Binance Crypto Exchange: Breakdown of the Basics and New Opportunities

Crypto Exchange Binance (go online) – the largest cryptocurrency exchange in the world, it has a huge volume of cryptocurrency turnover, a huge number of users, easy registration and work on it for beginners and inexperienced users. At the exchange well worked out the basic functionality, if you work carefully, there are almost no failures and difficulties. The advantage of cryptocurrency exchange is that there are always new progressive methods of working with cryptocurrencies.

Contents

Getting Started on Binance

Let’s look at what you need to do to start trading on a cryptocurrency exchange

Registration

You can register an account very easily, through e-mail or through a phone number. It is better not to forget the invented password, because if you forget it, then you can not enter immediately – the service requires a code, sends, confirms, but when you try to enter with a new generated password again throws out in the e-mail confirmation service. This can happen several times, but you should not lose persistence too, sooner or later you will manage to log in with a new password. When logging in the user receives a notice from which you can see that the location is determined by IP inaccurately. But from a trading or investment point of view this does not matter much. In addition, registration by phone number is not possible for all regions.

The exchange supports 33 languages. In order to avoid errors when registering, it is better to immediately switch to the desired language. By the way, it is useful to make sure that crypto exchange Binance, this is exactly a crypto exchange Binance, not a phishing site with a similar name. Beginner users of the exchange on login can receive explanatory information in the form of a pop-up notification with text, through which you can go to the relevant pages. Also, from the very beginning it is possible to select the fiat currency for which the cryptocurrency is supposed to be bought. And here you can start buying cryptocurrency (Fig. 1). When you go to the buy service, you can see the offer to buy bitcoin, etherium, the new cryptocurrency Link in the dollar equivalent of the cryptocurrency exchange (BUSD) and are given an explanation of how to buy a cryptocurrency. To the right of the graph of the price of the coin to be bought there is a simplified purchase service via bank card.

Image. 1

Authentication

It is possible to work on the exchange after the initial verification, but experienced users always recommend securing the account and immediately connect the two-factor authorization to enter. Most often Google authorization is connected and the Google Authenticator app for Android or IOs is downloaded, while it is better to record and save the key to restore access (back key).

Verifying your account

Verification on Binance cryptocurrency exchange is optional, if you are going to withdraw money from the exchange in the equivalent of less than two bitcoins. If more, you will have to verify your account. In principle, the fact that verification is not necessary is a marketing gimmick, because one way or another, you will have to verify. To verify you will need to enter your name, date of birth and residence address, and upload a photo of your ID card and your own photo as proof of identity. Verification can start 3 times a day. The point is that the process on the part of the user must be continuously completed within 15 minutes, so it is necessary to prepare for it in advance.

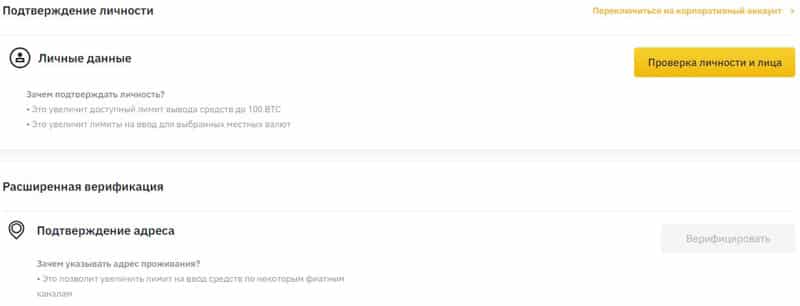

But situations are different, and it may happen that the user has to interrupt the verification. Then it is possible to start the process all over again, although too frequent repeated verification attempts can raise suspicions of bad intentions. This matters now, as tightening legislation is forcing crypto exchanges to adhere to KYC (“Know Your Customer”) requirements in order to prevent money laundering through cryptocurrencies. Technically, the verification process from the beginner’s side looks like this: after registering, you need to find the “Verification of identity and face” form (Fig. 2), select, take a photo or scan and upload the document used for verification.

Image. 2

Then you need to take a picture of your face as clearly as possible. The format for photos or scans of documents and faces is JPEG or PNG. The photo should be in color. The scanned or photographed document should be original, not a copy, the photo should be close to the official – without unnecessary details in the frame, without glasses, hat and other things. Then the images are sent for verification, which must be completed within 1-3 days. If it was unsuccessful, you can go through it again in 24 hours.

