Understanding Tickmill Account Types: Everything You Need to Know Prior Trading

Every trader is unique and their investment approach in the financial markets can vary greatly. That is why the Tickmill brokerage company has several types of accounts to meet the needs of both beginners and experienced clients. In this piece, we will look at the main Tickmill account types: Classic, Raw, Demo, and Islamic, by analyzing their features, and advantages, and determine who they are most suitable for.

Contents

Choosing an Account at Tickmill

Tickmill offers three diverse live accounts over and above the demo account: Classic Account, Raw Account, and Islamic Account. What are the differences between the account types at Tickmill? Firstly, the conditions improve depending on the type of account. Secondly, the required initial deposit differs depending on the selected type.

Classic Account: the Perfect Choice for Beginners

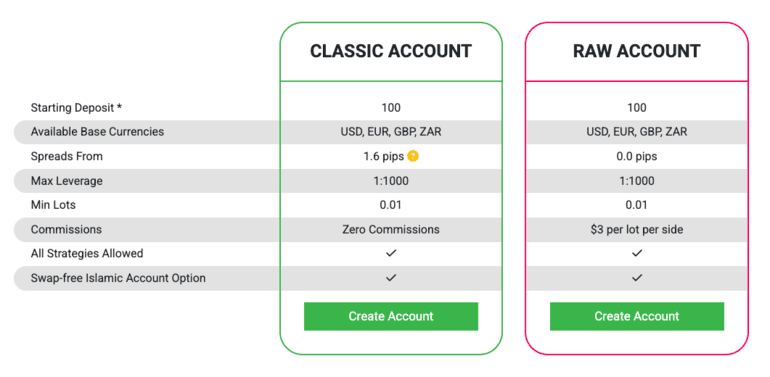

The Classic Account is a basic option that is perfect for beginners or those who prefer simplicity and convenience. Trading is more predictable and easy to understand thanks to fixed spreads starting at 1.6 pips at this type of account.

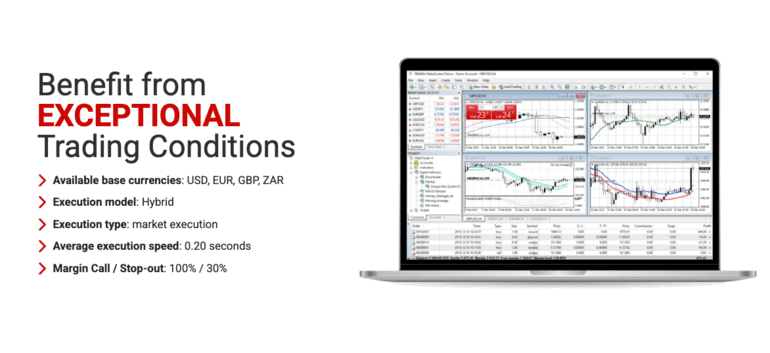

Another key benefit of the Classic Account is that clients can trade various base currencies such as USD, EUR, GBP, and ZAR. This allows traders to choose the most convenient currency for their operations. Trading parameters on this account are designed to meet the needs of a wide range of market participants. For example, the execution model here is hybrid, which means a combination of instant and market execution of orders. This approach ensures high speed of execution – on average only 0.20 seconds. This is especially important for traders who appreciate quick reaction to market changes.

Another important aspect is the Margin Call and Stop-out levels. The level of margin call is set at 100%, and the level of automatic position closing is set at 30%. These parameters help traders to control risks and protect their deposits from being completely zeroed out.

Not to mention, trades on the classic account are commission-free. All costs are already included in the spread, which makes this account attractive for those who do not want to understand complex calculations. The minimum deposit for opening an account is only 100 dollars, and the maximum leverage reaches 1:1000. This allows you to use strategies with a high level of leverage even with small funds.

Opening a Classic Account with Tickmill

In order to open a Classic Account, you should visit the official Tickmill website and click on the Create Account button, then follow the steps:

- At the beginning, you should select between an Individual or Corporate account type.

- Proceed with entering your title, full name, including middle name, and date of birth. If you appear to be a US citizen, you need to check the designated box for tax purposes.

- At this stage, you have to provide some financial information and personal experience.

- By uploading the necessary documents for verification (passport or ID card and proof of residential address or utility bills, you will confirm your identity. This step is absolutely necessary to complete.

- After reviewing your account, wait for it to be approved. Now you’re able to make a minimum deposit of 100 USD or equivalent in another currency.

- By downloading the MetaTrader 4 terminal, you may begin trading now and use the advantages of the Classic Account parameters.

