Crypto Trading in 2021: Trends and Features

What can the crypto market expect this year? What trends will define the nature of the industry? Which coins can be the most profitable and promising? Let’s try to understand these questions.

Contents

- 1 Growth trend of the crypto market

- 2 Increased demand for stabelcoins

- 3 Tougher legal regulation

- 4 Impact of Ripple

- 5 New ways of trading and investing

- 6 Adoption of cryptocurrency by the financial industry

- 7 Development of DeFi

- 8 The impact of 5G on the development of the crypto market

- 9 State of the world economy

- 10 Promising cryptocurrencies of 2021

- 10.1 Bitcoin (BTC)

- 10.2 Bitcoin Standard Hashrate Token (BTCST)

- 10.3 Ethereum (ETH)

- 10.4 Ripple (XRP)

- 10.5 Litentry (LIT)

- 10.6 Beefy Finance (BIFI)

- 10.7 SafePal (SFP)

- 10.8 Trust Wallet Token (TWT)

- 10.9 Cardano (ADA)

- 10.10 Enjin (ENJ)

- 10.11 Uniswap (UNI)

- 10.12 Litecoin (LTC)

- 10.13 Binance (BNB)

- 10.14 Filecoin (FILE)

- 10.15 Crypto.com (CRO)

- 11 Possible difficulties in the development of the crypto market

Growth trend of the crypto market

Marketplace cryptocurrencies has become interesting not only for cryptocurrencies and other interesting individuals, but also for serious investors. This is due to the fact that cryptocurrencies, despite periods of strong volatility, are steadily increasing in price over the long term (Figure 1). First of all, qualified investors are interested in bitcoin. The value of the coin has reached huge values, unaffordable for the majority of beginning or non-professional traders and investors, which automatically, even at the start, cuts off amateurs. Trading volumes have become really attractive and various professional trading tools have appeared. These are qualitative changes in the cryptocurrency market, which affect it positively and lead to further growth. Let’s take a closer look at the reasons for the growth of the crypto market.

Image. 1

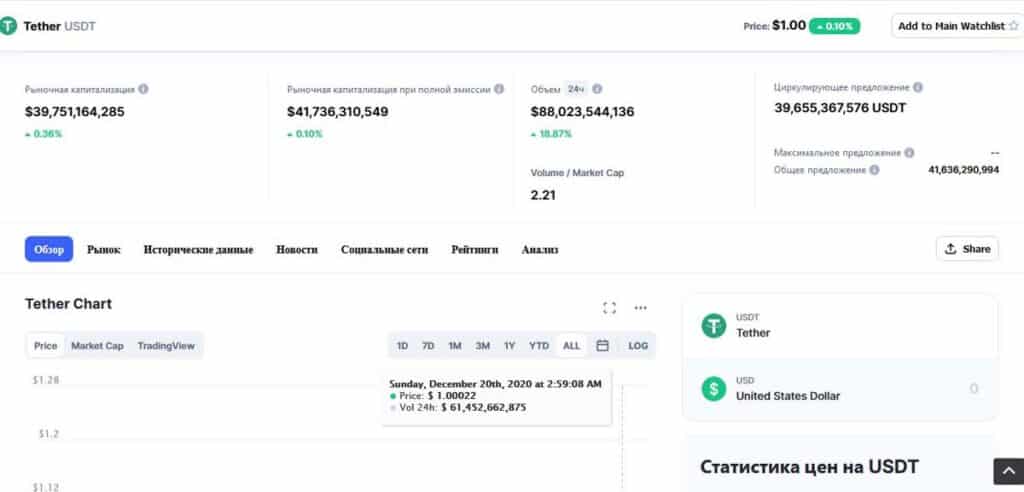

Increased demand for stabelcoins

At the end of 2020, the turnover of stabelcoins, based on the dollar, increased by 500% compared to the previous year, and exceeded $144 billion. That is, the inflow of investment is also noted in this segment of the crypto market. There is no obstacle for this trend to continue. Stablecoins USDT, USDC, DAI, BUSD, and TUSD (Fig. 2) are attractive because their volatility is low. However, these coins can also be backed by stocks or commodities, all of which are much more stable than “regular” cryptocurrency. Stablecoins can be used as savings, as a “safe haven” for cryptoassets in times of sharp volatility. And not just for crypto-assets. It is, in principle, a good value-saving tool, so the trend will gain popularity.

