Tether Reviews – Token of Honor

Tether is now of great importance to the development of the cryptocurrency industry. Despite this, cryptocurrency Tether raises doubts and suspicions among many that it is a scam. Even many crypto market participants who regularly use Tether believe that tokens are a scam. How justified is this attitude towards cryptocurrency?

Contents

What is Tether?

Tether is a cryptocurrency founded in 2012. It is all the more surprising how quickly it has gained in importance. The author of the idea of the new cryptocurrency is J.R. Willett, who first initiated the creation of the Mastercoin token, for the promotion of which the Mastercoin Foundation (Omni Layer Foundation) was founded. The issuance of tokens, already renamed Tether on the bitcoin blockchain, began in 2015 (Figure 1). Later versions of Tether on the Tron, EOS, Algorand, Solana, Liquid, Bitcoin Cash and OMG blockchains were issued. According to some reports, 65% USDT is now Ethereum tokens of the ERC-20 standard, on which other Stablecoins and which is used to provide DeFi projects.

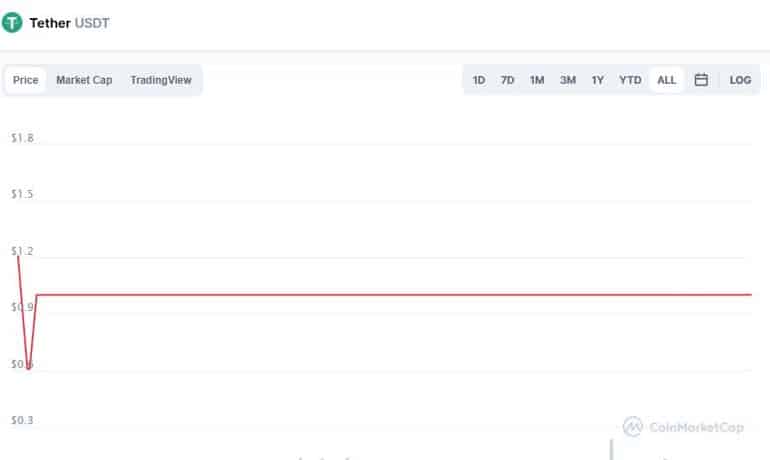

Image. 1

There was nothing unusual about this cryptocurrency initially, except for pricing – the creators initially wanted to peg the price of the crypto coin to the dollar, or rather, set the price of the token so that it was equal to one U.S. dollar. In 2014, such an idea did not look progressive, because many still perceived cryptocurrency as some kind of alternative to fiat, an opportunity to get away from the dollar system. But apparently, the creators of Tether saw a little further. Maybe they noticed that in fact cryptocurrencies are not “changing the world” as it was then positioned, but they are valued in the same fiat currency and cannot go anywhere away from it, because there are simply no other methods of valuation of cryptocurrencies and it is impossible to use crypto effectively outside the fiat system. Cryptocurrencies have to be withdrawn into fiat one way or another, in this system cryptocurrencies serve only as a means of earning fiat money. And if so, why not just print cryptodollars so you can change them one-to-one without making up some koins expecting them to rise in value in years to come?

But the real practical use of Tether quickly became clear: the token, which is pegged to the dollar exchange rate, allows cryptocurrency transactions for an asset roughly equivalent to USD within the cryptocurrency system. Therefore, the developers began to promote cryptocurrency not as another altcoin, but as a service-“adapter”, an intermediary link between the cryptoindustry and the fiat economy. For a particular trader or investor, the significance of Stablecoin is that the price of cryptocurrencies can always not only rise strongly, but also fall strongly, that is characterized by volatility. Withdrawing cryptocurrencies to stabelcoin USDT protects the trader from losses. In fact, of course, you can just exchange cryptocurrencies for fiat, but the exchange transactions of withdrawal-input lead to additional costs. If one stays in crypto worth about 1 to 1 USD, the extra costs can be avoided. This is the reason for the rapid growth of tokens’ popularity.

