The Stock Market: How to Make Money on It?

Stock markets – is the foundation of modern economics and finance, a world of securities, vast amounts of capital, and colossal financial losses (detailed overview of the stock markets). Earnings in the stock market are now available to almost everyone, but to be a successful investor or trader, you need to have certain knowledge and possess the skills of trading or investing in financial markets (The stock market as a source of profit).

Contents

Market and stocks

The stock market, to put it simply, is a system of organizing and maintaining securities trading (Fig. 1) by both individual traders and companies (Stock Market Trading). The trading sphere of the stock market includes currencies and raw materials, but the main instrument is still the securities. First of all, they are stocks and bonds, less often used are certificates and bills of exchange (securities market). A share is a security that entitles its owner to a share in a company and to income (dividends). Shares may be preferred or non-privileged. Non-preferred shares are ordinary shares, the income from which is determined by the performance of the company. Preferred shares have a fixed income.

Image. 1

The stock market performs five main tasks in the modern financial system. Firstly, it is the consolidation of capital at the level of a country or even the whole world into a single structure. This makes the stock market a global factor of economic stability or destabilization in a crisis, because it is sensitive to many factors. As an example, the coronavirus, the news about which began to “crash” the stock market long before the virus became a pandemic. After that, the stock market situation triggered real economic problems that could turn into a full-blown global economic crisis, and now the disease itself, caused by the virus, does not threaten the economy as much as the panic it triggers in the stock markets.

From the point of view of trading and investing in specific stocks, we must remember that in joint-stock companies the main factor influencing the share price is the controlling shareholder, who makes decisions concerning the development of the entire company. The second of the main functions of the stock market is the redistribution of financial flows, in which money is directed to the industries with the highest profits, and thus provides an opportunity for investors and traders to earn.

The development and opportunities of the stock market attract new participants, and the more traders and investors there are, the more profits all market participants can make. This dependence allows the stock market to act as a driver of the economy. This, too, is a very event- and news-sensitive function of stock markets. Compensation of money supply is a very important function of stock markets at the level of national economies. The fact is that in times of crisis, a country may experience a shortage of money supply. Then the Central Bank of the country or some other state structure, issues securities, which cover the deficit of money supply.

Accounting of financial instruments is an additional function. It is logical that stock markets record shares and other financial instruments. Information is recorded on when specific securities were issued, the circumstances of the transaction, and so on. In terms of trading and investing in securities, this allows you to build effective income strategies.

Types of stock markets

The stock market can be classified according to different characteristics. For example, stock markets differ by types of traded assets – securities, equity, debt and others; futures contracts (Fig. 2); options and others. Stock markets can also be divided by the term of traded assets, i.e. markets of short-term, medium-term, long-term, perpetual securities.

By assets, markets can be primary, where new securities are traded, or secondary, where financial instruments that have already been in circulation are resold. According to the structure of organization, financial markets can be exchange markets, where traders and investors trade according to certain rules. Here the rate of traded assets is determined. The over-the-counter market trades securities that have not been listed on a stock exchange, such as securities of small, start-up businesses.

Also, stock markets are divided according to the type of issuer of financial instruments, i.e. securities can be corporate, state, municipal and so on. And, of course, the markets can be international, regional and so on – depending on the affiliation with the territory where the assets are located. When choosing a stock platform for trading or investing you need to pay attention to all these details, the effectiveness of investing or trading depends on them (Trading in the Stock Market in 2020).

Image. 2

What is the appeal of stock markets?

It is useful to know a few of the features of the stock markets that make them attractive to investors and traders:

- Government regulation. Stock markets are regulated directly or indirectly by the state (Fig. 3). This is a plus for investors and traders, because they remain under the protection of the state. The measures taken by the authorities protect investors to a greater extent. Most companies and firms that own stocks are neither directly nor indirectly protected by the state, at least formally. To make money on the stock market efficiently, it is very desirable to find out what rules of law govern a particular trading platform.

- Reliable income. The stock market is a fairly reliable source of income, because it is protected by the state. Trading is characterized by relatively low risks, ease of operation.

