Copy Trading vs Social Trading: Differences, Advantages and Disadvantages

Contents

Copy Trading and Social Trading represent two innovative methods of managing investments in financial markets. Copy trading involves investors replicating trades made by successful traders, automatically mirroring them in their accounts. It allows newcomers to replicate the strategies of experienced professionals without needing deep market knowledge.

Social Trading, on the other hand, is a concept where users come together on platforms or social networks to exchange ideas, market analysis, discuss strategies, and copy each other’s trades. It creates a virtual community of traders who interact and learn from one another.

Understanding the differences between copy trading and social trading is crucial for traders planning to choose an approach that best suits their needs and goals. Let’s explore the key characteristics, pros, and cons of each method, and provide recommendations for choosing the right investment management approach.

Copy Trading: Key Characteristics

Copy trading or trade copying, is an investment strategy where a trader automatically copies trades executed by successful and experienced traders known as signal providers. The concept is based on the idea that novices or traders with limited experience can leverage the expertise and strategies of professional users by replicating their trading actions.

In copy trading, clients connect to a platform or service that provides access to trading signals from various providers. After selecting a provider whose results and strategy they find suitable, all trades executed by the provider are automatically mirrored in the client’s account in the same proportional sizes.

Advantages of Copy Trading:

- Access to Expertise: Copy trading allows users to benefit from the knowledge and skills of successful traders without needing deep market understanding themselves.

- Time Efficiency: Since all trading decisions are made by signal providers, traders save time on market monitoring and analysis, allowing them to focus on other aspects of life.

- Portfolio Diversification: Traders can copy trades from multiple providers employing different trading strategies, which helps diversify their investment portfolio and potentially reduce risks.

- Learning by Observation: By copying the trades of successful traders, novices can observe their strategies and decision-making in real market conditions, facilitating learning and skill development.

Disadvantages of Copy Trading:

- Lack of Control: Traders rely entirely on the decisions of signal providers and have no control over trading decisions, which may lead to unforeseen losses if providers make mistakes or use unsuccessful strategies.

- Risk of Fraud: There is a risk of fraudulent activities from dishonest signal providers who may manipulate their results or mislead users.

- Potential Copying of Losses: Despite a provider’s successful history, there is always a risk that they may execute losing trades in the future, which would be automatically copied by traders.

- Dependency on Platform/Service: Users depend on the reliability and stability of the copy trading platform or service they use, which may pose issues in case of malfunctions or technical glitches.

Copy trading offers a convenient way to leverage the expertise of successful traders but comes with certain risks and limitations that need careful consideration before deciding to use it.

CopyFX by RoboForex

The RoboForex platform offers its proprietary trade copying program, CopyFX. To become a part of it, you need to create an account and go to the “Accounts” section. By registering in the CopyFX system one can join the social trading platform, allowing you to copy the trades of successful traders or share your trades for rewards. There, you will see a special form for opening a CopyFX trader account, where you need to specify:

- CopyFX Trader Name: Choose a unique name for your profile.

- Type of Trading Account: Select the type of account, such as MetaTrader 4, MT5 Pro, MT5 ProCent, MT5 ECN, MT5 ECN Affiliate, or MT5 Prime.

- Account Currency: Choose the currency in which the trading will be conducted.

- Leverage: Determine the leverage size for your account.

- Password and its Confirmation.

- Partner Code: The code of the partner who invited you to the platform.

- Additional Information: Enter your country of residence, city, address, and postal code.