Depositing and withdrawing to Binance

Let’s look at how the funds are credited to the account of a cryptocurrency.

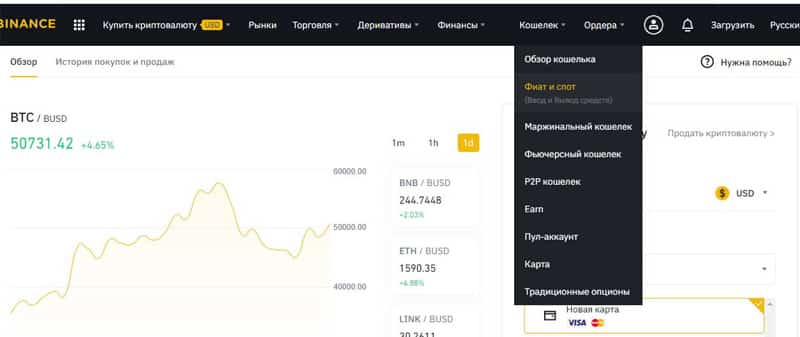

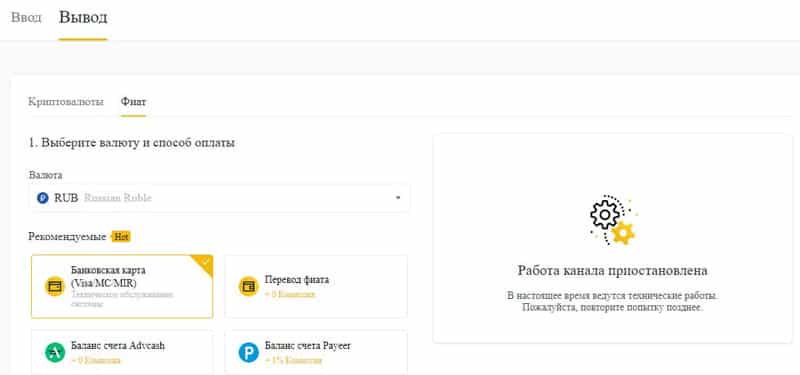

Fiat

To deposit fiat money to your account, you need to go to “Main Account” through the spot wallet (Fig. 3), then to the subsection “Input” and go to the tab “Fiat”, where you choose the desired currency. By default, the section is set to the currency that the user selected for payments during registration. But you can change it in the fiat section when depositing funds. Service recommends different methods of input. When trying to conduct the process of fiat input to its logical conclusion it will be necessary to verify the account and confirm the identity.

Image. 3

You should also take into account the fees of payment systems when depositing fiat to cryptocurrency exchange. For example, when entering euro from Visa or MC card, the commission is 1.8%, and when entering ruble 3.3%. Not all types of input are subject to commission. Fees depend on user status, form of payment and other parameters, specific fees can be found for each case on the corresponding page. In addition, the crypto-exchange periodically holds promotions on the deposit of funds without commission, for example, until April 2020 the deposit and withdrawal through Payeer were carried out without commission. In addition, it is necessary to pay attention to the limits that are displayed when entering the amount. By the way, you can buy cryptocurrency not necessarily throwing money on the balance, but directly through the fiat gateway Binance from credit or debit card VISA/Mastercard. But you’ll have to be verified as you go through the process. Once the spot wallet is funded, funds from it can already be deposited to other cryptocurrency accounts – margin, futures, p2p wallet – instantly and for free.

