Bitcoin in 2021: Forecast for the Short and Medium Term

The year 2020 was probably the best year for bitcoin in terms of value dynamics since its inception (bitcoin trading). However, will bitcoin be able to hold the heights for a long time? Let’s look at different variants of events.

Contents

The success of HODL

In 2020, crypto-enthusiasts who once bought bitcoin and did nothing with it (hodlers) proved that this strategy worked successfully. However, traders were happy too, as bitcoin value increased throughout the year, but also the volatility was enough to make money on fluctuations. At the same time, the situation became more stable and can be said to be “healthy” compared to 2017, when a sharp rise in the value led to a panic in the crypto market (top crypto-exchanges).

The sharpest exchange rate fluctuations were in December 2020: On December 1, bitcoin’s price was $19,000 – and it wasn’t a bad price, pleasing many traders and hodlers. But by the end of the month, the price had almost reached $30,000. The growth did not stop with the new year, and in January the value of the main cryptocurrency passed over $40,000, and the peak price occurred on January 8.

After that, the price of bitcoin began to decline, but at an acceptable pace. The media this time did not manage to provoke panic with articles juggling the words “collapsed”, “collapsed” and their counterparts. Bitcoin did not collapse, the fluctuations were well within the standard for this coin, and thus since the beginning of the year bitcoin went up by 110%, and then went down by 20%. As of today (Figure 1), bitcoin is over $31,000. The trend is downward, but the rate is moderate.

Image. 1

Bitcoin growth drivers

Bitcoin’s steady growth can be attributed to several reasons. First, in the spring of 2020, there was a halving of miners’ rewards for mining coins. In this case, many cryptocurrency market participants prefer to hold on to coins, waiting for a higher exchange rate to compensate for the “lost” profit. When the exchange rate rose slightly, they started to work more actively in the crypto market and thus pushed the bitcoin rate up.

Second, and perhaps more importantly, money from institutional investors (e.g., fintech giants MicroStrategy, Square, MassMutual) who were looking for a way to save and grow their money in the difficult environment of the coronavirus pandemic, which brought entire industries to a halt, went into bitcoin. Institutional money played itself out and also attracted money from outside retail investors who believed in the prospect of bitcoin after appreciating the actions of large companies.

Third, the rise in bitcoin’s value was pushed by one of the most powerful payment systems in the world, PayPal (Figure 2), which added support for cryptocurrencies in October 2020, benefiting bitcoin by bringing additional investors and additional money to the crypto market. This was an unexpected move that contradicted the media’s replicated perception of cryptocurrencies as a poorly understood and unreliable financial instrument.

Causes of bitcoin’s fall

The reasons for bitcoin’s price decline after a fairly long period of growth are natural – no asset can grow indefinitely incrementally. Bitcoin is correcting at the beginning of 2021 as expected, however, unlike 2017-2018, this correction is still gradual, bitcoin continues to trade at its historical maximum. This, however, does not exclude the possibility that the even decline in price could also turn into a panic-sell. Such a scenario is generally typical for cryptocurrencies. But so far, there is no sign of that, and a price collapse is considered unlikely.

Image. 2

What is the reason for such not quite traditional for the crypto market smoothed dynamics of bitcoin value? Presumably, since 2017, the least qualified investors and traders have left the market, and random people have lost interest in bitcoin. Because of this, more financially advanced people began to pay more attention to the cryptocurrency market. That is, the crypto market as a whole has become more professional, its participants have “matured” and become less prone to sharp rash decisions (crypto trading security). The arrival of institutional investors has made the crypto market even more “solid” and stable. We can only hope that this character of the market will continue in the future.

Predictions for bitcoin

Let’s consider the most likely predictions about the possible rise or fall in the value of the cryptocurrency.

100 thousand dollars and more

As usual, there is no shortage of forecasts in the crypto market and, as usual, their range is very diverse. Most market participants and experts agree that the cryptocurrency market as a whole will no longer have such long crises as in 2018. There may be corrections, but they will be acceptable in time and not too deep. Many forecasters claim that bitcoin will reach a six-figure value during 2021. The following statements are cited to support this prediction:

- Despite the fluctuations, the de facto price of bitcoin is constantly rising;

- A sharp rise in the price of bitcoin is a fairly regular phenomenon and there is no reason why it will not be repeated, for example, in the fall of 2021;

- The current supply of the asset is reduced relative to the inflow (Stock-to-Flow) of bitcoin into the market, which leads to an increase in the price – there are fewer bitcoins and more demand for them, respectively, the value of bitcoin objectively grows.

