How to Sell Bitcoin: Exchange It for Cash in 2026

As cryptocurrency grows in popularity, many users look to convert their crypto into fiat currency. This is a comprehensive guide on all the methods you can use to sell Bitcoin and how to exchange Bitcoin for cash.

Contents

How to Cash Out Bitcoin in 2026

In 2024, the interest in cryptocurrencies has recovered, leading to some traders making significant profits. As a result, some cryptocurrency owners may be considering ways to take advantage of the current market enthusiasm and sell their digital assets. Here are several methods you can use to cash out your Bitcoin.

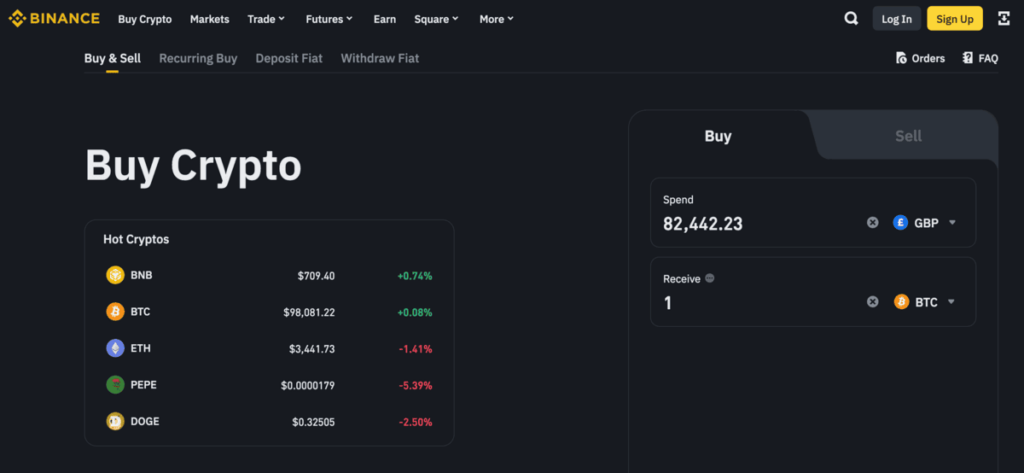

1. Sell Bitcoin Through Cryptocurrency Exchanges

Cryptocurrency exchanges are one of the most popular ways to sell Bitcoin. This is because high liquidity ensures faster sales and their secure platforms provide escrow and insurance.

The next steps are about how to exchange Bitcoin for cash.

- Create an Account:

Register on a reputable exchange (e.g., Binance, Bybit, Coinbase, Kraken). - Complete KYC Verification:

Provide identification documents for verification to comply with regulations. - Deposit Bitcoin:

Transfer Bitcoin from your wallet to the exchange’s wallet. - Place a Sell Order:

- Market Order: Sell immediately at the current market price.

- Limit Order: Set a specific price and wait for a buyer.

- Withdraw Cash:

Transfer the proceeds to your bank account using supported withdrawal methods.