Later, USDT began to be used to provide liquidity to decentralized projects (as most of them are ERC-20 tokens), which also added popularity to the cryptocurrency. In general, the developers achieved their goal, now most transactions on cryptocurrency exchanges are conducted in USDT tokens, on derivatives exchanges transactions are also often concluded in Tether, so the sphere of token’s influence is expanding. According to various data, from 50% to 70% of cryptocurrency turnover on cryptocurrency exchanges is provided by USDT. It is impossible to obtain Tether tokens in any other way than buying them on exchanges or through exchanges. USDT is instantly “emitted” when the fiat dollars are transferred to the account of the holding company, and when the money is withdrawn to the user’s account, the tokens “disappear”.

The peculiarity of using USDT is that the network uses Proof-of-Reserves to achieve consensus: the requested amount of USDT is verified on the page https://www.omniexplorer.info/asset/31. The dollar amount is verified with the money in the bank account. In theory, this means that the amount of fiat money with which tokens are backed should match the amount of Tethers in circulation, but in fact this has probably never been the case and is not the case now either.

What is not Tezer?

It is incorrect to say that USDT is tied to the U.S. dollar. It is not tied to the dollar in any way, it is just that when it was created, the token was arbitrarily valued at about $1 without any calculations, just like any developer can value some software he created on his own before selling it. Even bitcoin pricing was more logical – NewLibertyStandart suggested using the cost of electricity used to generate the bitcoins and paid $5.02 for the first 5050 bitcoins based on that. There was nothing like that in USDT pricing. The U.S. dollar is issued by the U.S. government, the Federal Reserve (Figure 2), and the developers of USDT have nothing to do with the issuer of the fiat dollar.

Image. 2

It is very important to understand that tokens are not backed and secured by the fiat dollar as the US state currency, are not a cryptocurrency version of the US dollar, are not its “crypto-avalues”, dollar derivatives and so on, as they are called. Therefore, one cannot transfer confidence in the U.S. financial system and the fiat U.S. dollar to this cryptocurrency. There is no real correlation between USD and USDT. This is also stated in the documentation of the developers of Hong Kong Tether Limited, in which they warn that holders of Tether coins do not need to fully associate tokens with real dollars and that the cryptocurrency is not an electronic expression of fiat money. That is, Hong Kong Tether Limited specifically shows that tokens are not money, they have no real value, and accordingly, the company has no obligation to either guarantee value or return dollars to users. The company can refuse service and compensate loss to users who violate the user agreement or in case of termination of the company. Thus, Hong Kong Tether Limited absolves itself of responsibility, shifting it, in case of anything, to the users who were “warned”.

Historically, the main currency of the world is USD. Ultimately, all cryptocurrencies are exchanged for it, accordingly, it is very convenient to have such a cryptocurrency, which is constantly worth about that much. But it is secured by the money that is only in the accounts of the private company Hong Kong Tether Limited, which issues these tokens. It follows that the issuer cannot issue more tokens than it has real money. In fact, the cryptocurrency community accepted this proposal of USDT issuers and agreed to include them as an intermediary between fiat and cryptocurrency. That said, not everyone thinks this is a good idea and many are sure that sooner or later token intermediation will cost all holders of real cryptocurrencies dearly. But as long as the community is okay with it, and as long as the token fulfills its role, it will remain stable. Again, it should be made clear that community consent is not the only factor in the token’s conditional stability.

Where and how to trade Tether cryptocurrency?

You can buy and sell Tether on the website of the issuer, on a cryptocurrency exchange or through an exchange service.

Tether Limited

First of all, the token can be purchased on the website of the issuer itself, for which you first need to register on the website https://app.tether.to/app/signup (Fig. 3). Tether Limited implies full verification and two-factor authentication. After verification, USDT can be bought for fiat money. To do this, on the Add Funds page you specify the address of your cryptocurrency wallet for receiving and storing USDT, on the Fund from Bank page you specify the bank account.