Image. 2

Tougher legal regulation

Cryptocurrency regulation is gradually being formalized and tightened. First of all, the authorities aim to tax the cryptocurrency business. Since the beginning of this year, the law “On Digital Financial Assets” came into force in Russia, according to which cryptocurrency is recognized as property and is taxed accordingly. It is necessary to submit a declaration already this year, until April 30 to the branch of the Federal Tax Service at the place of registration. In the declaration, you need to show the income from the sale of the cryptocurrency, subtract the expenses for the purchase of this cryptocurrency from this amount, and multiply the difference by the personal income tax rate of 13%. The tax must be paid by July 15.

If the tax return is not submitted, it entails a penalty in the amount of 5% of the unpaid amount of tax for each full or incomplete month from the day set for submission of the declaration. For non-payment of tax is also established responsibility, the amount of which, according to Art. 122 of the Tax Code can be 20% of the amount of unpaid tax and 40% of the amount of tax deliberately not paid. In addition to the fine for the tax offense committed, the taxpayer will be required to pay the amount of tax and related penalties. Attempts to evade paying taxes threaten criminal prosecution. Although stricter regulation of cryptocurrencies looks threatening, there are many benefits, which are more likely to lead to the growth of the cryptocurrency market. Putting the crypto business in a legal framework makes it attractive to legitimate bona fide investors and traders, which increases the quality of the market (Cryptocurrency Trading on the Exchange). The problem now is that the legislation is underdeveloped, including in the direction of taxation, clear rules have not been created. This will hinder the development of the crypto market. But the trend to strengthen regulation of the crypto market is stable.

Responding to the growing demands of financial regulators, cryptocurrency exchanges are implementing KYC/AML procedures that reduce the number of anonymous transactions and increase the protection of both customers and cryptocurrency exchanges from the actions of fraudsters. Under the influence of regulation, the cryptocurrency market is moving towards the formation of a structure that replicates the classic, familiar and familiar to everyone financial market. Based on this development forecast, some experts say that there will be jurisdictions in the cryptocurrency market with minimal government involvement in the cryptocurrency industry, a kind of crypto- offshore. Countries that may soon become a safe haven for cryptocurrency projects with minimal regulation may include countries with a developed cryptocurrency industry and traditional financial markets, such as Switzerland, Singapore and various island jurisdictions.