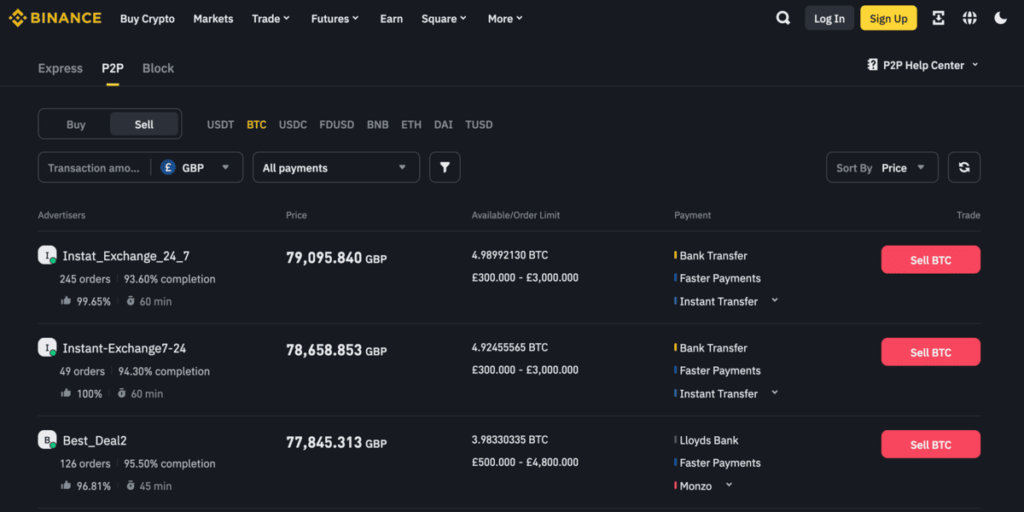

2. Sell Bitcoin via Peer-to-Peer (P2P) Platforms

Alternatively, you can engage in a direct trade, selling your cryptocurrency directly to another individual through an intermediary. The most common method is through an online platform that connects buyers and sellers, allowing for seamless transactions. However, if necessary, you can also conduct the trade in person.

With an online peer-to-peer trade, you can sell your cryptocurrency for fiat currency. These transactions are typically facilitated by an exchange, such as Binance or Bybit, which operates a well-known online platform. Once you have agreed to the trade, the platform holds your cryptocurrency in escrow. After verifying the transaction details in your payment account and confirming the receipt of funds from the buyer, the exchange releases the cryptocurrency to the buyer on the platform.

Popular P2P platforms include Bybit P2P, HTX, Binance, and OKX.

How to Cash Out Bitcoin via P2P:

- Register on a P2P Platform. Choose a reliable platform that provides escrow services, such as Binance crypto exchange.

- Set the price, payment method, and amount of Bitcoin you want to sell.

- Select a Buyer from the list of available buyers.

- Confirm payment. Once the buyer sends payment (e.g., bank transfer, PayPal), release the Bitcoin from escrow by following the crypto exchange instructions.

The payment methods that are supported depend on the chosen crypto exchange, region, and currency. Commonly, these include bank cards (Visa and MasterCard), bank transfers, electronic wallets, and some payment systems.

3. How To Sell Bitcoin via ATMs

Bitcoin ATMs allow you to sell Bitcoin and receive cash directly. These machines are available in various locations worldwide.

How to sell Bitcoin using a Bitcoin ATM? Start by locating a nearby machine. Some websites with a map of Bitcoin ATMs can help you identify available options in your area.

Once at the ATM, select the “Sell Bitcoin” option and specify the amount you wish to sell. You’ll then need to scan the QR code from your Bitcoin wallet and send the specified amount to the ATM’s wallet address. After the transaction is confirmed, the machine will dispense the cash equivalent of your Bitcoin.

One of the main advantages is that selling Bitcoin through this method is quick and convenient, especially for smaller transactions. It also eliminates the need for an online account or wallet app.

However, the main disadvantage is that the transaction fees are generally higher compared to other methods. Additionally, identity verification might be required for larger amounts.

4. Sell Bitcoin via Over-the-Counter Trading

OTC (Over-the-Counter) trading involves direct transactions between buyers and sellers, usually facilitated by brokers or specialized services, and is conducted off-exchange. This method is ideal for large Bitcoin transactions as it avoids impacting market prices. OTC trading offers a more controlled environment, allowing large amounts of Bitcoin to be sold without causing price fluctuations.

Platforms like Binance offer OTC desks, connecting high-volume traders with institutional buyers and providing dedicated brokers for smooth transactions. In contrast, P2P (Peer-to-Peer) trading involves individuals directly trading with one another, typically through platforms that act as intermediaries. While P2P trading offers more flexibility in payment methods and can be more accessible to retail traders, it may not be as suited for large transactions as OTC trading, which is more structured and often involves institutional buyers. P2P also tends to carry more risk, as the buyer and seller are not always verified to the same extent as in OTC services.

While both methods provide privacy, OTC trading offers greater liquidity and is generally considered more secure for large-scale trades. However, P2P platforms might offer better rates or convenience for smaller transactions. You should stay cautious to avoid potential fraud, so it’s essential to use trusted platforms and brokers.

5. How To Exchange Bitcoin for Another Crypto to Convert to Cash

Another way to indirectly cash out your BTC is by trading it for another crypto, such as exchanging Bitcoin (BTC) for a stablecoin like USDT or USDC, which are backed by fiat currencies like the US dollar.

To do this, you’ll need to access your crypto exchange account, like Binance, HTX, or Bybit, and find the trading pair you want to trade, like BTC/USDT. Once you’ve initiated the trade, your Bitcoin will be converted into the desired stablecoin, which you can then withdraw to a platform that supports fiat withdrawals, like PayPal or a bank-linked service, to convert the stablecoin into cash.

