trader can trade with a leverage of x5 for bitcoin, etherium and ripple and x2 for others. To do this, on the Trades page, go to the Intermediate interface, which contains additional features, including margin trading for 12 cryptocurrencies.

Image. 5

Kraken charges a commission on margin trading operations. For example, for bitcoin the commission for opening a transaction is 0.01%, for ETH (Ethereum) 0.02% and so on, for transferring a transaction is also charged.

Withdrawal of funds from the exchange is possible in cryptocurrencies or by bank transfer, but only after verification. There are commissions on fiat deposits.

In general, the Kraken differs from all the others in its conservatism and utilitarianism on the verge of limitation, but it is one of the leaders in terms of reliability and security.

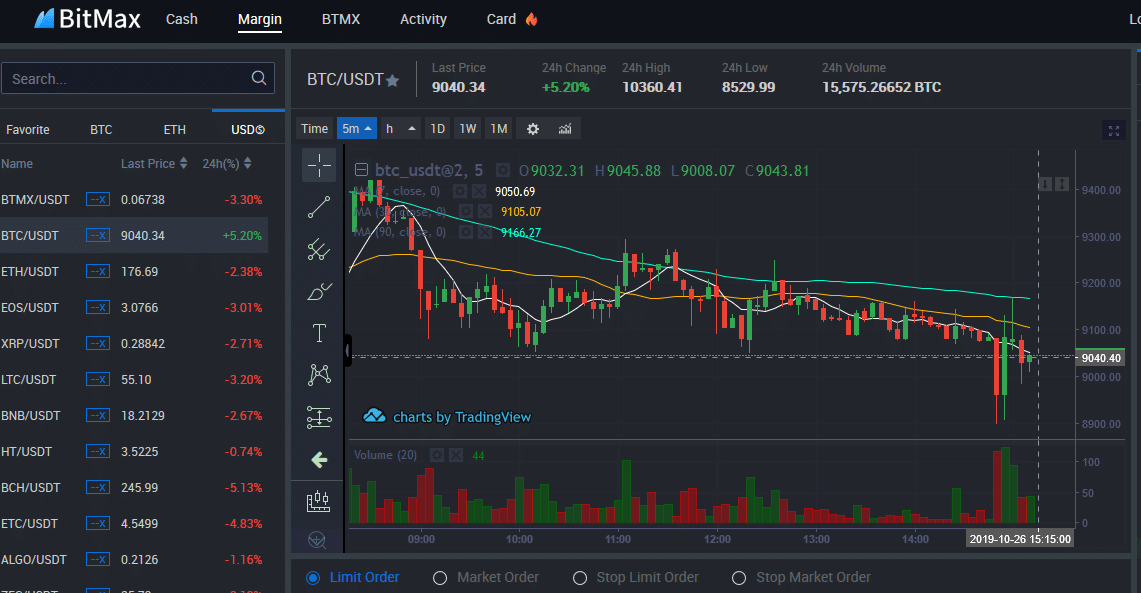

BitMAX

The Singapore exchange Bitmax (go to the exchange site) one of the youngest crypto exchanges, is considered advanced and progressive mainly due to the Trade-to-Mine capabilities, in which the more transactions the user conducts, the more income he receives, in this case, BTMX tokens.

The limitations of the exchange are due to the fact that it is presented in Chinese, Korean and English, perhaps just did not have time to translate. Also, there are no fiat transactions on the exchange.

Registration via email, but with a simple registration can not withdraw funds. To withdraw you need Google Authentificator. Six-digit code, which will be generated, is used for transactions on the exchange.

Verification involves passport data, selfies with passport, e-mail and address BitMax.io

Image. 6

BitMAX offers margin trading (Figure 6) with leverage up to x10 and 0.04% commission. But to participate in margin trading, you need to have at least x3 credit collateral in your account.

A special Margin Account is opened for trading, to which the user will transfer funds from the “My Assets” section.

As soon as the trader transfers cryptocurrency to the Margin Account, his balance is considered as collateral for the loan, this happens automatically. Direct trading is conducted in the Margin section, placed in the interface of the exchange. Users recommend transferring funds in BTMX tokens, it is more profitable. There are trading pairs with this token, too.

