Strategy for Binary Options “Way”

Big diverse trading strategies provides the trader with the possibility of free choice. This is of key importance for beginners. Because of their little experience, they have not yet developed their own trading system. Therefore, in order to trade profitably, they have to follow the rules of ready-made systems. Strategies are developed by experienced traders, who understand the principle of indicators and are also familiar with the mechanism of pricing on the market.

Contents

Trading platform INTRADE.BAR In contrast to many of its competitors, it allows you to carry out the analysis directly in the terminal. However, the limited range of instruments imposes serious limitations in terms of the available list of trading systems. The way out in this situation is the use of third-party platforms. An excellent choice is TradingView. We have already reviewed dozens of strategies using this service on our website. In this article, we will look at the “Way” system, which consists of two indicators.

Review of the trading strategy for INTRADE.BAR

The algorithm of the system is based on the use of two tools with different approaches to the evaluation of market indicators. Firstly, it is the classical ADX (indicator review on InvestMagnates.com), which may already be familiar to you. By the way, this indicator is built into the Intrade.Bar trading platform (Open a demo account). The second tool is “CM_Stochastic_MTF”. It is the leading one in this connection, where ADX acts as a signal filter. This indicator can only be found on the TradingView platform.

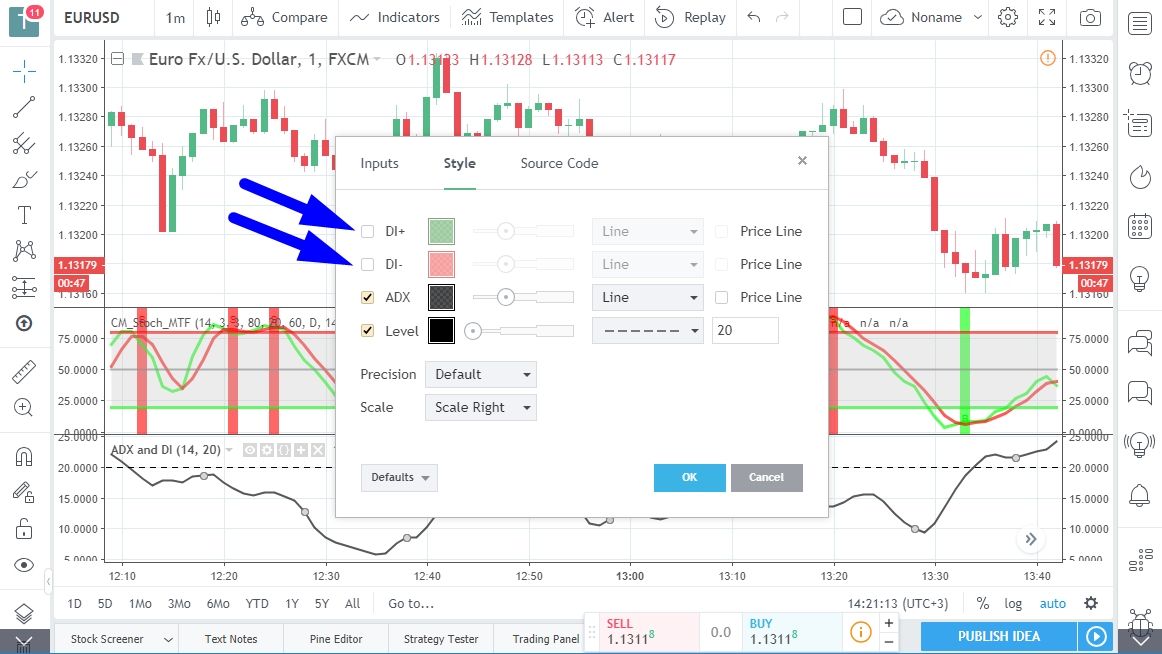

- “ADX and DI” – directional movement system. With its help the trader can determine the strength of upward and downward price movements. There is also an average index, which is not tied to the type of trend. That is what is called the ADX, the other two lines are called +DI (positive index) and -DI (negative index). In our case, we need only ADX, so for convenience, it is recommended to hide the other two lines. How to do this, we will discuss below.

- “CM_Stochastic_MTF” – stochastic oscillator, as its name suggests. However, it differs from the classical version of this indicator. The differences can be traced in two ways. Firstly, it is an advanced formula for calculating the value of curves. Secondly, it has an understandable interface. The indicator signals are clearly underlined by a color marking, so they are harder to miss.

Setting up TradingView and Intrade.Bar

To trade using this strategy, you need to open two websites in two browser tabs. In the first – TradingView (open the terminal), in the second – Intrade.Bar (open the terminal). Trading asset, candlestick chart type and time frame – these parameters must be identical in the two windows.