Using this method can be helpful if your exchange doesn’t offer many fiat withdrawal options, but has strong crypto-to-crypto trading features. Also, using stablecoins like USDT can help you avoid market volatility when you’re preparing to withdraw fiat.

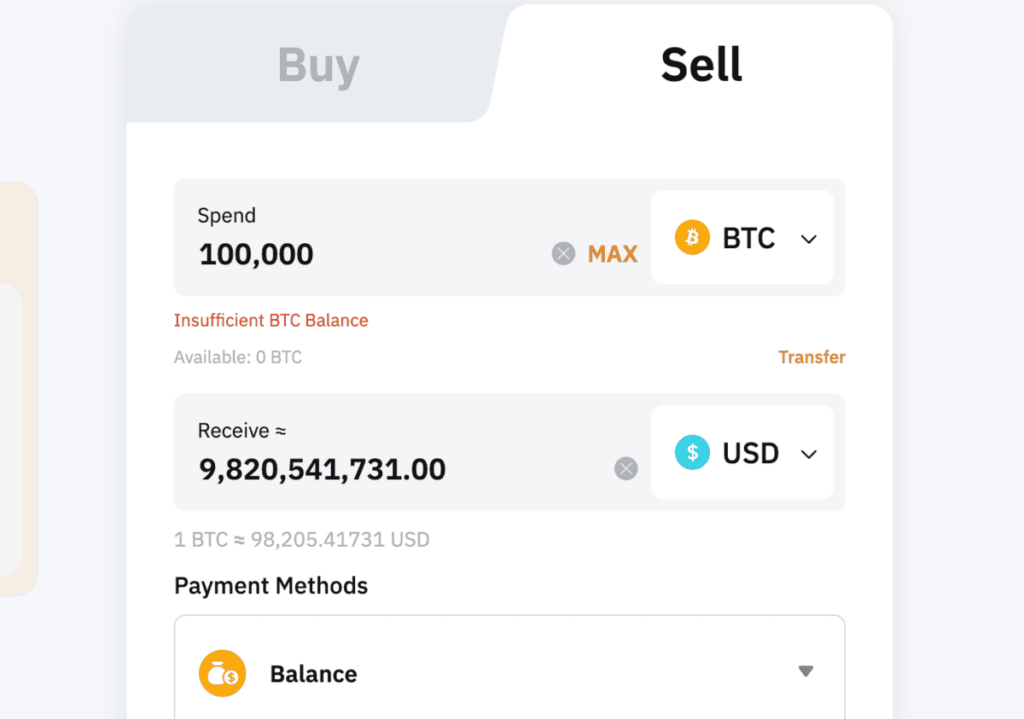

How To Sell Bitcoin via Bybit One-Click

Bybit One-Click Buy is a feature that allows users to quickly buy and sell cryptocurrency using fiat currencies through various supported payment methods. With just a few clicks, you can trade cryptocurrencies like Bitcoin and Ethereum using options such as P2P Trading, Bank Card Payment, Third-Party Payment, or Fiat Balance.

Here’s an example of how to exchange Bitcoin for cash on Bybit:

- Create an Account on Bybit.

- Complete KYC Verification.

- Go to the “Buy Cryptocurrency” section in the main menu of the Bybit website and select “One-Click Buy” from the dropdown menu.

- You will see two tabs: Buy and Sell. Choose Sell.

- In the form, select BTC as a crypto option and a suitable fiat currency (for example, USD). Complete by choosing a payment method. Then, press the “Sell BTC” button.

Do I Need To Pay Tax When Selling Crypto?

In the U.S., the taxes you pay when cashing out cryptocurrency depend on several factors, including your income, the holding period, and how the transaction is classified.

The IRS treats cryptocurrency as property, meaning any gains from selling, trading, or cashing out are subject to capital gains tax. The tax rate depends on how long you held the cryptocurrency before cashing out:

- Short-Term Capital Gains:

This applies if you hold the crypto for one year or less. The gains are taxed at your ordinary income tax rate, which ranges from 10% to 37%, depending on your income bracket. - Long-Term Capital Gains:

This applies if you hold the crypto for more than one year. The tax rates are lower, typically 0%, 15%, or 20%, based on your income.