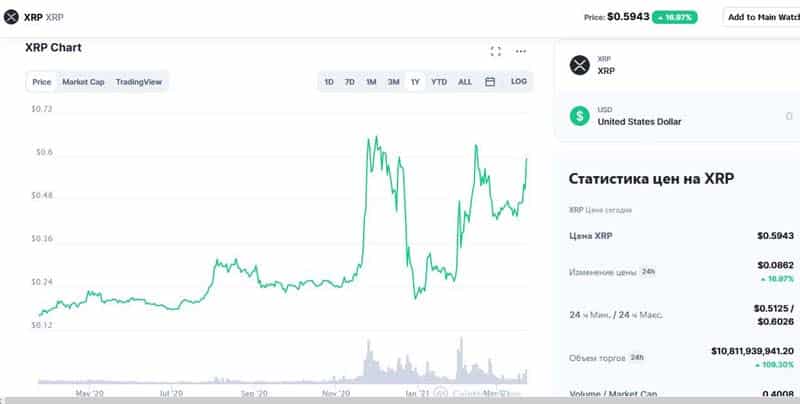

Impact of Ripple

A big impact on the cryptocurrency market is the Ripple case (Figure 3), which fell out of favor with the U.S. financial regulator, the Securities and Exchange Commission (SEC). The bottom line is that the company and its management were selling unregistered securities to circumvent the law, as Ripple was not registered as a security and did not receive any legal clearance. As a result, one of the most famous Ripple coins was delisted from the leading crypto-exchanges (rating of crypto-exchanges). It was telling that the cryptocurrency generated increased demand from investors in Asia afterwards. This makes sense, as a public review of a cryptocurrency by the most powerful financial regulator is already a big step forward. The SEC turned its attention specifically to Ripple because it not only has value as a cryptocurrency, but also practical value, which distinguishes it from bitcoin and ether. But the important thing, of course, is the outcome of the case and it seems to be a positive one, because the other day an SEC representative said that cryptocurrency exchanges are not breaking the rules by trading XRP. So ripple is coming back a winner, which will certainly have a positive impact on the crypto market.

Image. 3

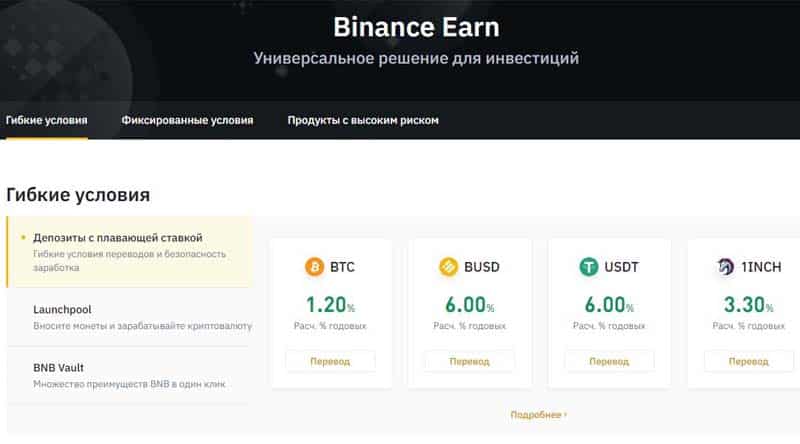

New ways of trading and investing

Crypto exchanges are actively promoting new trading and investment methods that make it easier to enter the crypto market. The driver in this direction is the crypto exchange Binance (go online), which offered a whole set of instruments for earning (Fig.4) practically from scratch. In particular, these are perpetual deposits – investments in stackcoins, crypto or fiat with guaranteed yield and zero commission; Liquid Swap – investments with yield from 5 to 50% p.a. with commission up to 0.04%; deposits with floating rate; Launchpool – a new service that implies rewards in the form of tokens, which the user receives by sending their assets to the staking; fixed rate deposits; fixed staking; promotions; ETH staking 2.0; DeFi-stacking. To one degree or another, all crypto exchanges offer such tools.

Image. 4

New ways of trading and investing are aimed at attracting an audience that has a hard time entering the crypto market directly due to lack of knowledge of cryptocurrency specifics or lack of money. For the most part, these methods are adapted for the “average” bank, which has experience using banking services, so it is easy to start its own crypto-business without having to dive deep into blockchain technology. But the ease of entry into the crypto market should not be misleading. Before investing or trading in any of the new ways, you should study all the information presented on the crypto exchange, calculate the possible benefits and likely losses, check the possibilities of withdrawing the expected profit, calculate the commissions, and see from the reviews the realism of earning with the new tools. The crypto market is still complicated, and learning some basics cannot be avoided anyway. The emergence and development of new tools for making money on cryptocurrency exchanges, especially tools that attract new, unskilled in cryptocurrencies users is a steady long-term trend in the cryptocurrency market.

Adoption of cryptocurrency by the financial industry

What last year. PayPal began to support bitcoin transactions was one of the factors behind the cryptocurrency’s sharp rise in price and the cryptocurrency’s rising status in the eyes of serious investors. The fact that JPMorgan uses cryptocurrency in transactions gives confidence in its usefulness, significance and prospects. This bank has been offering cryptocurrency deposit services to customers since 2018, proving through a U.S. federal court that bitcoin is an acceptable means of payment. This has led to permission in the U.S. for legal entities to open accounts in cryptocurrency, to receive cryptocurrency payments for goods and services. One of the most reputable financial groups, Barclays, has converted letters of credit to blockchain technology. The adoption of cryptocurrencies by legitimate and important participants in the global financial market increases investor interest and investment inflows, and this leads to further acceptance of cryptocurrencies. This is a self-sustaining long-term process in a positive direction: cryptocurrencies are seen as a viable investment and trading tool, in many ways already comparable to assets such as real estate and gold.

