Trading on the Stock Market

At stock market trading securities, in particular shares (The stock market as a source of profit). A share is a security whose owner is entitled to a share and to income (dividends from the company’s operations) from the issuer of the share. For preference shares, the income is fixed, while for non-preference shares, the income depends on the success of the company.

Contents

The stock market (Fig. 1) can be called the backbone of the modern financial system and economy, because it performs several key tasks:

- Consolidation of capital at the global and national level. The factor that ensures the stability of the economy;

- Redistribution of financial flows so that money follows the most profitable industries;

- Constant development. Companies issue securities for the purpose of business development, and this is a factor in attracting more and more new participants to trading;

- Compensation of the money supply. During a crisis, the Central Bank issues securities that cover the resulting deficit in the money supply.

- Systematization of information. Since the stock market is regulated, and working issuing companies are represented on it, then exchanges are a source of comprehensive information about companies, their status and prospects, and the development of the national and global economy.

Image. 1

Speaking of regulation: the stock market is regulated by the state, investors are protected by the state, which makes stock trading attractive to novice traders (Training in Stock Market Trading). Transactions on the stock market are completely legal and transparent, transactions are legal, and revenues are protected by law. Transparency and regulation of stock exchanges ensure, in general, a fairly fair rate of traded assets, so the rate of shares from different sellers is the same. Stock markets differ in:

- Types of traded assets (securities, equities, debt);

- By asset: primary (new securities) and secondary (derivatives, i.e. derivative securities)

- By term of assets (short-term, medium-term, long-term, perpetual securities);

- By structure: exchange-traded (trading assets listed on the exchange) and over-the-counter (securities not listed on the exchange);

- By type of issuer: securities can be corporate, government and so on.

Trading on the Stock Market

The main way to make money on the stock exchange is to invest, that is, to buy a stock or other traded asset in order to make a profit as its price rises. Investments are made for a medium to long term. At low risk, the average return is 50% per month. Competent investment is a complicated business, and not everyone has the time or desire to do it. But people who have free money – a little or more – know that it is possible to make money on stocks.

Therefore, for investment purposes, funds are directed to a trust or individual management stockbroker. He disposes of them and reports to the investor on the results of his actions. Most people can’t allocate significant sums to investing. But they can be included in a collective investment, such as a mutual fund, by buying some part of the asset. When the price of an asset goes up, the contribution of investors, each and every one of them individually, goes up as well.

Unlike the investor, traders are trying to profit from asset price fluctuations, they have no interest in dividends. It is now possible to trade stocks on your own, on brokers’ online platforms. Profits from trading can be bigger and faster than from investing, but also the risks are much higher. Another way of making money in the stock market is portfolio investing. In this case stocks, among which there are shares with very low risk, issued by large companies or the government, are selected for your “portfolio”. Such investments are managed by an investor himself, who forms his portfolio and is responsible for the investment results. Transactions in portfolio investing are made 12 to 15 times a year, but the profitability is higher than in trading, and the risk is lower.

How to choose a stock broker

On the stock exchange, trading is done through a broker. Choosing a reliable broker is one of the key tasks of an investor. When choosing, one should pay attention to the following features:

- What is the minimum deposit offered by the broker: Not many people can afford to trade with large sums at once, in addition, one should make sure that the broker knows his business, so it is better to start investing with small amounts;

- The amount of brokerage commission: the smaller, the better;

- Of particular importance is the issue of withdrawal: how much withdrawal is available, how often, how quickly and how conscientiously (the latter can be clarified by reviews of the broker online);

- The amount of leverage: how much and under what conditions the loan is granted. It is important to understand that you can use the credit only with gaining the necessary experience and understanding of the market;

- Does the broker provide risk hedging – the ability to hedge a client against falling prices is a big advantage of the broker.

Where and why buy stocks?

There are no rules that define the parameters of the stocks that one should buy. It all depends on the goals and professionalism of the investor or trader. Presumably, one should start trading with stocks of companies in the industry in which the novice investor is well versed. But first of all it is necessary to define the aims of investment or trading – whether it will be the main activity or additional income. This will have to be taken into account when calculating the amount to be invested, when choosing shares, brokerage, etc.

When trading in the stock market it is very important to get information from reliable and at the same time operative sources. Market statistics of global or national markets, important industries, companies issuing shares, etc. are important. Every investor and trader creates his own “information portfolio”. The order of trading on the stock exchange from the very beginning looks something like this:

- Theoretical training;

- Registration of an account on the broker’s service;

- Downloading and exploring a terminal or exploring a web terminal;

- Work in demo mode until stable positive results;

- Account replenishment;

- The choice of certain securities;

- Purchase.