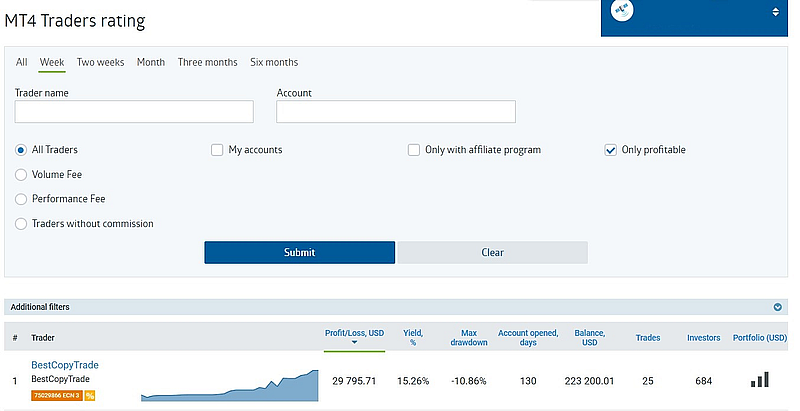

After opening the account on roboforex.com, new tabs with information will appear. You can click on the “CopyFX Settings” button. It will open a window with details about the account type, trader name, account number, password, type, and currency. In the “Trader Ratings” tab, there is a list of users with their profitability indicated in percentages and USD, account opening time, maximum drawdown, balance, number of operations, and investors. For each Forex trader, you can open a profile and study detailed information.

Social Trading: Key Features

Social trading is a concept where traders come together on specialized platforms or social networks to share ideas, analyze markets, discuss strategies, and copy each other’s trades. This creates a virtual community of traders where beginners can learn from experienced participants, and professionals can share their expertise and attract followers. Social trading platforms often include features such as forums, chats, blogs, and the ability to follow the portfolios and trades of other traders in real-time.

Advantages of Social Trading:

- Learning and Development: Social trading provides beginners with a unique opportunity to learn from experienced traders, study their strategies and approaches, and receive valuable advice and recommendations.

- Access to Information: Participants have access to a wide range of analytical data, trading signals, and market reviews, which helps them make more informed decisions.

- Communication and Support: Social trading fosters a community where users can exchange opinions, ask questions, and receive support from colleagues.

- Diversification: The ability to follow different traders and copy their trades allows participants to diversify their investments and reduce risks.

Disadvantages of Social Trading:

- Risk of Errors: Following the recommendations of other traders does not guarantee success. They can make mistakes or face unpredictable market conditions, which can lead to losses.

- Dependence on Others: Social trading can lead traders to become too dependent on the opinions and strategies of others, which can limit their own development and decision-making.

- Information Overload: A large amount of data, signals, and opinions can make the decision-making process difficult, especially for beginners.

- Potential for Fraud: In some cases, unscrupulous traders may spread false or misleading signals and recommendations, which can harm platform participants.

Social Trading from Pocket Option

Pocket Option is a top-tier platform that offers social trading. To take advantage of its features, go to the “Trade” section. In the menu on the left, a “Social Trading” tab will appear. This tab opens a list of traders whose trades can be copied. At the top of the list, there is a convenient filter where you can choose display settings – top traders for the past 24 hours, best trades, top 100, copied trades, watched traders, and traders watching me. There is also a search function to quickly find the trader you need. Additionally, settings are available to enable/disable the display of social trading deals, follow copied traders, and show only trades from the watchlist.

The list of traders includes their names, number of trades, profit amount, and percentage of profitable trades. By opening a trader’s profile, you can see their name, profile level and accounts, status, and number of followers and watchers. Additionally, trading statistics are available for today, yesterday, all time, or a specific period. This includes information on the number of trades, percentage of profitable trades, turnover, profit, maximum income, and largest and smallest trades. In the social statistics section, the number of traders who have copied the trades, rating, status, and awards are displayed.

The “Achievements” tab lists all of the user’s bronze, silver, and gold awards. After reviewing the trader’s information, you can start copying their trades, follow them, or send a message. When selecting copy trading, you need to set up the tool. This involves choosing the copy percentage, stop balance, and minimum and maximum amounts for copied trades. At any time, you can stop copying, view the history, and change the settings.

Traders on Pocket Option whose trades are copied can receive rewards in the form of crystal shards, which can be used to purchase various bonuses in the market. Each time a trade is copied by a trader and its value exceeds $5, you automatically receive crystal shards, which are added to your rewards balance. The color and number of shards depend on the amount of the copied trade:

- Red crystals: from $5 to $49.

- Blue crystals: from $50 to $99.

- Green crystals: $100 and above.

Statistics on copied trades are updated daily, and the corresponding rewards are automatically credited to the balance. The balance is updated daily at 00:00 UTC+2. Once you accumulate enough shards, you can assemble whole crystals. These can be used to purchase various trading advantages in the market.