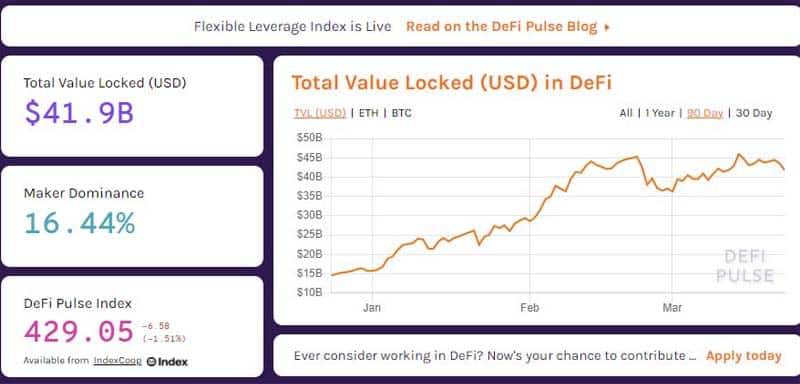

Development of DeFi

Interest in cryptocurrencies is inextricably linked to the development of decentralized finance in general (DeFi). DeFi (Fig. 5) are financial instruments created on the blockchain in the form of applications and other services. Most DeFi projects are based on the Ethereum blockchain. One of DeFi’s goals is to attract everyone who wants to earn passive income from cryptocurrency assets. Even an investor who is not qualified in blockchain can use these kinds of tools to earn money (but it is highly desirable to be qualified in traditional investment tools). The volume of funds circulating in the DeFi industry is not exactly known, and in the media there are figures from $15 billion to $100 billion, but in any case, this is a very serious development, a long-term and very promising trend.

Image. 5

The impact of 5G on the development of the crypto market

The introduction of the 5G data transmission standard is already underway, and it could have a major impact on the crypto market for the foreseeable future. The point is that 5G transactions will not be limited to the speed of data transmission over the network. This is extremely important for high-frequency trading of volatile assets, which include cryptocurrencies, because the conditions for transactions will be the same regardless of the region in which the crypto exchange is located. This will help to attract new traders (How to make money on cryptocurrency).

State of the world economy

The main factor in the development of the cryptocurrency industry, which ensures its progressive movement at this time, is the structure of the global economy, which is shaped by the coronavirus pandemic. Restrictions that the authorities of almost all countries imposed during the pandemic and that continue to persist in most countries of the world contribute to the development of all kinds of online businesses, so it is not surprising that reaching the maximum value of bitcoin was at the peak of the pandemic. The pandemic also showed that the traditional economy is extremely vulnerable and dependent globally. States are not only unable to cope quickly with problems, but even refuse to acknowledge them in a timely manner. Doubts about the authorities’ capacity are transferred to the traditional financial structure, forcing people to look for alternative ways to earn and preserve their earnings. This is how people come to cryptocurrencies.

Promising cryptocurrencies of 2021

In general, we can say that all cryptocurrencies in 2021 are promising in terms of trading or investing. But if we are talking specifically about working with cryptocurrencies, rather than tools that allow you to work with them indirectly, you need to choose cryptocurrencies carefully. There is no difficulty with information on cryptocurrencies, there is an abundance of it on the Internet. In addition, there are analytical reviews, which consider successful cryptocurrencies for investing in a particular period of time. And it is necessary to pay attention to new cryptocurrencies that periodically appear, which often can be purchased on more favorable terms.