Subsequently, an active investor or trader must constantly study the market, buy new shares, optimize the stock portfolio, withdraw profit (dividends), invest again and so on. The largest stock exchanges for trading stocks are the NYSE, NASDAQ, London Stock Exchange, Tokyo Stock Exchange, and for Russian investors, the Russian Stock Exchange is important.

The NYSE (https://www.nyse.com/index) is the world’s key exchange, which largely determines the structure and trends of the industry. The Dow Jones Index is formed here, which is extremely important for the stock market. The world’s largest corporations are traded on the exchange, and more than 4,000 issuers offer their shares in total. Traders download the LEVEL-2, Arcabook or Nyse Openbook applications for trading, and trading is done online.

NASDAQ – the world’s largest exchange in terms of the number of issuers, plus it is considered the key exchange for trading shares of the largest technology companies. The NASDAQ main index is notable for its volatility, which attracts traders. Trading is done electronically; apart from stocks, derivatives, ETFs and even cryptocurrency indices can be traded there.

London Stock Exchange (https://www.londonstockexchange.com/home/homepage.htm) is the world’s leading exchange of securities, options, futures contracts, where issuers from all over the world are represented. Among the key players are General Electric, Vodafone, CNN, BASF, Unilever. In addition, there is a separate trading floor for shares of small companies that are not listed on the main platform.

Exchanges have restrictions on the time of operation, quite serious requirements to brokers and to the amount of investment. Therefore, you should ask the broker for all possible information about the exchange. And at the same time ask to see the license for trading, because the opportunity to work on the exchange, especially from the top list, not all brokers can afford.

Futures and options trading

A futures is a contract between a buyer and a seller to sell an asset, but at prices that are predicted for the future. That is, it is a derivative (derivative) of the underlying asset. In fact, it is a bet between participants, because it is impossible to forecast the price. It is quite an attractive type of trading, because the entry price is acceptable, the market liquidity is high, broker’s fees are low.

The price is speculative because the vast majority of transactions do not involve the delivery of commodities. The most popular futures are: stock indexes, oil, gas and gold. This is the most complex type of trading. The mechanics of trader’s profit is as follows: he buys futures of a certain asset for a certain period of time assuming that the price will grow. If his forecast is correct, he will be credited a premium. Also, the price of the futures can change during the term until expiration.

There are few strategies for trading futures, however, it is one of the complex types of trading, which involves learning the specifications of the contracts, choosing the direction of trading, understanding how the market works. It is quite a risky derivative. The evaluation often forecasts the wrong price, you need to keep a close eye on the price dynamics, because it changes in a fairly wide corridor.

An option is similar to a futures contract, but the terms of the contract require the trader to buy a futures contract, while options transactions are only the right to buy or sell an asset at a fixed price (binary options trading strategies). Options come in two versions: Call (to buy) and Put (to sell). The buyer pays the seller a premium when the option is purchased. The strike price of an option is the selling or buying price of the option. A profit is formed when the price of the asset is above the strike price for call options and below for put options.

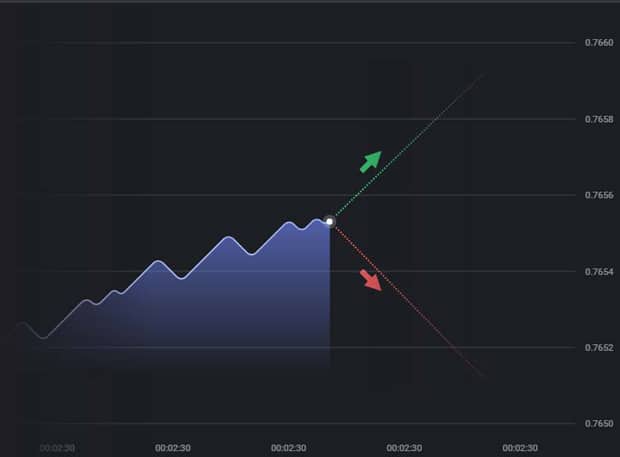

Image. 2

Operations with options are more simple than forex or stock, because in fact the trader needs to “guess” only the price direction (Fig. 2), that is, the main thing in trading is volatility. Brokers (not all of them honest ones) conduct massive promotion campaigns binary options trading, appealing to the simplicity of this type of trading (Binary Options with Minimum Deposit). However, this “simplicity” is profitable only for experienced traders (option trading training). Objectively, for novice traders this is a difficult type of trading with high risks and lack of any protection (binary options without risk). And even among brokers the attitude to options is ambiguous. As for the question of where to trade binary options, you can focus on Binary options brokers ratingwhich is available on our website.

Reviews