Uniswap Decentralized Crypto Exchange: Why and How to Use It?

Uniswap is a somewhat unusual crypto exchangewhich is a protocol on Ethereum for exchanging ERC20 tokens at prices generated mathematically, without creating demand by buyers and sellers.

Contents

What is Uniswap?

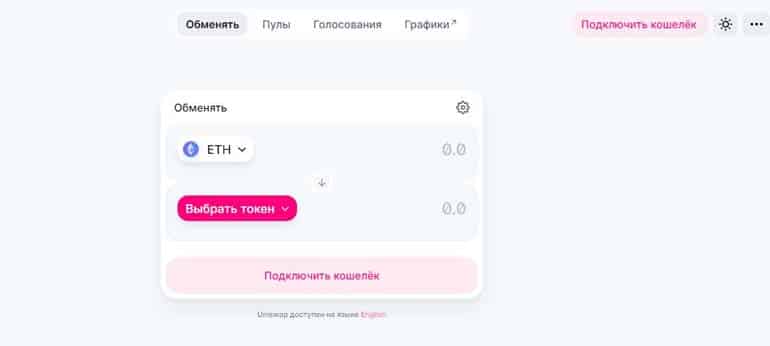

Uniswap (Figure 1) is a decentralized crypto-exchange (DEX) that operates on Ethereum smart contracts. Strictly speaking, it is not even exactly a crypto-exchange, but an automated exchanger based on Ethereum, which works depending on liquidity. The exchanger is open source.

Image. 1

This is the third version of the service, Uniswap V3. The first version was launched back in 2018, but it required a transaction via ETH. And Uniswap V2 platform, launched in May 2020, provided technical opportunities to exchange any ERC20 format tokens. Uniswap V3 was launched about a month ago and is somewhat of an upgraded version of V2. The new version has the ability to combine individual positions in a common pool, offers several levels of commissions for suppliers, the ability to sell one asset for another and so on. Those who traded on V2, are now in the process of transferring assets to V3. The attitude to the improvement of the exchanger to the level of V3 is ambiguous. In fact, it is done in favor of large liquidity providers, giving them more opportunities and reducing their risks, but rather disadvantages most retail traders. Large liquidity providers (LP) are the main privileged part of the target audience of the exchange, so all the innovations are offered primarily for them.

The user who is just starting to trade on the decentralized cryptoexchange, will do it already in V3, and to trade he does not need to go anywhere, the exchange is located at: https://uniswap.org (crypto trading in 2021). The exchange refers to platforms where tokens are traded without intermediaries and without commissions. The main difference between Uniswap and other platforms is that the automatic Constant Product Market Maker Model is used to form prices and make transactions on the exchange, which is based on a simple mathematical equation: x * y = k, where x and y are the number of ETH and ERC20 tokens available in the liquidity pool, and k is a constant value. That is, the equation will determine the price of a particular token (rather than the average price from all tokens) using the balance between ETH and ERC20 tokens, and between supply and demand. And when a user buys an ERC20 token for ETH, the supply of the ERC20 token decreases and the supply of ETH increases, so the price of the token goes up. This means that the price of tokens changes directly when transactions are made. On the Uniswap crypto exchange, the value of tokens directly depends on how much users want to buy or sell them.

The Constant Product Market Maker Model is a variant of the AMM model based on automatic trading through a liquidity pool. Uniswap is probably the most successful AMM project at the moment. Any Uniswap user can trade tokens and contribute to the liquidity pool (while receiving a liquidity provider commission of 0.3%). Contributions to the pool are made in ETH and ERC20 tokens. Because Uniswap exchange is decentralized, there is no listing. That is, any ERC-20 tokens are available for exchange, if sufficient liquidity can be consolidated. But in practice, of course, there are very few successful pools, and they are secured primarily by stack blocks. But formally, you can trade any ERC20 token, topping it up with an equivalent value of ETH and a traded ERC20 token (Cryptocurrency Trading on the Exchange).