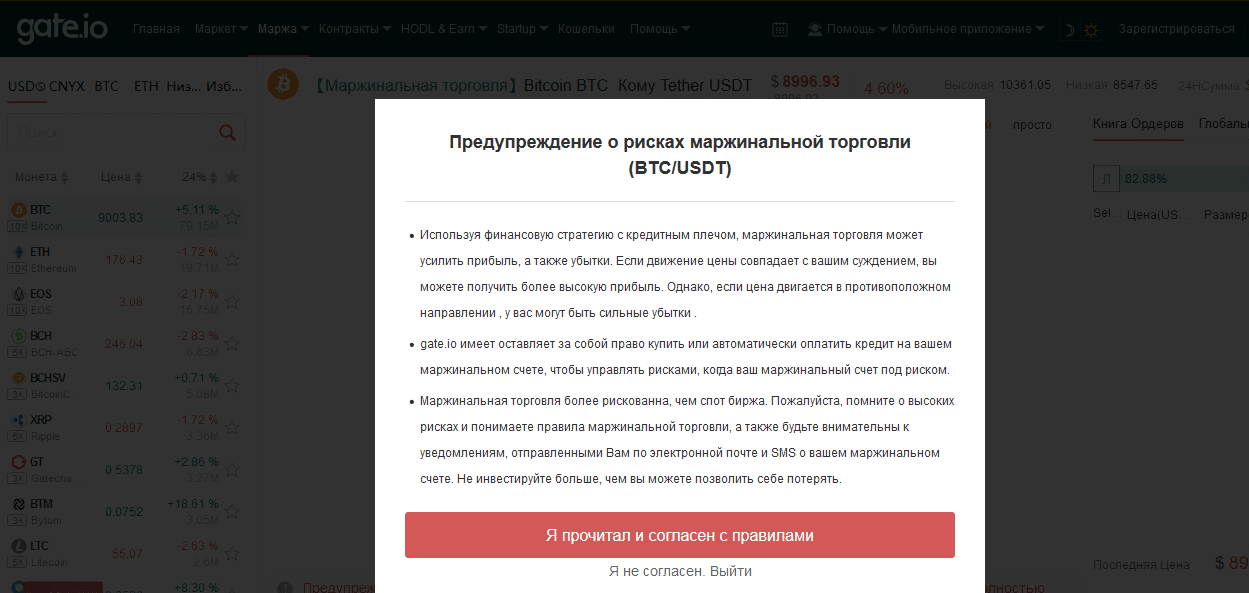

Gate.io

Another fairly well-known crypto exchange is Gate.io (go to the exchange site) (the Chinese exchange Bter, acquired by the Americans), offers the opportunity to trade about 300 pairs of currencies, there is no support for fiat. Such features as multilinguality are noted, though translation to 12 languages is not very correct, except for English. A high level of security and fairly responsive support, although not everyone agrees with this.

Registration is done via e-mail or phone in a mobile version. When registering you need to generate two passwords – for login and trading, they must be different. Exchanger can be tied to IP, but it is not necessary if IP is dynamic. When registering, exchanger shows you what similar sites are phishing and offers the opportunity to generate anti-phishing code.

For operations with large sums, as well as to speed up deposit/withdrawal and increase the level of security, it is necessary to undergo additional verification with confirmation of personal data. It is stated that verification is carried out within 24 hours.

Image. 8

The exchange provides the possibility of margin trading against collateral (and responsibility, Figure 7) users, with leverage up to x3. The user can lend the user an interest or borrow a certain amount for trading for a certain period of time.

Trading takes place in the “Margin” section, the amount of credit depends on the amount transferred for trading. The credit is given by default for ten days, but the term can be extended.

Margin trading on the exchange can be started from $100. If the trader defaults on the loan payment, his assets are blocked.

