The Best Cryptocurrency Exchanges: Top 10 Platforms for Successful Trading

The best crypto exchanges make buying, selling, and trading popular cryptocurrencies, NFTs, and other digital assets easier. In this article, we’ll answer a key question for traders: what are the top 10 crypto exchanges available today?

Whether you’re looking for platforms with the lowest fees, highest security, or the best options for trading Bitcoin and other top-performing coins, we’ve got you covered. Let’s explore the world of cryptocurrency trading and find the right exchange for your needs.

Contents

What Are Cryptocurrency Exchanges?

A cryptocurrency exchange is an online platform where users can buy, sell, and trade cryptocurrencies. These platforms serve as marketplaces for exchanging digital assets like Bitcoin (BTC), Ethereum (ETH), and other cryptocurrencies, often paired with fiat currencies (e.g., USD, EUR) or other cryptocurrencies.

10 Best Cryptocurrency Exchanges

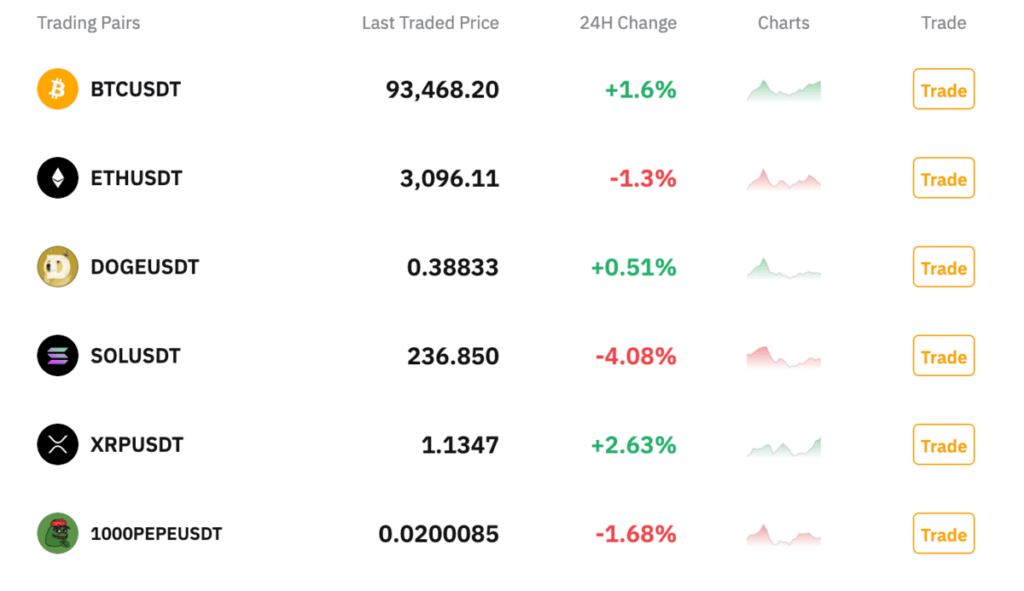

Binance

Best for: variety and trading features

Binance is one of the largest and most popular cryptocurrency exchanges worldwide, offering a wide selection of over 350 digital assets for trading. With its extensive range of features, Binance caters to both beginners and advanced traders seeking a powerful platform with advanced tools.

Unlike many best crypto exchanges, Binance stands out with its diverse range of trading options. Users can engage in spot, futures, margin, and staking trades, providing ample opportunities for growth. The platform supports a variety of fiat currencies, making it accessible to both retail and institutional investors. Binance‘s low fees make it an attractive option for those looking to maximize their returns.

Additionally, users can leverage up to 10 times their initial investment in margin trading, allowing for greater flexibility and potential profits.

Coinbase

Best for: cryptocurrency selection, beginner crypto trading

Coinbase, one of the largest U.S.-based cryptocurrency exchanges, offers a user-friendly platform with access to hundreds of cryptocurrencies. It caters to intermediate and advanced traders, as well as institutions and high-net-worth individuals, with its Pro, Advanced Trade, and Prime platforms.

With a low account minimum, Coinbase makes it easy to get started and provides secure digital wallet storage for your cryptocurrencies and other digital assets. Additionally, Coinbase’s beta NFT trading platform offers no transaction fees for creators and collectors, enhancing its appeal for those interested in digital collectibles.

ByBit

Best for: advanced trading features

Bybit is a global cryptocurrency exchange known for its advanced trading tools and features, making it a popular choice among experienced traders. The platform offers a wide selection of cryptocurrencies, including options for spot, margin, and futures trading, with up to 100x leverage available for certain pairs.

Bybit’s intuitive interface and robust charting tools are perfect for traders looking to execute complex strategies and manage large volumes. The exchange also offers low fees, high liquidity, and secure asset storage options. Additionally, Bybit provides access to staking, lending, and borrowing services, making it a comprehensive platform for serious crypto investors.