Cryptocurrencies

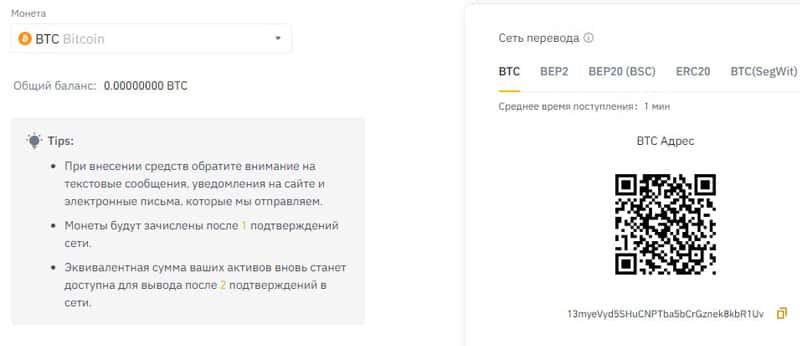

The algorithm for entering cryptocurrency to cryptocurrency exchange is about the same from different wallets and different cryptocurrencies. In the “Wallet” section, you need to move to the “Main Account” subsection of the “Input” service and select “Cryptocurrencies”. Next, you need to select the cryptocurrency from the available Bitcoin, Ethereum, TetherUS, USDT, BNB, EOS. You can also choose the network to withdraw from, for example, for bitcoin – BTC, BEP2, BEP20 (BSC), ERC20, BTC (SegWit). Before depositing funds into your account, make sure that the chosen network corresponds to the platform network from which the funds are withdrawn. Specifically, BEP2 stands for Binance Chain network, BEP20 stands for Binance Smart Chain (BSC) network, ERC20 stands for Ethereum network, OMNI stands for OmniLayer, which is based on the Bitcoin network, TRC20 stands for TRON network, BTC stands for Bitcoin network, BTC (SegWit) stands for Native Segwit (bech32), with addresses starting with “bc1”.

The network must be chosen based on the data provided by the external wallet or cryptocurrency, from which the funds are credited (cryptocurrency trading). Experienced participants of the crypto market pay attention to the fact that one should not strive to choose the network with the lowest commission – this is a typical mistake of beginners – if the network is not compatible with the platform, the money will simply disappear. For example, ERC20 tokens can only be sent to an ERC20 address. In most cases, you don’t need to do anything at all with the network, because the specific address to be credited is indicated on the right side of the cryptocurrency selection service (Fig. 4). It must be copied and entered into the address section of the platform from which you plan to withdraw funds. For cryptocurrencies to be transferred to Binance, a different number of confirmations are required, but if everything is done correctly, there are almost no problems with crediting funds, although the specifics of cryptocurrencies is that it does not happen instantly and sometimes you need to be patient.

Image. 4

Withdrawing funds from cryptocurrency exchange binance.com

Let’s look at what methods crypto exchange offers to withdraw funds.

Cryptocurrencies

Withdrawal of funds is also performed in the “Wallet” section, subsection “Wallet Overview”, tab “Withdrawal”, where you need to select “Cryptocurrencies” or “Fiat”. When withdrawing the cryptocurrency, you need to select the desired one and determine the network. Then you need to enter the address of the recipient, and to do this, you must first go to the “Address Management” service. Then you need to click “Add address for withdrawal” function, choose the coin, network and information about the address. You can name a purse so you know which recipient the withdrawal address refers to later. MEMO field sometimes needs to be filled – and this issue should be clarified, otherwise the funds will go nowhere and will not come back.

In particular, when sending funds to another cryptocurrency MEMO will likely have to be filled, as many wallets use MEMO as a payment identifier. After that, you can mark the address in the white list and “Send” – “Send Code”. The next time this address can be downloaded from the white list to send immediately. The code will come by e-mail or phone or in the Google Authenticator application. The code is entered in the appropriate place and the money is sent to the specified address. It is extremely important to make sure that the data entered is correct, so it is necessary to check twice, three times, as many times as necessary to make sure that the details are accurate, because the slightest inaccuracy will lead to unrecoverable loss of funds – this is a critical vulnerable link in cryptocurrency transactions.

Fiat

To start withdrawing fiat currency, you need to choose the type of account in the “Wallet” section (Basic, Margin, Futures, etc.), in the “Withdrawal” subsection you select the “Fiat” tab. Then you should select the currency in which you plan to withdraw. It should be noted that there may be problems with withdrawal (Fig. 5) – both with individual currencies, and with Fiat withdrawal service in general.

Image. 5

You should be prepared for the fact that the exchange can suspend the withdrawal, for example, at a sharp rise in the price of the cryptocurrency. Usually, the exchange later justifies itself by the fact that there turned out to be too many people willing to withdraw money, although it constantly engages in self-promotion as an exchange that can handle a huge volume of transactions. If there is no withdrawal in a particular currency, you can try to withdraw in another fiat. But, in any case, fiat withdrawal requires account verification. Objectively, there are not very many methods available for fiat withdrawal, depending on the specific cryptocurrency, but most importantly, it is possible to throw money immediately to Visa or MC card. Service gives the recommended methods of withdrawal of currency. And you need to pay attention to the amount of transfer fees, although almost all fees are small. There are restrictions on the withdrawal of funds from the exchange, the minimum withdrawal amount depends on the specific cryptocurrency and is specified in the withdrawal window in the “Quantity” column. Limits are expanding with the deepening of verification.

