Top 4 Day Trading Strategies on Pocket Option: From Scalping to News Trading

Contents

Day trading is a dynamic approach to financial markets where traders open and close positions within a single trading day. This strategy allows traders to profit from short-term price fluctuations while minimizing the risks associated with holding positions overnight.

Advantages of Pocket Option for Day Traders:

- A wide range of assets for trading.

- Low spreads and commissions.

- A user-friendly interface with customization options.

- Fast order execution.

- Access to analytical tools and indicators.

Successful day trading requires a clear strategy. A well-chosen and tested strategy helps traders make informed decisions, manage risks, and maximize profits.

Principles of Day Trading

Day trading demands a deep understanding of the market and strict discipline. Successful traders rely on several key principles to navigate the complex and fast-paced world of financial markets. These principles not only increase the chances of profitability but also protect against significant losses. Let’s explore the main principles that every trader should know and apply in their trading.

Basics of Technical and Fundamental Analysis:

- Technical Analysis: Uses charts and indicators to predict price movements.

- Fundamental Analysis: Considers economic factors and news that affect the market.

- Combining Both Approaches: Provides a more comprehensive market view.

Risk and Capital Management:

- Define Maximum Risk Per Trade: For example, no more than 1-2% of the deposit.

- Use Stop-Loss Orders: To limit losses.

- Adhere to Risk-to-Reward Ratios: For example, 1:2 or 1:3.

- Diversify Trading Portfolio: To spread risk.

Trader Psychology and Emotional Discipline:

- Controlling emotions, especially fear and greed.

- Sticking to the trading plan despite short-term results.

- Regularly analyzing trades and learning from mistakes.

- Maintaining a positive mindset and confidence in the strategy.

Choosing Suitable Assets for Day Trading on Pocket Option:

- Focusing on assets with high liquidity.

- Considering volatility: choosing assets with sufficient price fluctuations.

- Accounting for correlations between different assets.

- Selecting assets that match your trading style and level of experience.

These principles form the foundation of successful day trading on Pocket Option. Mastering these aspects will allow a trader to develop an effective strategy and increase the chances of long-term success in the dynamic world of financial markets.

Popular Day Trading Strategies on Pocket Option

Pocket Option offers traders a wide range of opportunities to implement various trading strategies. Let’s look at the most popular approaches to day trading on this platform.

Scalping

Scalping is a high-frequency trading strategy aimed at profiting from small price movements. Traders open and close positions within minutes or even seconds.

Advantages:

- Possibility of frequent profits.

- Minimal holding time reduces risk.

- Suitable for highly liquid markets.

Disadvantages:

- Requires constant attention and quick reaction.

- High commission costs due to frequent trades.

- Stress and emotional strain.

Examples of Use on Pocket Option:

- Trading on minute charts of highly liquid currency pairs.

- Using indicators like Stochastic or RSI to identify short-term overbought or oversold conditions.

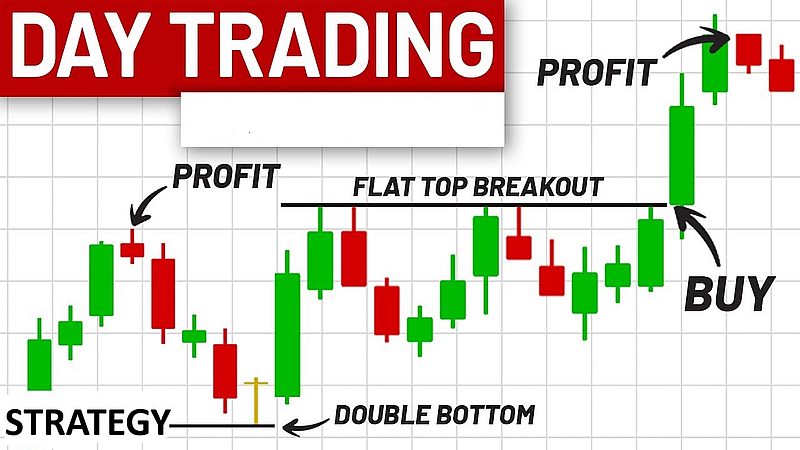

Trend Trading

Trend trading is one of the most popular and effective strategies in financial markets. The essence of this approach is to identify the direction of price movement and open positions accordingly. On the Pocket Option platform, trend trading can be especially effective thanks to the wide range of tools and indicators available to traders.

