Is Cryptocurrency a Scam?

Cryptocurrency trading, as a source of income, is currently experiencing a boom in popularity. Since its appearance on the Internet, this digital currency has caused a real chain reaction: who among us has not heard about its potential? Almost the entire global community and most governments are concerned about the uncontrolled growth of cryptocurrency’s popularity. You probably already know what cryptocurrency is and how to make money from it.

Contents

- 1 How Does Cryptocurrency Work?

- 2 The Benefits of Making Money from Cryptocurrency

- 3 Disadvantages of Cryptocurrency

- 4 Myths About Cryptocurrency

- 5 And Yet, Is Cryptocurrency a Scam? Absolutely Not

- 6 When Is Cryptocurrency a Scam, Fraud, and Deception?

- 7 How to Earn Money on Cryptocurrency: What to Keep in Mind?

- 8 Is There a Future for Cryptocurrency?

- 9 Are Cryptocurrency Brokers a Scam?

- 10 Can I Choose a Reliable Cryptocurrency Broker?

- 11 The Whole Truth About Cryptocurrency: What Is It Really Like?

But still, what is the whole truth about cryptocurrency? Is it just another pyramid scheme? Having studied a lot of material online, we are ready to answer these questions in today’s article.

How Does Cryptocurrency Work?

In order to answer the main question of the article “Is cryptocurrency a trick or a scam?” – it is necessary to understand the peculiarities of the principles of this market.

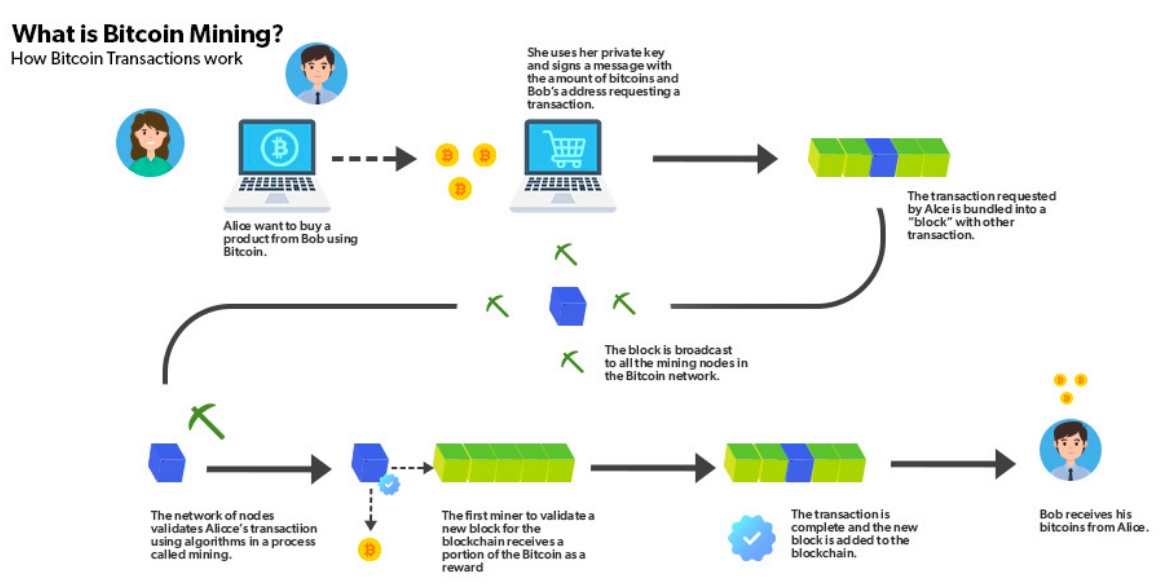

The operation of a digital currency system is based on blockchain technology. This is a method of storing information that is not kept in one place but is distributed among all participants in the system (on computers around the world). It is automatically updated and available at any time to any user. Essentially, it is a continuous sequential chain of blocks of information that are usually stored and processed independently on multiple computers (Wikipedia).

Such a complex network is distributed among all the participants, and all the computers mining coins become members of the system. There is no central authority controlling it. Digital currencies are redistributed through the network, between market participants. This bypasses banks, eliminates government influence, and avoids transfer fees and other costs and complexities. Users have complete freedom of action with cryptocurrency – they have no obligations to the network, and their funds cannot be frozen, so they can do whatever and whenever they want.