The taxable gain is the difference between the cost basis (the amount you originally paid for the crypto) and the proceeds (the amount you receive when cashing out).

Formula: Taxable Gain = Proceeds – Cost Basis

If you sell for less than your cost basis, you can claim a capital loss, which can offset other gains or reduce your taxable income.

Additional Taxes to Consider:

- Net Investment Income Tax (NIIT):

If your modified adjusted gross income (MAGI) exceeds $200,000 (for single filers) or $250,000 (for married filing jointly), an additional 3.8% tax may apply to your net investment income, including crypto gains. - State Taxes:

Depending on your state, you may also owe state income taxes on your crypto gains, with rates varying significantly.

If you’re a resident of the USA, it’s essential to keep accurate records of your crypto transactions and consult a tax professional or use crypto tax software to ensure compliance with IRS regulations.

How to Sell Bitcoin: Key Tips

1. Compare Fees: The cost of selling Bitcoin can have an impact on the amount you receive, so it is essential to research and compare fees across various platforms. The transaction fees on the best crypto exchanges typically range from 0.1% to 2%, while Bitcoin ATMs may charge up to 10%. Furthermore, some platforms may have hidden charges, such as withdrawal fees for transferring funds to your bank account. Before proceeding, it is important to calculate the total costs involved to ensure you get the best deal. Always carefully review the fee structure of the platform to avoid any unexpected commissions.

2. Verify Buyers:

When selling Bitcoin on peer-to-peer platforms or directly with individuals, it is crucial to verify the buyer’s credibility. Seek out platforms that have robust verification procedures and user reviews. Many peer-to-peer platforms, such as Binance P2P, offer a rating system for buyers and sellers. Take the time to review the buyer’s profile, transaction history, and feedback from other users. Avoid transactions with buyers who have low ratings or incomplete profiles. This step helps mitigate the risk of fraud or chargeback scams.

3. Choose the Right Method:

Various sales techniques cater to diverse requirements, so it is crucial to consider factors such as speed, safety, and ease of use. If you require immediate access to funds, Bitcoin ATMs or instant cash-out services like PayPal may be the best options, albeit with higher fees. For larger transactions, cryptocurrency exchanges or OTC (Over-the-Counter) desks offer enhanced security and lower costs. If confidentiality is a top concern, P2P platforms provide more discreet transactions, often with a wide range of payment options. Evaluate your priorities and select a method that suits your objectives.

4. Use Escrow Services:

Escrow services are essential when conducting P2P trades to protect both parties from fraud. When you sell Bitcoin on platforms like Paxful or Binance P2P, the platform temporarily holds the Bitcoin in escrow until the buyer confirms payment. This ensures that you won’t release your Bitcoin before receiving the agreed payment. Always confirm that the payment has been fully processed and can’t be reversed (for example, a cleared bank transfer), before releasing your Bitcoin. Avoid using platforms or transactions that don’t offer escrow as they expose you to unnecessary risks.

By following these detailed tips, you can sell Bitcoin securely and efficiently, maximizing your returns while minimizing risks.

How to Exchange Bitcoin for Cash: CEX or P2P?

One of the most controversial questions is: how to sell bitcoin via crypto exchanges or P2P? The primary differences between selling Bitcoin through an exchange and via peer-to-peer (P2P) methods lie in the process, fees, control, and security.

While exchanges charge a transaction fee, which can range from 0.1% to 2%, depending on the platform and trade volume, P2P platforms may have lower fees compared to exchanges or sometimes no fees at all.

Moreover, P2P is more private since some platforms don’t require full KYC, depending on local regulations.

Both methods have their pros and cons, so the choice depends on your specific priorities and needs.

Conclusion

Exchanging Bitcoin and other cryptocurrencies into cash is an essential step for many users, whether to secure profits, mitigate losses, or simply access funds for real-world use. Understanding the available methods ensures you can make informed decisions based on your needs.

Traders have several reliable options for selling Bitcoin. Cryptocurrency exchanges are a popular and trusted choice, offering security and widespread recognition. For those seeking greater flexibility, peer-to-peer (P2P) platforms enable direct transactions with diverse payment methods. Alternatively, Bitcoin ATMs provide a quick and convenient way to sell your BTC, though they typically come with higher fees.

Reviews