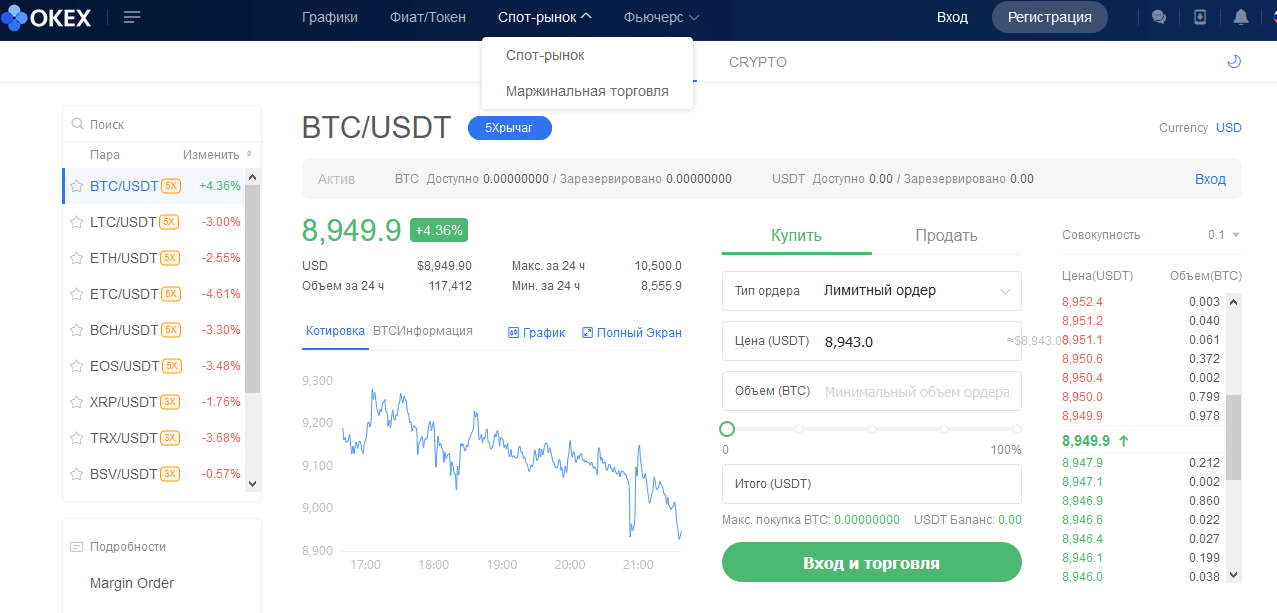

OKEx

OKEx Crypto Exchange (go to the exchange site) is a permanent member of the top 10 crypto exchanges. Offers more than 400 trading pairs, but fiat only yuan.

Registration by e-mail, with a confirmation code or by phone, in which case you will need in the activation window phone number and code from the SMS.

Verification on the exchange is mandatory for all users. At the first level, citizenship is specified and the ID is provided. At the second level, full data about the trader is uploaded – residency, scans, selfies. The third level implies verification by the online support service. You may start trading after the first level of verification.

It is claimed that the verification to level 2 takes 72 hours, but traders refute this.

The exchange has a limit on the withdrawal of funds, which increases with the growth of trading volumes, but does not exceed 1 thousand bitcoins.

Margin trading is possible after full verification. OKEx offers trading with a maximum leverage of x5.

The margin trading service is located in the “Spot Market” section (Figure 8). To take part in trading, you need to replenish your account, the maximum loan amount from the exchange is 500 thousand dollars.

_

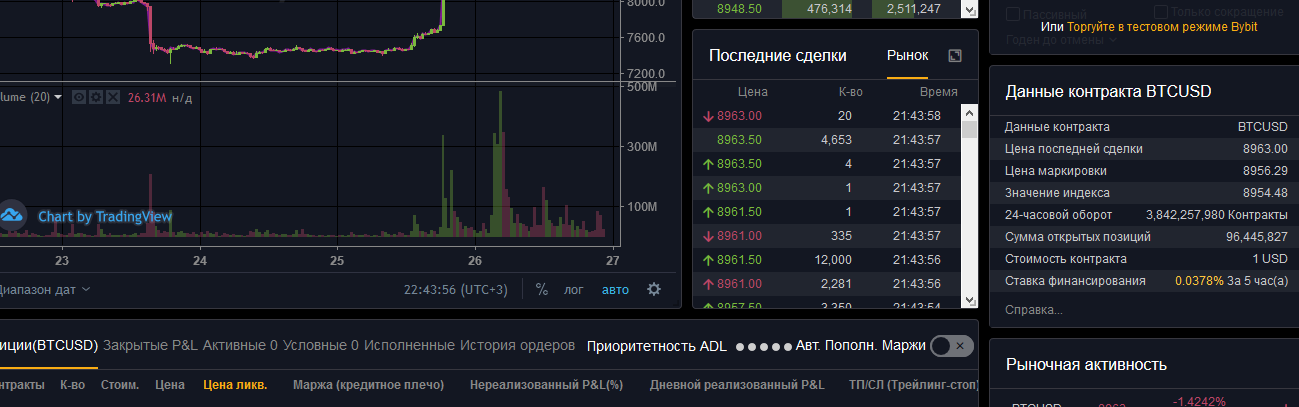

Bybit

Another new but rapidly progressing exchange Bybit (Go to the broker’s website). Users are well known as an exchange, which provides bonuses for registration and for the first deposit (in the latter case, it is necessary to deposit a certain amount). Transactions are made in cryptocurrency.

