Trading Strategy for Binary Options

The “Triple line” strategy is trading systemwhich consists of three linear indicators. All tools used are presented in the standard range of trading platforms from PocketOption. Therefore, to trade on the strategy under consideration it is not necessary to resort to the help of third-party services. This is very convenient for traders who prefer to open short-term deals.

Contents

The strategy is based on indicators RSI, Momentum, and ATR. The first two allow you to determine the state of the market, and the third indicates the current strength of the price trend.

Overview of indicators used

RSI (Relative Strength Index). This is a classic solution from the class oscillators. Its principle of operation is similar to that of Stochastic. However, it consists of only one curved line. The tool is easy to use. Moving within the area, the line enters the so-called oversold (located at the bottom) and overbought (located at the top) zones.

Momentum. Another indicator from the range of oscillators. The nature of the movement of the curve largely repeats the RSI. If this happens, then in this way the indicators signal about the upcoming market reversal. If their values of two different instruments diverge, it is better to refrain from trading. Externally, the Momentum also consists of a single curve line, which moves in a separate window divided into overbought and oversold zones.

ATR (Average True Range). Compared to the two previous indicators, this tool works on a different principle. When you first look at it, the absence of any levels and even the limits of the area where the curve is being plotted is striking. That means that the indicator does not allow you to get specific values. All it tells us is the trend: up or down. If the line is going up, it indicates that the trend is strengthening, and if it is going down, it indicates that the price movement is weakening.

Configuring the trading terminal

The strategy is universal, so choose any asset with a high percentage of profitability. However, the CRYPTO IDX shows best on the chart interval of 5 seconds. So, we add three indicators:

- ATR – standard period settings;

- Momentum – with a period of 28;

- RSI – period 28, both levels at 50.

The timeframe of the candlestick chart is 5 seconds. It is recommended to select the chart scale so that one grid cell occupies exactly 60 seconds. The terms of the transaction are minimal (30-90 seconds). The amount of investment in the contract is determined by the amount of the deposit. The less, the better. But no more than 5% of the balance for one transaction.

The concept of the strategy

Momentum and RSI have a similar calculation formula. However, their simultaneous use is justified in the sense that it increases the overall accuracy of the signals. Often in the market there are situations when individually one of the indicators gives trading signal. However, the second tool does not confirm it. This prevents erroneous entry into the market.

ATR in this bundle plays the role of the final filter. The indicator is very mobile and its tick movements are often wave-like. Therefore, it is necessary to assess the aggregate picture of what is happening. It is often difficult for beginners. But it is possible to give two practical tips. First, if the ATR increases at the signal candlestick, it is an unambiguous confirmation of the signal. Second, the rapid deceleration of the curve fall and the beginning of line formation in the horizontal plane is also a confirmation of the signal. Recognizing such a fine line is not very easy, but it comes with experience.

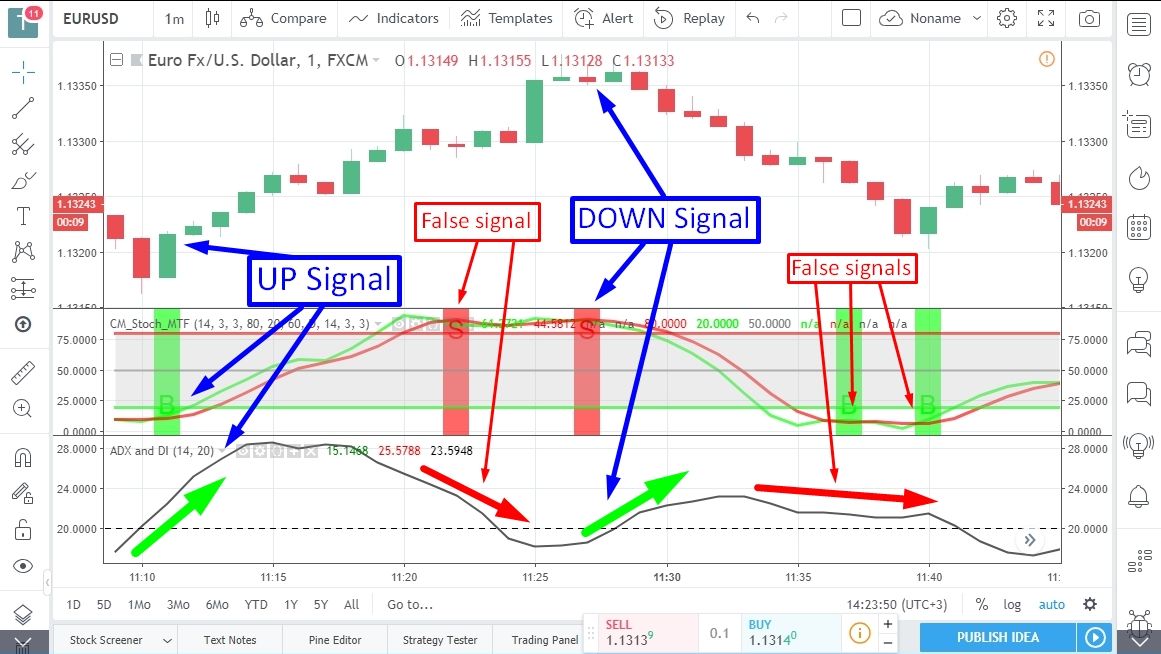

Trading signals by strategy

The strategy is based on the main principle of trading – entering the market when trends turn. The indicators used will not allow you to miss the key moment.

- The signal to go up – crossing the RSI curve and Momentum level N/A from below, the growth of ATR.

- Down signal – crossing RSI and Momentum level N/A from above, ATR growth.

The pictures above show examples of trading signals with an indication of the duration of the transaction.

Example of real trading

At the end of the strategy review, we will give an example of trading on the considered system.

So, all three indicators on the chart give a signal. However, there is some uncertainty about the ATR. But in this case, the decline in the last candle should be ignored, because the general trend over the past 5 bars is positive. Taking into account the totality of factors, we open a down trade.

In spite of the fact that the deal was closed in profit, the example cannot be called indicative. Almost immediately after entering the market the correction period began with a short pullback in the opposite direction.

There is the phenomenon of divergence, when the indicator readings diverge from the real price chart. In this case, the values of the oscillators should be taken into account. And this has been confirmed. Literally 15 seconds before the deal closing, the correction stopped and the market moved in the main direction. As a result, we made a profit in full. The strategy works and allows to receive approximately 65% profitable trades.

Reviews