Best Forex Brokers Accepting USA Clients in 2026

Foreign exchange trading can be both thrilling and profitable, yet it also has its complications. For American traders, finding a trustworthy and compliant forex broker can be difficult due to strict regulatory requirements. This article provides a comprehensive overview of top forex brokers for US traders, as well as advice on how to select the right broker and tips for safe forex trading.

Contents

- 1 Forex Basics to Understand

- 2 How to Choose the Right Forex Broker for US Traders

- 3 Why Some Forex Brokers Don’t Accept US Clients

- 4 Is It Illegal for USA Residents to Trade with Offshore Forex Brokers?

- 5 Best Forex Brokers Accepting US Clients in 2026

- 6 What Are Forex Brokers Regulated in the US?

- 7 Tips for Keeping Your Forex Trading Safe

- 8 Final Thoughts

Forex Basics to Understand

What Is Forex?

Forex, or foreign exchange, is a global marketplace for the trading of national currencies. It’s the largest and most liquid market in the world, with a daily trading volume exceeding $6 trillion. Unlike stock markets, Forex operates 24 hours a day, five days a week, allowing traders to engage in trading across different time zones.

What Is Forex Trading?

Forex trading, also known as currency trading, involves the buying and selling of international currencies. This activity takes place in a fast-paced, global market that operates 24/7. The exchange rates for currencies are influenced by global interest rates, as well as macroeconomic and political factors, which means they are constantly changing.

In Forex trading, a trader buys one currency while simultaneously selling another. For instance, a trader who buys the EUR/USD pair is long on the euro (EUR) and short on the U.S. dollar (USD). The exchange rate is simply the ratio of the two currencies. The most frequently traded currency pairs include EUR/USD, GBP/USD, and USD/JPY.

Is Forex Good for Beginning Investors?

Forex trading can be a good option for beginners looking to expand their investment portfolio by trading currencies and other forex assets. While it can be complex, the abundance of educational materials and demo accounts makes it accessible for those eager to learn.

Forex markets operate around the clock, offering high liquidity and adaptability. Forex brokers often provide a wide range of tools and research to assist beginners in navigating the market.

Begin with small micro-lot trades and practice on demo accounts to build confidence and comprehension before venturing into real-money trading.

Nevertheless, forex trading carries significant risks due to its volatility and the possibility of amplified losses. Beginners should proceed with caution and dedicate time to gaining a thorough understanding of the assets they intend to trade. Numerous platforms provide a plethora of educational materials and research tools to assist in making informed decisions. By utilizing these resources, prioritizing risk management, and selecting regulated brokers, novice traders can approach forex trading responsibly and potentially find it to be a beneficial addition to their investment portfolio.

How to Choose the Right Forex Broker for US Traders

Choosing the right forex broker who accepts US clients is essential for a successful trading journey. Here are key factors to consider:

1. Regulation and Compliance

US foreign exchange brokers must adhere to strict guidelines set by regulatory bodies such as the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). It is crucial to verify that the broker you select is registered and regulated to safeguard your investments.