When new ETH/ERC20 tokens are deposited into the liquidity pool, the user receives an ERC20 pool token. That is, pool tokens are formed each time the user deposits his or her funds into the pool. They are used for free exchange and can be used in other decentralized applications. Each token, accordingly, is a specific user’s share of the total pool (and a share of the pool’s commission of 0.3%). The decentralized exchange system allows for instant transactions, meaning there is no need to wait for a contrary order from a buyer or seller. On the other hand, if there is not enough liquidity in the pool, transactions are not possible at all.

Exchange token

Uniswap (UNI) is a decentralized cryptocurrency exchange token released very recently, in September 2020, after which it immediately began trading on the cryptocurrency exchange Binance (go online). UNI (ERC-20 token) was issued to support the development of the exchange and attract new users. When issued, 150 million UNI tokens began to be distributed to members of the Uniswap exchange. Each Uniswap protocol wallet was credited with 400 tokens, with more than 65 million tokens distributed in one day. Gradually all the tokens will be distributed – within 4 years, 1 billion. 60% of this amount is earmarked for users. In a distributed system, a UNI token gives holders the right to vote on the functionality of the protocol, i.e. in fact, the user has the right to participate in the management of the UNI system. Specifically, the list of privileges a token holder receives is as follows:

- voting among Uniswap holders;

- participation in the allocation of funds for the development of the crypto-exchange;

- participation in the management of commissions;

- participation in ENS (Ethereum Name Service, an Ethereum search engine;

- adjusting the Uniswap Default List (token list).

Managing SOCKS liquidity tokens

SOCKS is a meme token, also issued by Uniswap as a joke (the price of the token is two socks, literally), but quickly gained real value, for a while it was worth over $90. SOCKS greatly pushed the development of the crypto exchange and allowed for the creation of a real token, UNI. It is still in circulation and can be traded (Cryptocurrency Trading Strategies). Thanks to the Uniswap token, the decentralized exchange reached a $100 billion turnover for the first time. The UNI token itself has risen very high in the rankings, currently ranking 10th in terms of capitalization, with a value of $19.5 as of June 15. The UNI token can be bought on the Binance cryptocurrency exchange, in UNI/BNB, UNI/BTC, UNI/USDT, and UNI/BUSD pairs. Binance is a standard centralized exchange that requires registration and, eventually, verification. By the way, the exchange allows for margin trading with up to 5x leverage for UNI/BTC, UNI/USDT pairs. But the token can also be demanded on Uniswap after the wallet is connected. By the way, there is a page on Binance – Uniswap crypto exchange guide.

Trading technology and capabilities

Let’s look at what opportunities for trading offers this exchange.

Uniswap Wallet

To start trading on Uniswap crypto exchange, you don’t need registration or verification. You just have to follow the link on the website and click on “Use Uniswap” or you can go directly to the service by the link https://app.uniswap.org (Fig. 2). In the smartphone exchange works just like the browser version.

Image. 2

The exchange service itself is translated into Russian, it is very simple, it does not have any complicated functions. But to trade, you need to connect a wallet. The most popular option for this exchange is the MetaMask wallet (Fig. 3). This is a specialized decentralized wallet for Ethereum and ERC20 tokens. In fact, it is an ordinary extension for Google Chrome browser.