Earnings on Binance Crypto Exchange

Let’s take a look at how you can earn on this crypto exchange (How to make money on cryptocurrency).

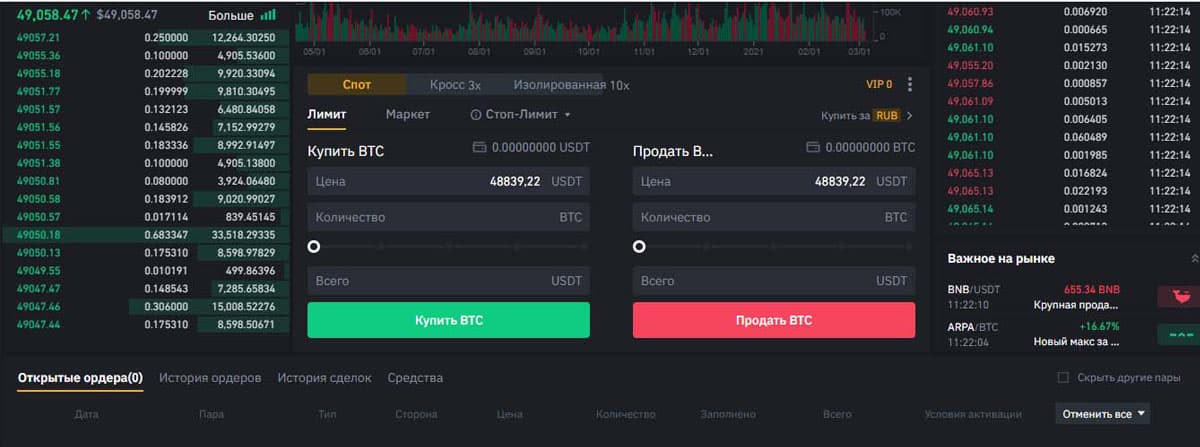

Standard Trading

Binance provides different modes and methods of trading cryptocurrencies. The main terminal is presented in basic and advanced versions. They differ in the set of trading indicators and tools for technical analysis. You can start trading in the “Trading” section. The first offers the simplest method – conversion, an over-the-counter exchange of money. It is carried out on the most simplified scheme: you select a coin to sell and a coin to buy, the amount is determined and the deal is done. Classic Trading – the main mode of trading on Binance, represents the terminal, which has a number of basic options for trading: the choice of currency pairs, stock market, buy and sell orders panel, chart, trading history. Despite the fact that this is a really basic version, it is quite powerful and it takes time to get used to its functionality. Although, actually, buying/selling is simple, like on most cryptocurrency exchanges, in the service under the price chart (Fig. 6).

Image. 6

Advanced trading implies the ability to use additionally all the technical analysis tools available on the crypto exchange. But, in general, it is an extended version of the classic interface.

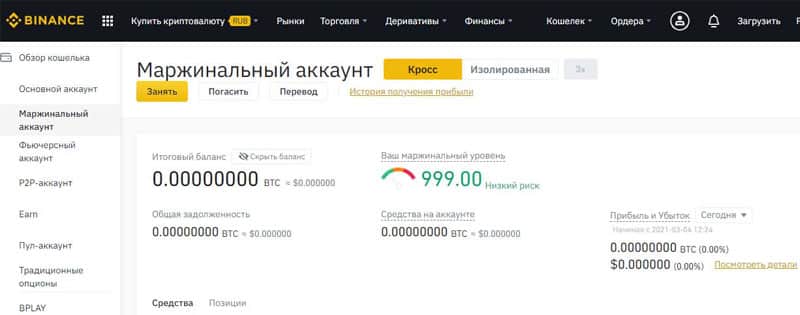

Margin Trading

The “Trading” section on Binance also includes margin trading – trading using borrowed funds. This is a relatively new way of trading for cryptocurrencies, in the sense that until recently, cryptocurrencies did not officially support margin trading. To participate in margin trading on a crypto exchange, you need to verify your account, deposit money into your balance and enter the “Margin” subsection. Before starting to familiarize with the interface, it is suggested to read a training video and take a test, and this should be done if a trader is trying to engage in such a risky way of trading as margin trading for the first time. To work, you need to open a specialized account, – go to the “Wallet” section, and click on the appropriate section on the left (Fig. 7).