Bitcoin (BTC)

Bitcoin was and still is the most profitable cryptocurrency, the basis of the entire cryptocurrency market and industry (bitcoin in 2021). It is de facto recognized by the world’s largest developed economies, bitcoin underpins the vast majority of legal investment and payment cryptocurrency solutions recognized by banks. In fact, bitcoin has become an integral part of the global financial system. Bitcoin is listed on all cryptocurrency exchanges, and the dynamics of bitcoin value can predict the dynamics of the entire cryptocurrency market. Despite the fact that bitcoin’s key problems (scalability and relatively long transaction processing time) have not been solved, it is still the most promising cryptocurrency.

The factor that severely limits investing in bitcoin is its cost, which now exceeds 55 thousand dollars, in most countries of the world it is unaffordable amount for the vast majority of the population. That is why big investors, who can afford such investments, come to bitcoin. Small investors can already consider bitcoin as an investment target, which will be a safe haven for investments, for storage and multiplication of earned money.

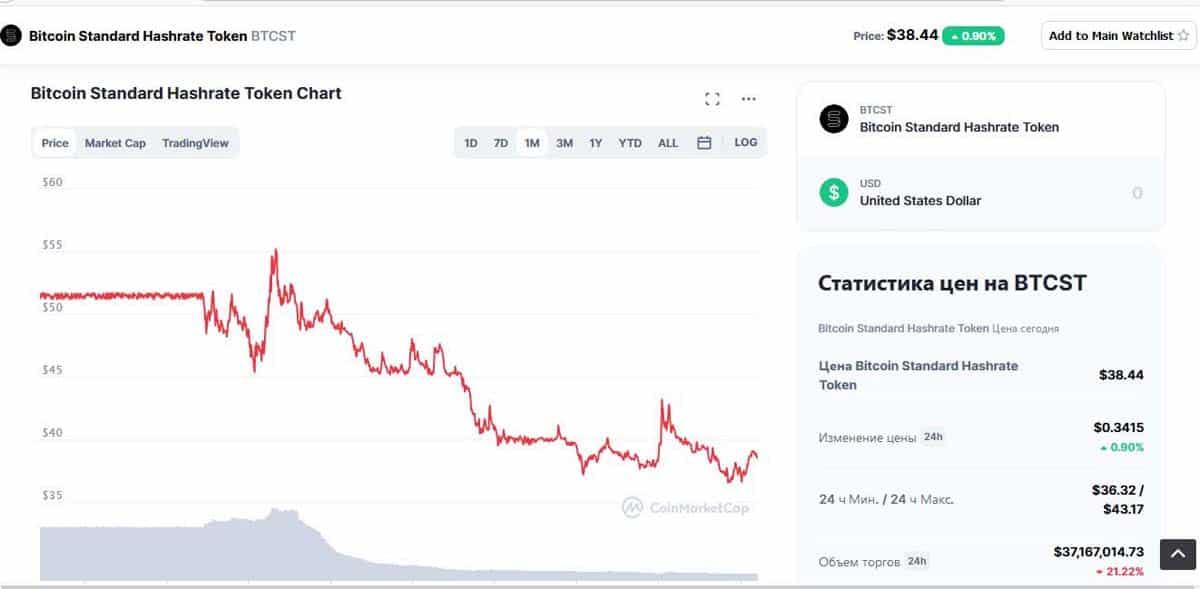

Bitcoin Standard Hashrate Token (BTCST)

A way to participate in bitcoinomics without buying bitcoin is to use the BTCST token (Figure 6), which is a market expression of BTC mining power. A user who buys tokens is entitled to a certain amount of computing power at a rate of 0.1 Th/s (hashing rate) for each BTCST. Like regular bitcoin, this asset can be sold or held for passive income. The project cooperates with the Binance Pool, the token holders get profit according to the volume of tokens they have. In terms of investing or trading, the point of BTCST is that its value is now less than $40, making it affordable for most people to enter the market.

Image. 6

Ethereum (ETH)

The value of Ethereum now exceeds $1,600, so over the past couple of years, the cryptocurrency has risen by 1000%. The prospects for ether are not only due to its intrinsic value and good growth rate, but also to the peculiarities of the infrastructure created around it. Developers of ether support major DeFi projects Uniswap (UNI), Maker (MKR) and Aave (AAVE), which represent a kind of alternative to the services of centralized financial institutions. By its own count, DeFi has about $15 billion in investments, and 98% of transactions are made through ETH. But even if those aren’t entirely accurate numbers, the dynamics of ether show that it’s a promising tool for investing and trading. The advantage of ether is that its infrastructure presents opportunities to use a greater variety of instruments than bitcoin.