The currency’s anonymity allows a large number of Bitcoin addresses to be created without being linked to personal information. If a user deliberately omits their identity, no one can trace a particular Bitcoin address belongs to them, and for anonymity, one Bitcoin address is usually used for a single transaction. Due to the transparency of transactions, the system keeps a history of all transactions, and these transactions cannot be undone or refunded, only the recipient can do that.

Coin issuance depends on the work of millions of computers using a program to calculate mathematical algorithms, it is only digital and anyone can mine the currency. Having appeared recently, cryptocurrency is now a real free coin, that is devoid of the complexities and limitations inherent in standard money. It has become, the antagonist of a centralized system, where everything is dictated by the state and the economy, rather than the interests of citizens.

The Benefits of Making Money from Cryptocurrency

- Lack of control. No one controls the rate of digital currency at all, it is not affected by the economy of the state, or the welfare of the world.

- Anonymity.

- High security of cryptocurrency (cryptocurrency: what is it in simple words, read here). It cannot be tampered with or hacked.

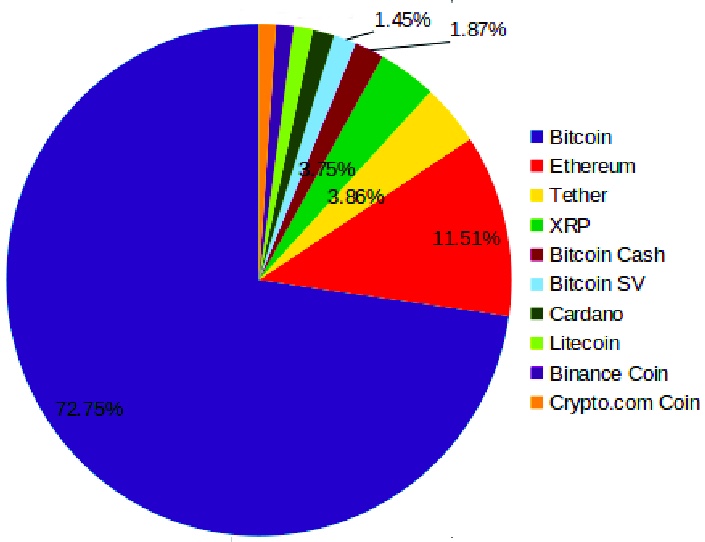

- Large selection of cryptocurrencies for work.

- High volatility and unlimited income. Cryptocurrency is dynamic “pre-legendary”, its rate is growing all the time, and excites people’s minds.

- Easy money. By tracking market trends, it is easy to increase your capital on the rise or fall in value.

Disadvantages of Cryptocurrency

- Lack of a one hundred percent guarantee of safety of users’ wallets.

- Risks of hacking crypto exchanges and loss of funds.

- Lack of centralized regulatory bodies.

- The unclear future status of cryptocurrency, and the possibility of introducing a ban on the use of digital money.

- High volatility.

- No ability to cancel a transaction if it is incorrect or you change your mind about sending coins.

- Risks of losing capital if you lose access to your wallet.

Myths About Cryptocurrency

The growing popularity of cryptocurrency has led not only to a large involvement of Internet users in this market but also to the fact that today there are a large number of myths about digital coins, which mislead users. Let’s talk about these myths.

Myth 1: Cryptocurrency Is a Pyramid Scheme

This is one of the common myths among those who do not understand digital currencies. However, can a cryptocurrency be a pyramid scheme? It’s worth starting with how a pyramid is structured. It involves investing money for profit. Benefit for honorable “old” depositors occurs at the expense of attraction of new participants of the system. If, after attracting new participants to the system, the pyramid experiences difficulties, it closes, all the money is frozen and cannot be used until some time. The principle of cryptocurrency is completely different from that of a pyramid. No one freezes the money, it is available to the trader on a cryptocurrency exchange at any time. There are no bonuses for transferring funds, as well as for inviting new traders “into the system”. In conclusion, cryptocurrency cannot be a pyramid scheme.