Image. 8

It is impossible to open a margin account without funds on the user’s balance. After replenishing the balance you need to “Open margin account” in the menu that opens, read the terms of the agreement and confirm the terms of this agreement. After activating the account, you can start trading with the leveraged assets. There is a “Borrow” function in the margin account. Click on it to define the leverage size and confirm the loan. The amount of credit directly depends on the size of margin account. For example, if the user has half a bitcoin in his account, he can borrow one bitcoin, the rate will be hourly and determined by the selected cryptocurrency. The interest can be seen in the “Margin Data” section. If a functioning margin account is open, the loan can be automatically received.

If there is money on the account, and the leverage size is selected, you can move to the appropriate trading section, where you set the desired type of order (limit, market, stop-limit), select the mode “Cross 3x” or “Isolated margin” (when buying), make an order using the “Margin Buy/Sell” button. The difference between cross and isolated margin is that in the first case, when using cross margin you can add assets to a losing position, this significantly reduces the risk of liquidation. Isolated margin implies a fixed amount of margin, which means automatic liquidation of a losing position and the loss of the amount traded, but not the entire balance. The margin wallet shows the level of markup with a color indicator showing the risk level of the trader. The exchange sends a margin call if the amount of collateral is insufficient and it is necessary to replenish the deposit to continue betting. Repayment of the loan is carried out in the account, you need to click “Repay” and repay the entire loan, including interest.

And to withdraw the earned money, you need to fix the profit, transfer money from the margin account to the main balance. To do this, open a wallet, specify the withdrawn cryptocurrency, specify the amount of money, the direction of movement, confirm the operation. Withdrawal of money from the margin account is also possible with an outstanding loan, but it increases the risk of liquidation of an open position. Moreover, the exchange can confiscate all funds from the user’s deposit. Accordingly, it is necessary to understand the technology and features of margin trading, because it is a risky method of earning, and one of the fastest ways to plunge the user into debt. But there is no denying that with the right calculation it is also a fast way to maximize profits.

New methods of crypto trading

Let’s look at new ways of trading, offered by cryptocurrency exchange.

P2P trading

Another, relatively new method of trading on a crypto exchange – P2P trading – is quite simple and fast. It is provided by card transactions and a hundred more ways of depositing money: cash, electronic payment systems, bank transfers, and so on. In fact, this method is a direct trade of cryptocurrencies between users – one user sells cryptocurrency, another – buys, and the cryptocurrency exchange in this case acts as a guarantor of the integrity of the transaction. During the trading process, the trader selects the value of the coin, the payment method, concludes the transaction directly with the counterparty, changes the fiat asset offline, and confirms the transaction online. The cryptocurrency remains on deposit until the seller confirms receipt of the money. By the way, the exchange supports and provides the opportunity to exchange some cryptocurrencies in person, in cash, but only for qualified merchants.

Futures

An exchange would not be an exchange if it did not offer derivatives trading. These Binance features are placed in the “Derivatives” section. A futures account is opened by clicking on the corresponding button, but you can work with it only after topping up your balance and transferring money to your futures account. After the registration is complete, you can move to the futures contracts trading terminal (Fig. 8). Here you can set up leverage, track mark-to-market prices, track time to delivery of financing, control positions in the auto-deleverage queue and, of course, track price dynamics over the past 24 hours, as well as daily trading volume.

_

On the right side is a trading window where you can open positions, place orders or transfer funds from the main wallet of the exchange, a calculator, which calculates the profit/loss, target price and liquidation price, also here is a calculator on Binance Futures, order book with configurable depth and broadcast of all ongoing transactions in futures.

Traditional options

A new trading method for the Binance exchange is trading traditional options. This service uses USDT Stablecoin as the base currency. Option mark price is calculated by the exchange based on the position security and unrealized profit or loss, such price can be used as the base price of an option contract at the current moment. The option buyer must have the means to execute the trade. The option seller must have the funds to post a margin deposit. Accordingly, before any transactions with options, it is necessary to top up the balance and deposit money into the futures account. The interface of the Binance Vanilla service is a service consisting of two parts – Call on the left and Put on the right. At the top are the functions to monitor the status of transactions, and under them are the indexes of open positions.