Ripple (XRP)

The cost of the cryptocurrency Ripple is now about $0.5, which makes it available for investment to almost anyone, which is certainly its great advantage. At the same time, the coin’s capitalization is third after the giants bitcoin and ether. Prospects of Ripple are determined not only by its availability, but also by the fact that this coin is actively used in legal transactions of participants of the classical market of financial services – with the help of it enterprises and physical persons conduct inter-currency transactions. The group of participants of intercurrency interbank payments includes Merrill Lynch, Canadian Imperial Bank of Commerce, Mitsubishi UFJ Financial Group, Royal Bank of Canada, Grupo Santander, Standard Chartered, UniCredit and Westpac Banking Corporation. Ripple is even called a potential competitor to the SWIFT system. Despite some disagreement with the SEC, Ripple remains one of the promising coins for investment this year, but more so for long-term investment.

Litentry (LIT)

Litentry is a blockchain project that consolidates data on users of decentralized networks, for example, to assess their creditworthiness. The Litentry project is based on the LIT token, which now has a value of about $10. The goal is for blockchain projects to be able to identify target audiences based on certain parameters. The list of tasks and the potential usefulness of the project are such that it could well be a meaningful part of the traditional financial system, which makes Litentry a very promising cryptocurrency for investment.

Beefy Finance (BIFI)

BIFI is a project – the profitability optimizer of decentralized credit protocols on Binance Smart Chain. The value of the token is now about $2 and shows good growth dynamics. The infrastructure is a system of “vaults,” each of which operates according to a strategy set forth in the smart contract. Vaults support different coins and, accordingly, the vaults have different yields. The functionality of the system allows holders to vote for changes in the protocol, to earn money by investing coins into particular vaults, moreover, the system of BIFI allows to earn income from stacking – holding coins. The prospect of the project is that it is the first analogue of Ethereum optimizer projects, which not everyone likes.

SafePal (SFP)

SafePal is cryptocurrency wallets installed on mobile devices, hardware and software, which can be integrated with each other. And it is also an infrastructure for wallets consisting of decentralized management, which can be used to get discounts on transaction fees, on the purchase of hardware devices and passive earning of SFP tokens, which are currently worth more than $3.6. The SFP system is quite actively developing, which determines the prospects of this coin for investment.

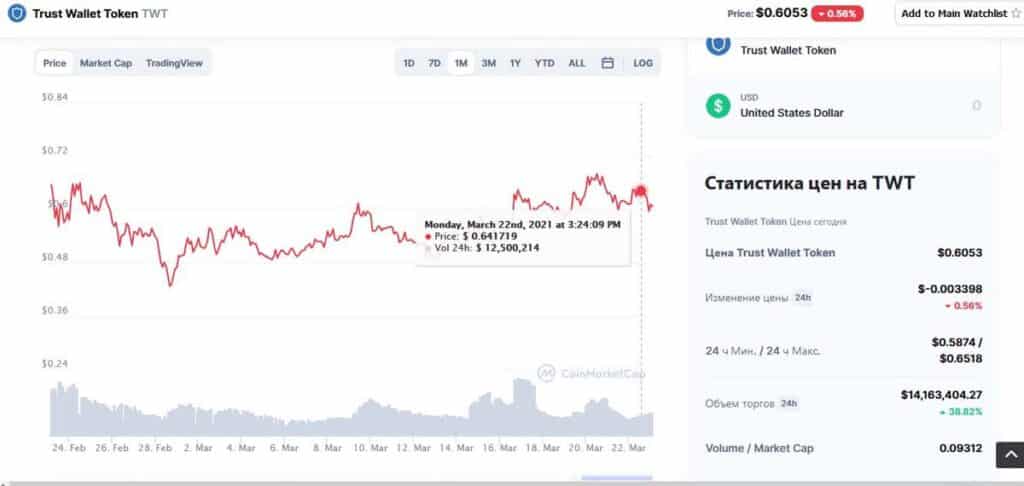

Trust Wallet Token (TWT)

