How to Trade Forex on Interactive Brokers in 2026

If you’re thinking about trading in foreign currencies but unsure if a broker offers forex trading with reasonable fees and a trustworthy platform, we can help answer the question: how to trade forex on Interactive Brokers.

We’ve carefully researched the trading conditions at Interactive Brokers to provide valuable insights into their fees and security measures, so you can make an informed decision.

Contents

What Is a Forex Broker?

Forex trading, or foreign exchange trading, is the simultaneous buying and selling of two currencies to make a profit. In forex transactions, a currency pair is traded, rather than a single currency and trading takes place in the foreign exchange market, which is one of the largest and most liquid financial markets in the world.

Key Takeaways

- Online forex brokers provide a comprehensive range of options for interested investors.

- The U.S. dollar, euro, Japanese yen, British pound, and Chinese yuan are some of the most traded currencies in the world.

- Forex brokers cater to a variety of clients, including retail traders and large institutional investors.

The foreign exchange market is where currencies are traded in pairs, such as EUR/USD. When you trade the EUR/USD pair, you buy euros and sell US dollars. The euro is known as the base currency in this pair, while the US dollar is called the quote currency. The exchange rate, or price of the pair, represents how much one euro is worth in US dollars. This price varies constantly due to market demand for these currencies.

A foreign exchange (FX) broker, or Forex broker, is a company that helps with currency trading for its clients. They charge a commission for their services and act as an intermediary between buyers and sellers. The broker matches buy and sell orders from their clients with the orders of other clients, ensuring successful trades. This eliminates the need for clients to evaluate each other’s creditworthiness as the broker assumes this responsibility. Forex brokers use their network of liquidity providers, mainly banks and dealers, to get favorable exchange rates. These rates are offered to clients in low spreads, making trading more cost-effective.

Does Interactive Brokers Have Forex?

Interactive Brokers offers trading in stocks, futures, EFPs, bonds, funds, cryptocurrencies, and options, along with a range of advanced tools and platforms for managing these investments. Still, does it provide forex trading? Let’s explore all its possibilities below.

Interactive Brokers Overview

Interactive Brokers (IBKR) is an American investment company founded in 1977 with headquarters in Greenwich, Connecticut. The company operates across multiple global offices and offers a diverse range of trading products including stocks, futures, ETFs, forex, bonds, funds, and cryptocurrencies. It is regulated by several prominent US authorities such as the SEC, NYSE, CFTC, FINRA, and CME, among other self-regulatory organizations.

As of 2024, Interactive Brokers has received numerous awards. Notable among these is Barron’s rating of IBKR as the #1 Best Online Broker for 6 consecutive years. This recognition highlights its excellence in the field. In addition, Investopedia has recognized IBKR for being the Best Broker for International Trading and the Best Online Broker in 2019.

In terms of market access, Interactive Brokers (IBKR) provides clients with the ability to trade in over 135 markets worldwide. The company offers a comprehensive suite of tools for both novice and professional traders, including AI-driven portfolio management, centralized asset management interfaces, customizable APIs, and platforms to select managers and other specialists.

Additionally, the Interactive Broker Mutual Fund Marketplace provides access to over 43,000 funds from over 600 fund families with over 18,000 available funds without transaction fees. IBKR’s commitment to technological advancement is evident through its continuous improvement of trading platforms. For example, the introduction of new tools and features on the Desktop Trading Platform in December 2024.

Overall, Interactive Brokers’ extensive regulatory oversight, diverse product offerings, advanced trading tools, and industry recognition underscore its position as a leading global brokerage firm.

Interactive Brokers’ Pros and Cons

Undoubtedly, Interactive Brokers offers several advantages, including regulation in multiple jurisdictions worldwide, a strong range of CFDs on forex and stocks, and robust trading platforms. However, there are some drawbacks, such as customer support being difficult to reach, a website that can be confusing for beginners, and a limited selection of commodity CFDs.