The practice of trading options on the exchange is generally straightforward – one chooses the expiration date and direction. If it is assumed that the price of the cryptocurrency will rise, Coll is purchased, if it is assumed that the price will fall, Put is purchased. Then the transaction amount is specified and the order is confirmed, thus opening a position. The position can be closed before execution. To do this, go to the open positions tab, calculate a profit or loss, and confirm closing. If the trader has not closed the position, the system will close it automatically when the position expires. The crypto exchange warns users that trading options is a risky method, only the user is responsible for the results.

Leveraged tokens

Leveraged tokens are another new trading method for a cryptocurrency exchange. The service itself assumes that leveraged trading is available to those who are not well versed in leveraged trading, so the exchange removes liquidation risk (which does not reduce the overall risk of this method of trading).Leveraged tokens are in demand because they allow to manage liquidation risk – this reduces the probability of closing a position. Trading tokens with leverage allows you to engage in margin trading under a simplified scheme. Leverage is adjusted automatically, which allows you to create more profitable positions.

The interface for leveraged token trading is simple, with a list of tokens, leverage value, last price, 24-hour change, and three possible operations: “Trade”, “Sign”, or “Redeem”. Despite the fact that the functionality for this type of trading visually looks very simple, attention should be paid to the trading description that the crypto-exchange provides. Leveraged token trading itself on a crypto exchange even with a reduced risk of liquidation is not easy and often leads to losses, so at one time it was closed on Binance due to complaints from users, but then trading was restarted. In order not to lose money, it is not unreasonable to find an explanation of trading with concrete examples on the Internet. There is not enough information on Binance itself to organize safe leveraged trading.

Advanced earning methods

Consider how else you can earn on the cryptocurrency.

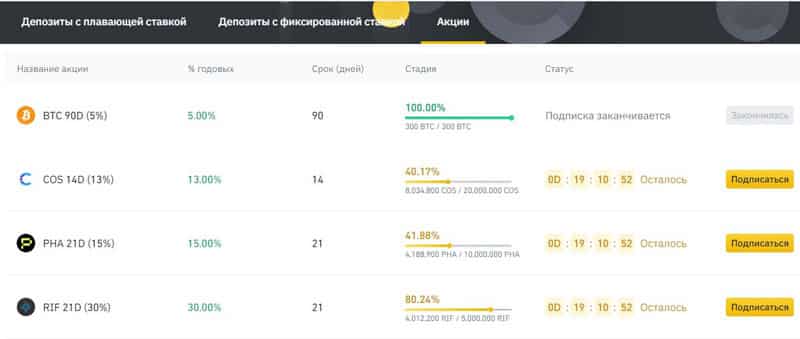

Binance Lending

The Binance Lending platform is designed for passive income by saving unused cryptocurrency assets. The method is generally well known, similar to a bank deposit – funds are frozen for 14 days and then returned with accrued interest. The annual interest rate ranges from 7 to 15 %. The project offers three types of financial products – floating rate deposits, fixed rate deposits, promotions. The interface for work is quite simple. For floating rate deposits, the coin, 7-day yield, estimated yield and dynamics for the previous day, floating yield per thousand tokens are specified. For fixed-rate deposits, the coin, the annual percentage, the term in days and the coupon per lot are specified. For shares, the name, percentage per annum, term in days, stage and subscription status are indicated (Fig. 9).

Image. 9

Accordingly, the lot is selected, the purchase conditions are evaluated, and the purchase is made from the exchange account (not from the margin account and not in pending orders). After a certain period, the deposit, together with the interest, is credited to the balance.

Double deposits

Such method of earning as double deposits is a passive, but risky income, which is accrued regardless of the direction in which the cryptocurrency market goes. The Binance Dual Investment strategy involves investing in two assets with a fixed rate of return. The profit calculation is based on the estimated price and the pegged price. If the market price of cryptocurrency assets increases, the investor’s income will exceed the investment. If the market price of cryptocurrency assets falls, the investor receives income from interest on the deposit. The minimum and maximum investment amount of a dual investment depends on the specific offering, the yield depends on the price of the specific asset.

