Universal Trading Strategy “Direction”

ADX is one of the unique indicators, its detailed review can be read on the website InvestMagnates.com. Its addition to the range of tools INTRADE.BAR will significantly expand the horizon of possibilities for traders. If, for example, in practice RSI differs faintly from StochasticsThe ADX is a fundamentally different indicator. In this article we will consider a trading strategy, the main of which is the two indicators – Average Directional Movement Index and Exponential Moving Average, read about all types of this indicator at InvestMagnates.com

Contents

Review of indicators

ADX – this is part of the DMI system, which has gained the greatest popularity. We will not go deep into the theory, go straight to practice. To use this tool, you need to understand its structure. The Average Directional Movement Index consists of three lines – red, green and white.

The meaning of the lines:

- The red (-DI) is an index of negative price movement. The higher the curve is on the level, the stronger the downward price trend.

- Green (+DI) is an index of positive price movement. The line shows the strength of the upward price trend.

- White (ADX) – the curve shows the cumulative strength of the current trend. Its direction does not play a role.

The key point is the intersection of +DI and -DI. This means that one of the forces in the market has gained the upper hand. The potential of the ADX is high because the distance between the curves and their position relative to the white line also matter. The specific numerical value of the index level also plays a role. But in this strategy we will not touch such subtle points.

Exponential Moving Average – This indicator is the second most popular after the simple Moving Average (Simple). The only difference is the modified averaging formula. For ordinary traders mathematical details do not play any role. Therefore, in conclusion of the review, let us note that this indicator is distinguished by a reduced lag without reducing the accuracy of signals.

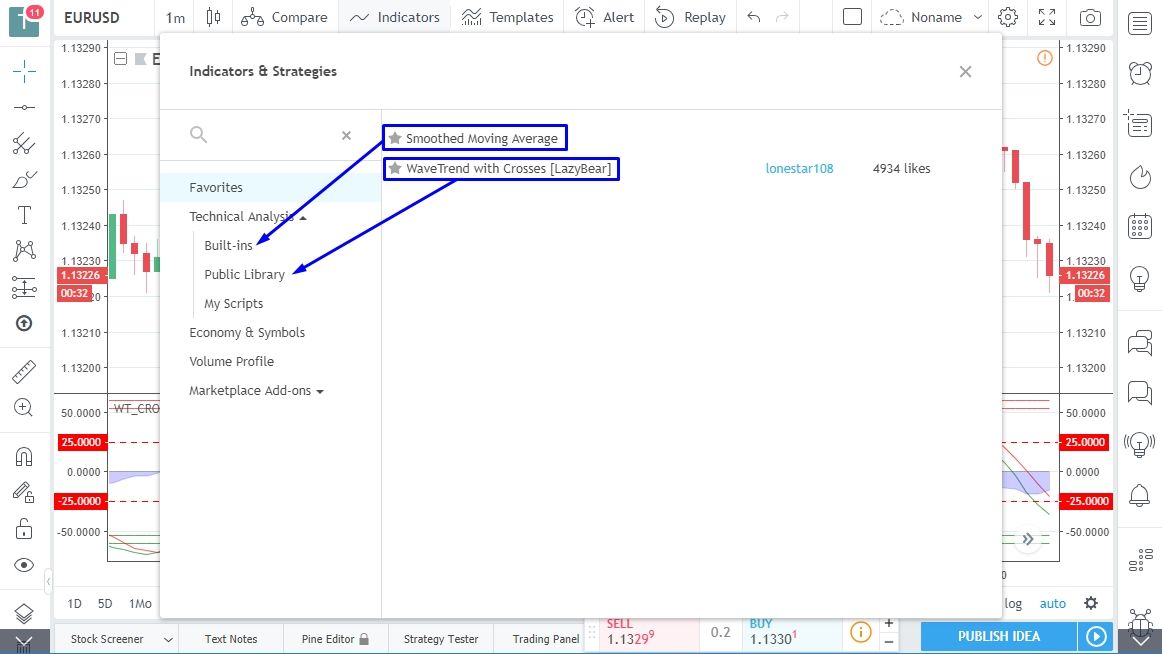

Setting up the trading platform

To begin with, let us note that this binary options strategylike the vast majority of others from our site, is universal. Therefore, the trading asset used does not play a fundamental role. For this purpose volatile currencies or Cryptocurrencies. So, it will be necessary to add two indicators.

- ADX. The main period and the smoothing coefficient is 30.

- Moving Average. Period – 50, type – Exponential, color – any contrast, e.g. yellow.

Indicator-based technical analysis should be performed on a candlestick chart. As for the time frame, this is an ambiguous issue. The strategy is scalable. The main criterion is the observance of the ratio relative to the time frame of the chart and the duration of the transaction. It should be selected in such a way that expiration equal to 3-6 candles from the chart. The optimal ratio: period – 15 sec, expiration – 1 minute, minimum.

Trading signals by strategy

The principle of the trading system is simple. It is the ADX with an increased averaging period and the controlling Moving Average, which allows you to determine the state of the market. Using EMA allows you to filter out a large number of false positives of the indicator. At the same time it compensates for the lag of the ADX due to the period of 30.

- A signal to go up – increase +DI and decrease -DI to the point of their intersection, the growth of the white line ADX, combined with a breakdown of the EMA from below.

- Down signal – decrease in +DI and increase in -DI until they cross, growth of ADX and breaking the EMA by a red candle from above.

An important point is the state of the FVF during the last 10-15 price bars before the formation of the signal. If the distance between the green line and the red line was minimal, they often crossed and built almost in the same plane, it is better to refrain from trading on signal. This is a sign of low volatility.

Example of trading by strategy

The key success factor of a trader is the ability to recognize subtle signals, which together form a complete picture. ADX quite often demonstrates the crossing of lines. Therefore, the sign of a true signal is the formation of the second candle after the breakdown of the Moving Average, which continues the direction of the first.

There was a crossing of the curves +DI and -DI with the output of the latter over the other lines. The signal is confirmed by the formation of the second candle below the EMA. Therefore, we open a down trade.

The deal closed in profit. As a result of the signal we managed to capture the final impulse of the price movement before the downtrend reversal. The picture was taken in the first fraction of a second after closing the trade, so the moment of entry and exit from the market can be seen on the chart.

Conclusion

If you have also studied and Other strategies from our siteYou should be aware of the general trading rules. First, it is a 5% limit on the amount of maximum investment in a trade. Secondly, the standard prohibition on trading in conditions of market flat.

Reviews