Here’s a table summarizing the pros and cons of using Interactive Brokers for forex trading:

| Aspect | Pros | Cons |

| Trading Platforms | Advanced Trader Workstation (TWS) with over 100 order types and algorithms | Complex platform with a steep learning curve for beginners |

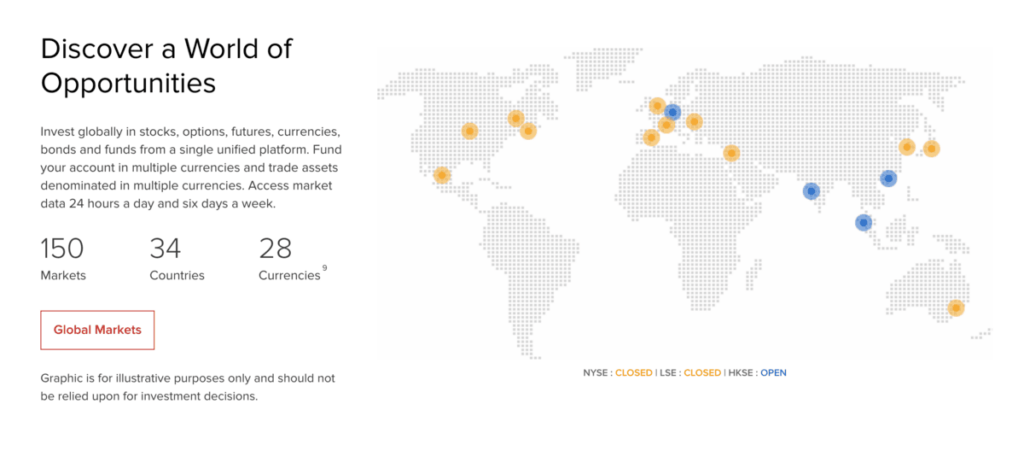

| Market Access | Access to 150 market centers in 34 countries with a broad range of currency pairs | Limited focus on features specific to retail traders |

| Fees and Costs | Low trading fees and competitive margin rates, low commission on raw prices | A minimum commission of $2 per trade can be expensive for smaller trades |

| Research and Education | High-quality research materials and educational content | Limited beginner-specific guides for forex trading |

| Currency Pairs | Lots of FX pairs available | Fewer exotic currency pairs compared to some specialized forex brokers |

| Third-Party Tools | Direct access to powerful trading tools and integrations | Lack of support for MetaTrader, a popular platform among forex traders |

| Risk Management | Transparent pricing with real-time risk management tools | No guaranteed stops |

| Additional Features | Excellent forex trading platform, customizable features | No spread betting |

Can You Trade Forex on Interactive Brokers?

So now, that you’re aware of the basic facts about Interactive Brokers and its advantages and disadvantages, you probably want to answer a summary question: Is Interactive Brokers good for forex trading?

Interactive Brokers (IBKR) is a reputable choice for forex trading, particularly suited for experienced traders seeking advanced tools and access to a wide range of global markets.