Raw Account: a Professional Approach at No Extra Cost

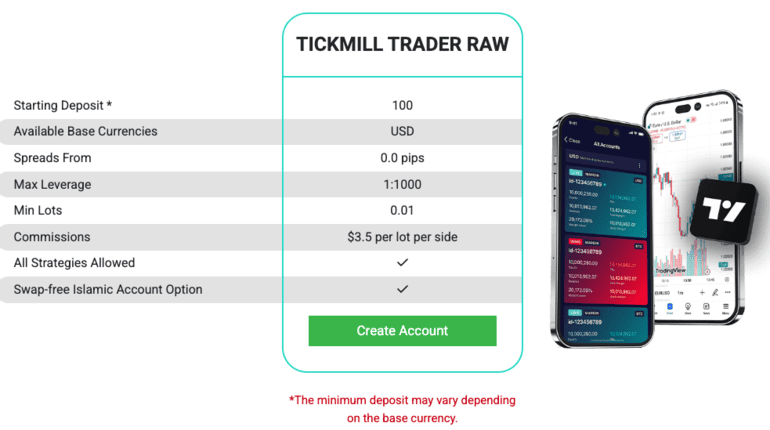

If you are an experienced trader who values minimal costs and strives for the fastest possible order execution, Raw Account will be your ideal choice. With this account, you will have so-called raw spreads, those that come directly from liquidity providers. As for spreads, on this account, they start from 0.0 pips. This reduces trading costs significantly.

However, there is a small fee for using such low spreads – only $3 for every lot of transaction volume. That is why Raw Accounts are so beneficial for scalpers and algorithmic traders as they open a large number of trades during the day. Meanwhile, the minimum deposit for a Raw Account is $100, and the maximum leverage is also up to 1:1000. It is suitable for volume investors who use strategies that require high speed and accuracy of execution.

Raw Account offers an exceptional investment environment. As the account is available in several base currencies such as USD, EUR, GBP, and ZAR, it’s convenient for traders from different countries around the world. In addition, the average order execution time is only 0.20 seconds. This guarantees fast and reliable execution of trades. As for Margin Call and Stop-out levels, they are set at 100% and 30% accordingly, and help traders to effectively manage risk and protect their funds.

This account is ideal for active traders who are going to minimize their costs and want deep market liquidity. With low spreads and a transparent fee structure, Raw Account becomes an attractive choice for professionals who know how to properly capitalize on market opportunities.

Demo Mode: Learn Before You Trade

Tickmill‘s Demo Account suits those who are new to the financial markets or want to apply new techniques without the risk of losing real funds. This mode fully imitates the conditions of real trading, using virtual money. With its assistance market players can gain knowledge, experience, and confidence before moving on to real trading.

Various trading instruments are one of the principal advantages of a demo mode. You can use over 180 tradable tools covering 6 asset classes on Tickmill. Users can trade on such popular markets as Forex, stocks, stock indices, commodities, bonds, and cryptocurrencies. At the same time, the spreads on the demo account are the same as for the real market. It means you can evaluate the real costs and opportunities of trading. Tickmill is known for the lowest spreads in the market, it makes a demonstartional mode even more attractive for training.

In addition, a demo account gives full access to the MetaTrader 4 platform. Its terminal is one of the best in the industry due to its reliability, convenience, and bigger prospects for financial analysis. Thanks to it, you will be able to try various technical analysis tools, experiment with automated strategies, and master the basics of working in financial markets.

It’s worth noting that the demo mode can be used unlimitedly. This can be useful for beginners who want to gradually get used to trading, as well as for professionals who want to test new approaches without losing their funds. However, the lack of emotions when trading on a real account is what differentiates it from working with virtual money. Therefore, you better use a demo account as a learning and testing tool, rather than as an end goal.

Getting Started with Trading on a Tickmill Demo Account

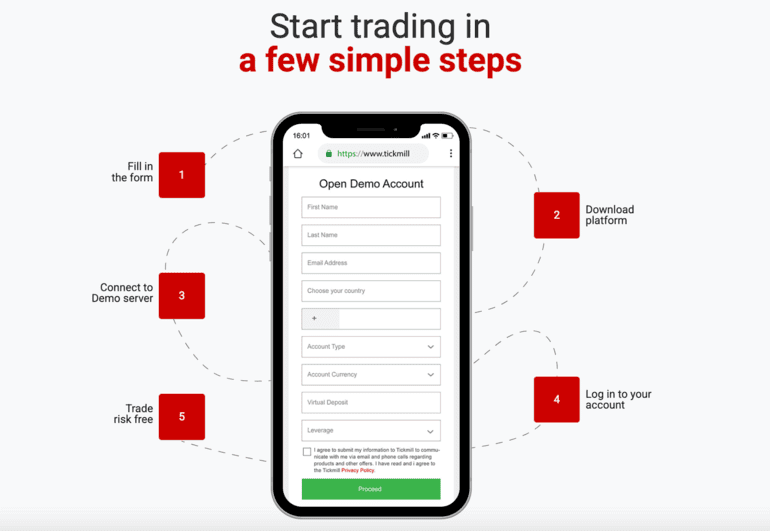

In order to enjoy all the benefits of a demonstrational account, you should complete the registration:

- You should go to the primary site tickmill.com and press the Demo Account button in the top right corner. The next thing you need to do is to fill out the dedicated form with your name, email address, mobile number, and country. Then, choose your account type, preferred terminal (MT4/5), and leverage. The next step is mandatory: agree to the privacy policy and click “Open Demo Account” to move forward.