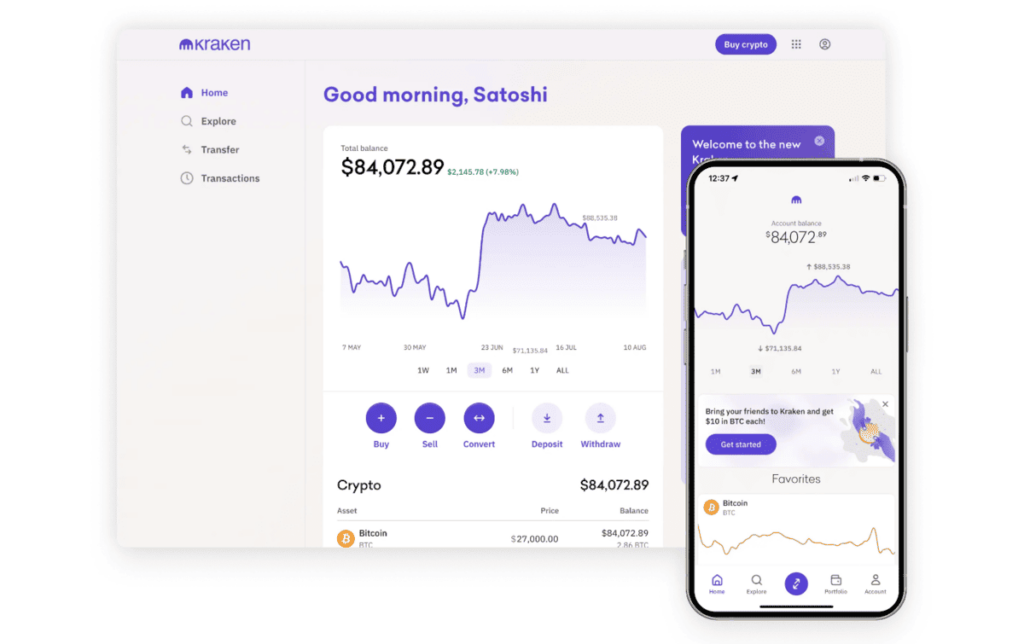

Kraken

Best for: security, low fees for advanced trading, and a large selection of cryptocurrencies

Kraken is a highly reputable and long-standing cryptocurrency exchange, known for its strong security measures and comprehensive educational resources. With over 200 available cryptocurrencies, Kraken provides a secure platform for investors seeking a reliable trading experience.

Compared to the other best crypto exchanges, Kraken puts a strong emphasis on transparency and security. The platform offers support for various fiat currencies, catering to both individual and institutional investors. Additionally, Kraken offers margin and spot trading options, allowing users to leverage up to five times the value of their account funds. This increased liquidity helps to enhance trading volumes and opportunities.

Furthermore, Kraken’s transactions involving Non-Fungible Tokens (NFTs) are free of gas fees, providing additional convenience to users.

OKX

Best for: wide range of trading instruments

OKX is a top choice for those looking for the best crypto exchange, with an extensive selection of trading instruments and a strong international presence. Known as one of the largest and most reputable exchanges globally, OKX offers a variety of cryptocurrency pairs, including BTC, ETH, and many others, along with margin trading, futures, and other advanced trading tools.

Focused on security, OKX employs cutting-edge encryption and multi-level authentication to protect user assets. The exchange is also committed to regulatory compliance, ensuring a trustworthy and secure trading environment for users worldwide.

Pros of Using OKX:

- Extensive selection of trading pairs and instruments

- High security and regulatory compliance

- Global reach with customer support available worldwide

MEXC

Best for: new projects and lesser-known cryptocurrencies

MEXC is a cryptocurrency platform that excels in offering access to new projects and lesser-known altcoins. Known for its active involvement in the cryptocurrency space, MEXC regularly adds new assets, providing traders with unique opportunities. The platform also features innovative tools like auctions and staking to enhance the trading experience.

Pros of using MEXC:

- Extensive selection of lesser-known cryptocurrencies.

- Innovative features like auctions and staking.

- Excellent customer support.

Crypto.com

Best for: mobile trading

Crypto.com is one of the best crypto exchanges, famous for its user-friendly mobile app that offers a range of rewards and DeFi wallet storage. While Crypto.com has a web platform, U.S. investors are primarily limited to using the mobile app.

Supporting over 350 cryptocurrencies, including Bitcoin, Ethereum, and Dogecoin, Crypto.com also accepts more than 20 fiat currencies. The mobile app offers a variety of features, including Visa Card perks, reward-earning opportunities, crypto tracking, and price alerts, making it ideal for traders on the go.

