Taxes on Cryptocurrency in Russia: in General, in Particular, and as for Others

On January 1, 2021, the Digital Financial Assets Act came into force, and earlier changes to the Civil Code related to cryptocurrencyAccording to which cryptocurrency is recognized as property. Most importantly, the circulation of cryptocurrency in Russia is not prohibited, but it is significantly complicated. The law, at first glance, is harsh.

Contents

- 1 Tax status of cryptocurrency in Russia

- 2 Tax legalization of cryptocurrency

- 3 How to Make Money on Cryptocurrency?

- 4 Difficulties with the legalization of cryptocurrency

- 5 Comments from representatives of the Binance cryptocurrency exchange

- 6 Consequences of the legalization of cryptocurrencies

- 7 Taxation of cryptocurrencies in other countries

Tax status of cryptocurrency in Russia

Federal Law N 259-FZ of 31.07.2020 “On Digital Financial Assets, Digital Currency and on Amendments to Certain Legislative Acts of the Russian Federation”. (FZ on CFA) will be applied together with the Federal Law of 18.03.2019 N 34-FZ “On Amendments to Parts One, Two and Article 1124 of Part Three of the Civil Code” (which enshrines the property status of digital assets (Article 141.1 of the Civil Code) and smart contracts and allows for digital transactions) and the Federal Law of 02.08.2019 N 259-FZ “On raising investments using investment platforms and on amendments to certain legislative acts of the Russian Federation” that already entered into force (“Crowdfunding Law”).

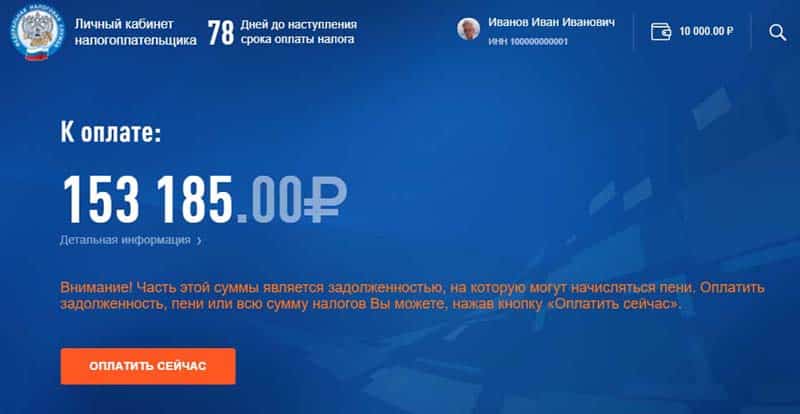

This year, individuals will declare only income from the sale of cryptocurrency. To do this, you should submit a tax return for 2020 to the FTS office at the place of registration in person, by mail, or via a personal account of a taxpayer at the FTS website (Fig. 1) until April 30. In the tax return, you need to show the income from the sale of the cryptocurrency, subtract the expenses for the purchase of this cryptocurrency from this amount, and multiply the difference by the personal income tax rate of 13% (cryptocurrency trading). The tax must be paid by July 15. And it will be necessary to report even if the cryptocurrency was purchased more than a year ago.

Image. 1

If the tax return is not submitted, it entails a fine of 5% the amount of tax not paid in the prescribed by the legislation on taxes and fees, for each full or partial month from the day set for submission of the declaration, but not more than 30% the specified amount and not less than 1000 rubles. For non-payment of tax liability is also established, the amount of which, according to Art. 122 of the Tax Code can make 20% the amount of tax not deliberately paid and 40% of the amount of tax deliberately not paid. In addition to the fine for the tax offense committed, the taxpayer will be obliged to pay the amount of tax and the corresponding penalties.

Income from the sale of cryptocurrency is calculated as income from the sale of property. That is, according to the current legislation, income from the sale is subject to personal income tax (How to make money on cryptocurrency). The tax rate in this case is 13%, and from January 1, 2021 on income exceeding 5 million rubles is taxed at a rate of 15%. Attempts to evade tax threaten criminal prosecution. If the unpaid amount of personal income tax for 3 fiscal years exceeds Br2.7 million, an individual may be held criminally liable for tax evasion under part 1 of Article 198 of the Criminal Code, which threatens imprisonment for up to 1 year. If the unpaid amount for three financial years exceeds 13 million rubles, the term of imprisonment reaches 3 years.