Steaking

Staking is another method of passive income from cryptocurrencies. Technically, stacking is the process of locking digital assets in a Proof of Stake type blockchain for a certain period of time in order to receive a reward. In Proof of Stake (PoS) cryptosystems, the bigger reward goes to the one who owns more coins. But on the Binance cryptocurrency exchange, it is a financial product for guaranteed income from staking, simply by holding coins on the exchange’s balance sheet. There is no need to understand the technical nuances of PoS. You need to go to the service of staking through the section “Finance”, in the subsection “Binance Earn”. All the user has to do is to top up his account with coins or buy them. Remuneration parameters are presented in lot descriptions.

A separate way to earn money on Binance is through Ethereum (ETH) stacking to support ETH 2.0 network upgrades. The user receives BETH tokens at the same value as ETH as income. The minimum investment amount in the project is 0.0001 ETH. DeFi is a variant of staking in “decentralized finance”, which initially implies certain technical knowledge. But on Binance a simplified, accessible to all DeFi stacking is possible. DeFi projects are high-risk, the entire responsibility for the outcome falls on the investor, the exchange only provides opportunities for investment. The minimum investment amount is at least $100.

Binance Liquid Swap is another way to make money on the Binance cryptocurrency exchange, related to stacking, in which the investor works with a pool of liquidity. Each pool has two tokens, the price is determined by the relative number of tokens in the pool. The user selects a pool of liquid trading pairs and invests in it and the system converts the money into two tokens taking into account the ratio of prices of the current pool of trading pairs and replenishes the liquidity pool with the corresponding volume. After stacking, part of the pool can be closed, the sum is fixed and the share of commission from operations in the pool is accrued on it. The method is placed in the section of high risk strategies “Binance Earn”.

Launchpool is a method of earning associated with steaking in BNB, Binance USD tokens, ARPA or ONT. It assumes remuneration in the form of tokens, which the user receives by sending his coins to the staking. All parameters are specified in the corresponding subsection of the service “Binance Earn”. DeFi-projects Bella Protocol and Wing are now available on Launchpool. It should be recalled that Bella is a platform for DeFi products with decentralized banking, adapted for inexperienced participants of the crypto market, so that they can perform all transactions in one click. Wing is a DeFi lending platform that interfaces between different blockchains and decentralized financial products.

BNB Vault

BNB Vault is a way to earn money, which implies participation in projects of Binance cryptocurrency exchange and getting remuneration for it. The calculation of income and interest is calculated separately for each project, the minimum investment amount depends on the specific offer, as well as the annual yield. This method belongs to the risk-free ways of earning. Log in to the service through the section “Finance”, in the subsection “Binance Earn”.

Promotions

Binance regularly holds promotions to attract new users. But in this case, users already working on the exchange can earn additional income. The minimum investment amount depends on the lot size of a particular product, the annual return also depends on the terms of the promotion, there is virtually no risk in this way of earning.

Binance Projects

Let’s see what projects and services the crypto exchange offers.

Binance Fiat Gateway

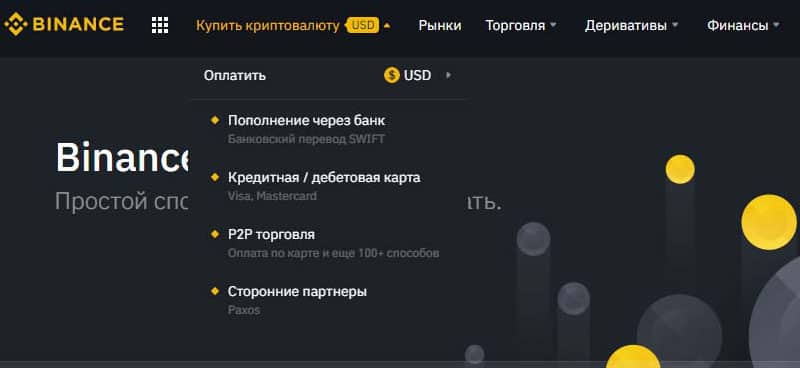

Binance Fiat Gateway is a service of buying or selling cryptocurrency for fiat money, directly to Binance balance (Figure 10). Transactions are possible by bank cards and with stabelcoins. The service is located in the “Buy Cryptocurrency” section. The method of replenishment depends on the specific currency. For example, for the dollar it is deposited through a bank, SWIFT bank transfer, credit/debit card, Visa, Mastercard, P2P trading, Paxos. For Euro – deposit via bank transfer, SEPA, credit/debit cards Visa and Mastercard, P2P, BANXA, Simplex. The service is as simple as possible – when the purchase process starts, it automatically goes to the desired service, the corresponding data is entered and the purchase is completed.