Gate.io

Best for: wide selection of trading pairs and additional services

A versatile cryptocurrency exchange, Gate.io, offers a wide variety of trading pairs and additional services to meet the needs of all types of traders. Known for its user-friendly interface, Gate.io makes it easy to navigate through a broad selection of cryptocurrencies. The platform also supports margin trading, staking, and cryptocurrency loans, providing more options for traders looking to diversify their strategies.

Pros of using Gate io:

- Extensive selection of trading pairs

- Additional services like margin trading and staking

- Simple, intuitive interface

HTX (Huobi Global)

Best for: traders seeking advanced features and high security

HTX is a cryptocurrency exchange known for offering advanced trading features and a focus on security. With a wide range of trading pairs and robust tools for both spot and margin trading, HTX caters to experienced traders looking for a versatile platform. The exchange also places a strong emphasis on protecting user funds with advanced security protocols.

Pros of using HTX:

- Extensive selection of trading pairs

- Strong security measures

- Ideal for experienced traders

BingX

Best for: traders seeking high liquidity and a wide range of trading pairs

Another best crypto exchange is BingX, renowned for its high liquidity and diverse selection of trading pairs. The platform offers a reliable trading environment with a range of instruments, including futures, options, and leverage, catering to experienced traders. BingX is also committed to ensuring the security of user funds, making it a trusted choice for those looking to trade with confidence.

Pros of using BingX:

- A wide variety of trading pairs

- A diverse range of trading instruments

- Strong focus on security

Types of Cryptocurrency Exchanges

Centralized Cryptocurrency Exchanges (CEX)

Centralized Exchanges are operated by companies that manage the platform and act as intermediaries, for example, Coinbase, Binance, and Kraken. Their basic features include easy-to-use interfaces, advanced trading tools for experienced users, and custodial wallets (the platform holds your funds).

Pros of Centralized Cryptocurrency Exchanges

- User-Friendly for Beginners: Most of the best centralized crypto exchanges offer intuitive websites and apps, making it easy for users to log in, check balances, and trade without dealing with the complexities of crypto wallets or peer-to-peer transactions.

- Added Security and Trust: Transactions are handled through well-established systems, providing a sense of reliability for users.

- Margin Trading Options: Some exchanges allow margin trading, enabling users to amplify investments with borrowed funds. However, this comes with higher risks alongside potential rewards.

Cons of Centralized Cryptocurrency Exchanges

- Hacking Vulnerability: Managing billions of dollars in assets makes these platforms prime targets for cyberattacks. For example, the Mt. Gox hack resulted in the loss of 850,000 bitcoins and the exchange’s collapse.

- High Transaction Fees: The convenience of centralized exchanges often comes with high transaction fees, which can be costly for large trades.

- Custody Risks: Most exchanges act as custodians, holding users’ assets in their wallets instead of allowing direct control via private keys. While convenient, this exposes users to the risk of exchange failures or fraud, potentially leading to loss of funds.

Decentralized Cryptocurrency Exchanges (DEX)

Decentralized Cryptocurrency Exchanges (DEXs) operate on blockchain technology without central oversight. Examples: Uniswap, PancakeSwap. Key features of DEXs include full control of your funds (non-custodial), peer-to-peer trading directly from wallets, and no requirement for KYC or account registration. All these features set them apart among the best crypto exchanges.

Pros of DEXs

- Full Asset Control: Users retain complete control over their assets, reducing reliance on third parties and minimizing risks of hacking, theft, fraud, or platform failure.

- Market Integrity: Peer-to-peer trading prevents market manipulation, such as fake or wash trading, ensuring fairer transactions.

- Greater Privacy and Anonymity: DEXs do not require KYC forms, offering enhanced privacy and anonymity.

- Wider Cryptocurrency Selection: More cryptocurrencies, including lesser-known altcoins, are available compared to centralized exchanges, thanks to the lack of censorship.

Cons of DEXs

- Complexity for Users: Managing wallet keys and passwords can be challenging. Lost keys mean permanent loss of access to assets, making DEXs less beginner-friendly.

- No Fiat-to-Crypto Support: DEXs don’t support transactions involving traditional currency, making them less convenient for new users who need to buy or sell crypto using fiat.

- Liquidity Issues: With lower trading volumes compared to centralized exchanges, DEXs often face liquidity problems, making it harder to find buyers or sellers, particularly during low trading periods.