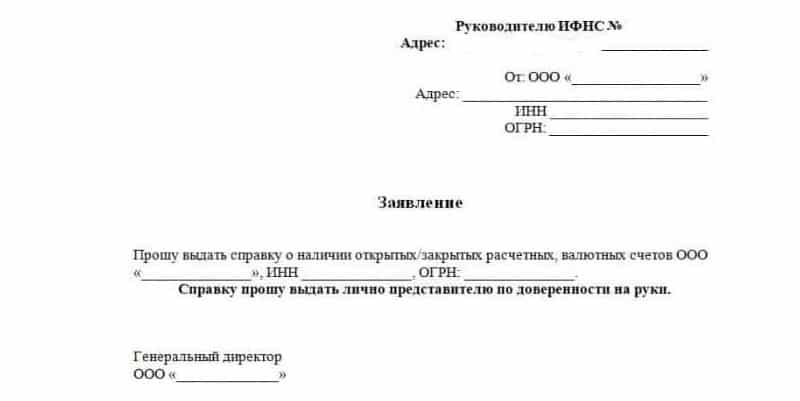

Cryptocurrency legislative initiatives are not limited to the requirements that have come into force. Citizens, including foreigners with residence permits in Russia and permanently residing on its territory, as well as organizations, including branches and representative offices of foreign companies established in Russia, having the right to dispose of digital currency will be required to report to the tax authorities the right to dispose of cryptocurrency, turnover of funds and the balance, if the amount for the year exceeds 600 thousand rubles. This bill was recently adopted in the first reading by the State Duma. At the same time, the Federal Tax Service will be able to request from banks statements (Fig. 2) of transactions in the accounts of individuals and certificates of transfers of digital currency.

Image. 2

Tax legalization of cryptocurrency

The Russian Association of Cryptocurrencies and Blockchain (RACIB) called the position of the Russian Central Bank (Central Bank) one of the toughest in terms of banning cryptocurrencies compared to approaches in the United States, the European Union and Asia. But the tightening of cryptocurrency regulations just means that it will not be banned, which is good news. At first glance, the toughness of the government’s requirements for cryptocurrency market participants shows that it treats them rather negatively as a way to avoid taxes, which does not seem to be good news.

But there is a definite advantage in this, as the legality of operations with crypto and charging tax on this activity will lead to the legalization of income that is received by individuals and legal entities in transactions with digital assets (crypto trading security). This opens the way for legal development of cryptocurrency companies, with all the corresponding advantages, for example, the possibility of lending and, if necessary, you can count on judicial protection. Legalization complicates the life of crypto market participants, but clearly increases their status in the country’s economy and offers new prospects. Qualified participants can enter the market, while those who can’t control their finances will leave the market. But this way will really clear the cryptocurrency industry exclusively from those who evade taxes by not paying them on cryptocurrencies.

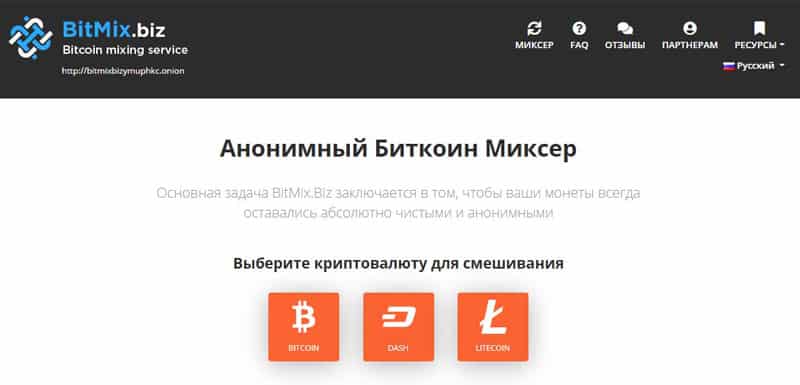

One of the reasons for stricter regulations was declared to make sure that cryptocurrencies are not used in any illegal transactions. But in the end, this is the weakest part of the legislation, as the legislation does not say anything about the source of cryptocurrencies from users (Figure 3). In fact, the authorities, through taxes, legalized cryptocurrencies that came from users in any way, even criminal. The Federal Tax Service can request from banks statements of accounts of individuals that were used to conduct transactions with digital currency, in case of suspected violation of tax laws only. Thus, for example, the problem of money laundering with the help of cryptocurrency is not solved in any way, which is constantly mentioned by various critics. On the contrary, laundered proceeds now become legal if taxes are paid on them.