Myth 2: Cryptocurrency Is Only for Shadow Markets

Of course, some cryptocurrencies became popular after participating in illegal trade and shady schemes. However, today cryptocurrency, Bitcoin in particular, is becoming an active part of our offline life. Digital coins can be used to buy a car, an apartment, or a yacht, to pay in restaurants and cafes. Our conclusion: cryptocurrency is not solely a currency for shadow markets.

Myth 3: Cryptocurrency Is a Bubble

This myth is widespread online, but when people use the term “bubble” to cryptocurrency, they often forget what the term actually means. A “bubble” refers to assets that have some value, but thanks to the news background, have a rising price. Does this apply to cryptocurrency? Cryptocurrency prices are affected by demand – the higher the demand, the higher the value. Conclusion: cryptocurrency is not a bubble.

Myth 4: Cryptocurrency is Unsupported by Any Assets

As we know, the gold standard was abolished in 1971, meaning that today, no global currency is backed or secured by anything (except probably by GDP). In general, cryptocurrency (what is a cryptocurrency in simple words? – Read here) is no different from traditional fiat money. Conclusion: cryptocurrency is not backed, just like conventional currencies.

And Yet, Is Cryptocurrency a Scam? Absolutely Not

There are enough materials online claiming that digital currency is a scam. Is it so? In this section, we’ll explore the truth.

First, mining virtual currency involves serious costs: the purchase and renewal of professional equipment, electricity expenses, and maintenance of servers. Usually, fraudsters do not understand technology and spend time on the development of innovative services, or on the maintenance of a team of specialists. Their goal is to collect money and disappear quickly.

Secondly, cryptocurrency is widely discussed in popular media, online platforms, and newspapers. In Japan, Bitcoin is recognized as the official currency of the country. Developed countries have to think about cryptocurrency and adapt the law for it. The president of Kazakhstan has proposed to create a global digital currency, which would rid the world of currency speculation.

As we can see, society accepts cryptocurrency, and at least begins to recognize the prospects of digital money. If this were a scam, it would have been exposed by now, and would not have achieved much attention from the world community.

Thirdly, there are enough successful stories of traders on the web who have achieved high earnings in cryptocurrency trading. There are negative reviews of traders, but it is difficult to imagine the functioning of any financial market (binary options trading, forex trading, for example) without it. We would have seen a huge negativity and traders’ complaints about brokers and crypto exchanges.

Fourth, cryptocurrency is actively moving from the digital world to the real world. Digital money has successfully “debuted offline,” as one site rightly puts it, and today we are witnessing this active “debut”. Now cryptocurrency can be used to pay in the U.S., Japan, and Europe (for a complete list of countries where you can pay with Bitcoins, visit the special service coinmap.org). Digital currency is accepted as payment on websites, stores, restaurants, and cafes, and even as a donation at the Church of St. John the Evangelist in the American city of Goshen.

When Is Cryptocurrency a Scam, Fraud, and Deception?

Cryptocurrency has a crazy dynamic, which scammers are ready to take advantage of. They offer non-existent currencies, do not allow withdrawals, and cheat. Let us tell you about the examples of fraud that are widespread in the cryptocurrency market.

Fake Sites

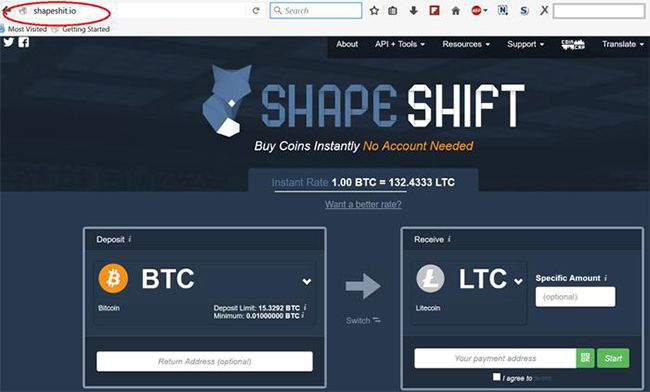

Today, users “get caught” by scammers, investing money seemingly in a popular resource they are familiar with (they see the same design, texts, navigation, etc.), but then it turns out that the money is gone and the trader is left with nothing. This happened, for example, when an investor lost Bitcoins working on a fake website disguised as a popular platform ShapeShift.io (official website):

Such fake sites impersonate reputable platforms like BitStamp, Blockchain.info, etc. By creating an exact copy of a popular resource, scammers can not only take money from inattentive users but also their passwords. That’s why it’s worth checking whether the name of the resource you’re working with is spelled correctly in the browser address bar.