Image. 3

It should be noted that when buying tokens from Tether Limited, the issuer receives complete information about the buyer – from the place of residence, to the bank account.

Exchanges

Tether tokens are listed in many cryptocurrenciesThe list of which is very large. On many exchanges USDT is positioned as the main currency.

Binance

Crypto Exchange Binance (go online), perhaps the most popular way to buy USDT, here you can buy tokens for fiat money or cryptocurrency, there is a Russian-language interface. To buy, it is necessary to register, an e-mail is enough. In the appropriate section you enter the amount, select the currency, the payment method. To buy USDT for cryptocurrency, you need to make a deposit in the personal cabinet. Then, in the “Trading” section in the top bar of the site, you need to enter the exchange service, select the cryptocurrency and USDT. After that, enter the exchange amount and complete the exchange. Tokens will be credited to the Binance wallet.

EXMO

On the cryptocurrency exchange EXMO (go online) (Fig. 4) the purchase of USDT can be done through the quick exchange service. Transactions can be performed after registration. Transaction is carried out on the main page, where you select the section “Quick exchange”, the function “I give” and the choice of the purchased currency, and in the function “I receive” you select Tether (USDT). After that, you need to click “Exchange” and pay for the purchase in the appropriate way. USDT tokens should go to EXMO balance.

Image. 4

Huobi

Huobi (go online) allows you to buy Tether directly in the OTC trading section. In order to trade on the exchange, it is necessary to register and verify. After verification, the user goes to the OTC trading section of the platform (OTC), selects the cryptocurrency to buy and sell. You can buy USDT through a bank card or via payment systems QIWI or PayPal. Buy/sell transactions on crypto exchanges are generally conducted in the same way. Most of them allow trading without verification, after registration, but it is better to pass it for safety, especially if we are talking about significant amounts of money. It is important to know that crypto exchanges support all or several Tether on the blockchain. And when depositing or withdrawing funds, you need to accurately specify the standard – if the token is sent in the wrong format, it will be lost.

P2P platforms

USDT is also exchanged at P2P venues, including PaxFul (go online), Cryptolocator, Binance P2P Wallet, Bitpapa (go online) and many others.

PaxFul

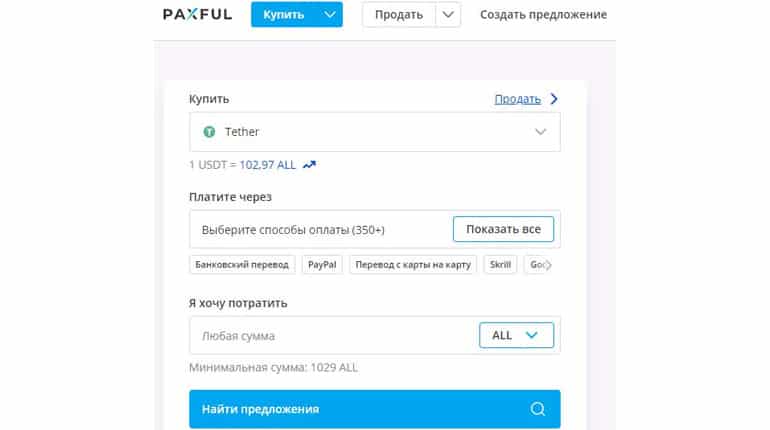

PaxFul (Figure 5) is a service for bitcoin trading. To make transactions, you need to register and verify with the service. After registration, the user receives a bitcoin address to use in transactions. Verification on the service takes up to 20 minutes (at least 3 minutes). To sell bitcoins, including for Tether, you need to enter the appropriate section at the top of the service. On the main page you can view the offers and choose the appropriate one. Using the filter system, the necessary parameters are set. After that, you need to click “Buy” and go to the transaction page. If everything is satisfactory, you need to accept the seller’s terms and complete the transaction.