The Stock-to-Flow model applied to bitcoin by an enthusiast and investor nicknamed “Plan B” is generally consistent with the dynamics of the bitcoin price. If all of these factors “play out” simultaneously, bitcoin could hit six figures in the fall of 2021. But it is also well known that bitcoin has the ability to go beyond any model. Dan Morehead, founder of crypto investment firm Pantera Capital, has said that bitcoin could surpass $115,000 by August 2021, but that won’t necessarily happen and according to Morehead himself, he won’t put all his savings on that possibility. But with the kind of momentum that bitcoin is showing in December 2020-January 2021, reaching the $115k mark is likely. The fact that Morehead can be listened to says that in April of 2020 he has given a forecast of bitcoin price dynamics, which is still being implemented with small discrepancies. More to the point, it shows that bitcoin has stabilized and become more predictable, which is not a bad thing.

Citigroup’s forecast is even more impressive – $300,000 at the end of 2021, and Guggenheim Partners Chief Investment Officer Scott Minerd twice confirmed the $400,000 forecast for this year. His reasoning is that the development of markets after the pandemic coronavirus will be similar to the development of markets after the Spanish flu in 1918 – and the economy began to boom after that. If we overlay the diagram of gold price dynamics after the “Spanish flu” on the dynamics of bitcoin price as a kind of “digital gold”, it turns out that 400 thousand dollars is quite an achievable value. At the same time, the investor stipulated that there could be a strong correction in the market in the near future and it might be worth withdrawing money from cryptoassets.

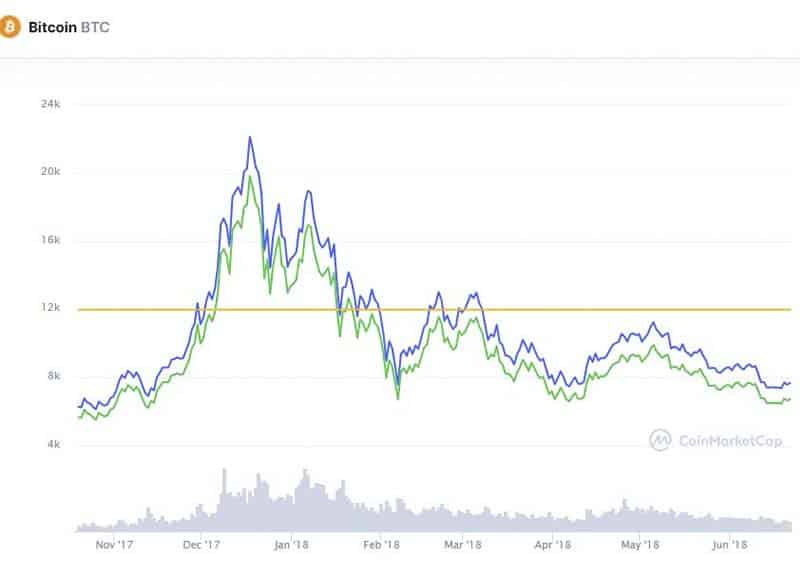

$25,000 – $40,000

There is no doubt that bitcoin will correct (correction is already underway). The question is how deep the correction will be. In the most negative scenarios, bitcoin prices fall to $20,000-$15,000. It may be noted that this year there are almost no predictions that bitcoin may fall to zero, and this can also be considered a sign of maturity of the cryptocurrency market. A more realistic scenario is a drop in bitcoin price to 30% relative to the highs, as this fits well with the previously observed dynamics. Thus, in 2017 and in 2019, the bitcoin price has been declining between 20-40%. The question arises, what will happen next? Will such a price decline lead to a panic flight of investors from the cryptocurrency, as it already happened (Fig. 3)?

Image. 3

Most market participants express confidence that the correction will not be long, and moreover, it will bring even more participants who will want to invest in bitcoin while it is relatively inexpensive. More experienced crypto market players advise newcomers not to spend all their savings or even significant money to buy cryptocurrencies at the moment, as the correction continues. The good thing is that it is going at a fairly slow pace.

Also, despite the relative calmness in the market now, it is not recommended to trust forecasts on the correction – bitcoin behavior is still unpredictable. At least, it is necessary to watch the dynamics of price decrease, as well as traders’ behavior and news background, so as not to miss the moment to buy or get rid of a risky asset with profit. With regard to the correction, it is not only a question of depth but also of duration. It is not the same thing – a correction can be long but weak, with pullbacks and returns to higher values.

There are forecasts, according to which the correction this year will continue throughout February, and then the price will return to growth. Perhaps the February correction will bring the price down to $30,000 or even to $25,000, but not below $15,000. (although there are forecasts of a fall to 5 thousand dollars). Then there may be an upward correction, and the price will fluctuate in the range of 25-30 thousand dollars. It is very possible the return to the mark of 40 thousand dollars, with further testing of even higher prices. But bitcoin will not reach $100 thousand in 2021.

