Makers, Takers and Rates on Cryptocurrency Exchanges

Most cryptocurrencies work on a maker/taker system. Each user who places an order becomes a maker or a taker and pays a certain commission for the transaction. The amount of commission varies depending on what role the exchange client plays. They are also different on different crypto exchanges, depending on different loyalty programs, client status, additional discount system and so on. Let’s look at the commission systems of some of the largest crypto exchanges.

Contents

Orders

The difference between makers and takers has to do with the types of orders – limit and market orders. Orders can be seen in the order book (orders), which is available at any cryptocurrency exchange. The order book (Fig.1) contains all orders of a particular trading pair – both buy and sell orders.

Image. 1

Limit orders are orders placed by makers to buy coins below the current market price or sell them above the current market price, at a user-defined value and within a set time frame. The transaction is not concluded immediately, but only when the desired price is reached. Takers set the maximum price of their buy orders and the minimum price of their sell orders themselves and wait for the buyer to buy or the seller to sell the coin at the price of the taker. Market orders place takers, and these are buy or sell orders at the existing market price. The trade is executed immediately, as the price is considered the best at that particular moment and users accept offers immediately. Market orders are placed to avoid the risk of failure to execute a trade, which is always present when placing limit orders (How to make money on cryptocurrency).

Thus, takers and makers are not buyers and sellers, as inexperienced traders mistakenly believe. If a user places an order to buy below the current price, he is a maker; if he places an order to sell at a higher price, he is still a maker. If the user buys or sells at the current market price, he/she is a taker. It should be noted that makers are not the same as market makers, you should not confuse these concepts, although there are similarities in their functions. Market makers are participants of exchange trade with such a big capital that they can manipulate quotations of interesting assets. It is also a mistake to think that takers are a group of speculators aimed against market makers. Takers are all traders who consider offers of market makers in the Order Book and either accept or reject offers of market makers. It can be noticed that takers and makers, in general, do the same job. The only significant difference is practically in one thing – the order execution prices. But this difference is crucial for the functioning of crypto exchanges.

Roles and Commissions

Depending on the type of transaction, the crypto exchange charges a commission. A user who sets limit orders is charged with a market maker commission. A user who sets market orders is charged a taker commission. In most cases maker commissions are less than taker commissions, they may even be zero. This is determined by the fact that makers and takers contribute differently to a crypto exchange. Base commissions on crypto exchanges can be the same, the differences start when a certain amount of balance and a certain turnover of trade are reached.

Makers are users who make delayed orders to the order book and thus increase the size of the order book, i.e., building up and increasing liquidity on exchanges. Makers practically create the market and maintain its continuous functioning. For example, a user has decided to buy 1 BTC on a crypto exchange, but not at the current price of $41,400, but at a lower price, e.g., $41,000, because he believes that the price will go down. He sets a limit order for the appropriate price and term. The size of the order in the book, the user creates liquidity, attracts buyers and thus contributes to the active work of the exchange. Naturally, the exchange welcomes the activity of makers and encourages them with low or zero commissions on transactions on cryptocurrencies.

Moreover, sometimes exchanges can even pay “anti-commissions,” effectively paying makers extra for trades. This is a small profit (relative to the value of the coin), but some traders know how to make money on this as well, and regularly. Negative commissions in the tables are listed with minuses. Takers do not create liquidity on the exchange, because they make trades at once, at the offered prices, and do not add anything to the order book. That is why they pay higher commissions than takers do. For example, the user decides to buy BTC immediately, and at the price of $44.4 thousand. This price is already in the order book, it is the most popular current selling price, so the order will be executed immediately. The takers are practically taking the coins out of circulation, reducing the interest in the coin, so the exchange has to compensate for the losses with high commissions. At the same time, the commission charged by takers is compensated by the fact that they manage to buy assets at the best prices at the moment, provided by a narrow spread.