Registration is standard, however, the code that will be sent to your phone or email is only active for five (5) minutes, so you need to hurry. New participants can practice on a demo account.

Withdrawal of funds from the exchange associated with the protection of the account, you need to activate the two types of protection offered by the exchange, so you can withdraw money.

Image. 9

Bybit provides margin trading (Fig. 9) of BTC/USD or ETH/USD with leverage x100 and EOS/USD and XRP/USD with leverage x25, with restrictions on the amount of funds to open a position. The peculiarity of the exchange is that the leverage can be changed after opening a position.

The exchange sets a risk limit and, according to user feedback, liquidates unprofitable positions less frequently than other crypto exchanges. When a position is liquidated below the limit price, counterparties’ costs are reimbursed from the exchange’s insurance fund.

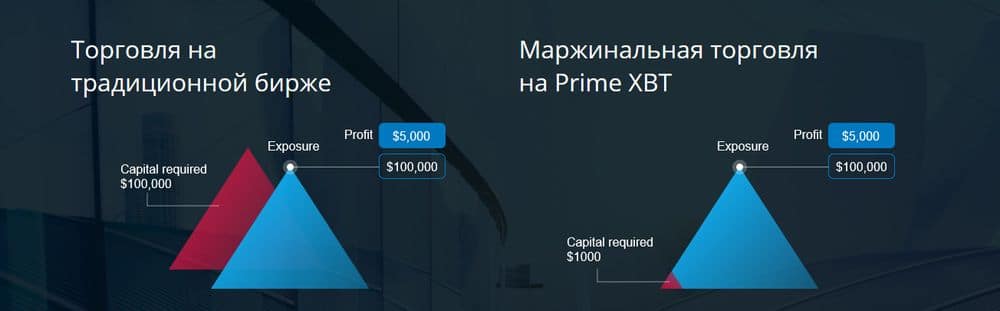

PrimeXBT

Prime XBT Trading Services (go to the exchange site) (Figure 10) is a specialized margin exchange for cryptocurrencies. The exchange allows trading with leverage x100 in pairs BTC/USD, ETH/USD, LTC/USD, XRP/USD, EOS/USD and recently available crosses ETH/BTC, EOS/BTC, LTC/BTC, XRP/BTC. At the same time, it is possible to deposit cryptocurrencies and fiat from the built-in Changelly exchanger.

The exchange charges 2 types of commissions: per trade and overnight financing. You need 0.001 BTC to start trading.

PrimeXBT also defines limits, exceeding which reduces the leverage. The trader cannot adjust the leverage on his own. There are also limits on the amount, for example for bitcoin it is 15 BTC and it is not possible to open an order larger than that.

Account registration at PrimeXBT is simple – you get an email with a password and a confirmation link. It is recommended to strengthen verification by installing Google Authenticator.

_

Of the crypto exchanges that have good functionality for margin trading is also worth noting:

- Currency (go to the exchange site): Offers leverage up to x50, the size of the leverage and the volume of the position is specified by the trader;

- Deribit (go to the exchange site): offers trading with leverage up to x100, simplified verification, deposit and withdrawal only in BTC;

- Bibox (go to the exchange site): you need a separate account for margin trading, leverage x3.

How to choose an exchange for margin crypto-trading

Not all exchanges where margin trading is available are suitable for high-quality trading. When choosing a cryptocurrency exchange, it is necessary to proceed from the following parameters:

- High liquidity of the crypto exchange;

- Large selection of cryptocurrencies and sufficient choice of fiat;

- Many active users;

- Operational support service;

- High security, in particular, two-factor authentication is very desirable;

- A large number of trading, analytical, statistical tools;

- Relatively small commissions;

- Sufficient choice of deposit and withdrawal options;

- Predominantly positive feedback from users, with some negative feedback.

These qualities will somewhat reduce the risk of margin trading by reducing the likelihood of technical failures or unpredictable actions on the crypto exchange.

Reviews