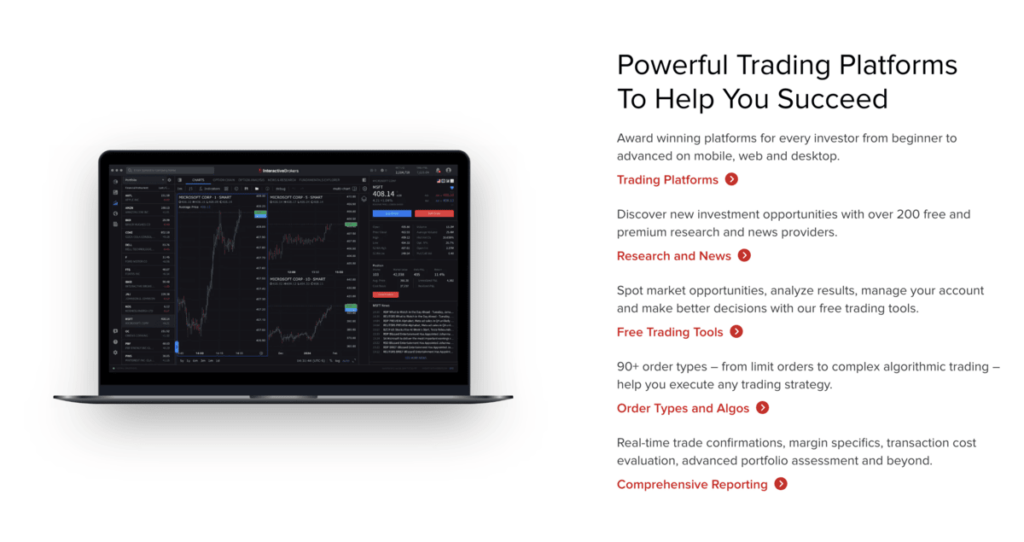

Interactive Brokers offers a range of platforms for forex trading, catering to traders of all levels. The Trader Workstation (TWS) is ideal for experienced traders, offering comprehensive order routing tools for managing larger trades. For more casual traders, its web platform provides a user-friendly interface that allows them to trade currency pairs based on their desired position size, rather than standard lot sizes. This platform also supports limit and market orders, as well as the ability to set stop-loss and take-profit orders based on specific profit or loss targets.

When choosing a broker, you should pay attention to the availability of the necessary features and tools. Here’s our review of them:

- By offering competitive pricing for actual shares, Interactive Brokers has become the perfect platform for swing traders who hold positions for extended periods.

- Low commissions, robust trading platforms, and sophisticated trading instruments provide day traders with a competitive advantage in the market. The advanced scanners integrated into the TWS platform help day traders identify promising instruments to concentrate on.

- The TWS platform provides a remarkable news feed, which includes articles from Reuters and Dow Jones.

- The broker provides a diverse selection of investment options, including stocks, exchange-traded funds, mutual funds, and bonds.

Why Trade Forex with Interactive Brokers?

Interactive Brokers is a top-notch online broker, offering a plethora of features that set it apart from its competitors. Below you will find some compelling reasons why you should consider trading Forex with Interactive Brokers.

- Competitive Fees: The broker provides its investors with favorable spreads and low commissions without hidden fees. Traders can retain a significant percentage of their profits.

- Variety of Currency Pairs: A wide selection of currency pairs is available on the website, including major, minor, and exotic pairs. Each currency has its own unique characteristics and trading options, allowing traders to choose the best strategy for their needs.

- High-Quality Research and Education: The platform offers a set of educational resources, including articles, video tutorials, and webinars, that explore the fundamentals of trading strategies. These resources empower traders with the knowledge and technical expertise they need to make well-informed trading decisions.

How to Trade Forex on Interactive Brokers

Now that you are familiar with all the necessary details about Interactive Brokers, you can finally begin trading forex on the platform. Here is a step-by-step guide on how to trade currencies using Interactive Brokers:

1. Creating an Account: Access the broker’s website and set up a trading account. Select a suitable account type, such as IBKR Lite or IBKR Pro, depending on your trading needs.

2. Funding Your Account: At this step, you should deposit funds into your Interactive Brokers account. Available methods include bank transfer, transfer from Wise Balance, and credit/debit cards. Make sure you have sufficient capital to support your trading activities.

3. Choosing a Trading Platform: Download and set up the Trader Workstation (TWS) desktop application, which is available from Interactive Brokers. Learn how to navigate the platform, explore its tools, and discover its capabilities.