For example, the price of ether is now $2654, if the user is a taker and plans to buy, he places an order at this price in the Order Book, and almost immediately the deal is completed, the coin is bought. But if the user places an order at a different price, for example, $2,650 and the order is not executed immediately, then the user increases liquidity and becomes a maker. Cryptocurrency exchanges are interested in having as many users as possible. The more users, the more income of the exchange. The maker/staker model optimally stimulates exchange activity. Makers pay a lower commission, it encourages users to place limit orders. At the same time, takers provide more and faster turnover, taking away liquidity.

For cryptocurrency exchanges, the maker/staker model is the most appropriate because it minimizes the difference between sell and buy orders and provides narrow spreads, which are optimal due to the fact that the most popular coins are expensive. The taker/maker model is one of the important factors determining the specifics of the cryptocurrency market – significant value fluctuations and clear trends. Commissions must necessarily be taken into account by bidders, especially when trading top, very expensive currencies on a regular basis. Even a seemingly small commission on a single transaction can turn into a very significant loss when trading regularly. Because of the high prices of the top cryptocurrencies, commissions are calculated down to the thousandths of a percent. Commissions are settled after the transaction is made.

Exchanges and commissions

Different crypto exchanges may have different indicators.

Binance

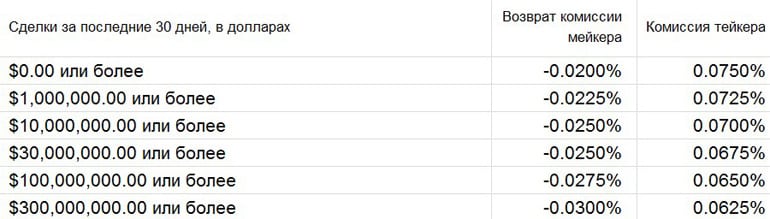

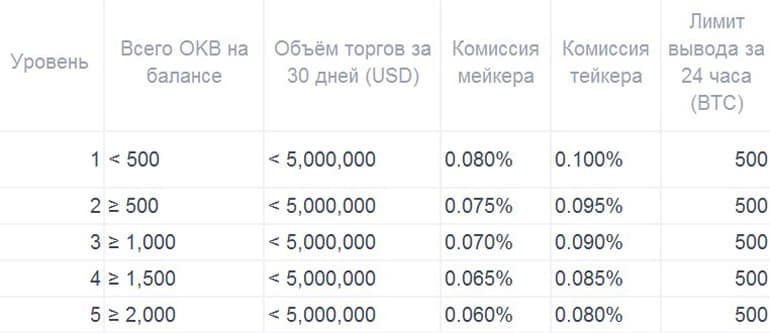

At the stock exchange Binance (https://www.binance.com) traders trade on the spot market (Spot Trading on a Cryptocurrency Exchange), the market of perpetual futures USDT-M and the market of quarterly futures COIN-M. Commissions for each direction is different, calculated on the system maker / taker and its size is affected by factors such as the use of token BNB, referral link and user level in the VIP-program. The basic commission on the Binance spot market is 0.1% for makers and for takers. For users BNB discount is 25% commission. If the user has a referral link, the discount can reach 40%. Basic discounts on Binance are valid at the zero level of the VIP program. According to the user’s level of participation in the VIP program, commissions on Binance are as follows:

Clients who operate with amounts over 50 bitcoins are offered individual commission programs on the cryptocurrency exchange. Binance base commissions for perpetual futures USDT-M are 0.02% to makers and 0.04% to takers. If traders use BNB tokens, the maker pays 0.018% and the toker 0.036%. VIP clients have such discounts:

Binance offers customized commission programs for clients who operate with amounts greater than 50 bitcoins. Quarterly COIN-M futures on Binance have a base commission of 0.015% for makers and 0.040% for takers, with no discounts. Clients who operate with amounts of more than 50 bitcoins are offered individual commission programs on Binance. The crypto exchange also offers various additional ways to reduce commissions.