Scam

Messages from individuals offering to sell you Bitcoins or accept payment in cryptocurrency are common online. There is a high likelihood that these are scammers who will disappear as soon as you transfer your money. Such scammers are skilled manipulators; they know how to gain your trust and may even impersonate well-known figures in the Bitcoin community, providing fake documents to deceive you.

Often, scam ads that use links to phishing (Wikipedia) or fake sites, promise unrealistic bonuses and a 400% return on investment. They may include ads of supposedly recommended sellers, who are willing to sell you currency that does not exist (here they use positive customer reviews, specifying prices below the market); and ads for the sale of non-existent equipment for mining. To avoid falling victim to fraud, study the actual list of scams, the seller’s identity, suspicious sites, and e-mail addresses. Too lucrative offer, too many good promises, for example, triple the benefits – that should alert you.

Pyramids

Scammers associated with pyramid schemes are excellent psychologists who are ready to promise you maximum profit. Often pyramids hide under a beautiful website that promises high profits (for example, 200-400% per annum), also if you keep “bumping” into people who are trying to lure you to such resources, be sure – it is a pyramid. There are a lot of variants of online pyramids, but most often they offer income for keeping cryptocurrency (sometimes your money is freezing for some time), and for using services for mining. To avoid problems with pyramids, be cautious about very tempting offers.

Phishing Sites and Links

To take money from traders, scammers create malicious sites. Often a superficially familiar site turns out to be a fraudulent one, and by proceeding to it the user loses his/her data (money, passwords, etc.). To avoid losing your data and phishing attacks, look carefully at the name of the resource in the address bar of the browser, see if the connection is protected by an SSL certificate, and follow the links only to trusted users.

Deceptive Schemes in Applications and Plugins

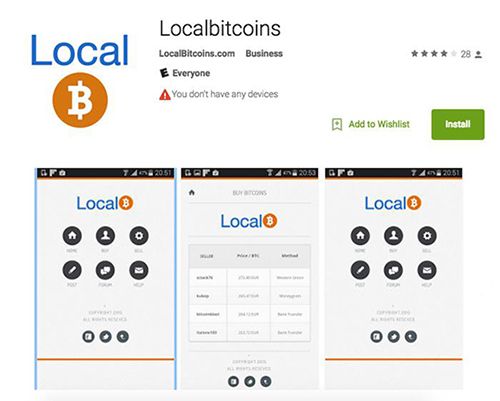

Yes, nowadays, fraud is also found in apps and plugins. For example, such a story happened with the Localbitcoin app, which was available in the Android app store:

BitcoinWisdom Ads Remover, an add-on for Chrome browser, also turned out to be fraudulent, sending funds to the scammer’s wallet. How to avoid such problems? You should not blindly rely on the high ratings and a large number of positive reviews of any application. Before installing the program, contact the developer and find out whether they are the author of the application, look for information on the Internet, perhaps someone has already worked with them.

How to Earn Money on Cryptocurrency: What to Keep in Mind?

Cryptocurrency is not just about “buy low and sell high.” It’s much more complex, and you should keep this in mind.

Key Factors Influencing the Cryptocurrency Market in 2024:

- Volatility and Risks. The cryptocurrency market remains highly volatile. After a rapid price rise, there can be a sudden drop, often leading to panic among investors. In the first half of 2024, the market capitalization reached $2.2 trillion, which is 23% lower than its all-time high. However, this still indicates significant interest in crypto assets.

- Market Speculation. Large speculators operate in the market and can artificially influence the value of digital coins. This creates additional risks for investors, especially in uncertain conditions.

- Political Factors. Politics continues to impact the cryptocurrency market. For example, in 2024, interest in Bitcoin increased due to political events in the U.S. and the U.K. Bitcoin’s success is also linked to the launch of exchange-traded funds (ETFs), which attracted institutional investors and broadened the market’s participant base.