Compare the Best Cryptocurrency Exchanges

| Company | Transaction Fees | Supported Coins | U.S. Availability | Trade Limits |

| Binance | 0.00% to 0.10% (depending on volume and BNB use) | 350+ coins, including BTC, ETH | Binance.US is available in some states | Depends on account verification |

| Coinbase | 0.00% to 0.40% maker fee, 0.05% to 0.60% taker fee | 50+ coins, including BTC, ETH | Available in all U.S. states | Depends on account status |

| Bybit | 0.00% to 0.10% (maker), 0.00% to 0.10% (taker) | 100+ coins, including BTC, ETH | U.S. residents restricted | Depends on account verification |

| Kraken | 0.00% to 0.40% | 70+ coins, including BTC, ETH | Available in most U.S. states | Depends on account verification |

| OKX | 0.08% to 0.10% (maker), 0.10% to 0.15% (taker) | 200+ coins, including BTC, ETH | Available in some U.S. states | Depends on account verification |

| MEXC | 0.00% (spot), varies for other services | 200+ coins, including BTC, ETH | U.S. availability limited | Depends on account verification |

| Crypto.com | 0.00% to 0.075% | 250+ coins, including BTC, ETH | Available in most U.S. states | Depends on the account type |

| Gate.io | 0.09% | 180+ coins, including BTC, ETH | Available in some U.S. states | Depends on account verification |

| HTX | 0.20% | 100+ coins, including BTC, ETH | Limited U.S. availability | Depends on account verification |

| BingX | 0.10% | 100+ coins, including BTC, ETH | Available in most U.S. states | Depends on account verification |

How to Choose the Best Crypto Exchange

You need to consider these key factors when selecting the top cryptocurrency exchanges for your needs:

- Security: Since cryptocurrencies are digital, they are susceptible to cyber threats. A reliable exchange can safeguard your funds and personal data. It is advisable to seek an exchange with strong security protocols, like 2FA (two-factor authentication), cold wallets, and encryption.

- Regulation: Using a regulated exchange can minimize the risk of fraudulent activities and enhance the likelihood of safeguarding your assets. A licensed exchange that operates in compliance with local regulations offers a sense of security. Additionally, the transparency of regulated exchanges, which often disclose their operations, can instill confidence in their services.

- Fees: Different exchanges charge different fees for transactions, deposits, and withdrawals, so it’s important to compare these costs.

- Liquidity: High liquidity is particularly essential for large transactions, as it ensures that you can complete trades quickly and at a suitable price.

- Supported Assets: Some exchanges offer a wide selection of cryptocurrencies, while others focus on a smaller number. If you want to trade new or lesser-known cryptocurrencies, we recommend choosing an exchange that regularly adds new coins to its platform.

Top 10 Crypto Exchanges in USA

In the list of the best crypto exchanges we’ve provided, not all are suitable for U.S. residents due to regional restrictions. Cryptocurrency exchanges operating in the United States are subject to regulation by the Commodity Futures Trading Commission (CFTC), which oversees futures markets, as well as regulations from FinCEN (Financial Crimes Enforcement Network) for anti-money laundering (AML) compliance. Additionally, various other government agencies enforce rules and regulations affecting cryptocurrency exchanges.

For U.S. residents, platforms like Coinbase, Kraken, Gemini, and Binance.US are better-regulated options. Many global exchanges, such as Bybit, OKX, Gate.io, and MEXC, avoid the U.S. market due to strict compliance requirements. Always ensure that the platform you choose adheres to U.S. laws to minimize potential risks.

- Binance.US – Best for Experienced Traders & Security Runner-up

- Coinbase – Best for Cryptocurrency Selection

- Crypto.com – Best for Mobile Trading

- Bitget – Best for Derivatives & Copy Trading

- Kraken – Best for Low Trading Fees & Security

- Gemini – Best for Security

- Robinhood – Best for Stocks & Crypto

- eToro – Best for Social Trading

- FTX.US – Best for Low Fees and Speed

- Paxos – Best for Stablecoins & Compliance

These exchanges are ranked by their trading volume and user preference in the U.S., ensuring that each platform serves different needs based on security, features, and offerings.

Frequently Asked Questions

What is the best crypto exchange for beginners?

Regulated and centralized exchanges like Binance, Coinbase, and Kraken are best for beginners. Binance is widely considered the best crypto exchange. With its user-friendly interface and comprehensive educational resources via Binance Academy, it makes it easier for newcomers to navigate the complex world of cryptocurrencies.

Which crypto exchanges support USD?

All the exchanges listed in our article support USD deposits and withdrawals, including Binance US, Coinbase, Kraken, Gemini, Crypto.com, and others.

Which crypto exchange has the lowest fees?

MEXC is renowned for its competitive pricing among the best cryptocurrency exchanges. The platform provides free trading for spot transactions, making it appealing for traders seeking to minimize expenses. For futures trading, MEXC charges a minimal fee of 0% for makers and 0.01% for takers. Moreover, users can further decrease these fees by utilizing MX tokens on the platform.