How to Identify a Trend:

- Analyzing price highs and lows.

- Using trend lines and channels.

- Applying trend indicators.

Indicators and Tools for Trend Trading:

- Moving Averages (SMA, EMA).

- MACD (Moving Average Convergence Divergence).

- ADX (Average Directional Index).

Examples of Trades:

- Buying when the price breaks the upper boundary of a channel in an uptrend.

- Selling when the price crosses a moving average from above in a downtrend.

Countertrend Trading

Countertrend trading involves opening positions against the current trend in anticipation of its reversal. Traders look for signs of trend weakening and potential reversal points.

How to Identify Reversal Points:

- Analyzing support and resistance levels.

- Using oscillators (RSI, Stochastic) to identify overbought/oversold conditions.

- Looking for candlestick reversal patterns.

Risks:

- High probability of losses in a strong trend.

- Difficulty in determining the exact reversal moment.

Advantages:

- Potentially high profit if the reversal is correctly identified.

- Opportunity to enter a new trend at an early stage.

News Trading

News trading is a strategy that leverages the volatility that occurs after the release of important economic data or events. This strategy is especially popular among day traders on Pocket Option, as the platform provides quick market access and up-to-date information. Success in news trading depends on a trader’s ability to quickly analyze information and make decisions in highly volatile conditions. The key tool is the economic calendar.

How to Use the Economic Calendar:

- Tracking important economic events and releases.

- Analyzing market expectations and actual data.

- Assessing the potential impact of news on the market.

Entry and Exit Strategies for News Trading:

- Straddle Strategy: Opening opposite orders before news releases. Closing the losing position and holding the profitable one after a sharp price movement.

- Breakout Trading: Identifying key levels before the news release. Entering the market when a level is broken after the data is published.

- Pending Orders: Placing pending orders above and below the current price. Activating the order during a sharp movement after the news.

Each of these strategies has its own nuances and requires thorough study and practice. Traders on Pocket Option are advised to test different approaches on a demo account before applying them in real trading.

Technical Indicators and Tools

Technical analysis is a fundamental part of day trading on Pocket Option. Proper use of technical indicators and tools can enhance the accuracy of trading decisions. Let’s explore the most popular and effective tools.

Moving Averages

Moving averages are one of the simplest yet most powerful tools in technical analysis. They help smooth out price fluctuations and identify the overall trend direction.

- Simple Moving Average (SMA): The arithmetic mean of prices over a specified period.

- Exponential Moving Average (EMA): Gives more weight to recent prices.

How to Use Them to Identify Trends:

- The slope direction of the moving average indicates the trend.

- The price crossing the moving average can signal a trend change.

- The crossover of short and long moving averages is used to generate trading signals.

RSI (Relative Strength Index)

RSI is a momentum oscillator that measures the speed and change of price movements. It is particularly useful for identifying overbought and oversold market conditions.

Application in Day Trading:

- Identify potential reversal points.

- Confirm trend strength.

- Detect divergences between price and the indicator.

Determining Overbought and Oversold Levels:

- Traditionally, a level above 70 is considered overbought, and below 30 is considered oversold.

- These levels can be adjusted based on the characteristics of the specific asset.

MACD (Moving Average Convergence Divergence)

MACD is a trend-following indicator that shows the relationship between two moving averages of price. It helps determine the strength and direction of a trend and potential reversal points.

Principles and Entry Signals:

- MACD consists of two lines: the MACD line and the signal line.

- The crossover of these lines generates trading signals.

- The divergence between MACD and price can indicate a potential trend reversal.