Image. 5

Cryptolocator

On Cryptolocator service (cryptolocator.com) USDT is allocated in the special section along with bitcoin and ether. After registration and verification it is possible to start transactions. Buy and sell options are placed at the top, on the left side of the site. When clicked, the user receives current offers. The service allows you to sort the counterparties by rating and select them by the time of response to the proposal, including in the profile you can explore the details of the seller. It is also necessary to determine the payment system. Then the transaction form is filled out and the counterparty’s response is expected.

Binance P2P

Binance P2P is a direct cryptocurrency exchange platform within a popular cryptocurrency exchange. Trading on it is also possible only after registration and verification. USDT tokens are almost basic for the service. The advantage of the exchange in this case is that it acts as a guarantor of the integrity of the transaction, keeping the means of exchange in escrow. The order of purchase/sale on the service is about the same as on other similar platforms.

Exchangers

The Exchange – the easiest way to buy/sell Tether. Everyone knows that an exhaustive number of exchangers are presented in the BestChange aggregator. Exchangers do not require verification, you can choose them by rating and reviews. The exchangers with a good reputation include 60cek (go online), 365cash (go online), Prostocash (go online) and others. Buy/sell in the exchangers is about the same: the service offers to select the payment system, the amount, specify the address to which the payment will come. The disadvantage of exchangers is high commissions.

Wallets for Tether

The question of a wallet for storing USDT is important because the tokens belong to different blockchains, mainly USDT Omni (bitcoin, Omni Layer protocol), USDT ERC20 (Ethereum), USDT TRC20 (Tron blockchain). Thus, the most suitable wallets for Omni tokens are Omni Wallet (omniwallet.org) and Omni Core (omnilayer.org). Wallets for Tether ERC20: MyEtherWallet (myetherwallet.com), MetaMask (metamask.io), Guarda (guarda.com), Trust Wallet (trustwallet.com) (application supported by Binance). Wallets for Tether TRC20: imToken (token.im), TronLink (tronlink.org), Math Wallet (mathwallet.org).

Reasons for distrusting Tezer

The main reason for the popular opinion that Tether is a scam is that there is no credible evidence that the issuer stands by its own setup that every USDT is secured by USD. But that is not the only reason for disbelief. Tether may be secured. Or it isn’t. The original reasons for being very skeptical of Tether Limited and their tokens have to do with the fact that the company has been hiding information about itself for some unknown reason. Tokens were issued in 2015, and almost immediately there were rumors that Tether Limited is connected with Bitfinex crypto-exchange probably because the crypto-exchange was the first to integrate this token into its service, when nothing really was known about USDT. But in order to confirm this information, which is nothing special, the research resource Paradise Papers conducted an entire investigation. Nobody understood why they had to hide the obvious fact, but, as they say, “the sediment remained”.

In 2018, Bloomberg published that the main U.S. financial regulator, the Commodity Futures Trading Commission (CFTC), demanded through a court of law that Bitfinex and Tether Limited confirm that the 2.3 billion tokens issued by Tether were indeed backed by the same amount of dollars. The regulator doubted that the company had 2.3 billion real dollars to cover the tokens, as Tether Limited claimed, although the words were not backed up by anything, no audit of the company was ever conducted. As a result, in 2019, it turned out what it should have turned out – the tokens are not backed by dollars in the same amount. The issuer issued a statement saying that the token was backed by reserves, which included fiat, and in addition it was “cash equivalents,” “other assets,” and “forthcoming proceeds from loans that were made to third parties.”