$36,000 to $52,000

In the medium term, bitcoin price will fluctuate between $36,000 and $52,000. Going forward, the first half of 2021, bitcoin dynamics will be similar to those of 2017, when bitcoin was rising for 15 months after the halving-halving. This prediction is based on the behavior of traders, a large mass of whom expect the value of bitcoin to be spread between these prices. But, of course, most traders are moderate in their forecasts and believe that $36,000 is the most likely mark near which bitcoin’s price will fluctuate. A very small portion of traders believe that bitcoin will return to growth within a few months and reach $52,000.

But there is no need to remind once again that the growth of the price to $21 thousand in 2017, and the growth of the price to $40 thousand in early 2021, no one predicted, so the probability of reaching the price above $50 thousand is not a fantasy. Traders’ expected levels of $36k to $52k are the levels at which crypto traders plan to lock in profits. Thus, if the price does not reach $36,000, many investors may be disappointed – a pessimistic forecast that bitcoin may go down in price to $15,000 is connected with this. Below that mark, bitcoin’s price is unlikely, as it runs counter to the interests of institutional investors who provide solid support for bitcoin’s price. Even if retail investors’ nerves give up at some level, institutional investors will slow down the fall. But so far, there is nothing to indicate that panic is forming.

On the other hand, the consequence of greater rate stability may be reduced volatility, which, again, leads to greater confidence in bitcoin as a profitable and secure asset for all and prevents the bitcoin price from starting to fall too quickly or too deeply. The forecast of about $50,000 is confirmed by reputable sources, for example, Bloomberg analyst Mike McGlone suggests that bitcoin will be worth 50 thousand in 2021, and the famous crypto-enthusiast and founder of the cryptocurrency hedge fund Mike Novogratz says that bitcoin can reach $65,000.

Strategic factors of bitcoin price

In general, it is clear what will happen to bitcoin in the short and medium term. But what will happen next, is the hodlers’ strategy still justified or is it worth catching the moment to sell assets profitably? Let’s try to understand.

Factors restraining the value of Bitcoin

Let’s take a closer look at the factors that are holding back the growth of the value of cryptocurrency.

Legal status

A factor holding back price growth and new investors is bitcoin’s hitherto unclear legal status. This status remains unclear at least in the medium term, as banks and national currency issuers will definitely not share financial power with the blockchain and will not legitimize payments that are out of their control and are legally shadowy. A serious deterrent to bitcoin investing is that if an investor loses bitcoins, there is no way to recover their losses, as they are not backed by any government institution.

However, it is impossible not to notice that bitcoin no longer shocks or surprises anyone, most countries and all significant for the world economy developed countries do not prohibit bitcoin (although they do not encourage it) and do not prevent bitcoiners from trading, investing and developing financial infrastructure. It is also known about the interest in cryptocurrencies of the world’s leading economies – the U.S., China and the EU – which encourages investors in the long term. Many of them believe that bitcoin is a transition from existing uncontrolled cryptocurrencies to cryptocurrencies of centralized, digital analogues of national currencies.

China, some European Union countries and some countries that are under U.S. sanctions pressure are developing such projects, although there is no talk yet about introducing such money into circulation. Because there is no clarity as to whether they will be as in demand as bitcoin. The legal ambiguity of the status of bitcoin and other cryptocurrencies is, in fact, the only serious factor limiting their development. There are many more factors that contribute to cryptocurrency development and price growth.

State prohibitions

The negative impact on bitcoin exchange rates by regulators could intensify if the government goes on the offensive and starts to ban bitcoin. But there are reasons that make it doubtful that this will seriously affect the cryptocurrency exchange rate. For example, to bring down bitcoin with bans, all governments of all countries would have to simultaneously impose restrictions on bitcoin, and this will not happen because there is no unity in the world towards cryptocurrencies.

Under the circumstances, if one state starts repressing “cryptocurrency dealers,” they will find a way to deal with cryptocurrencies via the Internet in other countries – this is the global economy. And no country in the world will shut down the Internet to fight bitcoin, putting at risk an economy that is simply not functional without the Internet right now.

Second, states are not equal in terms of influence on the global economy, and a ban on cryptocurrencies in one or even several countries, if they are not the most powerful economies in the world, will not affect the value of bitcoin in the world. But even the strongest countries may not have any effect on the price of bitcoin. For example, in 2017 China practically banned bitcoin transactions, and a couple of months later the price of bitcoin flew “ace” for the first time, to $20,000.

Cryptocurrency development factors

Let’s take a look at the factors that could help bitcoin rise in value this year.