Image. 3

This is not prevented by the fact that, at present, anyone can carry out any transactions with digital currency, provided that the main thesis is observed – “no one has the right to accept digital currency as a counteroffer for goods, works and services. True, according to research cryptocurrencies and control agencies in other countries, cryptocurrencies are far from being the most popular way to launder money. In particular, because they are difficult to legalize, it is difficult to report on their origin, especially if they are large amounts – in Western banks, the origin of large sums of money is paid special attention.

How to Make Money on Cryptocurrency?

The head of the Central Bank Elvira Nabiullina commenting on decisions related to the cryptocurrency said that amid the rapid appreciation the attitude of the authorities to Bitcoin has not changed, but the fears were confirmed, and the upward spike in value may be followed by a collapse. From Nabiullina’s point of view, the volatility shows that cryptocurrency is not a real currency. Although not only bitcoin is volatile, so are some fiat currencies. In addition to the risks of volatility, the Central Bank also notes that it can be used for all sorts of dubious transactions.

The RACIB believes that the attitude of the authorities to cryptocurrencies shows that the authorities fear the negative consequences of the spread of cryptocurrencies in the country due to their volatility and the possibility of speculation associated with it. The RACIB agreed with the Central Bank’s arguments regarding speculation and volatility, but believes that the economy could be given a chance to attract cryptocurrency investments, but the government’s financial bloc is set on making money through fines and taxes. The RACIB also agrees that cryptocurrency is not backed by real assets, and the function of cryptocurrencies is either speculative or calculative.

But, on the other hand, the fact of levying taxes on cryptocurrency brings cryptocurrency into the legal field and makes it an established phenomenon in the economy, as many participants of the crypto market wanted. Of course, this is done by the rules of the state, without taking into account the interests of crypto market participants, although it does not particularly harm them. In fact, the authorities themselves pump cryptocurrency with real value, which is expressed in real money and thus make money on it themselves, without spending any money to create any cryptocurrency infrastructure in the country, but also without preventing market participants from making money on it – just pay taxes.

Looking more broadly, cryptocurrencies can now influence the economy to a much greater extent than when they were in an unclear, non-legal field. What almost all participants of the crypto market wanted is happening – cryptocurrency is de-facto recognized by the state, just not legally formalized to the full, but the authorities will have to do it, because soon there will inevitably be precedents of problems in interpreting the status of cryptocurrencies when trying to pay taxes. As for the strictness of the legislation regarding cryptocurrencies, it is no stricter than for other types of property – everyone pays exactly the same taxes on transactions with them. It is possible to argue only with the fact that cryptocurrencies are property, but since the law says so, it will be so, at least for some time. Difficulties of taxation of cryptocurrencies are determined by their properties and underdeveloped legal definitions of concepts.

Difficulties with the legalization of cryptocurrency

Legalization upsets many crypto market participants, although, objectively, the tightening of the law has not changed the situation in the market too critically. Anyway, cryptocurrencies had to be converted to fiat, and fiat turnover is already fully controlled by banks and tax authorities. But there are really complicated moments, because of which the legislation looks not fully thought out and this can lead to problems quite soon. For example, the bill doesn’t explain how to fill in the declaration. There is no clarity on how to account trading transactions on the exchange, whether it is necessary to report to the FTS the amount of the equivalent of 600 thousand rubles, if the owner of the cryptocurrency did not perform any trading operations, but, for example, the price jumped suddenly, and the taxpayer received a profit, as it often happens on the cryptocurrency market.

It is unclear what the banks will do when the user’s account begins to receive money from the sale of cryptocurrency, as the declaration is filed by April 1, 2022, and the money is received, for example, in 2020. It is not clear at what rate to specify cryptocurrencies when filing a declaration – there is no single rate for cryptocurrencies, but it is unclear whether the tax office will accept the report at the rate at which the user counted.

One of the main problems of the new legislation is that there is no concept of “digital currency” in the Civil Code of the Russian Federation. Rights related to digital currencies are defined as those named as such in the law as “compulsory and other rights. The use of the undeciphered concept of “digital currencies” in the tax legislation makes participants of the crypto market vulnerable to law enforcement amendments. In fact, taxes will have to be paid without a clear definition of not only such a concept as “digital currency”, but also “digital rights”, “digital money”, which should be enshrined in the Civil Code, as well as the order of their use. The lack of a conceptual apparatus may be a serious obstacle for banks to work with cryptoprojects, even in spite of their legal tax status.