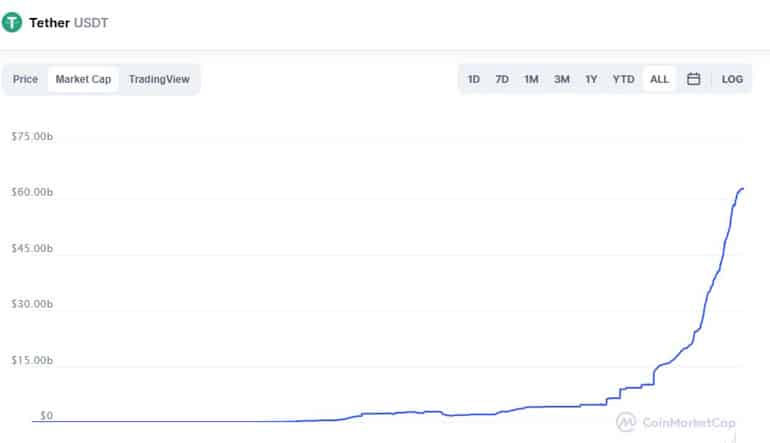

To put it simply, Tether was partially collateralized with dollars at best, the value of a token at $1 was confirmed as if by the “honest word” of the issuer. At that point, it turned out that only about 75% tokens were backed by assets of all kinds. At the end of the fall of 2020, the tokens had a capitalization of about $16 billion. As of today (June 26), Tether’s capitalization is $62.5 billion. The significant growth in token volume is believed to be due to the fact that most traders and investors are now no longer going into fiat on exchanges, but remain in cryptocurrency in the form of USDT. At the same time, the company has continued and continues to issue tokens, which only increases the capitalization of the token, but the issue of collateral remains open.

In March of this year, many, or some, crypto market participants were reassured by the opinion of Moore Global, an independent auditor, on the sufficiency of reserves of Tether Holdings Limited to fully collateralize Tether Stablecoin (USDT). But many were not reassured because the auditor is based in the Cayman Islands. Even earlier, Deltec confirmed full collateralization with reserves. But it is located in the Bahamas and stores assets in the same Tether tokens, as well as directly related to the issuer. The status of the companies confirming collateral is not enough to be fully confident in the stability of stablcoin. The mistrust remains.

Problems with the law

In addition to the pricing at the start of the token issue, the token issuer has become famous for litigation. In 2019, the Bitfinex exchange was charged with covering $850 million in losses with funds from its affiliate, Tether (in a sense, lent to itself, paid its own debt, since both companies are part of the iFinex Inc. perimeter). The New York prosecutor’s office found that Bitfinex had transferred 850 million client funds to the Panamanian payment system Crypto Capital Corp. – and lost access to them. The resulting shortfall was covered by Tether tokens issued, which were printed to the tune of about $700 million.

Bitfinex, of course, denied the accusations, but in early 2021 it repaid the “debt” to the issuer Tether in fiat. To the end, it is still unknown how the debt was formed. Bitfinex and Tether under the terms of the case settlement will also pay 18.5 million to the State of New York, although they did not admit the offense. The most important consequence of this indictment was that the bitcoin exchange rate plummeted – for many it was evidence of a direct link between tokens and bitcoin. The second important consequence was an explicit statement by prosecutors that Tether’s claims that the digital asset was fully backed by U.S. dollars had been false for at least some time – and the issuer knew this, but did not make it public.

Tether and Bitfinex agreed to an amicable settlement so that prosecutors wouldn’t keep poring over documents and discovering all the facts of the irregularities until the end. But under the terms of the settlement, Bitfinex and Tether pledged to stop serving customers in New York state, and to officially publish information about their reserves within two years. Everyone is wondering what that report will be. But the lawsuits are making many even more skeptical of Tether. Not that crypto-enthusiasts are particularly law-abiding, but when it comes to money, more certainty is desired. Interest in token issuers from law enforcement is considered the biggest threat to Tether’s existence. Since there is a lot of uncertainty surrounding Tether, a great many crypto market participants predict that sooner or later the Tether system will collapse because regulators will ban Tether Holdings Limited. If that happens, the entire cryptocurrency economy is believed to collapse, as most of its transactions are conducted through Tether.