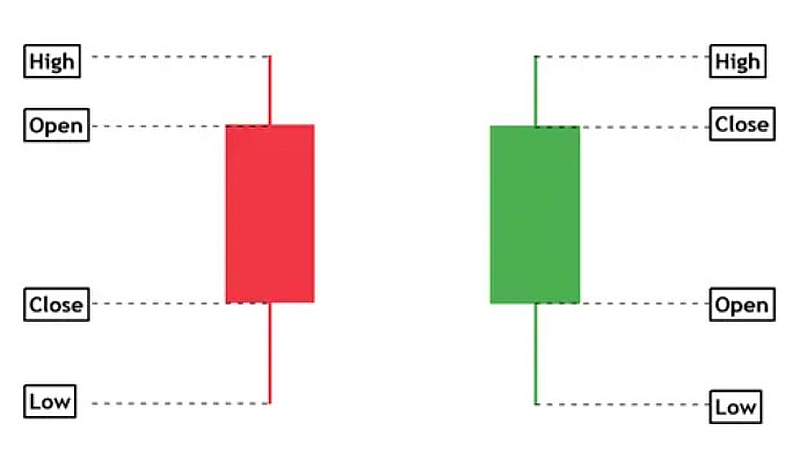

Candlestick Patterns

Candlestick patterns are visual models on the chart that can indicate potential changes in price movement. They are especially useful for short-term trading on Pocket Option.

Major Candlestick Patterns:

- Hammer and Hanging Man.

- Engulfing.

- Doji.

- Doji Star.

- Morning and Evening Star.

Examples of Trading Signals:

- A bullish engulfing pattern at a support level can signal an upward reversal.

- A hammer in a downtrend can indicate a potential reversal.

- An evening star at the top of an uptrend can signal a downward reversal.

How to Identify and Use Them in Trading:

- Look for levels where the price has repeatedly bounced or stalled.

- Use horizontal lines to mark these levels on the chart.

- Pay attention to round numbers, which often become psychological levels.

- Use breakouts of these levels as signals to enter the market.

- Former resistance often becomes support and vice versa.

Bollinger Bands

Bollinger Bands are a volatility indicator that helps determine when the price is in a relatively high or low range compared to the moving average.

Application for Determining Volatility and Potential Reversal Points:

- Band expansion indicates increased volatility.

- Band contraction can precede a strong price movement.

- Touching or breaking the upper/lower band can signal a potential reversal.

- Use in combination with other indicators for signal confirmation.

Remember, no indicator provides 100% accurate signals. Successful trading on Pocket Option requires combining various tools and constant practice. Always test your strategies on a Pocket Option demo account before applying them in real trading.

Practical Tips for Using Strategies on Pocket Option

Successful day trading on Pocket Option requires not only knowledge of strategies but also the ability to effectively apply them. Let’s explore practical aspects that will help you maximize the efficiency of your trading.

Setting Up the Trading Platform

Proper setup is the first step to successful trading. Pocket Option offers extensive personalization options, allowing you to create a comfortable and efficient trading environment.

Personalizing the Interface:

- Arrange charts and indicators for quick access to necessary information.

- Choose a color scheme that is comfortable for your eyes during long trading sessions.

- Place the most important indicators on the main screen.

Choosing Suitable Assets for Day Trading:

- Focus on assets with high liquidity and volatility.

- Select a few core assets and study their behavior.

- Consider the correlation between different assets in your portfolio.

Testing and Optimizing Strategies

Before applying any strategy to a real account, it is important to thoroughly test it. This helps you understand how effective the strategy is and how well it matches your trading style.

Importance of Demo Accounts:

- Use a demo account for risk-free practice and strategy testing.

- Replicate real market conditions on the demo account.

- Practice regularly to hone your skills.

How to Evaluate Strategy Effectiveness:

- Keep a detailed trade journal, including reasons for entry and exit.

- Analyze the ratio of profitable to unprofitable trades.

- Calculate the average size of profits and losses.

- Assess the maximum drawdown and overall profitability.

Managing Time and Trading Sessions

Choosing the right time to trade can significantly impact your results. Understanding market rhythms and the influence of various factors will help you make more informed decisions.

Optimal Trading Time:

- Determine the most active hours for your chosen assets.