_

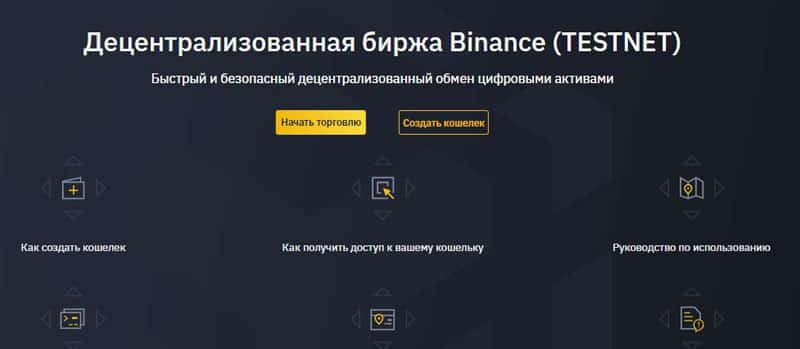

Binance Dex

Binance Dex is a decentralized (base Binance – centralized) cryptocurrency exchange, which operates on the blockchain Binance Chain (Figure 11). It provides standard crypto-exchange functionality – wallet management, private key storage, asset exchange, and it also has a BNB exchange token, which was transferred to this blockchain from the Ethereum blockchain (ERC-20).

_

The user is registered on testnet.binance.org, where a wallet is created (Create a wallet) where special attention should be paid to the creation, saving the password and the way to unlock the wallet. After unlocking the wallet the user goes to the trading platform. Binance DEXThe terminal on the Binance Dex exchange has the standard functionality familiar to all cryptocurrency traders and almost no different from the interface of the Binance exchange itself.

Binance JEX

Binance JEXBinance JEX (jex.com), a new exchange platform for trading cryptocurrency options and futures, based on Binance, is so far only functioning in English and Chinese. But it can be accessed from an account registered with the underlying cryptocurrency exchange. It can be accessed with the same account used for the main exchange. The difference can be considered an exchange token JEX, which is used to trade on the platform. For example, trading options locks a certain margin and number of JEX tokens. When the option is closed, the user determines the selling price and receives a return on the sold asset and commits to sell the contract. So far, it is not quite clear why you need to trade on this crypto exchange, as there is nothing fundamentally new compared to Binance on JEX. The trading functionality is the same as on Binance. But perhaps it is convenient to concentrate on trading only options and futures on the exchange.

Binance OTC

OTC Binance – OTC portal for the toughest traders, because it is specialized for trading amounts of cryptocurrencies equivalent to 1 BTC, but the exchange focuses on amounts greater than 10 BTC. And to start using the services of OTC Binance can verified users who trade in volumes from 20 BTC. Transactions are executed off-exchange and do not show up in the order book on the underlying Binance platform, though linked to the buyer and seller accounts on it – so a user logs into his OTC account from his Binance account. This separation of powers should help maintain confidentiality when trading large volumes, while continuing to use the functionality of the crypto-exchange and using the same wallets. That is, there are no technical differences from the standard functionality of Binance.

Binance Card Debit Card

The Binance Card debit card appeared in 2020. With it you can pay for purchases in the store – offline or online, but with cryptocurrency. However, ordering and processing the card will be relatively expensive, the equivalent of $15. The debit card represents the ability to use cryptocurrencies in the real world, which, in fact, is a revolutionary step in the development of cryptonomics. When you pay, the Binance Card automatically converts cryptocurrency into fiat instantly.

Of course, while the card can be ordered and used not in all countries, the list of acceptable regions should be consulted on the website of the exchange. To order a Binance debit card can only users who have passed the second level of verification of the account on the exchange. To be able to credit money to the card, you need to go to a special Card Wallet and transfer cryptocurrency from the spot wallet to the card within the daily limits. The balance of the card is displayed in the currency that was specified by the user when registering the card. In principle, when registering, ordering, delivering and using the card there are no significant differences from the usual bank card, the card standard is Visa.