- Analysis and Forecasting. Successful investing requires a thorough analysis of a cryptocurrency’s popularity, its prospects, and the factors influencing its price dynamics. In 2024, analysts predict further growth for Bitcoin and Ethereum due to updates and the introduction of new financial instruments.

To make money on cryptocurrency, it is essential to consider all these factors. Cryptocurrencies can offer high returns but also come with significant risks. Proper analysis and understanding of current trends will help avoid losses and achieve substantial profits. If you need any further assistance or adjustments, feel free to ask.

Is There a Future for Cryptocurrency?

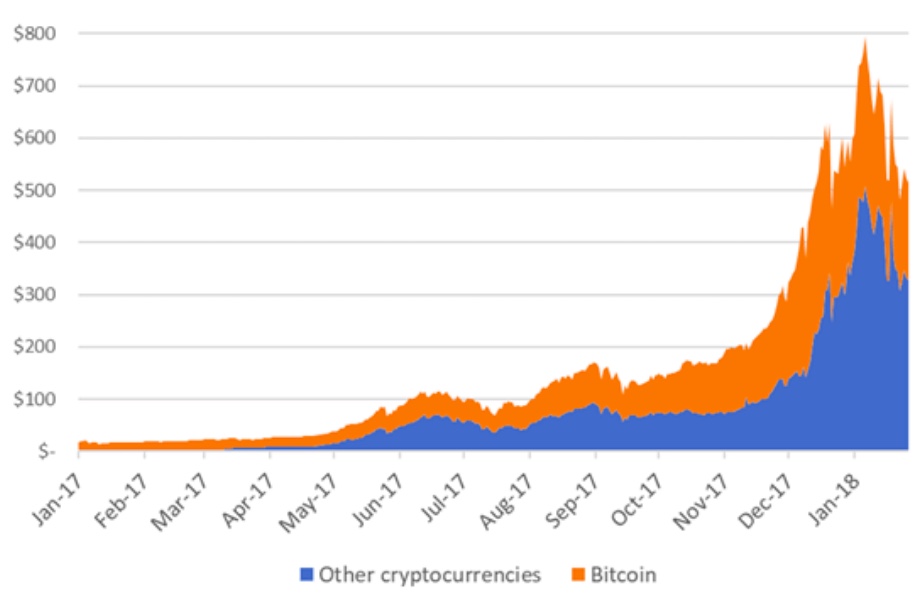

When will this bubble burst? The collapse of cryptocurrency has been predicted multiple times, with some labeling it a financial pyramid scheme. The media has urged the online community to move on and encouraged developers to pursue more promising projects. However, cryptocurrency has withstood all trials and continues to astonish with its volatility and rapid growth. The “fever” persists, accompanied by ongoing debates about the necessity of digital currency and the implications of its official legalization.

Having emerged on the internet, cryptocurrency has actively transitioned from being just digital money to a real-world asset. But what will happen next? Can it be considered the future of all money? The current situation can be described as a “reality somewhere in between.” Some see cryptocurrencies as the future, while others view them as a bubble that is about to burst.

Some believe that both cryptocurrency and blockchain are technologies worth attention and are promising, while others think that cryptocurrency will become a reality when technological development reaches critical levels. In 2024, there is a growing interest in cryptocurrencies from institutional investors and increasing legalization in various countries.

For example, discussions on cryptocurrency regulation continue in the U.S., and some countries are already accepting them as legal tender. The significant influence of DeFi (decentralized finance) technologies is also expected, offering new ways to interact with financial instruments without intermediaries.

The truth may lie somewhere in between the statement that some currencies will disappear while others become entrenched in the global financial system. Bitcoin and Ethereum could emerge as the primary currencies of a new financial order. Ideally, cryptocurrency should function as a supranational currency, unifying users and facilitating transfers and payments for everyone.

As we transition into a digital world, we recognize its advantages. Therefore, cryptocurrency is an essential part of the virtual world for convenient payments. Today, several countries see a future in cryptocurrencies: Australia, New Zealand, Germany, and Singapore are actively developing their crypto ecosystems. At the same time, there are countries like Bolivia and Ecuador that have banned the use of digital currencies.

