Arms Ease of Movement Value Indicator

Contents

Arms theory and its application to forex

EMV indicator created by Arms for the stock market (stock market trading) as part of his Equivolume methodology described in Profits in Volume: Equivolume Charting.

In classical technical analysis, price and volume of an asset are considered separately and represent a balance between the fear of losing what is already there and the desire to maximize profit. Richard Arms proposed a different view of the markets, called Equivolume, and this methodology creates “equivolume”, that is, equal-volume charts, in which price and volume are considered in relationship and are displayed as a whole.

| Broker | Bonuses | Open an account |

|---|---|---|

|

1

|

50 %

Bonus on deposit from $100 USD – promo code WELCOME50

|

Start |

|

2

|

From 25 To 60 %

Deposit increase for the first deposit

|

Start |

|

3

|

Cashback

Refunds of commissions, spreads and other costs

|

Start |

|

4

|

100 USD

Loyalty program remuneration

|

Start |

|

5

|

20 %

Bonus and cashback by promo code revieweek23

|

Start |

Based on the methodology, charts are constructed that combine elements of candlesticks and equal-volume charts in the form of rectangles – shadows, bodies candles, width, which refers to the volume. This allows you to interpret the type of candles, their height, minimum, maximum and at the same time the dynamics of the volume, which represents the volume of sales of assets over a certain period of time.

The horizontal scale on the equal-volume chart, unlike standard charts, shows volume, not time. It is the volume that Arms considered the most important factor in trading. The market situation in a particular trading period is determined by rectangles, for example, short and wide rectangles show weak price dynamics with significant turnover and occur at the moment of turnaround.

On the contrary, long and narrow rectangles show marked price dynamics with low volume and show a steady trend. Rectangles can also show the probability of a breakout, for example, if rectangles show growth in width and height, it indicates growing volume and a high probability of a breakout, but if the rectangle is narrow, a breakout is unlikely.

A similar method of interpretation is used in the indicator Ease of Movement. But in the Forex market the emphasis on volume analysis is not so effective, because traders do not have any information about volumes, as in the stock market (Forex Indicators). So adapting the indicator for forex trading involves difficulties, which make it not popular, although still quite applicable.

Description of the EMV indicator

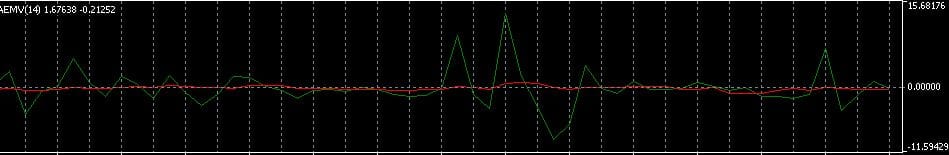

EMV in the forex market gives a fairly realistic “picture” of the current state of the market and can be used for its in-depth analysis and for making strategies. More precisely, the indicator of ease of movement is the ratio of the average movement point (MidpointMove) and the period of the previous bar, to the quotient of the full value and volume of the current bar. The values of Ease of Movement Value are presented on the chart as a histogram, a simple line or in a complex – a histogram and a line.

Understanding the formula used to calculate the indicators can be useful, it shows the relationship between prices and volume, but of course you do not need to know it, in the terminal it is all calculated automatically. The formula of the indicator looks like this: EMV=/(Volume/High-Low), where:

MidpointMove = (current max + current min)/2 – (previous max + previous min)/2.

Rules of application of the Arms ease of movement indicator

It is believed that an increase in price should correspond to an increase in volume, but, according to Richard Arms’ theory, it is not necessary to trade with this attitude in mind. He believed that it is more effective to trade in paradoxical situations, which are usually avoided by traders. The Ease of Movement indicator was originally created for such situations, albeit in the stock market.

To use EMV in the forex market, you need serious trading skills and testing of the indicator on demo accounts. You can use Ease of Movement as a signal indicator or as a filter within a particular strategy with other indicators.

Decisions on the indicator are based on the ratio of indicators to the zero mark. The universal signal is a situation when the indicator indicators become above zero, it can be a signal to buy, and when they are below zero – a signal to sell.

When determining the point of entry into the market on the indicator EMV pay attention to changes in the trend, which is displayed on the histogram by color and values. For example, if the histogram crosses the zero level from bottom to top and changes color from red to green (in this case), it is a signal to possibly open a buy position.

If the histogram crosses the zero level from top to bottom and the colors change from green to red, it can be a signal to sell. Also Ease of Movement Value can show divergences, which in some situations can be assessed as a leading signal of trend development. For example, when price updates highs and the indicator does not, it can be a reversal signal to decline, and vice versa, if price updates lows and the indicator does not, it can be a signal to price growth.

The rule of Ease of Movement Value can also be considered its undesirable use without additional indicators. Still it is not considered a sufficient tool for trading. The most effective is its application with other volume indicators, which can act as a confirmation of trading signals.

Adding an indicator to the MetaTrader 5 platform

Ease of Movement is not a standard indicator for trading platforms. In particular, to work on MT5 you need to download it, for example, here at. The file or zip-file is downloaded to the MQL5 folder on your computer, from where it is extracted and loaded into the terminal by: “File” – “Open Data Directory” – two clicks on the file. The indicator appears in the list of custom indicators.

There are a number of parameters that can be changed in the indicator, such as the type of moving average of the indicator parameters – simple, exponential and several others. It is possible to change the moving average period, which is 9 by default, because according to the methodology of Arms himself the period more than 14 is undesirable.

Using EMV with other indicators

It follows from the formula that the maximum values of the indicator are shown if the sharp increase in prices is not confirmed by the dynamics of trade turnover, as well as the minimum indicators arise when the fall in prices occurs without a correspondingly large turnover. In its turn, the indicator values, which are close to zero, can be seen, when the trading volume changes without the price changes. Thus, the indicator generates the following basic signals (forex signals):

- When EMV rises, it also means rising prices, but without rising volumes, which means we can expect a trend reversal soon.

- When EMV falls, it means lower prices with low volumes, and you should also expect a trend reversal.

- And when the Ease of Movement moves near the zero mark, it means that there is uncertainty in the market and not enough volume to form any distinct trend.

The Ease of Movement Value indicator is offered for trading in the Forex market since not very long time, so there are almost no special strategies for working with it. The principle of assessing the market situation using this indicator is unusual for many, and most traders prefer a more classic indicators. Moreover, EMV, in general, is not more effective than other indicators and oscillators. A trading strategy based only on the Ease of Movement exists, but is not recommended without additional indicators.

If the trader is still at risk of such a trade, then, in general, the position to buy open when the indicator moves into a zone of positive values with the obligatory installation of stop-losses below the local extremum (Forex Trading Training). As soon as the indicator passes into the zone of negative values, the position is closed. A sell position implies the opposite conditions – entry into the area of negative values, the trade is closed when entering the area of positive values. It is considered optimal to apply EMV with indicator RSIBut I could not find examples of real application of this strategy by any traders for forex trading.

To a greater extent, the Ease of Movement indicator is focused on binary options marketBut it is not on the list of the most popular there either, for the same reasons as in the forex market. The strategy of its application for BOO is similar: if the EMV indicators cross the zero mark from bottom to top, a Call option is purchased, if the Ease of Movement indicators cross the zero mark from top to bottom, a PUT option is purchased.

Not just EMV

Arms’ most famous and much more popular invention is not the Ease of Movement, but the Arms Short-Term Trading Index (TRINArms’ Short-Term Trading Index), which is widely used at the stock market and can be useful for forex trading.

An index is a sample of securities, which is carried out according to algorithms developed by a certain exchange. Exchange indices are also relevant for the forex market, since they are present in the form of contracts for market differences. The TRIN formula is very simple: the numerator is the number of rising stocks divided by the number of falling stocks, and the denominator is the trading volume of rising stocks divided by the trading volume of falling stocks.

Market sentiment is determined similarly to EMV: there is a certain level, for TRIN it is 1.0. If the value is higher, from 0.2, then traders are preparing to buy, if lower, for example, 0.2, it is a signal to sell. In general, this methodology is similar to the one used in the Ease of Movement indicator. And just like in the Ease of Movement, the optimal trading entry points are clarified by averaging the values through moving averages with different periods, and crossings of moving averages are considered as signals to buy and sell.

Conclusions

Instruments created by Richard W. Arms Jr., in particular the Ease of Movement indicator, are not created for forex trading and therefore are used relatively rarely. But, in principle, traders who use them note a fairly high degree of reliability of the signals it generates.

However, an effective use of EMV is possible only with other indicators and oscillators. But because this indicator is not particularly effective, it is replaced by other more adapted for forex indicators.