Coronovirus pandemic

Among the factors that can contribute to bitcoin and its value growth is the ongoing coronavirus pandemic, which stimulates people’s interest in all forms of the online economy and in new forms of profitable investment at a time of crisis in many sectors of the “offline economy. Bitcoin is one of the most attractive assets in this regard.

State control

One cannot help but notice that during the coronavirus pandemic, the state has increased its control over all spheres of life, imposing a host of justified and unjustified restrictions, and people naturally feel the need to reduce this pressure. State restrictions also directly harm many businesses and reduce the income of citizens. In this direction, minimal control over cryptocurrencies by the government is more of an attractive factor for investing and for trading as a way to earn money.

This factor is positive for the development of bitcoin and for the growth of the price. The delayed positive factor of the coronavirus is that states are forced to develop the online economy – they transfer employees to remote work, do not prevent the development of online services, payment systems, contribute to the transfer of regulatory functions to the Internet. All this is a promising positive factor of influence on cryptocurrencies.

USA

In the U.S., Donald Trump, a Republican, a representative of what is believed to be conservative circles that gravitate toward huge “real economy” corporations like oil, the auto industry, and so on, left the presidency. Democrats, led by Joe Biden, who are seen as patrons and representatives of modern high-tech industries, including the Internet economy, have come to power in the United States. This is a positive factor in the development of cryptocurrencies. By the way, the rise in bitcoin price accompanied the process of Joe Biden’s election victory, cryptoinvestors reacted positively to the Democrats coming to power.

The news that Biden plans to support small businesses in the U.S. with huge financial injections also has a positive effect on the mood of investors and traders. So, maybe under Biden the era of cryptocurrencies will begin (maybe even began), at least now the Biden factor has a positive effect on the cryptocurrency market, bitcoin remains at historic highs.

China

Interestingly, the only country that was officially positive about the rise in the bitcoin price was China. On November 18, CCTV, the state’s main TV channel, stated, “The bitcoin price increased by 70% in less than 50 days and exceeded $17,500. Compared to the bull market of 2017, bitcoin’s network, development and investment ecosystem are now in much better shape. The growth observed is due to the interest of investment funds.

It is not quite clear what China’s praise of bitcoin has to do with it. Perhaps China sees cryptocurrencies as a possible alternative to the dollar, from which it can not get rid of and remains dependent on the “sworn friend” of America. – America, but the fact remains that China has suddenly supported bitcoin, which cannot but have a positive effect on the development of cryptocurrencies.

Real Institutionalization

While the media and the general public looked for signs of a “Ponzi scheme” in bitcoin (and still do), institutional investors took it seriously and during the 2018 “crypto-zima,” created bitcoin as a serious investment and earning tool. A powerful driver of cryptocurrency development was the so-called “DeFi revolution” (decentralized finance), which occurred just in the fall of 2020, when a huge flow of real external investment – that is, money from serious, massive investors – flowed into decentralized projects, primarily cryptocurrencies.

While in June 2020 the figure for such investments did not exceed $1 billion, at the end of November it was already $18 billion, meaning that cryptocurrency capitalization increased 18-fold in 5 months. Billions of dollars were invested in bitcoin by real money industry super giants: Grayscale Investments, Ark Invest, Kinetics Portfolios Trust, IFP Advisors, Boston Private Wealth, Rothschild Investment, Heritage Wealth Advisors. This fact almost immediately brought the dubious cryptocurrency to the highest financial level, which only the most hardened skeptics did not notice.

Bitcoin – an alternative to fiat currencies

A number of experts argue that cryptocurrencies are currently the only asset in the world that is not subject to inflation. It is easy to notice that in the last five years at least, the world keeps moving from one crisis to another, the traditional economy is collapsing, what comes in its place is unclear, fiat money no longer looks a sufficiently reliable asset, especially since issuers are virtually unbound and can print as much money as they want, which of course devalues money more and more.

In this respect, bitcoin looks more and more preferable – its price is not entirely clear how it is determined, but it is definitely not some state institution with a printing press. And for the most part, bitcoin’s price seems to be really shaped by the market, by the balance of supply and demand. This attracts people to cryptocurrency who want to protect and grow their assets.

Conclusion

Thus, it can be argued that a serious drop in bitcoin in 2021 is unlikely – this is how the situation looks like today. More factors in favor of bitcoin price will rise, but how much it will rise, opinions differ. At the moment, we can say the main thing – there is no doubt that bitcoin is not some form of “swindle”, it is a serious financial instrument, which must be taken as seriously as possible.

By the way, I have a colleague who makes a lot of money on bitcoins. He was one of the first to get wind of this topic