Image. 3

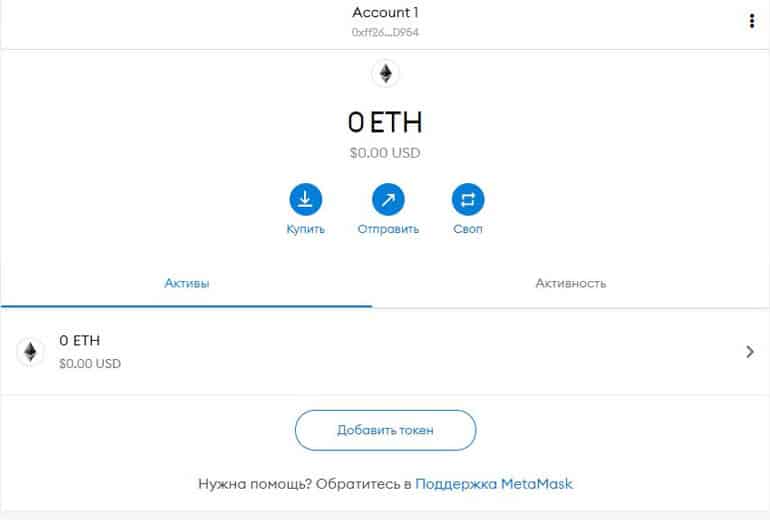

MetaMask is installed as an extension from the Chrome Web Store. You can import the data of an existing wallet or install a new one. A password is created, you are offered to accept and memorize (and save) the secret phrase, you need to confirm it at once – go through verification and you can proceed with the transactions (Fig. 4). You can also download the wallet to your smartphone via QR code.

Image. 4

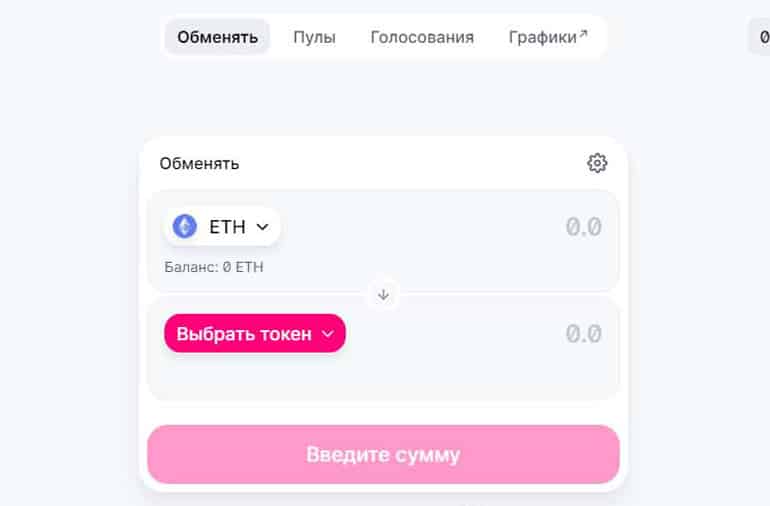

After installing the wallet, you need to connect it to the Uniswap crypto exchange system. Click on the “Connect Wallet” button and you will see wallet options in the drop-down menu. By the way, if the wallet Metamask just installed, the exchange does not recognize it and still offers to download a new wallet. But you do not need to download another new wallet, just reload the exchange or wait for a while – the exchange finally identifies Metamask. Then the connection follows – you just need to consistently click the appropriate buttons on the right side of the interface. Thus, the Metamask wallet will be connected (Fig. 5).

Image. 5

Right on the exchange, you can change the type of wallet you connect – to do this, click on the wallet address in the upper right corner of the interface. In the drop-down menu, you can not only change the wallet, but also see the history of transactions. By the way, we should not forget that on decentralized crypto exchanges, coins are not actually deposited to the exchange itself, all funds remain in the wallet of the user, and the exchange is a technical platform for transactions. This reduces transaction security, but on the other hand, always when trading on Uniswap or a similar platform, the user must always control that it is on that exchange and not a phishing site. Naturally, no questionable or unknown transactions should be confirmed.

Trading and earning

Trading is done by pressing the “Trade” button in the upper left corner of the trading service. To do this, you select a coin to buy and a coin to sell, enter the amount and carry out the transaction. You can and most often need to clarify the terms of the transaction, for this there is an option in the upper right corner of the service, in the form of a gear. Clicking on it, you can correct the slippage, the duration of the transaction, adjust the complexity of the interface. Before completing the transaction, the service will offer to check the initial data once again, and then you can finish the payment. Upon purchase, the tokens received should appear in the user’s wallet. You can earn money on Uniswap by investing your money in the pool – you can get into it by clicking the appropriate button in the control panel (Fig. 6).