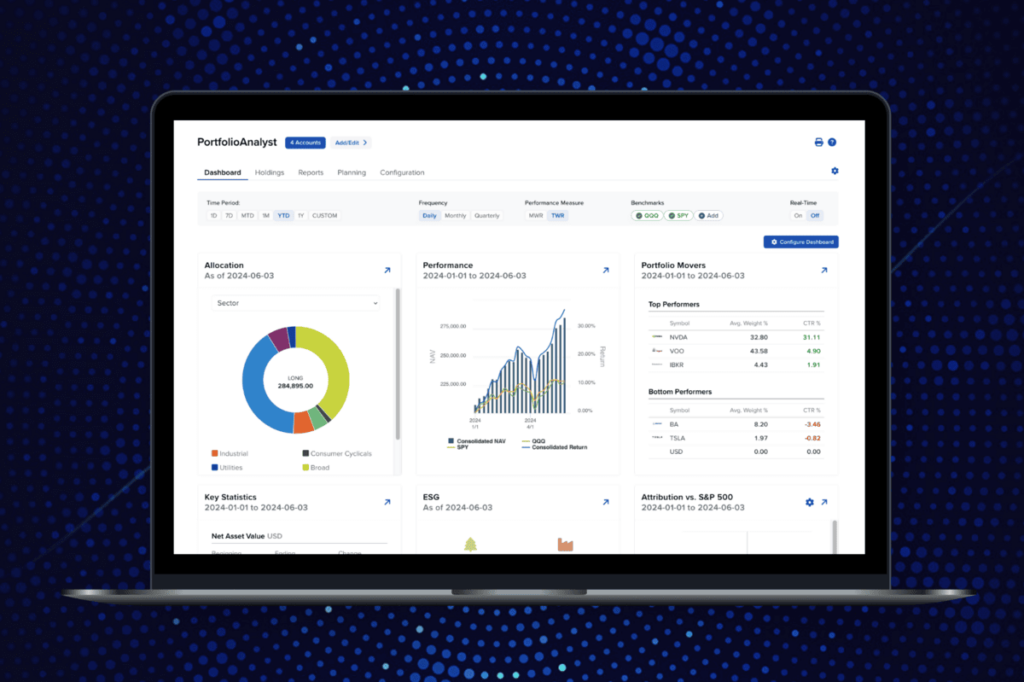

4. Research and Analysis: To conduct thorough research on currency pairs, use the research tools available on the TWS platform, such as market news, charts, and analysis tools. You can keep an eye on economic indicators and news that may impact currency prices.

5. Placing Trades: To place a trade on the TWS platform, select the “Forex” tab and search for the desired currency pair. Click on the pair to bring up the order entry panel. Specify the trade size (lot size) and choose the order type (market order, limit order, stop order) according to your trading strategy. Review the order details, then click “Submit” to execute the trade.

6. Monitor and Control of Transactions: You should watch your ongoing trades. To manage your risk and potential earnings, you can set stop-loss and take-profit orders. We recommend regularly reviewing your trades and making adjustments to your positions.

7. Using Risk Management Tools: You can leverage risk management tools, including trailing stops and guaranteed stop-loss orders, to safeguard your trades against unfavorable market conditions.

8. Staying Current: By keeping yourself informed about market news and events you will be prepared for any occasion that may affect the currency markets. Useful resources might be: the news feed and economic calendar available on the TWS platform.

Follow this practical guide to a successful start trading Forex with Interactive Brokers.

Interactive Brokers Forex Fees and Commissions

Regardless of whether you are a seasoned trader or just beginning, having a thorough comprehension of these charges can assist you in making well-informed choices regarding your trading approach and selecting a broker.

| Aspect | Details |

| Minimum Deposit | A minimum deposit of $2,000 is required to enable forex trading. |

| Active Trader or VIP Discounts | Available for traders who meet specific monthly trading volume requirements, offering reduced commission rates and other benefits. |

| Deposit/Withdrawal Options | Supports a variety of methods including bank wire transfers, ACH transfers, and credit/debit cards for both deposits and withdrawals. |

| Commission per Side | Commences at 0.00002 (0.2 basis points) with a minimum order size of $2 ($4 per round turn), and may decrease to 0.08 basis points for traders with high activity. |

| Minimum Charge per Trade | $2 per side, but trading anything less than 100,000 units will become more expensive proportionally. |

| Commissions and Execution | Aggregates prices from 17 of the world’s largest interbank forex dealers; charges a commission of $16 to $40 per million round turn ($8 to $20 per side). |

| Large Orders | A Request for Quotation (RFQ) is available to minimize the impact on the market and ensure the best possible execution for large orders. |

| EUR-USD Spread | 0.1 (compared to the average spread of 0.6 for the same currency pair at many other brokers) |

| Withdrawal Fee Charged | $0 (however, your bank may impose its fees for receiving international wire transfers) |

| Inactivity Fee Charged | Not applicable |

Interactive Brokers has established a reputation for being highly competitive in terms of fees. Indeed, the spreads, commissions, and interest rates on margin are among the most attractive in the industry.

Conclusion

Trading Forex with Interactive Brokers offers a smooth and cost-effective experience for both beginners and experienced traders. The company provides high-quality research and educational materials, empowering traders with the necessary knowledge to make informed decisions. Whether you are just starting in forex trading or have years of experience behind you, Interactive Brokers has the tools and resources you need to optimize your strategy and maximize your profits.

Reviews