How to Open a Real Account in the Forex Market?

Contents

Top 5 best forex brokers: test their terminals

| Broker | Bonuses | Open an account |

|---|---|---|

|

1

|

50 %

Bonus on deposit of $100 – the promo code WELCOME50

|

Start |

|

2

|

25-60%

Deposit increase for the first deposit

|

Start |

|

3

|

Cashback

Refunds of commissions, spreads and other costs

|

Start |

|

4

|

100 USD

Loyalty program remuneration

|

Start |

|

5

|

20%

Bonus and cashback with the promo code revieweek23

|

Start |

Before you deposit funds, you should choose an online broker. You can use our rating of forex brokers when choosing a real account platform, and pay attention to the reviews and comments from clients. When you choose a platform to open a real account, pay attention to its characteristics:

- Broker’s license, certificates, terminal history, and documents.

- Deposit and withdrawal methods.

- Types of working trading accounts (not all online brokers have an open service for opening a real or demo account).

- Prompt work of the support service.

- Trading technologies, technical characteristics of the online platform, and mobile application.

It should be convenient for you to view your balance, monitor transactions, and learn. Educational materials, webinars, or consultations on Forex should be placed on the website of the chosen company.

Top Famous Forex Brokers

- Alpari (alpari.com). It has been working since 1998. Suitable for beginners and experienced traders. Online training, analytics, and a wide range of accounts.

- RoboForex (roboforex.com). It is possible to open a cent account on RoboForex.

NPBFX (visit a website) and AMarkets (amarkets.org) have also launched Forex trading accounts, with access to a demo account after registration. NPBFX works with MetaTrader, one of the best-known Forex trading applications. Once you have chosen the platform, register, get verified and, after opening a personal cabinet, choose the type of account from which to trade.

Register and Create an Account

The first step will not take more than ten to fifteen minutes. When opening a personal account you will need to specify personal information: name and surname (real, for the withdrawal of funds from the deposit will need to be verified), date of birth (minors are not allowed to trade), citizenship (for taxation and other issues), e-mail and contact phone number.

Why Do I Need to Open a Forex Account?

An account is also a record of pending orders, open and closed transactions, and deposits. To perform any action on the broker’s platform, you first need to open an account.

Types of Forex Trading Accounts

You can choose any convenient account in order to understand the trading or to try out new strategies. There are many strategies for trading: scalping, trading within one day or, on the contrary, you can keep the deal open for weeks, using trading robots, or surfing. Every broker has different rates, which are chosen according to the peculiarities of trading or the possible experience of the trader.

Let’s start with the standard account. This is an offer with a classic set of conditions: maximum leverage, trades with standard or micro lot sizes. The speed of order execution is not the fastest, unlike Micro. Accounts where you do not have to deposit a large amount of money will be suitable for working with small lot sizes. Transactions can be opened with minimal bets.

Developed three types of accounts with small starting capital and volume of trade: Cents account (minimum unit of deposit currency is $0.01), Micro (order size from 0.01 lot), and Mini (from 0.1 lot). It is possible to try such accounts to test trading ideas or to pass from demo to real.

Demo Account

Brokers offer to try their forces on a demo account. To understand whether the platform and the chosen type of trading suits you, whether the strategy works, and what currency pairs are better to choose. The deposit on such an account is virtual and it is impossible to withdraw the profit. Accounts are divided according to the type of processing of orders (the time at which the orders are processed):

- NDD. The most famous option. The dealer center is not involved, the broker automatically transfers the trades made on their platform to the liquidity provider. Orders on cent accounts, for example, can be processed by the broker himself.

- STP. A variation of NDD. Orders leave the trading terminal to liquidity providers. Execution of orders must take place immediately. Intermediaries earn on small markups on spreads or by charging interest on trade volumes. Brokers do not directly participate in transactions.

- ECN. Fully automated service. Selects the best exchange price for the trader at which to open or close a trade. Collects orders and processes them. Participants can interact with each other on the interbank market.

Swap-Free Accounts

When the trading day on the exchange ends, traders’ open positions are rolled over. Swap is a commission, that is charged by traders at such transfer, some brokers offer accounts without swap, but still, there will be a charged commission for transferring the transaction to the next day. It will be just a fixed amount.

Competitive and No-Deposit Accounts

Promotional rates, for example, some brokers offer when you open a deposit to get bonuses the bonus can then be traded. But it is impossible to withdraw them. It happens that companies offer cashback as a percentage of the deposit for opening an account.