- Having registered, you’ll need to download the recommended trading platform. Make sure to install it on your device, because without it you won’t be able to start.

- Having got the platform, enter the login details you received to connect to the demo server. This will give you access to the trading terminal.

- When you’re logged in, you can start researching the functions and capabilities of the demo version. The good news is that, with virtual funds in your demo account, you can practice, test different strategies, and get comfortable without any financial risk.

At this stage, you are ready to explore over 180 investment tools and six asset classes including Forex, stocks, indices, commodities, bonds, and cryptocurrencies. A demo account is your first step to winning trades where you can learn, experiment, and improve your competencies without any risks.

Islamic Account: Shariah-Compliant Trading

Tickmill offers a special account designed for Muslim clients who seek to follow the principles of Islamic law (Shariah). This account, known as the Islamic Account, takes into account the prohibition of riba (interest), excluding swaps (commissions for rollover of positions to the next day). Thus, traders can earn in the capital markets and support their religious beliefs at the same time.

If you want to apply for a swap-free account, it is crucial to read the relevant terms and conditions first and understand them completely. After submitting your request, Tickmill’s customer support team will process it within one business day. When the status has been changed to Islamic Account, you will receive a confirmation email. Moreover, all future investing accounts you open with Tickmill will be automatically set as swap-free. And you do not have to contact the support team anymore.

However, it is worth noting that some features of trading require attention. For example, an annual fee of 10% is applied for long cryptocurrency positions. For new cryptocurrency positions, 5 days without swaps is provided. This allows traders to customize their trading according to halal principles.

The processing of position holding fees depends on the number of days the position remains open, including weekends. For example, if you open a position in AUDJPY, the first five nights after the position is opened will be free. Daily commissions will begin on the seventh night at 00:00 and continue each night until the position is closed. The fee may vary depending on the instrument. For AUDJPY, the fee is $5 per lot and the number of free days is 6.

Islamic Account is available in both classic and raw versions, allowing traders to choose the most suitable criteria for their investment. All other features such as spreads, leverage, and available financial tools remain the same as on regular account types. It makes Islamic Accounts a versatile solution for those who want to trade following Halal principles without sacrificing quality of service or access to global markets.

Comparative Table of Tickmill Account Types

To make it easier to choose between the different accounts, we present a comparison table of their key features:

| Features | Classic Account | Raw Account | DEMO Account | Islamic Account |

| Minimum deposit | 100 USD | 500 USD | No (virtual funds) | Depends on type (Classic/Raw) |

| Spreads | From 1.6 pips | From 0.0 pips | Simulation of real spreads | Similar to the selected type |

| Commission for transactions | No | 2 USD per 100K volume | No | No |

| Swaps | Yes | Yes | No | No |

| Leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 | Up to 1:500 |

| Suitable for | Beginners | Professionals | Training and Testing | Muslim Traders |

| Platform | MetaTrader 4 | MetaTrader 4 | MetaTrader 4 | MetaTrader 4 |

FAQ

What are the Negative Aspects of Investing with Tickmill Account for Beginners?

Despite the fact that Tickmill offers convenient conditions for beginners, such as low minimum deposit and fixed spreads on Classic Account, some points can be challenging for novice traders:

- Lack of educational materials and analytics directly on the Tickmill platform. Traders will have to look for information on third-party resources.

- High leverage (up to 1:500) can lead to a quick loss of funds if a beginner does not know how to properly manage risk.

- Raw Accounts’ commission fees may be less understandable for beginners who are not yet familiar with the cost structure.

Does Tickmill Offer Leverage and What Is It?

Yes, there is leverage for all Tickmill account types. The maximum leverage is 1:500, being the highest in the industry. However, you have to remember that high leverage increases both profits and risks.

What Type of Broker Is Tickmill?

Tickmill is an ECN broker (Electronic Communication Network). This means that traders can access the market directly through liquidity providers, skipping a dealing desk. This model shows conflicts of interest between the broker and clients, as Tickmill earns from commissions and spreads more than traders’ losses.

Which Account Type Offers the Best Commission and Payout Benefits?

Thanks to its commissions and payouts, the Raw Account is the top cost-effective option for active market players. Its commission is $2 per $100,000 trade volume, and spreads start at 0.0 pips. This reduces overall trading costs significantly. Apparently, the Raw Account offers minimal expenses to traders who execute numerous trades per day.

However, for novices or those who prefer simplicity, the Classic Account may be more convenient. It has no commissions, and all costs are included in the spreads. But remember that spreads on this account are higher than those on the Raw Account.

Conclusion

Tickmill offers a variety of trading profile types to meet the needs of traders at various experiences and needs.

- Classic Account is ideal for beginners due to its straightforward conditions.

- Raw Account is preferred by professionals who value low spreads and the absence of conflicts of interest.

- Demo Account is a great tool for studying and testing trading techniques.

- Islamic Account ensures compliance with Sharia principles.

The choice of an account depends on your goals, level of experience, and investment priorities. The key is to carefully review all options and select the one that suits your needs.

Reviews