Comments from representatives of the Binance cryptocurrency exchange

Crypto-exchanges have a lot of work to do to educate Russian users, most likely they will have the maximum amount of information on this topic. For example, crypto-exchange Coinbase has created the most detailed instruction on paying cryptocurrency taxes in the U.S. Exchanges maintain services to calculate cryptocurrency taxes. One of the largest crypto-exchanges Binance (https://www.binance.com) has already commented on the new cryptocurrency laws in Russia. Other crypto-exchanges are likely to take approximately the same position on a number of key issues. For example, Binance will not hand over user data to the tax authorities, as under existing laws, Binance is not obliged to disclose information to Russian tax and law enforcement and other supervisory authorities. An exception may be reasonable individual requests for specific criminal cases.

If the user received the cryptocurrency for free, that is, not as a result of a purchase, but as a result of an event like a raffle, the tax payment procedure depends on where the cryptocurrency is deposited. There is a higher tax for drawings, but we need confirmation that the cryptocurrency was received as part of a drawing or as a prize. But so far, there are no known rules to follow in this situation. Therefore, Binance recommended to declare the income, as in the sale of cryptocurrency at 13%, as income from the sale.

Binance also clarifies that the tax is payable on the occurrence of income from the sale of cryptocurrency in fiat, as from the sale of property in fiat. So far, there are no rules for the tax authority to recognize a particular rate at which the declarer calculated the rate and the exchange recommends waiting for the addition of legislation in this matter. The cryptocurrency exchange also cautions against attempts to reduce profits from the sale of cryptocurrency. The documents submitted to the tax authorities must include the date, the amount of the transaction, contain personal information. At the same time, it is not always possible to report electronically, and Binance account statements may not be recognized by the IRS.

Binance warns that there is no clarification from the tax authority on how to calculate tax if a user made a profit on growth and then suffers a loss over an extended period. The cryptocurrency exchange believes that pending any clarification, the difference in fiat between the amount at the beginning of the tax period and at the end of the tax period should be the difference. But which rate will be considered correct by the tax authority, and how fluctuations will be accounted for, is unknown. By the way, we can assume that ambiguity with determination of the rate of cryptocurrencies will force the Central Bank to deal with this issue and form a consensus rate, at least for bitcoin. At the same time, Binance unequivocally responds that high volatility will not be taken into account as a mitigating factor for losses. The cryptocurrency exchange advises to contact the tax authorities directly on the issue of specific filing.

Consequences of the legalization of cryptocurrencies

First of all, it should be noted that the taxation of cryptocurrencies in Russia had no effect on the value of cryptocurrencies and did not lead to any frenzy in the Russian cryptocurrency market or in any other market. The cryptocurrency market continues to grow successfully. The introduction of taxes on cryptocurrency was quite expected, but not as significant as, for example, Tesla’s billion-dollar investment in bitcoin. The specifics of the cryptocurrency market is that it is global and the user can switch to another jurisdiction if the conditions there are more acceptable. Therefore, one can imagine that Russian users who are interested in legalizing their cryptocurrency business will start paying taxes without much difficulty, though without pleasure.

So far, there is a lot of ambiguity in this area, but over time, the legislation will surely adapt, and all the nuances will be taken into account. Users who do not want to enter into tax relations with the state will prefer to move to another jurisdiction and report in Russia for regular fiat. It is safe to assume that users in Russia itself will find an opportunity to mitigate tax legislation by schemes involving any payment systems, purchases of goods, services and other opportunities – in this respect, the target audience of the cryptocurrency market is quite advanced and will not just give up. But cryptocurrency exchanges and all other cryptocurrency projects will surely cooperate with the financial service and provide tax authorities with any data on users – the same way they act in the USA, so as not to lose business due to conflict with the authorities.

Taxation of cryptocurrencies in other countries

Let’s take a closer look at how taxation is done in different countries.

USA

Most likely, the American tax legislation served as a model for the Russian one and, most likely, the Russian legislation will continue to be adjusted to it, because it is minimally loyal to ordinary participants of the crypto market. The U.S., represented by the SEC, the main supervisory authority, began to regulate the cryptocurrency market more than five years ago. “The Internal Revenue Service” (IRS) defined cryptocurrency as property, just like in Russia, hence the taxation practice.