Image. 6

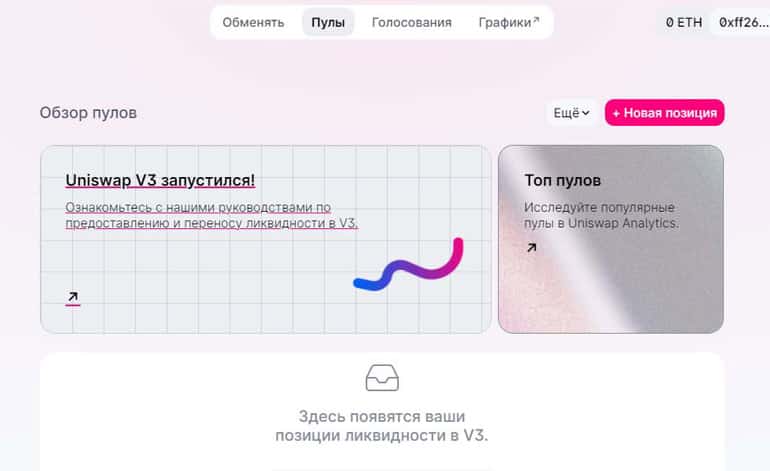

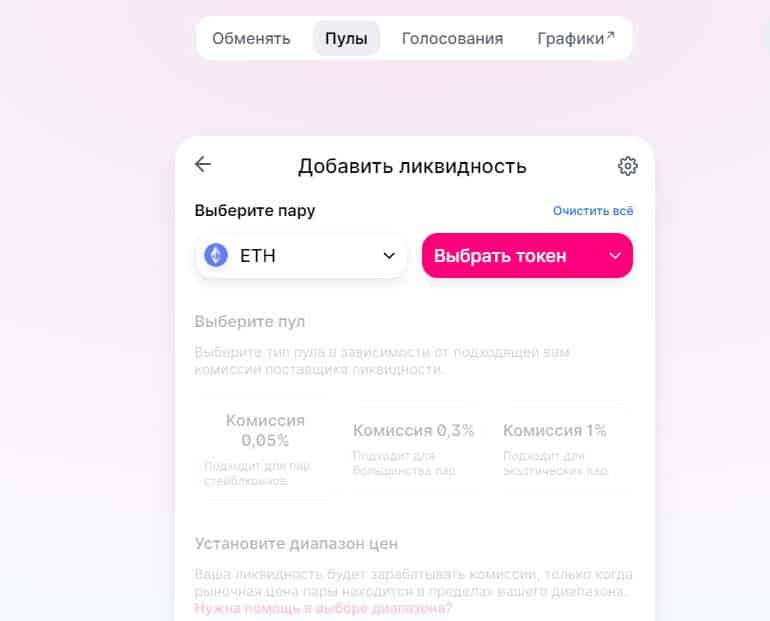

Since the exchange is transferred to V3, now the interface is aimed primarily at those who have liquidity on V2 and need to move it to the new version. To add funds to the pool for a newcomer, you need to click on the “New position” button (Fig. 7).

Image. 8

In the menu, you will need to select a pair from the list that falls out of the windows with the name Cryptocurrencies or token. When a pair is defined, the pool terms appear at the bottom – representing commissions for token categories. Next, the user can set the price range, this is an extremely important point, because it is possible to earn in this way only if the price range of the market pair can be calculated. The exchange provides help in choosing the range – just click on the appropriate link – it will open a section with comprehensive information on this topic, but in English. Once you have determined the maximum and minimum prices, you can deposit amounts and complete the transaction. The amount is entered only for one asset, the other in the pair is calculated automatically. The service shows the average price of the deposited token in dollars, and also allows you to specify the parameters of the transaction. To do this, click on the gear in the upper right corner and enter the allowable slippage, transaction term and interface settings. Once funds are deposited into the pool, the user will begin to profit from commissions only in the pool to which the funds are deposited.

Contributing liquidity does not mean that the user gives his tokens to the pool – Uniswap provides users with liquidity tokens that sort of store information about how much of the liquidity pool the user is responsible for. The assets contributed to the pool can be withdrawn by the user if desired. In doing so, the user receives a portion of the total fees that correspond to the size of his share in the pool. Accordingly, when the user withdraws his share, the liquidity markers are destroyed. The exchange lists the top pools, which can be explored in the appropriate section. Having selected a suitable pool in the list, you can use it for trading (the “Trade” button) – then the user returns to the cryptocurrency exchange service. Or you can use it to add liquidity to the pool – the “Add Liquidity” button, by clicking on which the user is redirected to the pool replenishment service.