Comparison of Copy Trading and Social Trading

In copy trading, signal providers are typically chosen based on their past performance, strategy, and other statistical data provided by the platform or service. The process of selecting a provider can be complex, as it requires analyzing multiple factors such as profitability, risk, trading style, etc.

In social trading, the selection for imitation occurs more interactively. Users can observe the activities of other traders in the community, study their strategies, ask questions, and communicate directly. This allows for more informed decisions about whom to follow, based not only on statistical data but also on understanding the trader’s personality and motivation.

Level of Control and Management

In copy trading, traders have minimal control over their investments. They rely entirely on the decisions of the signal provider and cannot intervene in the trading decision-making process. In social trading, traders have more control over their investments. They can choose which signals to copy and which to ignore, based on their own analysis and preferences. Additionally, they can adjust position sizes and manage risks according to their strategy.

Degree of Learning and Analytical Support

Copy trading provides limited learning opportunities, as clients mainly observe the actions of the signal provider but don’t gain a deep understanding of the strategies and analysis used. In social trading, the learning process is more interactive and profound. One can communicate with successful traders, ask questions, discuss strategies, and receive analytical support. Moreover, by observing different traders, they can learn various approaches and trading styles.

Risk and Return

In copy trading, risk and return directly depend on the results of the signal provider. If the provider makes losing trades, traders will also incur losses. On the other hand, successful trading by the provider can bring high returns. In social trading, risk and return can be more diversified, as traders have the opportunity to follow signals from multiple traders with different strategies and trading styles. This can reduce overall risk but may also affect potential returns.

Community and Communication

Copy trading mainly involves a one-way process where traders receive signals from providers, but interaction between them is limited. Social trading involves active interaction and communication within the community. Users can exchange ideas, strategies, analysis, and support each other. This creates a valuable environment for learning, collaboration, and developing trading skills. The choice between copy trading and social trading depends on individual preferences, level of experience, risk tolerance, and desire to participate in the trading and learning process.

Recommendations for Traders: Which Approach to Choose?

When choosing between copy trading and social trading, it’s important to consider your individual goals and trading style. If you’re a beginner and want to learn through practice, copy trading can be an excellent choice as it allows you to follow the experienced traders.

If you’re more experienced and looking for active participation in a trading community, exchanging ideas and strategies, social trading can offer a richer experience. Determine whether you want to passively copy trades or actively participate in discussions and market analysis.

Regardless of the chosen approach, risk assessment and potential return are key factors. In copy trading, it’s important to choose traders with a proven track record of success and consider their risk level. Social trading requires additional analysis and filtering of signals and recommendations to avoid mistakes and potential losses. In both cases, it’s useful to set a personal risk limit and carefully monitor your portfolio, regularly reviewing your strategies and adapting them to changing market conditions.

Choosing the right platform or service plays a crucial role in trading success. When selecting a copy trading platform, pay attention to its reputation, trading conditions, commissions, and trade execution quality. Study user reviews and check for licenses and regulations.

For social trading, the platform’s functionality, presence of an active trading community, access to analytical tools, and the ability to exchange ideas in real time are important. Try using test versions or demo accounts to evaluate user-friendliness and user support.

Conclusion

Each method has its unique features, advantages, and disadvantages that need to be carefully studied before deciding which approach better suits your trading goals and preferences. Copy trading is attractive for its simplicity and the ability to benefit from the expertise of successful traders without the need to conduct your own market analysis. However, this approach also comes with risks such as lack of control, dependence on the signal provider, and potential copying of losing trades.

Social trading, on the other hand, provides more control and flexibility in choosing signals to copy. It also promotes the learning and development of trading skills through active interaction with the trading community. Nevertheless, this approach requires more active participation and responsibility from the trader and can be more challenging in managing risks when copying signals from multiple sources.

Regardless of which approach you choose, it’s important to study its features, risks, and potential benefits. Understanding your trading goals, level of experience, risk tolerance, and preferences for learning and communication will help you make an informed choice.

Reviews