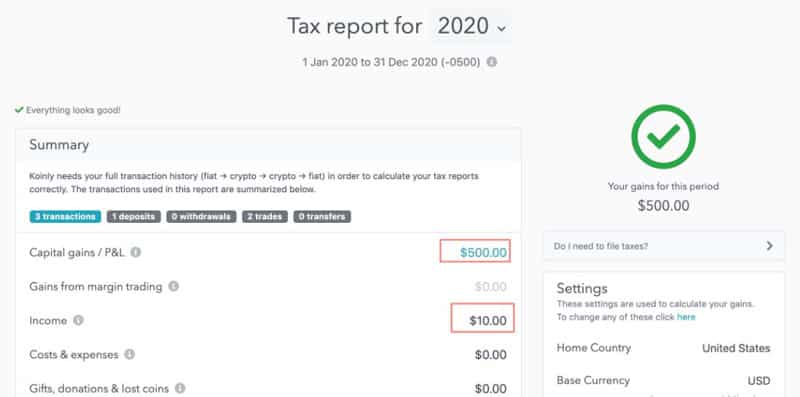

U.S. citizens are required to report absolutely every dollar-denominated cryptocurrency transaction on their tax return (Figure 4). Even if the user receives no income from either trading or mining, having received the cryptocurrency for free as an AirDrop, this is classified as income and is subject to income tax of 10 to 37% depending on the level of income. If you sell cryptocurrency for fiat, you have to pay 20% of capital income. At the same time, transferring cryptocurrency between personal cryptocurrency wallets is not taxed. Also, one-time purchase of cryptocurrency for fiat and keeping it without movement is not taxed.

Image. 4

When calculating profits and losses, the user must consider transactions and exchange rates immediately at the time of the transaction. In case a trader is professional and makes a lot of transactions, this is a significant difficulty, so crypto-exchanges help with calculations. It is quite possible that something similar will happen in Russia. Of course, if the user did not report, concealed income or calculated incorrectly, he will be punished, in America this is very strict.

FRG

Germany is the leading cryptocurrency country in the EU and the main bitcoin hub in the EU. In general, Germany follows the 2015 ruling of the European Court of Justice, which states that transactions exchanging bitcoin and other electronic currencies for real money belong to monetary transactions and are therefore exempt from value-added tax. But in practice, Germany has a more complicated interpretation of cryptocurrencies. For example, buying a product or service for cryptocurrencies, the user makes a transaction of alienation of one value (not money) exchange it for another, from the point of view of the German tax service this is “speculation.

In Germany, the main issue of taxation of cryptocurrencies is the issue of VAT. Transactions to exchange fiat currency for cryptocurrencies and other virtual currencies are considered taxable services but are not subject to VAT. Cryptocurrencies and other virtual currencies, if used only as a means of payment, are treated as standard means of payment. Therefore, their use as a means of payment for the purchase of goods, services and other cryptocurrency is not subject to VAT. Mining, in theory, is subject to a transaction fee on miners, however, this fee is paid voluntarily, but mining is also exempt from VAT. According to the law, receiving cryptocurrency through mining cannot be qualified as a payment for mining, as there is no exchange of anything, so mining is not subject to VAT.

But digital wallets on a computer, tablet or smartphone in Germany are taxable if they are offered for payment – these are services and VAT is paid on them. Cryptocurrency trading platforms, from the point of view of the Ministry of Finance of the Federal Republic of Germany, are services for the provision of technical opportunities for financial transactions, on which VAT is paid. However, if the work on the platform is organized as the provision of intermediary services, they can (but not necessarily) be exempt from VAT. But in the FRG there is no unambiguous scheme that applies to all cryptocurrency projects in the same way, the taxation of each project is carried out individually, which is probably optimal for such a complex asset as cryptocurrencies, but time-consuming and costly for the authorities.

France

In France, the cryptocurrency market is regulated as part of the fight against money laundering and terrorist financing. Any profit from the sale of cryptocurrencies is subject to taxation; interestingly, the value of cryptocurrencies is taken into account when calculating wealth tax. However, the tax is calculated differently, depending on whether the purchase and sale of cryptocurrency is a one-time transaction or an ongoing activity of the user. That said, if the user decides to donate cryptocurrency to someone, they will pay gift tax. Users are required to file returns every year and, of course, are penalized for withholding income from cryptocurrencies. So, as you can see, the Russian legislation does not differ much from the relevant norms of the developed economies of the world and nothing terrible is happening in the Russian crypto market.

Reviews