Nonetheless, we conclude that cryptocurrency has a future. Trends toward legalization worldwide, its active transition from online to offline, and the constant growth in the number of investors confirm this. Like other technologies, cryptocurrency will face challenges and critical sentiments in society.

Despite some people’s distrust and others’ optimism, the value of digital currencies continues to rise. Investors are pouring funds into the development of this sector. Cryptocurrencies are imperfect; blockchain requires improvements. However, saying “no” to digital currency is naive and shortsighted.

Are Cryptocurrency Brokers a Scam?

An important stage in the development of cryptocurrencies was the emergence of cryptocurrency brokers, which allow people to earn money through trading digital currencies. Today, the platforms offering the opportunity to trade cryptocurrencies are forex brokers and binary options brokers. For the most part, these are well-known companies, such as Pocket Option (site), INTRADE.BAR (site), Alpari (site), Quotex (site), RoboForex (site), NPBFX (site), and AMarkets (site). Amid the general popularity of digital currencies, they offer them crypto as assets.

Is it possible to consider these companies a scam? You should know that there is no trading without scammers and there will always be scammers. Remember that fraudulent companies are created to cheat traders, it is important for such “scam brokers” to get your money in any way and disappear. The fast-growing and incredibly dynamic cryptocurrency market also attracts scammers who are willing to do anything to cheat. Your task in this situation is to find a reliable company and work with it, not being afraid to entrust your capital to it.

Can I Choose a Reliable Cryptocurrency Broker?

Yes, you can. The main thing is not to rush to choose and not to “rush into” tempting offers from companies. In this part of the article, we will tell you how to choose a reliable crypto broker:

- Find out about the broker’s license (forex brokers, binary options brokers). All serious brokers provide licenses on their official websites.

- Study the reputation of the cryptocurrency broker, the length of service, and the activity of the position. This information is available on company websites and the Internet.

- Research reviews from traders about trading at cryptocurrency brokers’ websites.

- Try demo trading on a broker’s demo account. A demo account is not a useless online toy, it is an important tool for a trader, which helps to understand how serious is the broker’s intentions, whether the terminal works well, the support service, etc.

- Find out about broker bonuses, including demo account bonuses. Bonuses are also one of the important tools for a trader to determine how honest a broker is with you. To begin with, study the conditions of work with a bonus, the possibility of withdrawal of funds, and conditions of bonus withdrawal. Then, you can start trading by using bonuses and try to withdraw funds.

- Try real trading with a broker by transferring the smallest possible deposit to your account.

It is worth doing such serious work to be sure of the broker’s real intentions. Often it turns out differently. A naive trader chooses the most profitable offer from a broker for work, not thinking at all about the fact that behind beautiful words and high profitability, there can be a scam. It is recommended to choose a cryptocurrency broker consciously, it will save you money and nerves.

The Whole Truth About Cryptocurrency: What Is It Really Like?

The whole truth about cryptocurrency is that it is one of the most popular and fastest-growing markets with great volatility and the potential for high returns. You can count on decent returns from this market, but it is worth remembering how to profit from cryptocurrency. You need to make informed decisions, utilize all the tools available in the trading terminal (such as charts, terminals, indicators, robots for automatic trading, etc.), and track the dynamics of digital currencies.

TOP-5 Cryptocurrency Exchanges

| Exchange | Bonuses | Registration |

|---|---|---|

1 | 2 USDT welcome bonus | Go to |

2 | Until 4000 USD Registration Bonus | Go to |

3 | Until 20 USDT Sign-up bonus | Go to |

4 | Until 100 % Cashback on trading volume | Go to |

5 | 1000 USDT Bonus for futures trading | Go to |

The article is ordered, the first listed forex brokers are not once caught cheating, secondly, there is no license for binary options it is a scam. The cryptocurrency market is not regulated by the regulatory authorities, you will have nowhere to complain in case of an unknown situation. Once you’ve made a lot of money, you won’t be able to withdraw it from the market. You simply will not be allowed to do so. All the reviews about the broker can be faked. Think with your head. And believe the propagandists less.