- Consider the overlap of major trading sessions for increased volatility.

- Find a balance between market activity and your schedule.

Impact of News and Events on the Market:

- Monitor the economic calendar and plan your trading accordingly.

- Be cautious when trading during major economic releases.

- Consider seasonal factors and periods of low liquidity (e.g., holidays).

Remember, successful trading on Pocket Option is the result of continuous learning, practice, and adaptation. Regularly review and adjust your strategies according to market changes and your experience.

Features of Trading on Pocket Option

Pocket Option offers traders a range of unique features that set this platform apart from competitors. Understanding and effectively using these features can significantly improve your day trading results.

Unique Tools of the Platform:

- Turbo Options: Allow for trades with short expiration times (from 60 seconds).

- Multichart: Ability to view multiple charts simultaneously.

- Market Sentiment Indicator: Shows the percentage of buyers and sellers.

- Strategy Builder: A tool for creating and testing your trading algorithms.

Trading with the Mobile App:

- Fully functional app for iOS and Android.

- Quick market access anytime and anywhere.

- Synchronization with the desktop version of the platform.

- Push notifications for important market events and price changes.

Social Trading and Copy Trading:

- The ability to follow successful traders and copy their trades.

- Exchange of experiences and strategies with other platform users.

- Trader ratings to choose the most effective strategies for copying.

- Opportunity to become a signal provider and earn from subscribers.

Common Mistakes and How to Avoid Them

Even experienced traders are not immune to mistakes. Understanding the most common problems and ways to prevent them will help you improve your trading efficiency on Pocket Option.

Ignoring Risk Management:

- Mistake: Risking too much of your capital in a single trade.

- Solution: Set strict capital management rules, such as not risking more than 1-2% of your deposit on a single trade.

Emotional Decisions:

- Mistake: Making trading decisions under the influence of fear or greed.

- Solution: Develop and strictly follow a trading plan. Practice emotional control techniques like meditation or breathing exercises.

Overtrading and Greed:

- Mistake: Opening too many positions or staying in the market too long in an attempt to gain more profit.

- Solution: Set a daily limit on the number of trades and stick to it. Use automatic take-profits to lock in profits.

Lack of Preparation and Analysis:

- Mistake: Entering trades without thorough market analysis and preparation.

- Solution: Always conduct pre-trade analysis using technical and fundamental factors. Regularly update your market knowledge and trading strategies.

Remember, successful trading on Pocket Option requires continuous learning and adaptation. Regularly analyze your trades, learn from mistakes, and don’t be afraid to experiment with new strategies on a demo account. Use the platform’s unique features, but always stay within the bounds of your trading plan and risk management.

Conclusion

Day trading on Pocket Option opens up vast opportunities for profit, but it also requires a serious approach, discipline, and continuous development. Let’s summarize and review the key aspects of successful trading on this platform.

Tips for Beginner Traders:

- Start by learning the basics of technical and fundamental analysis.

- Practice on a demo account before moving to real money.

- Choose a few strategies and study them thoroughly.

- Don’t neglect risk management – it’s the key to long-term success.

Financial markets are constantly changing, so it’s critical to:

- Regularly update your knowledge of the market and trading strategies.

- Stay informed about economic news and events affecting the market.

- Adapt your strategies to changing market conditions.

Develop a clear trading plan that includes entry and exit rules for trades. Determine your goals, risk level, and trading time frames. Strictly adhere to your plan, not allowing emotions to influence decisions. Record details of each trade: asset, entry and exit times, and reasons for the trade. Note your emotional state during trading. Regularly analyze your journal to identify patterns and areas for improvement.

Now that you are armed with knowledge about day trading on Pocket Option, it’s time to take action:

- Register on Pocket Option: Create an account on the platform and familiarize yourself with its functionality.

- Use a demo account to practice strategies: Start with virtual funds to test different strategies without risk and fine-tune your trading style.

- Participate in educational webinars and courses from Pocket Option: Take advantage of the platform’s educational resources to deepen your knowledge and skills.

Remember, success in day trading comes with experience and continuous practice.

Reviews