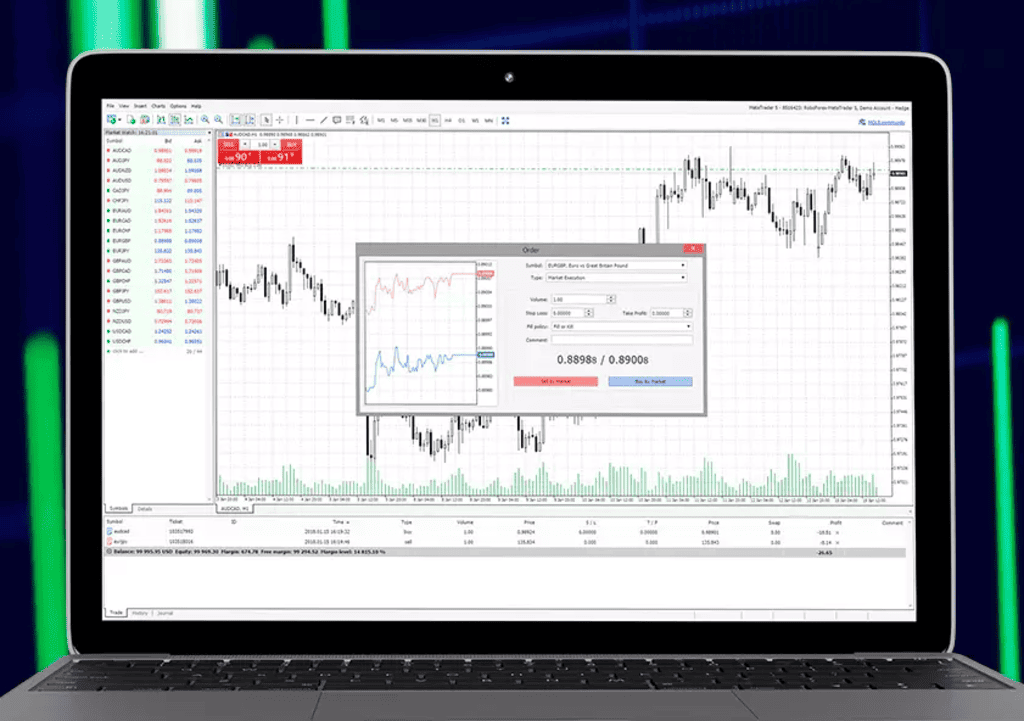

2. Trading Platforms

All forex brokers utilize a platform — the tool you employ to execute your actual forex transaction. However, not all platforms are identical, and not all brokers offer the same selection of platforms to choose from.

A user-friendly and technologically sophisticated trading platform is crucial. Seek out features such as sophisticated charting tools, automated trading options, and a mobile-optimized interface.

3. Leverage and Margin Amounts

In forex trading, the concepts of leverage and margin play a crucial role. They determine the extent of control you have over your trading activities compared to the initial investment. This, in turn, influences your potential for profit or loss. Leverage empowers you to manage substantial positions with limited funds, but it also multiplies the risk involved.

Margin, on the other hand, acts as a safeguard. It ensures that you have sufficient funds to cover potential losses. It is essential to carefully select the appropriate leverage and comprehend the concept of margin to strike a balance between profit and risk.

US regulations limit leverage to 50:1 for major currency pairs and 20:1 for minors. While this may seem restrictive compared to offshore brokers, it’s designed to mitigate risks.

4. Fees and Commissions

Evaluate the broker’s fee structure, including spreads, commissions, and withdrawal fees. Clear pricing guarantees that there are no unexpected expenses that could reduce your earnings.

5. Customer Support

Responsive and knowledgeable customer service can be a lifesaver, especially for beginners. Opt for brokers who offer 24/7 support via multiple channels, including at least by phone and email.

Why Some Forex Brokers Don’t Accept US Clients

Numerous foreign exchange brokers opt not to serve clients from the United States due to the stringent regulatory standards set by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). These regulatory bodies are responsible for overseeing the foreign exchange market and maintaining strict regulations and standards to ensure market integrity and protect investors.

These regulations include:

- Capital Requirements: Brokers must maintain substantial financial reserves to ensure they can meet client obligations.

- Reporting Standards: Brokers are required to submit detailed reports, increasing operational costs.

- Leverage Restrictions: Lower leverage limits make the US market less attractive to brokers who cater to high-leverage traders.

These regulatory obstacles discourage some offshore brokers, as failure to comply can result in severe penalties and bans. In the United States, the CFTC and NFA regulations are designed to safeguard investors by ensuring the transparency, integrity, and fairness of Forex trading operations.

Furthermore, the profits earned from Forex trading are subject to taxation in the United States. Forex traders must accurately report their trading profits as either ordinary income or capital gains, depending on the nature of their trading activity and the duration of their holdings. The tax rates are determined based on the trader’s income tax bracket.

Is It Illegal for USA Residents to Trade with Offshore Forex Brokers?

It is not inherently illegal for US residents to trade with offshore forex brokers. However, it is risky because these brokers are not subject to US regulations, leaving traders vulnerable to fraud and lack of recourse in case of disputes. To mitigate risks, ensure the offshore broker is reputable, well-regulated in its jurisdiction, and has a history of reliable service.

Offshore brokers operate without regulation, making them ineligible to accept clients from the United States and other countries with strict financial regulations. They operate online and maintain a level of anonymity.

Due to their lack of adherence to the stringent regulations imposed by US authorities, American traders are usually drawn to offshore brokers. These brokers provide greater leverage, more affordable trading fees, lower trading capital requirements, and the option to trade CFDs. They also allow for hedging and other trading techniques.

Therefore, trading with well-known offshore brokers can be both thrilling and lucrative. However, it is important to note that there are no refunds available and no regulatory bodies to ensure equity and fairness. Finally, US-based traders have the option to trade with offshore brokers, but it is a much riskier endeavor compared to trading with US-regulated brokers.