OKEx

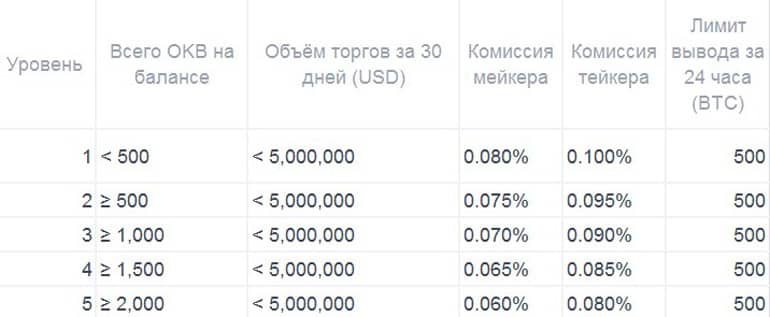

OKEx (https://www.okex.com) is a universal exchange on which you can engage in spot trading and trade derivatives. The basic commission on the OKEx exchange for makers is 0.10%, for talkers 0.15%. There are encouraging discounts under certain conditions, so if the user reaches a 30-day trading volume of more than 1000 BTC with more than 2000 OKB tokens in his account, the commission from the toker is 0.09%, and from the maker 0.06%. Specific commissions on the exchange are divided into classes. Class A includes BTC, ETH, LTC, OKB, OKT, BCH, BSV, ETC, EOS, TRX, XRP. Class B and C are less popular altcoins. Also commissions are different for “regular” users and for VIP-users, and there is a limit of cryptocurrency withdrawal during the day, which can be expanded, but you need to contact support for this. Both regular users and VIPs are divided into levels according to the ECV on the balance. So, commissions for ordinary users in group A on spot trading are:

Commissions for VIP-users are:

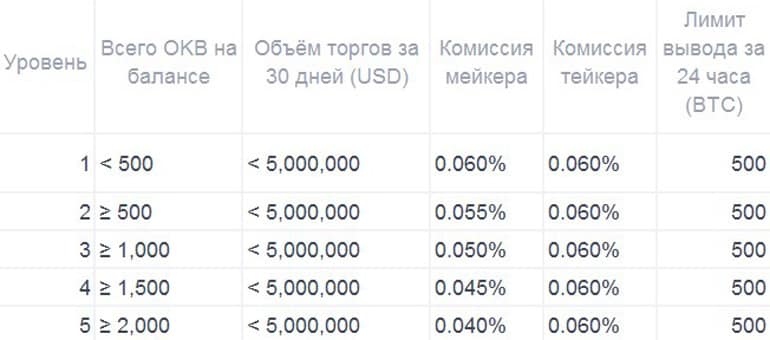

Commissions for spot trading group B (it also includes USDT) for ordinary users is:

For VIP users, the commissions are as follows:

Maker and taker commissions for Category B cryptocurrency trading are for regular users:

Commissions for traders with VIP status in this category of coins are:

For cryptocurrency futures, commissions for takers and makers are distributed roughly along the same lines. Cryptocurrencies are divided into categories A and B, in category B there are less popular coins, there are 4 of them: ADA, DOT, FIL, LINK. In category A futures for the average user the commissions are:

Commissions for VIP-category customers are:

Commissions for perpetual swap traders are divided into three categories by coin, USDT belong to the first category. Commissions for makers and takers in coin category A for regular users are as follows:

In the category of cryptocurrencies B commissions for the average user are:

For VIP:

And in category B for regular users, the commissions for tokers and makers on perpetual swaps are:

And for VIP commissions are:

KuCoin

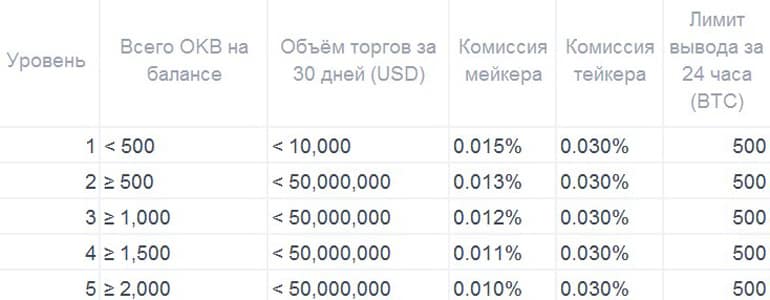

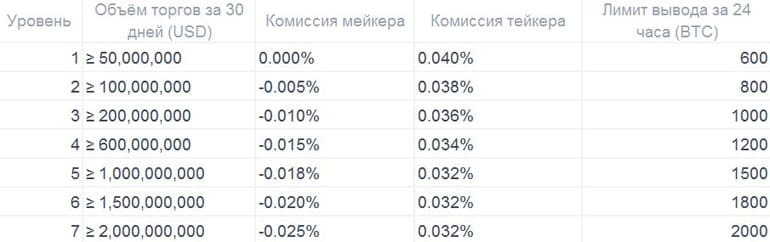

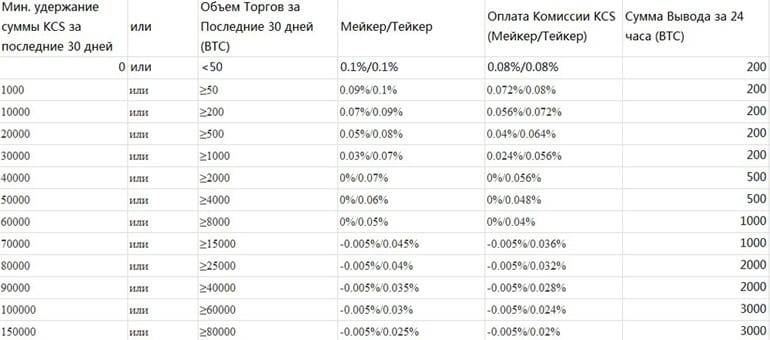

The difference in commission between the maker and taker on the exchange begins after the zero level. At the same time, the exchange draws attention to the fact that for some trading pairs the conditions are different and it is necessary to check them in each case. Also, commissions depend on the volume of tokens on the exchange KuCoin (https://www.kucoin.com) Token (KCS) at the user. Commissions for spot trading:

Commissions for makers and takers in futures trading are:

Huobi

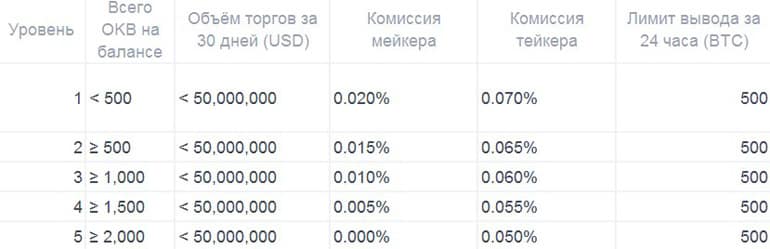

Huobi (https://www.huobi.com) charges a fixed commission of 0.2% from both the maker and the taker when trading most pairs. But the structure of commissions for the most popular pairs is different. Thus, commissions for ordinary users are as follows:

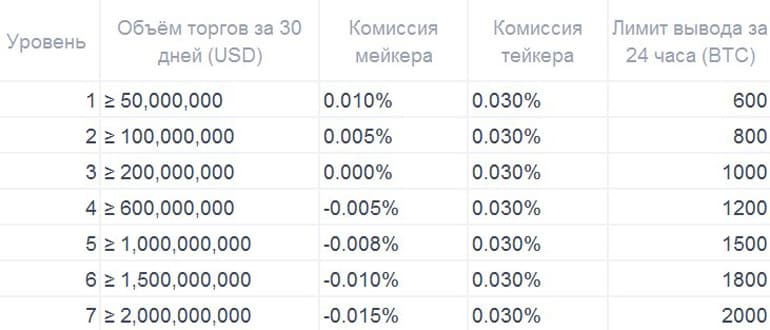

Depending on the level of trading associated with the volume of cryptocurrency turnover in a particular user, the commissions of the maker are as follows:

Huobi cryptocurrency exchange draws attention to the fact that commissions may differ from the standard, and to be aware of changes, you need to monitor the announcements.