Unlimited uncontrolled emission

One of the suspicious features of Tether is its unlimited issuance – the issuer can issue as many tokens as it wants. In theory, they are limited by the fact that each token must be covered by a dollar. But, as we can see, there are reasonable doubts about that. Many have not forgotten the events of late 2017-2018, when Bitfinex suspended service to customers from the U.S. and at the same time the issue of Tether increased dramatically – from 450 million to 2.2 billion. How can something grow four times in a couple of months?

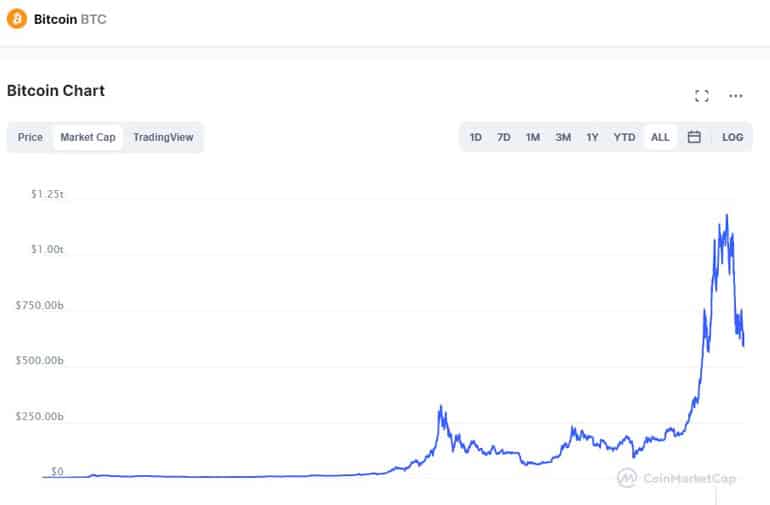

Part of the token growth coincided with bitcoin price dynamics, but Tether peaked when bitcoin’s active growth had already ended, and after that tokens and bitcoin and altcoins developed in different directions. Advanced users have established a clear, consistent correlation between bitcoin price dynamics and Tether issuance. A hypothesis has emerged that bitcoin’s price growth in general is supported only or predominantly by Tether issuance. They also believe that the current dynamics of bitcoin and Tether support their hypothesis. Tether’s capitalization graph on coinmarketcap.com, for example, is considered by many to be very suspicious – despite no developments in the crypto market, it has been rising steadily since the fall of 2018. In theory, Tether, as an intermediary service, implies that users use it when they need to move cryptocurrencies into fiat.

A huge number of investors and traders go into fiat if the price of bitcoin falls – this should have an effect on Tether’s capitalization, too. With Tether’s capitalization steadily rising, the situation looks like users are not withdrawing tokens into dollars at all. There was no flight from the crypto market via Tether during the period of constant bitcoin price decline from about May 2018 to April 2019, although there was a flight from bitcoin itself. In recent weeks already this year, bitcoin has fallen from nearly $60k to $35k. This too should have affected Tether, but it hasn’t (Figure 6,7). Tether’s stability could have been maintained by the same issuance, but what does it provide?

Image. 6

Image. 8

Centralization

Tether is issued by a single organization, which in itself already undermines the idea of a decentralized cryptocurrency system. It is not even a state-owned issuer, but a not very transparent group of people registered in the British Virgin Islands, with an office in Hong Kong but no address, which does not guarantee compensation for loss in case of problems. Basically, it is understandable why many think it strange that most of the crypto market and thousands of decentralized investment projects depend on the well-being of one centralized company.

Conclusion

In general, hardly anyone can firmly declare that Tether is not a scam. On the other hand, now it still generally performs its tasks well and is an important element of the cryptosystem. That’s why each market participant decides for himself how to treat USDT. But it is necessary to follow the news about the token in any case, in order to enter more transparent stablenecoins, of which there are many now.