Platform Settings:

- Asset: currency pairs (EUR/USD, AUD/USD and others from among the high-yielding ones);

- chart: candlestick mode of display, interval – 1 minute.

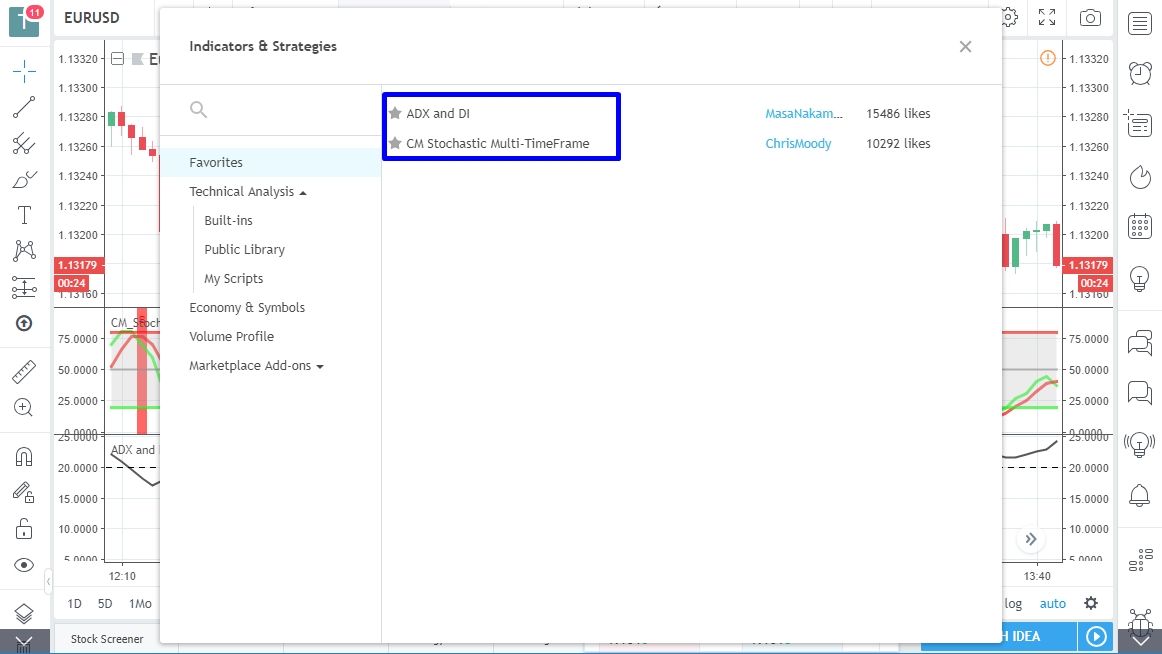

You will need to add two indicators to the TradingView chart. Open the search window and copy the names of the instruments: “ADX and DI” and “CM_Stochastic_MTF”. We leave the Stochastic settings unchanged, the standard ones are quite suitable.

By default, the ADX includes 3 lines. However, in this strategy we only need the main index, so we remove the other two curves. Open the indicator style settings and uncheck the “+DI” and “-DI” lines.

Trading signals by strategy for intrade.bar

This strategy with intrade.bar is simple, so this strategy can be recommended to novice traders. You should focus on the color indication of the Stochastic oscillator, and use the ADX to conduct a final check of the signal before entering the market.

- A signal to go up – the appearance of the green selection band on the CM_Stochastic, combined with the growth of the ADX line.

- Down signal – the appearance of the red selection band on the CM_Stochastic, as well as the growth of the ADX index.

The picture above clearly illustrates true and false signals, which in most cases do not allow you to make a profit. If the Stochastic Oscillator gives a signal, but the ADX index is falling, it is not recommended to enter the market. In fact, this indicator shows the strength of the price movement. If the momentum is weak or fading, the price movement will soon stop. When the strength of the trend increases, it means that the movement will continue for some time. This will make it possible to make a profit on the deal.

As soon as the signal appears on the Live Chart, you should immediately switch to the Intrade.Bar to open a deal. However, before that you need to manually select the expiry time, so that it is equal to approximately 5 minutes. In the “Time” drop-down list of the terminal, select the last or penultimate time value highlighted in orange.

In conclusion, let us note that when trading with this strategy, you should follow the basic rules of trading. Do not forget about the limit of 5% of the deposit amount. Also, you should watch out for periods of low volatility. The ADX is an excellent tool for determining the level of market activity.

Reviews