One of the most interesting cryptocurrency projects at the moment is Trust Wallet Token (TWT) (Figure 7) – a token and cryptocurrency wallet integrated into the Binance ecosystem, operating on the Binance Smart Chain blockchain. The project allows you to participate in the management, work with tokens, support application developers, receive discounts on services of the crypto-exchange. Binance is a leading and rapidly developing crypto-exchange. Accordingly, there are prospects for the development of TWT. TWT token is not a bad way to enter the cryptocurrency market, as its value at the moment is about $0.5. Since the beginning of this year, TWT appeared in the official listing, in pairs TWT/USDT, TWT/BTC, TWT/BUSD.

Image. 8

Cardano (ADA)

Cardano is a protocol that is designed to remove Ethereum flaws. The token is mined by means of stacking (it is a PoW coin), accordingly, the user receives a reward for storing the coin. Not all functionality of Cardano is developed yet, but already now the cryptocurrency is more centralized than Ethereum and more than 50% wallets participate in stacking, not to mention that this coin is much more accessible for investing, its value is currently about $1.

Enjin (ENJ)

Enjin is a decentralized tokenized platform for virtual goods in games, launched by the Enjin network of 20 million players. The goal of the project is to generate virtual goods, manage them, distribute them in some way, and, of course, sell them. Enjin Coin provides all members of the gaming industry with great opportunities and new ways to manage virtual property. Each purchased commodity can be expressed in ENJ units. What determines the prospects of the token is clear – cryptocurrencies and the game industry are on the rise, the synergistic effect provides good opportunities for earnings. The value of the coin is more than $2, which makes it available for investment to everyone.

Uniswap (UNI)

Uniswap is a decentralized exchange for trading ERC-20 tokens. UNI’s own token is now worth about $33. The aim of the project is to provide fast and hassle-free trading. It operates through standardized smart contracts that form pools and liquidity markets. The prospects of Uniswap are due to the fact that this protocol is a large gas (Ethereum ethereum unit for transaction payments) and one of the most popular decentralized applications at the moment. And it is quite affordable for many to invest in.

Litecoin (LTC)

Litecoin, a veteran of the crypto market, has for some time been extolled in the specialized media as a coin with incredible prospects, as a “silver” relative to “gold” bitcoin, or even as a cryptocurrency to replace bitcoin. But so far, that hasn’t happened. Nevertheless, the coin has a very large army of supporters, as it has proven its reliability and has significant advantages over many other coins. In particular, it is a convenient way to transfer funds since the currency has low commissions. At the same time, it is most likely represented on all existing exchanges, which means that it can be used for transactions with other coins and for storing value, such as bitcoin. Another plus is that Litecoin is supported by PayPal. In addition, Litecoin is working on a partnership with Cardano. Litecoin is now valued at around $188, which for many investors is a reasonable value and not a bad way to enter the crypto market.

Binance (BNB)

The cryptocurrency BNB is now worth more than $255, which means the price is quite high. It is one of the main elements of the cryptocurrency exchange Binance and one of the most popular and sought-after cryptocurrencies. Its popularity is determined by the fact that BNB is practically necessary for profitable investing and trading on the exchange, as it allows significant savings, speed up transactions, enjoy certain preferences for members of the cryptocurrency exchange. And, despite the high cost, investments in BNB have all chances to be useful. And the future prospects of BNB are determined by the prospects of the crypto exchange, which are evaluated very high.

Filecoin (FILE)

Filecoin is one very curious project of the cryptoindustry, which is a decentralized storage of electronic files, but not on the HTTP protocol, but on a specially developed protocol IPFS. If we consider the idea of Filecoin more broadly, the project is a prototype of a more advanced, decentralized Internet. The existing Internet of course cannot be called centralized, but the servers that make it work are concentrated in the US and the EU, which can be inconvenient for users in other parts of the world, or it can be interrupted altogether if cables at the bottom of the ocean are broken. Filecoin is designed to maybe solve this problem in the future. The coin within the project is needed to attract investment. The cryptocurrency is worth about $77. The prospects of the coin are determined by users’ interest in the idea itself.