Participation in the work of the exchange

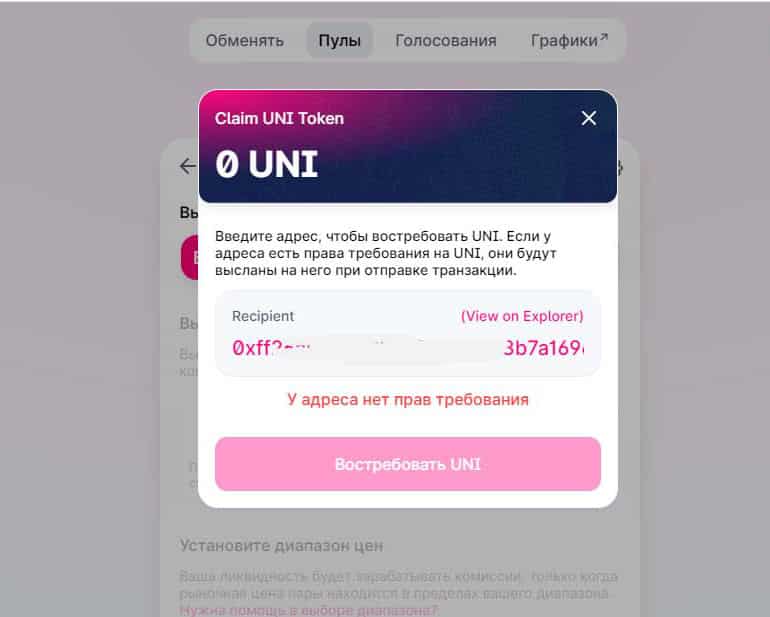

As already mentioned, a user can take part in the management of Uniswap crypto exchange by voting, and the one who has UNI tokens can vote. You can buy them, or you can demand them directly on the exchange itself. To do this, you need to click the three dot sign in the right corner of the interface and select the “Demand” button from the drop-down menu. If the address has the rights to receive the token, they will be sent (Fig. 8).

_

If the user has UNI tokens in his wallet, it is possible to go to the voting service by clicking the appropriate button. But, of course, there must be not any number of tokens, but not less than 1% of the total supply of these tokens at all. And that’s actually a very large amount, so few people can actually vote. The participants themselves are demanding that the threshold for submitting voting proposals be lowered. Voting proposals are, of course, written in English only. Decentralized Crypto Exchange cannot boast a lot of analytical information, but it still has an analytics section. Now analytics is provided initially for version V3, but there is a button to switch to V2 analytics. The information in the section allows to more or less present the situation on the crypto exchange, to see the prices of traded tokens and ether. Also from the account interface it is possible to go to Discord service to communicate with other participants of trading on the crypto exchange.

Is Uniswap a scam or not?

Let’s take a closer look at all the advantages and disadvantages of this exchange, and then you can conclude whether it is a scam or not.

Pros

Cryptoexchange has a number of advantages and a few disadvantages. Among the most notable pros:

- instant exchange of tokens, thanks to the AMM format and liquidity pools;

- the fact that the funds are stored in the user’s wallet all the time and can not “get stuck” on the exchange;

- Anonymity – no verification required; support for popular wallets; support for any Ethereum blockchain assets;

- low commissions and the opportunity to make money on the pool.

Traders are especially attracted by the low commissions. In particular, Uniswap charges a commission of only 0.25% per transaction. A new cryptocurrency of ERC20 format can be “tested” on the decentralized crypto exchange. The thing is that on “classical” centralized crypto exchanges all crypto projects must pass the verification, not all tokens and coins get to the listing. But on Uniswap any enthusiast can offer their token, and users can be the first tokens to be traded. There is a chance that the coin will be of high quality and you can make virtually zero money on it. But on the other hand, the chance that some new token will “shoot out” is small.

Minuses

Notable disadvantages include a high gas fee and a high probability of transactions with fraudulent tokens. When you first visit the decentralized crypto exchange Uniswap, you may get the impression that it is some kind of scam, because visually the interface does not inspire confidence, as if it is made hastily and not very neatly. But perhaps this is because the exchanger is constantly evolving, which is good. But some of the actions look questionable, such as the introduction of Uniswap V3, a version that is not aimed at most traders, but the exchange actually forces a switch to the new version. At the very least, this means that to trade on this exchange you need to be already in the loop and always be in control, which for beginners or inexperienced traders may be too risky. A specific feature of the platform is the inconstant losses. The bottom line is that the user deposits a token into the pool and the price of the token goes up, resulting in a profit that is significantly lower than what it could have been if the user had just kept the tokens untouched.

During trading it is difficult to understand when it is better to invest and when it is not, which turns trading into a variant of gambling and carries a constant threat of “under-earning”. You may encounter a specific fraud at the exchanger – the creation of duplicate tokens. This can be easily avoided, for example, by going to a crypto exchange via Coingecko or copying a token contract on Coingecko and pasting it on the crypto exchange. But it doesn’t add to the usability of Uniswap and doesn’t solve the problem. Crypto exchange seems to solve this problem, but it’s hard to imagine how, because the principle of exchange functioning means that any user can put his token into pool.

Users note that before exchanging purchased tokens for ETH, the reverse pair must be confirmed by carrying out a transaction, which specifies a small amount in tokens and a high commission. And this must not be forgotten every time, otherwise it will not be possible to sell tokens at the right price. The difficulty is such a point as determining the slippage parameter. When the price of a token rises quickly, even with a high commission it is difficult to sell the token. Slippage (slippage) is an indication of the percentage of difference of the final transaction rate from the initial one. There are preset slippage values in the service, but they can be useless. And it is difficult to understand what slippage value should be set, you need not only skill, but also understanding of the situation. This, again, is of little use to beginner traders.

When coins are exchanged on Uniswap, the transaction may fail. For example, the user may pay too little for gas and the transaction exceeds the time limit; the user may offer a price for the token that exceeds the maximum before the transaction is completed; or there may not be enough liquidity in the pool. There is no actual loss of money, the transaction is returned as if it never happened. But it is possible to calculate the lost profit due to these reasons. In addition, if you want to trade on this exchanger, it is a good idea to read the reviews. They are mostly negative – complaints about disrupted transactions, incorrect operation of the exchange and so on. Of course, this is not due to the fact that the exchanger is a scam, but most likely due to the fact that trading through Uniswap is a very specific activity. Before you start real trading, you need to carefully study all the features of this platform, and there are many of them (Cryptocurrency Trading Training). And if you do not devote enough time to this, the probability of losses is very high. Especially noteworthy is that the exchange does not have a Russian-language interface, so it is better to study the translated materials on the exchanger, there are not many of them yet. Or begin to learn English. Particular attention should be paid to slippage and reasons for transaction failures, you should also achieve a full understanding of the pricing of tokens and coins on the exchange.

Decentralized crypto exchanges are now positioned as having advantages over centralized ones, or as solving some problems of centralized exchanges. But if you look from the point of view of trading convenience specifically, Uniswap has no particular advantages over a centralized exchange from the top list, at least for beginner traders or for those who do not trade mainly in cryptocurrencies. Yes, it is still possible to trade cryptocurrencies anonymously and make quick exchanges on decentralized platforms. But if you go out and try to implement some strategies there, it turns out that the advantages are leveled by the fact that decentralized platforms are more difficult to understand. Rather, it is possible to work on a decentralized exchanger already having a good understanding of how the crypto market is structured. Also, most likely, unlike centralized crypto exchanges, the user will need some technical knowledge, you need to understand how this kind of platforms function technically. Even more knowledge will be needed to take part in some projects related to a decentralized platform. On the other hand, you can trade on centralized exchanges without much understanding of cryptocurrency technology. But, on the other hand, a trader who understands the peculiarities of trading on decentralized platforms really has a lot of interesting additional opportunities to earn money.