- Legitimacy. Transactions made on the stock market are legal, and there are no surprises in this regard, as in the case of forex or cryptocurrencies. All transactions are legal, income is legal, which means that traders and investors will not have problems with taxes, banks, law enforcement agencies. Not only because this business sector is controlled by the state, but also because all these risks are borne by the stockbrokers or managers through whom the stock market is traded (stockbroker rating).

- Transaction transparency. All information on stock market transactions – time, value, yield, etc. – can be seen in real time. This provides a high level of trust in the stock market, the ability to know all factors influencing asset prices and competently calculate the prospects of securities and other instruments.

- Adequate rate. Because of the transparency and state regulation on the stock market, the price of assets is formed as close to the real one as possible. That is why different sellers have the same rate for a certain financial instrument.

- Constant development of the market. Despite the inevitable crises, sometimes quite strong, the stock market is characterized by constant development – more and more people are involved in trading, more and more transactions are made, crises are replaced by rapid growth. All this ultimately creates opportunities to earn on the stock market for all its participants.

Image. 3

Stock market participants

The main participants of the stock market are issuers, stock market brokers, investors, dealers, managers, clearing company, depositary. Issuers are companies that issue securities. Investors purchase securities and other assets. A huge mechanism of stock markets revolves around these key participants. But of great importance are all the other participants that keep the stock market running smoothly – clearing and depository organizations and others that receive commissions for services provided.

Brokers and dealers are a necessary link in the stock market. Brokers conclude transactions on behalf of their clients, and dealers work with assets on their own behalf and at their own expense. Brokers and dealers may also manage clients’ investments on trust, advise and to teach stock market trading. In general, everyone who has to do with trading on the stock market can be divided into those who need an activity license and those who do not, i.e. into professional and non-professional participants.

How do you make money in the stock market?

Stock market activity is not diverse, but on its scale it is a huge industry with more than $70 trillion in capitalization. That’s enough money to make money for a lot of people. And many people take advantage of it.

Funds as insurance

The stock market provides business resilience because securities issued by companies protect businesses from price spikes in goods and services. The stock market can significantly reduce risks if transactions are made with futures and options. You could say that this kind of business insurance allows you to save money, which is a form of making money. But when they talk about making money in the stock market, they mean investing in assets and speculation (trading).

Investing

Investors buy financial instruments to make money on the fact that their price rises over time. Investments are mostly invested for the long term. An investor’s monthly profit rarely exceeds 50%, but this is compensated for by low risks. Not everyone who would like to invest has the professional knowledge and time to do so, so capital owners put their money in trust for individual management. The investor’s funds are credited to a special account, and the manager regularly reports to the investor on the results of his actions.

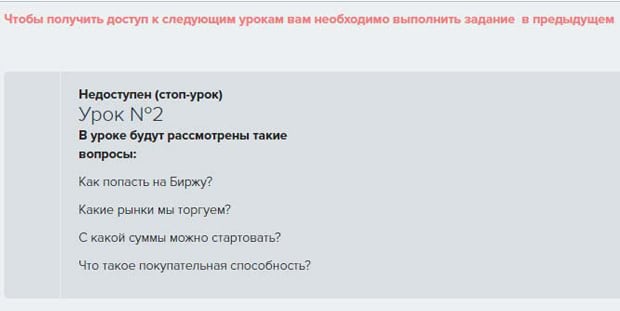

But most people don’t have the kind of money that they need to put into a trust to trade on the stock market. For a manager to be interested in an investor’s money, it has to be a really impressive amount. That is why the more popular method is collective investments (see Figure 4). In this case, the investor acquires only a part of the monetary assets of a collective fund – a share. And these funds are invested in various financial instruments, assets, including securities. If the value of securities rises, so does the price of each unit. The investor can sell the unit with the help of a management company.

The plus side of collective investments is that the investor may not know anything about securities trading (although that won’t hurt him at all). The disadvantage is that capital has to be placed in the hands of a manager. And if there are no conditions to understand how the stock market works, you should at least understand how to choose a reliable manager.

Image. 4

Trading on the stock market

Now the majority of market participants are traders who make money from fluctuations in asset prices. The trader seeks to buy the asset cheaper and sell it more expensive. The speculator is not interested in dividends or interest, his main task is to analyze the situation on the market, see the growth potential of the asset value and sell it in a profitable way and vice versa.

The potential profits from trading can be much faster and greater than from investing, but the risks are also much greater. Traders mostly act on their own, at their own risk, disposing of their own capital. Nowadays, trading is done on the Internet, which attracts a huge number of interested people to the industry. Trading can be done at a very fast pace when the deals are made in seconds or minutes but a considerable profit can only be made on the basis of a large number of deals. Short-term trading involves closing trades within a trading day, and profits are usually a few percent.

Long-term trading is trading in which positions are closed over months and sometimes years. But with the right calculation the profit can be very large. The main difficulty here is that you have to learn how to trade, to use Fundamental and technical analysisThe goal of trading can be formulated as follows: profits should be greater than losses. The aim of trading can be formulated as follows: the profit from trading must be greater than the loss. The profitability of trading depends on the professionalism of the trader. Traders do not trade chaotically, but according to a certain strategy, which they take from the manuals of advanced traders or develop by themselves, if they have experience in the market.

Portfolio investments

Portfolio investing is an additional way of earning on the stock market. It is an analogue of investment in a mutual fund with the difference that among financial instruments there are securities issued by the state or some industrial giant, the value of which is in little real danger. Also, portfolio investments are managed by the investor himself, not the manager, and he chooses the securities himself.

The “portfolio” is made up of stocks that steadily increase in value over time. In doing so, the investor must allocate shares of securities so that risk-free assets (or, more precisely, assets with reduced risk) compensate for the main assets in the portfolio in the event that their value does not rise as anticipated. Portfolio investing transactions are not very frequent, about 15 per year. But the probability of a profitable outcome is greater than in trading. Portfolio investments are designed for the long term. Availability in them of low-risk securities allows investor not to spend all his time for monitoring of situation on the market. Besides, portfolio investing is better predictable and therefore it is easier to insure investments against losses.

How to trade on the stock exchange?

The complexity of trading is underestimated. At the same time, brokerage firms actively advertise the benefits of trading, including securities, on stock exchange. This attracts users who are under the illusion of getting rich quickly. According to statistics, up to 90% beginning traders quit trading quite quickly with losses. To be among 10% real traders, you need to approach trading very seriously from the beginning (How to Start Trading on the Stock Market?).

Learning to trade on the stock exchange

Stocks, securities and other assets are traded on the stock exchange. If it is planned to trade rather than to invest, it is necessary to devote time to learning trading, although trading on the stock exchange will have to be done through a broker. It is necessary to learn how to analyze the market, how to manage capital, how to apply technical analysis indicators, how to implement classical trading strategies, borrowed original strategies, develop and apply your own strategies.

Most traders train on their own. There is a lot of high-quality training information on the Internet in all areas and stages of trading. So, self-education in this industry is available, free of charge and how effective it will be depends on the novice trader. The problem of self-education can be that there is no one to ask the unclear points. But there are many online platforms for communication of traders, where one can ask all the questions and among the answers there may be the right one.

Image. 5

There are also courses with an instructor (Fig. 5) – paid, free, online or offline, independent courses or from brokerage companies. If the teacher is competent and has practical experience in trading, such training may be the best choice. However, you should be guided not by the cost and loud regalia of such a teacher, but by the reviews of the courses from practicing traders.

Choosing a stock broker

Stock exchanges do not work with individuals, the trade is conducted through brokers and one should be able to choose a brokerage company correctly. Brokers provide the client with analytical information, credit (leverage), keep records of transactions, maintain the depository, deal with taxes and so on. Brokers usually have access to several stock exchanges, but it is better for a beginning securities trader to start with one stock exchange. When selecting a broker, there are a number of important points to be considered:

- Minimum deposit: This is the amount that the trader plans to start trading with. Its size depends on how much money a beginning trader can afford to spend. Brokers offer different minimum deposits – from 1 thousand rubles to hundreds of thousands.

- Commission: the commissions charged by brokers to clients vary, most often in the range of up to 0.1%. There may also be a fixed fee for access to the trading platform, for the use of the depository, and so on.

- Terminals: brokers provide clients with access to trading platforms, you need to pay attention to their functionality and capabilities.

- Withdrawal of funds: special attention should be paid to this criterion of choosing a broker. How conscientiously the broker withdraws funds, you can find out from the reviews. It is also important how quickly and how much money can be withdrawn.

- Leverage: how much and under what conditions a broker can grant such a loan.

- Risk hedging: a very important parameter. Hedging allows you to minimize risks. It is a big plus if the broker can hedge the client against a fall in prices.

In Russia, access to trading on the stock market is provided by brokers Sberbank, VTB 24, “Finam”, “Brokercreditservice”, Alfa Bank, “Aton.”, GC “Alor”, “KIT Finance”, FC Finance, “Tinkoff Investments, Zerich and a number of others (Russian Stock Market).

Money for trading

There is no certain amount of money at which to start trading. The universal rule is to spend money on trading, the loss of which will not lead to a decrease in the quality of life of a trader. At least, this rule should be followed at the beginning of the career. In any case, when trading on the stock exchange you should not pay attention to how much money other players operate with and how much money is circulating on the stock market, you should start with what you have. It is necessary to strive for development, to replenish the deposit, to expand the portfolio, to study shares of other companies.

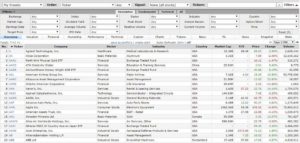

Which companies should I buy?

Which securities to buy is probably the most difficult question regarding trading on the stock market. There are no specific rules here, which is confirmed by the fact that many outstanding traders who made their fortunes trading stocks had no professional education. But it is considered to be reasonable to start trading with securities of the branch the beginning trader understands. If he understands the automobile business, he is more likely to be able to predict the value of automobile stocks than food producers.

Effective trading requires awareness, and for that you need to choose reliable sources of information (Fig. 6). There are a lot of information sources on the Internet, including specialized ones for stock market players. The trader’s task is to choose several reliable sources – market-wide, statistical information, major indices, industry news, corporate news and so on.

Image. 6

Goals and strategies for trading in the stock market

Before going deep into trading on the stock market, one should decide on the aims and tasks of trading – whether it will be additional income or main activity, which companies’ stocks to buy, whether there are funds to start trading and how much, and so on. If there is a decision to deal just with trading stocks, you should decide for how long to invest money, what rate of return will be satisfactory, how much time to devote to market analysis. Individual peculiarities should be taken into account when trading. For example, the period of investment depends on whether the trader will be able to wait a long time for the result or he is better able to make short-term forecasts.

In the first case, the trader can calculate the prospects of certain securities and buy them at the start very cheaply, and then wait for them to rise in price. In the second case, the trader can make a lot of short-term transactions, which in total will bring profit, even if some of them were unprofitable. A trader should also take into account what risk level is acceptable for him. If a trader prefers minimal risk, then the best choice for him/her is long-term low-risk investments, conservative strategies with the purchase of shares with the maximum dividends. If the average risk is acceptable, then possible strategies of investment in various securities: low and high risk, purchase of undervalued securities.

If a trader is willing to take risks, he can invest, for example, in start-ups, highly volatile assets, trade during periods of sharp asset price fluctuations. As the understanding of the market grows, traders also invest in long-term assets, trade on fast fluctuations, and on undervalued assets, in general, use all opportunities for profitable trading. Technically, trading in the stock market looks about the same as, for example, trading in the forex market, in stages:

- Trader Registration on the broker’s portal (How to Get into the Stock Market Online);

- Account replenishment;

- Downloading the terminal or working in the web terminal;

- Choice of securities;

- Selecting the number of shares;

- Purchase.

In the longer term, the trader:

- studies the market;

- buys new stock;

- expands the stock portfolio;

- withdraws or reinvests dividends;

- takes the profits;

- builds up capital;

- invests in securities again.

Main trading platforms

There are many exchanges where you can trade stocks now, but the most dynamic and profitable trading is concentrated on the NYSE, NASDAQ, London Stock Exchange and the Tokyo Stock Exchange. It is also advisable to trade on the national exchange of the country in which the trader lives. In Russia this is the Russian Stock Exchange.

The NYSE (https://www.nyse.com/) is the largest exchange in the world, one might say the main one, with a capitalization of $30 trillion. It is a benchmark for other exchanges, it forms the Dow Jones Industrial Average (Fig. 7) and NYSE Composite indices, on which all other indices are oriented. More than 4 000 issuers are presented at the Exchange, which gives vast opportunities for traders. The largest corporations are represented right here – Caterpillar, Boeing, Coca-Cola, American Express, Microsoft, Apple, etc. – not just American, but companies from over 50 countries. There are also Russian issuers – MTS, Mechel, Wimm-Bill-Dann. The conditions for listing on the NYSE are capitalization of more than $19 million and confirmed earnings of $3 million or more within the last two years.

The exchange trades weekdays from 9:30 a.m. to 4 p.m. New York time in an online auction format. Users can download the LEVEL-2, Arcabook or Nyse Openbook apps to track their trades. Funds entrusted by clients to brokers are insured up to $500,000. One-year licenses are sold for trading on the exchange, which costs more than $3 million. Direct traders may be brokers, liquidity providers and market makers. Brokers from Russia can trade on NYSE, if such service is offered at the broker, it is necessary to familiarize with conditions of work on his platform. To enter trading directly on the exchange, you need confirmation of your status as a qualified investor.

NASDAQ is the second most important, but first in terms of the number of listed companies in the world. The peculiarity of the site is that securities of the world’s leading technology companies are represented here. Such corporate monsters as Microsoft, Alphabet, Amazon, Facebook, Intel, Cisco and others are represented here. The main index here is NASDAQ-100 (Fig. 7), which is characterized by volatility and allows traders to earn significant profits.

The exchange works on weekdays from 09:30 to 16:00 local time, but there is also a post-trading session, which lasts for 4 hours after the regular session closes. Trading on NASDAQ is conducted only electronically. Shares of American companies and companies from other countries are traded on the exchange, as well as ETFs, bonds and derivatives on commodities, currency pairs and cryptocurrency. When choosing a broker who can bring trading to NASDAQ, you should carefully read the terms they offer.

Image. 8

The London Stock Exchange (https://www.londonstockexchange.com/) is the world’s third-largest exchange by capitalization and the first by bond turnover, options, futures contracts, depositary receipts. The main trading volumes are provided by foreign companies from 60 countries. Among the key players – General Electric, Vodafone, CNN, BASF, Unilever. The platform is divided into two parts – Premium Listed Main Market for large issuers and Alternative Investment Market for small companies. Trading takes place from 8.00 a.m. to 4.30 p.m. GMT.

The Tokyo Stock Exchange (https://www.jpx.co.jp/) is one of the world’s key financial centers with a capitalization of about $4 trillion. More than 500 corporations with a capitalization of about $500 billion are listed. The technology division includes more than 700 companies worth more than $60 billion. The main index, extremely important to Asian and global markets, is the NIKKEI 225, which is based on the average share price of 225 firms. The second significant index is the TOPIX 100, which is based on the average share value of the firm’s leading group of companies.

To trade on the stock exchange, you need to deposit 400 thousand yen, on JASDAQ – 100 thousand yen. The offered trading systems are Arrowhead online and offline ToSTNeT System. There is also J-Gate derivatives system. Indices trade, local time, from 09:00 to 15:10, and from 16:30 to 02:55, securities trade from 09:00 to 11:35 and from 12:30 to 15:15, futures and options trade from 08:45 to 11:02 and from 12:30 to 15:02. Trading in the stock markets can provide great returns, but you must always remember that it is always a risky business which can lead to substantial losses.

Reviews