Crypto.com (CRO)

In 2020. Crypto.com (go online) unexpectedly broke into the top 10 in terms of capitalization. The project does not have any super goals, the infrastructure of the project is aimed at offering users rational technical solutions for buying and selling cryptoassets and calculating cryptocurrencies in everyday life. It is assumed that the project promotes a fast and safe transition from the financial fiat system to cryptocurrencies. The plus side of Crypto.com is that users can sign up for a payment card with certain benefits. But the special merit of the coin is in its affordability – the cost as of today is only $0.2.

Possible difficulties in the development of the crypto market

The outlook for the cryptocurrency industry is positive, but it would be reckless to rate it as rosy. The cryptocurrency market will inevitably face great difficulties, so when investing in cryptocurrencies (if we are not talking about a fundamental perpetual “holding”) you need to constantly monitor the situation.

Reduced market growth dynamics

No asset grows forever. Right now bitcoin continues to rise in value and is pulling the entire crypto market up with it. Sooner or later the growth will stop and it is impossible to predict when and how. It can be a gradual decline, or it can be a sharp fall, or a prolonged but continuous fall. On the plus side, cryptocurrency price growth is proven to grow in the long run, no predictions like “bitcoin will fall to zero” are being made now by the most skeptical trader or investor. But the moment the market’s bearish trend prevails, you can lose a lot of money.

Technological limitations

Cryptocurrencies still do not compare to traditional payment systems in terms of turnover volume and transaction speed. This severely limits the process of cryptocurrency acceptance by institutional investors, and the integration of the cryptoindustry with the real economy and finance, remaining a parallel world. The fact that large institutional financial market players are embracing cryptocurrency is a good thing, but good news is quickly forgotten. And if a negative event occurs in the crypto-industry, such as a failure of a crypto-exchange, it immediately returns society to skepticism about cryptocurrencies, leading to a drop in the price and an outflow of investment. In any case, it helps that cryptocurrencies have positive features that provide attractiveness to investors in and of themselves, and it is still profitable to invest in them.

Difficulties with regulation

Tougher regulation, as mentioned above, is not a bad thing for the cryptocurrency industry, and it has its benefits. But if regulators “overdo it,” it will stall the development of the crypto industry and lead to loss of interest, investment outflows, and limited earning opportunities. Regulation can also be incorrect, without understanding of cryptocurrencies and will hinder the development of the industry, for example, taxes can encourage crypto-enthusiasts to legalize their activities, but if they are excessive, it will force qualified investors and traders – the backbone of the market – to go into the shadows.

End of the pandemic

Sooner or later the pandemic will end. Perhaps it will be soon, as covid vaccinations are being rolled out around the world. People will begin to return to their usual mode of work, there will be an opportunity to spend money, which until then was not involved. This also applies to cryptocurrencies. It is possible that when the pandemic restrictions are lifted, there will be an outflow of investments from the cryptocurrency industry to more traditional instruments. But that remains to be seen.

Hello everyone, I would like to express my opinion. One of the most promising coins to date-cryptocurrency eGOLD (electronic gold) is an electronic cryptocurrency, which received its name by its direct purpose .

eGOLD is positioned as an ecological alternative to physical gold and paper money. The value of the coin will always be linked to the troy ounce in the proportion of 1/100,000. When you open the wallet of this coin, you need to buy a coin in the exchanger, put it in your wallet and immediately the number of coins will begin to increase due to STACKING technology from 4 to 5% per month of the total number of coins in your wallet. Accruals go every second in automatic mode, even when the computer is turned off. In this cryptocurrency there is a 3-level referral system. To mine this coin does not need any additional costs for additional equipment and electricity. There is a white paper in which everything is described in detail. Do not be lazy, understand, in the cryptocurrency world such coins have not yet. A reliable tool for passive earnings on the Internet