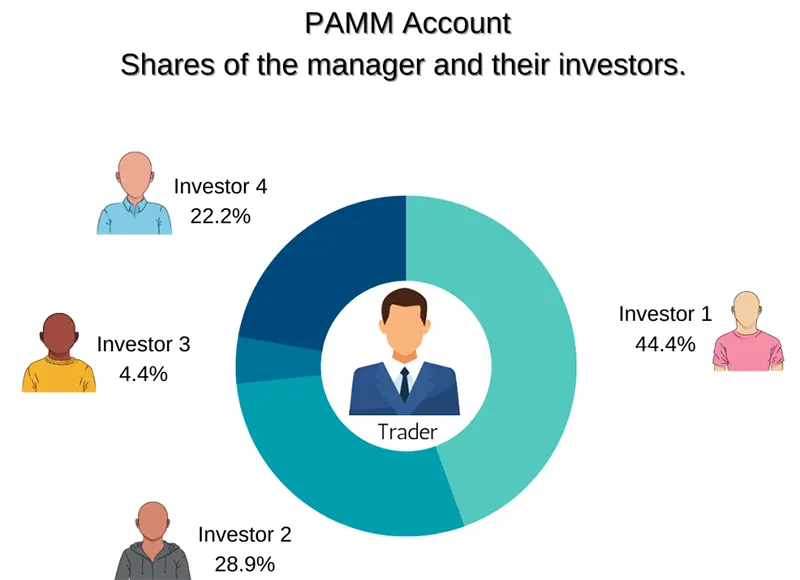

PAMM Account

An interesting service, the trader can invest in the trading of other exchange participants or manage their accounts. The broker controls the redistribution of funds between investors in case of successful execution of a transaction. Some brokers offer fixed accounts, on such accounts there is automatic protection of stop-loss and fixed spread.

Working mechanism: an experienced trader opens a PAMM account and starts trading. After a series of successful trades, they prepare an offer and send it to the broker. The management company selects investors, they can be players who have long been in the market or beginners. Investors receive the income in proportion to their contribution, and the trader gets the percentage of the transaction. Some tips when opening a personal account and choosing trading conditions:

- When choosing a broker, look at the rate schedule. Each company has its commission.

- For beginners: don’t work with a large sum at once, try to start with a demo account, micro or mini. Many begin with cent accounts and then proceed with larger ones. It is possible to make a profit on any of them (withdrawal is possible on every account, except the demo one).

- If you are already a relatively experienced trader and have decided to try robot trading for uninterrupted operation, pay attention to plans with virtual servers (VPS – Virtual Private Server). In this case, trading will continue even after the computer is turned off.

- Traders with extensive experience in successful trading, can pay attention to the PAMM tariffs and try to find investors or invest their own money.

- When opening long-term transactions, it would be better to choose rates where the transfer fees are fixed and there are no swaps.

- Accounts with minimum lots will suit beginners and those who have decided not to take risks when choosing new strategies for forex trading.

A brief glossary that you might need and help navigate when choosing an account:

- Warrant – the installation for the broker to buy or sell the currency. There are different types: market and pending. Through the orders will be conducted all your operations from the account.

- Spread (Bid and Ask) – the difference between the supply price and the demand price.

- Dealing Desk (NDD and STP accounts) – in simple terms, this is the platform where the broker sets the trading conditions.

- Leverage – borrowed funds, which the broker provides to the trader to participate in the trading. Forex rates can be too high for an individual and that is why one of the important indicators when choosing a broker is the size of this type of credit.

- Trade terminal – the trader’s working tool. Through it, access to trading will be carried out, it is possible to work with trading signals to track transactions and execution of orders.

While working with a demo or cent account, the trader can choose whether they want to stay in the Forex market or try their hand at something else, such as binary options. The pros of Forex trading include:

- Stable work on the exchange takes time. And this is also a job, but with a free schedule, although at first, it can occupy all the attention. After gaining experience and moving to the real account, the trader will be able to automate part of the work thanks to the Forex tools. Possibility to get a stable income from trades or investments. It is possible to multiply the starting capital by many times in case of good luck at the exchange.

- Ready-made strategies and the ability to automate trades. A huge number of strategies have already been developed to work on Forex (but it is worth noting that many of them have restrictions on the types of accounts and transactions with which they work). In addition, on the platform of the broker or the Internet, you can freely download or buy trading bots, but you have to be careful with them, the robots work on the set variables and transaction limits. Therefore, with unpredictable changes in the price of currency pairs, you can lose your investment.

- Improving your skills and broadening your horizons. A trader is constantly learning. New strategies, trading mechanisms, copying transactions of other players first, and then applying the acquired knowledge, compiling an economic calendar of events in the world that can affect the price of the currency. Forex is constantly in motion and provides an opportunity to learn and develop.

However, there are also disadvantages. One of the main drawbacks, which becomes visible in the transition to a real account, is stress and emotional burnout. High risks of losing deposits can lead to nervous exhaustion, therefore, one must start playing gradually from a demo and cent account to a real one.

Another one is the starting capital. Even with a good broker’s leverage, to start playing with standard Forex lots, you need a lot of money. The huge amount of available reference materials can be a minus, for the theory is spent time and it is better to try yourself on a demo account, learning the basics. And then already, implementing knowledge of the strategies.

Interesting Facts

Forex operates on a five-day schedule, but due to the difference in the working hours of the local foreign exchange markets, it is possible to trade almost around the clock. However, trade is usually at its worst on Mondays, on which day experienced traders advise to be attentive to trading signals, as there can be a lot of false signals. The exchange has no geographical reference and, for example, on New Year’s holidays, when many countries have weekends, trade is conducted by banks of Muslim countries, and on Easter weekend in Europe – by the Tokyo Stock Exchange.

According to the time zones, you can track the activity in the price of currency pairs, and the most volatile (volatile) period is considered the beginning of the American session. This is the time when the movement in the prices of assets begins. By opening a real Forex account traders will be able to trade currencies or options and speculate on the volatility of the price movements of currency pairs at a certain time interval. You can also try this kind of earning as a way to start, but it’s also a process of training and learning.