Best Forex Brokers Accepting US Clients in 2026

After thorough research, here are the top forex brokers accepting US clients this year:

| Broker | Account Minimum | Fees | Best For | Spreads | Currency Pairs | Trading Platform |

| RoboForex | $10 | Low commissions (from $0.004 per lot) | High-leverage trading | Variable (from 0.0 pips) | 40+ | MetaTrader 4/5 |

| Pocket Option | $50 | Fixed spreads, $1 per trade | Beginner and intermediate traders | Fixed (from 1.1 pips) | 30+ | Proprietary platform |

| FOREX.com | $100 | Transparent spreads (from $5 per 100K traded) | Comprehensive trading features, mobile trading | Variable (from 1.0 pips) | 80+ | MetaTrader, Web Trader |

| AMarkets | $100 | Competitive spreads (from $3 per lot) | Emerging market traders | Variable (from 0.2 pips) | 50+ | MetaTrader 4/5, Web Trader |

| FXCM | $50 | Low commissions (from $0.04 per lot) | Active traders, algorithmic traders, and beginners | Variable (from 1.3 pips) | 70+ | Trading Station, MetaTrader |

| EXNESS | $1 | Zero spreads option (from $0 per lot) | Trading fees and platform features | Variable/Zero (from 0.0 pips) | 100+ | MetaTrader 4/5 |

| IG Markets (Tastyfx) | $250 | Fixed commissions ($10 per trade) | U.S. Traders | Fixed (from 0.6 pips) | 80+ | Proprietary platform |

| OANDA | $0 | Competitive spreads (from $5 per 100K traded) | Flexible account options | Variable (from 1.2 pips) | 70+ | OANDA Trade, MetaTrader 4 |

| Interactive Brokers | $100 | Tiered pricing (from $2 per lot) | Advanced traders | Variable (from 0.1 pips) | 100+ | Client Portal, Trader Workstation |

What Are Forex Brokers Regulated in the US?

Forex brokers regulated in the US must comply with the CFTC and NFA’s rigorous standards. Some of the notable regulated brokers include:

| Broker | Regulatory Bodies |

| FOREX.com | – Commodity Futures Trading Commission (CFTC) – National Futures Association (NFA) – Financial Conduct Authority (FCA) – Japanese Financial Services Authority (JFSA) – Investment Industry Regulatory Organization of Canada (IIROC) – Australian Securities & Investments Commission (ASIC) – Cayman Islands Monetary Authority (CIMA)- Securities and Futures Commission (SFC) in Hong Kong |

| OANDA | – Commodity Futures Trading Commission (CFTC) – National Futures Association (NFA) – Financial Conduct Authority (FCA) – Australian Securities & Investments Commission (ASIC) – Monetary Authority of Singapore (MAS) – Investment Industry Regulatory Organization of Canada (IIROC) – Japanese Financial Services Authority (JFSA) – Polish Financial Supervision Authority (PFSA) – Financial Services Commission (FSC) in the British Virgin Islands |

| IG US | – Commodity Futures Trading Commission (CFTC) – National Futures Association (NFA) – Financial Conduct Authority (FCA) |

| TD Ameritrade | – Commodity Futures Trading Commission (CFTC) – National Futures Association (NFA) – Securities and Exchange Commission (SEC) – Financial Industry Regulatory Authority (FINRA) |

| Interactive Brokers | – Commodity Futures Trading Commission (CFTC) – National Futures Association (NFA) – Securities and Exchange Commission (SEC) – Financial Industry Regulatory Authority (FINRA) – Financial Conduct Authority (FCA) – Australian Securities & Investments Commission (ASIC) – Investment Industry Regulatory Organization of Canada (IIROC) – Monetary Authority of Singapore (MAS) – Japanese Financial Services Authority (JFSA) |

These brokers ensure high transparency, investor protection, and adherence to ethical trading practices.

Tips for Keeping Your Forex Trading Safe

- Choose a Regulated Broker. Always trade with Forex brokers regulated by the US CFTC and NFA to protect your funds.

- Use Risk Management Tools. Leverage stop-loss orders and position sizing to manage potential losses.

- Stay Informed. Keep up with market news and economic data to make informed trading decisions.

- Avoid Over-Leveraging. Stick to conservative leverage levels to minimize risks associated with volatile market movements.

- Verify Broker Policies. Ensure you understand the broker’s deposit, withdrawal, and fee policies to avoid surprises.

- Utilize Demo Accounts. Practice trading on demo accounts to improve your skills and test strategies without risking real money.

- Beware of Scams. Be cautious of brokers offering overly generous bonuses or unrealistic returns, as these are often red flags.

Final Thoughts

Forex trading offers exciting opportunities for US traders, but it’s essential to approach the market with caution and select a broker that matches your trading objectives. To answer the question of which forex brokers accept US clients, we have provided a list of reliable choices that ensure a secure and efficient trading experience for US traders. By understanding the basics of forex trading, prioritizing brokers with strict regulations, and implementing safety measures, traders can trade with confidence and responsibility.

Reviews