EXMO

On the cryptocurrency exchange EXMO (https://exmo.me) Base commission on spot trading depends on the trader’s turnover in dollars and is divided into 12 categories – the lower the turnover, the lower the commission. For example, at the initial level the commission is 0.3%, and at the 12th level it is 0.05%. At the same time, for pairs with USDT at the initial level commission is 0.1%. And also EXMO charges commission for inactivity of the account.

In addition to commissions, makers and takers have the opportunity to discount on the Cashback program, the percentage of discount also depends on the status of the trader – the higher the status, the greater the discount. But for makers the discount is higher than for takers of the same status. In addition, there is a Cashback premium program. In order to use this program, the user must sign up and choose their option. For example, the Basic option costs $1, which gives a discount for both makers and takers of 33% on the first two levels of trading turnover.

Standard – discount for makers 66%, for takers 33%, for the first five levels of users on turnover, the cost of subscription is $10. Advanced status costs $100, applies to 8 levels of turnover, but the discount for makers already 86%, for takers 53%. But the Professional subscription for $500 provides a discount of 100% for market makers and 66% for providers. It is valid for traders of eleven levels. The subscription is only valid for 30 days.

LocalBitcoins

Crypto Exchange LocalBitcoins (https://localbitcoins.com) is an example of a huge commission from a taker who places an ad, which is 1% from the transaction made. But buying and selling bitcoins is free.

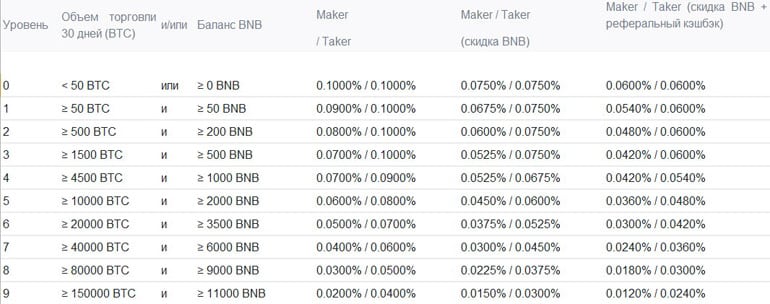

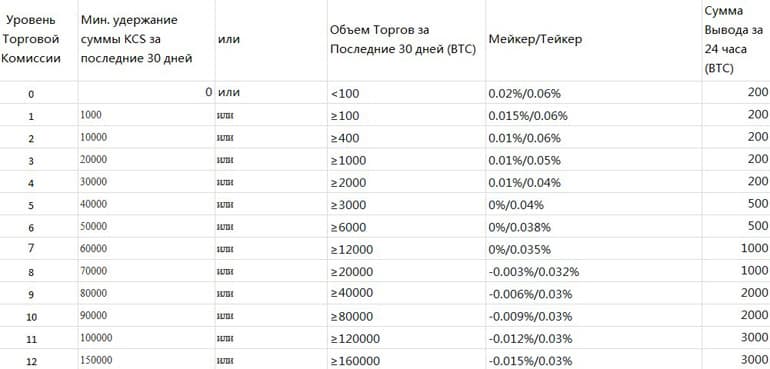

Bitfinex

On the cryptocurrency exchange Bitfinex (https://www.bitfinex.com) there is a system of discounts, determined by the volume of transactions in the last 30 days, the commission of the taker is more, but for them there are additional discounts for holders of Unus Sed LEO – service token Bitfinex. Thus, the order execution discounts are as follows: